Qudian Inc (NYSE:QD) is a Chinese stock that is interesting, keep in mind it is the Chinese stock market.

Qudian – A Chinese Stock With A Price To Earnings Ratio Of 4

Good day fellow investors. Today, I want to discuss a stock, I’m still long, it’s Chinese stock. I have been long in both of my portfolios on my stock market research platform. And we already made a nice money on it, but I’m still long with part and I want to discuss the company and explained also my approach to investing, my approach to analysing stocks and how that evolves over a long period of time.

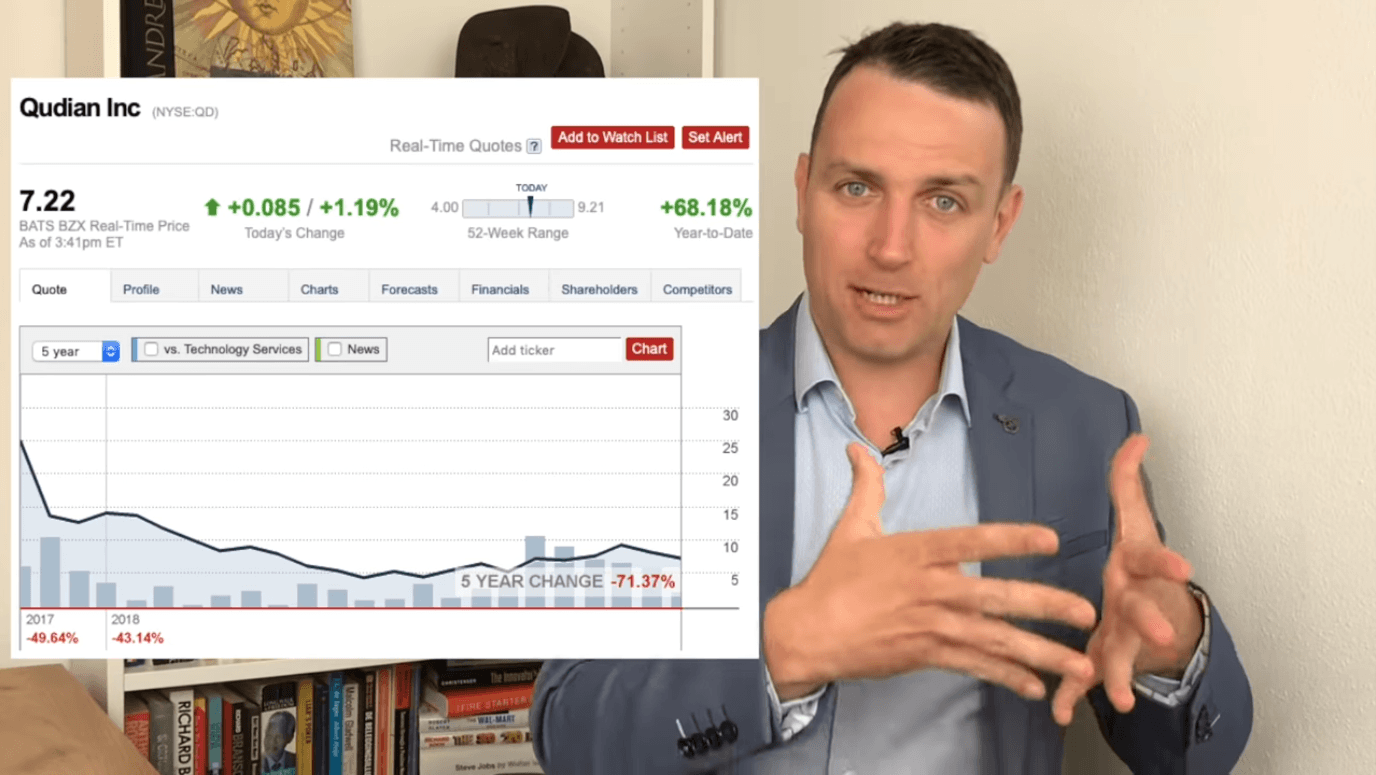

Only when you know a company very well for the last years that I feel comfortable enough to really invest a significant part of my money in it, no matter the volatility, no matter what’s going on. The company we’re talking about is Qudian or how I would say it Qudian but i think is in Chinese it is Qudian. NYSE:QD is the ticker. 2017 recent IPO FinTech lender, so loans, micro loans not be to be not p2p lending their official loans to the unbanked population in China with 76 million users. So the company has been really beaten down over the last two years. It’s up significantly over the last few months as things are starting to change, and the positives are outweighing the negatives that have crushed it since the IPO.

So I want to give you the story of Qudian, why I’m still long in my model portfolio and lump sum portfolio even if I just managed a little bit the risk there and sold the initial investment in the lump sum portfolio after it was up 50% so I still keep the profits. But if it goes down on my bite more, or things like that, that’s something that will evolve over the long term.

Valuation metrics

In short, Qudian is a stock with a forward price to earnings ratio of 4 that has grown net income over the last 12 months for 57% for a price earnings ratio of 4. Has A book value of around 6.6 on a current stock price of around 7 something so it is a margin of safety. The book value is in cash because it is a lender, it’s growing extremely fast, is doing well the management has trying this has been trying different things but has shown to be relatively speaking, trustworthy when you put it in a Chinese environment. So, a lot of these things are developing.

I want to discuss the company explain how I follow it. What I learned by reading through the conference calls, listening to those, reading to the announcements, the risks, the rewards, and why I think over the long term, this might work out, like a real gem.

Let’s start the FinTech lending sector in China had a very bad year in a year and a half. Everybody rushed to do an IPO in 2017 because I think they were feeling that the government will crack them down. Especially on p2p lenders, companies like [inaudible], and Qudian all fared terribly with stock prices down between 60 and 90%.

So that was a terrible experience for the whole sector and especially for those greedy investors that invested in growth stocks at the beginning. At the end of 2017 the government started with the correct down, they increase the legal requirements for micro lenders limited the total charging rate of 46%.

Qudian’s business model

So extremely high interest rates on loans eliminated many lucrative fees and all other scams that weren’t the normal two years ago. However, since then, a lot of things changed. First Qudian is not a never was a p2p lender. It was backed by Ant Financial that had a stake that had the connection with them on their platform. So that’s how they got to 746 million users later and financial fall stake was a 11% so it wasn’t material for them.

However, during that process of crackdowns and financials, also something very interesting the main shareholder of one of the main shareholders of Qudian, Kunlun, I think he they had the 16% share, they are a gaming software something in China, they were forced to sell the stock because of their own financial issues and they were stupid enough to announce it publicly in June 2018. So when somebody owning 60% of the of the Chinese fintech company says it will sell its entire stake and it does it publicly.

You know, nobody wants to buy such a stock because there will be so much pressure on selling. I think the announcement was part of a bigger plan or better to say blackmail attempt to force Qudian’s method management into quick buyback. However, the management didn’t budge waited for the price to fall to 4 and then..