Empire Financial Research Founder Whitney Tilson and his friend Glenn Tongue are giving investors lessons from the trenches. They discuss the much-maligned retail sector, and the opportunities with retail turnarounds such as Bed Bath & Beyond Inc. (NASDAQ:BBBY) as well as Best Buy Co Inc (NYSE:BBY).

Whitney Tilson and Glenn Tongue: Investing in Retail Turnarounds

Q3 2019 hedge fund letters, conferences and more

Transcript

What would you look for to go long Bed Bath & Beyond today? You're muted, Glenn. I just unmuted you.

I said, wow, we don't feel very good about the business.

Yeah, I'm going to pull up the Capital IQ chart while you're, if just to just to take a look.

You know, well, let me put it in a slightly different framework. Barnes & Nobles trading at around two times EBITDA. And I don't find that materially attractive. Because I can understand why it's not going to generate two times EBITDA translate into free cash flow translating this to money into investors pockets. So, you know, I would be interested in Bed Bath & Beyond at two times EBITDA.

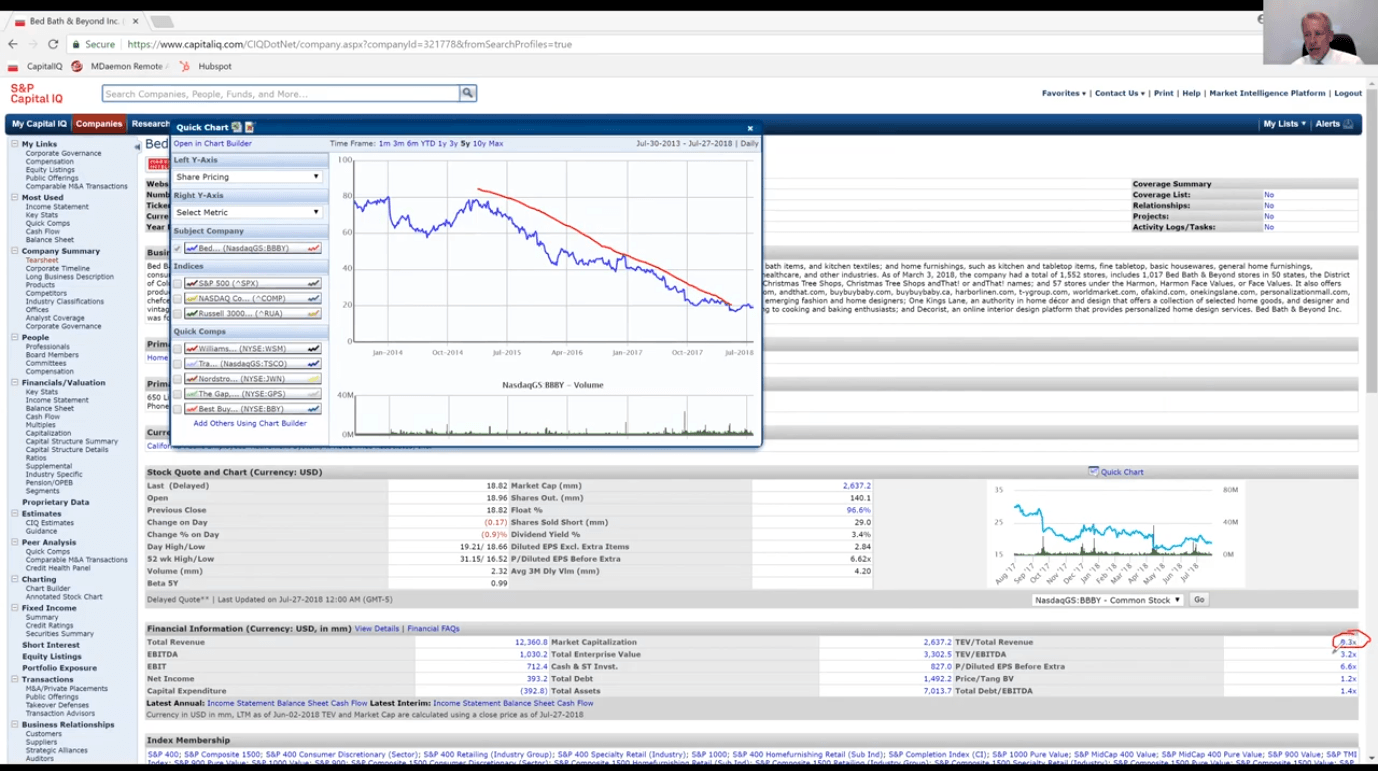

Trading right now Glenn, just so everyone can see. So I pulled up so this is a bombed out stock down 75% in the last This is a five year stock chart. So this is over four years. Right now it's trading at point three times sales, 3.2 times trailing EBITDA, 6.6 times trailing earnings. So those are starting to get to be numbers Glenn, you know, Where you know where it's sort of cheap retail turnarounds, but she it's getting cheap enough to be sort of interesting, right?

But take but take a look at the debt.

Okay, so here you've got 1.4..

1.5 billion of debt, every single one.

Not including leases.

Every one of their stores is run off with an operating lease.

Yeah, there is really much greater debt.

Yes.

Retail turnarounds - Fundamental analysis

So let's um, let's pull out the 10 year I'm just going to pull up revenue and you can see decline in the fundamentals. So here I'm going to pull up revenue and operating income. Right. And, you know, what I would be looking for here is some sort of bounce. I mean, look, you can play it just in the short term on sentiment. And you could just say, Wow, the sentiment is so bad, I'm going to play it for a bounce, right? And you know, it's getting cheap enough stocks trading at a 10 year low, that maybe there's some sort of bounce right. But if you're going to play this for a two or three year if you really want to make money here, look at operating income, which peaked at 1.6 billion, and is now more than been cut in half. It's down to 712 million as a trailing 12 months right. So revenues have flatlined, operating incomes gotten cut in half.

And I think from today's price, you could make money on this. If operating income merely stabilises you don't even need to if you want to make you know, two, three times your money, operating income has to actually turn upward right and for investors to believe that that's somehow sustainable something like what Bed Bath & Beyond and I'm sorry Best Buy Did you know I'm going to..

So you know here here that the sentiment is so bad that even just a stabilisation you could get a quick 50% on your money but you'd better be out there in the stores, talking to people in the industry and getting a super high degree of conviction that the company is doing something to stabilise the business that's going to work you know, obviously they've been they've been very late to the online game you know, maybe you think they're going to be successful there right so I'm not saying Bed Bath & Beyond is a hopeless situation.

est Buy case study

You know, it's nothing like Herts was down 80% with a huge pile of debt you know likely going bankrupt soon right? So let me just pull up BestBuy. Here to give you guys a sense of what a real turnaround looks like. Where a stock, you know, goes up 5x. So here's revenue and operating income for BestBuy going back, you know, 10 or 12 years and look at operating. So here's Bed Bath & Beyond what operating income looks like today, right? And look at how it turned for Best Buy.

And the stock went from $15 a share to something like $75 a share, right? So that's the kind of turn of a beaten down, bombed out retail turnarounds that really turns. And Best Buy. it's a brilliant case study. If I could find the article, there was a good article, I can see if I can find the article is like in Forbes or Fortune is an in depth profile of this CEO who came in with a plan to prevent BestBuy from going the way of Circuit City IE bankruptcy. And he pulled off that plan superbly.

And BestBuy is cranking out over 40 billion of revenues right now, but more importantly cranking out $2 billion of operating income down from basically, you know, basically 0. Well, it didn't get down to 0, but it got down to, you know, operating income peaked at 2.5 billion got cut in half to 1.25 billion. And that's another thing you want to look for in a turnaround the company is still producing, even though it's down 50% still producing a lot of operating income, and now it's almost doubled.

So it's interesting how closely these numbers here sort of mirror Bed Bath & Beyond, you know, flatlining revenues operating income cut in half but still, you know, pretty healthfully positive, and the question is, is can you catch a turn in the fundamentals that's where you really make a lot of money. Anything to add Glenn?

The only thing that's the wrong thing about with retail turnarounds such as Bed Bath & Beyond is who shops there and why? You know, because everything you get there, you can get it a Walmart cheaper, you know, at a target at Amazon. They've got a an inferior cost structure to all those companies, you know, led by of course, the disadvantage fees, the Amazon. And I have walked through Bed Bath & Beyond relatively recently, and boy, did they sell a lot of crap.

Or at least do they stock their stores with a lot of crap. So, you know, you need to see it honestly to be interested, it's either going to be trading and under two times EBITDA or and not operating on a distressed basis or you need to see a credible plan out there that that, you know, has some sense associated with it.

Part of that plan in my view would have to be terminating, probably half of their short half their leases. And, you know, making a go on a on a smaller, more profitable basis and then maybe they can ride it for some periods. But I think the business is dead in long term.

Yeah. Now Honestly, I would have said that about retail turnarounds such as Best Buy and I was completely wrong. It turns out that technology products, there is a substantial fraction of customers, you know, my wife, my, my mom, I, you know, who are just not at all comfortable with technology, and they want to go in and see and feel and touch the products, and they want to interact with a human being who can show them how it works.

If they buy a laptop somewhere and they can't figure something out, they can bring their laptop back into a store and some technology savvy person can help them figure it out.

Like there is a reason for BestBuy to exist and I think it will continue to exist. And the technology sector is so gargantuan that even if 90% of the business you know goes online, I would never you know I almost never buy anything at Best Buy. But there's a significant segment of the population that does and will Always want to Best Buy.

So you know, so that's a difference between, you know, the stuff that that Bed Bath & Beyond is selling, where I would argue very little of it, do people feel uncut?

Would people feel uncomfortable buying it online and where they want to, you know, need a lot of hand holding. So I think it's Hussein that says, you know, you'd have to go in and get conviction that there's some that there's some real value add to having the bricks and mortar there.

And I really liked the retail turnarounds idea he writes, perhaps a survey on shopper habits can give you insight into that. So before I bought a Bed Bath & Beyond, I would put together a survey monkey of some sort, perhaps, and I would send it out to everybody I know and find people who actually shop at the store, and then I would follow up and I would do I would ask them, you know, why did you used to shop there and do you shop there more or less?

Why Why do you continue to shop there? Because I understand that I am not a Bed Bath & Beyond customer. So it's very, very important to understand if you're doing an analysis on this, that you know we are not the core customer Bed Bath & Beyond and you haven't getting gaining a deep understanding into that core customer and why that core customer might continue to shop and spend their even knowing that they're paying a higher price than they could buy the same product online.

That would be a really important piece of the analysis getting out of the 10 K's and 10 Hughes and into the stores and into talking to the customers would be I think a critical element of this.