Farmland has historically performed very well on an absolute basis and relative to other major asset classes. Since the National Council of Real Estate Investment Fiduciaries (NCREIF) began measuring the investment returns of farmland as an asset class in 1990, returns have averaged ~11.5% annually, with consistently low volatility and a near-zero correlation with stocks. The issue with farmland as an alternative asset is that aside from purchasing and managing an entire farm, investors have had surprisingly few options to include farmland in their portfolio. There are now more options than ever to invest in U.S. farmland, which can improve both the relative risk profile of a portfolio as well diversification.

A simple story of supply and demand demonstrates why farmland has historically outperformed other assets. Agricultural land is a finite asset, so with a rising global population that needs to eat, and a steadily decreasing amount of farmland available to grow food, the land has continued to appreciate in value. The USDA has published that the average annual appreciation of agricultural land values over the past 50 years has been 5.9%. With both of these key supply and demand drivers continuing into the foreseeable future, basic economics suggest that the value of farmland could continue to increase.

Q3 2019 hedge fund letters, conferences and more

In addition to the appreciation that investors can anticipate capitalizing on upon the sale of the land, they are also able to generate income each year. The primary source of income from a farm is the rent a farmer would pay to lease and farm the land, and it can be further augmented with additional income streams from things like hunting or energy leases.

Typical farm rental arrangements are structured as a crop share or cash rent. With a crop share, the landowner receives a percentage of the revenues from the crop production. While there is additional return potential in this arrangement, the landowner also takes on additional risk factors due to weather, commodity prices, and the operation of the farm. A much simpler arrangement is that of cash rent. This is a more traditional tenant landlord relationship, and often rent is paid once per year, before the planting season. This arrangement keeps both vacancy rates and default rates exceptionally low and can create predictable revenue especially relative to things like monthly rent payments for other forms of real estate.

One unique attribute of farmland compared to other types of real estate investments is that there is typically little (50% or less Loan-to-Value ratio is common) or no debt utilized in financing farmland. This lack of material debt has allowed farmland to achieve attractive risk-adjusted returns without the volatility that has been experienced by many other types of real estate investments.

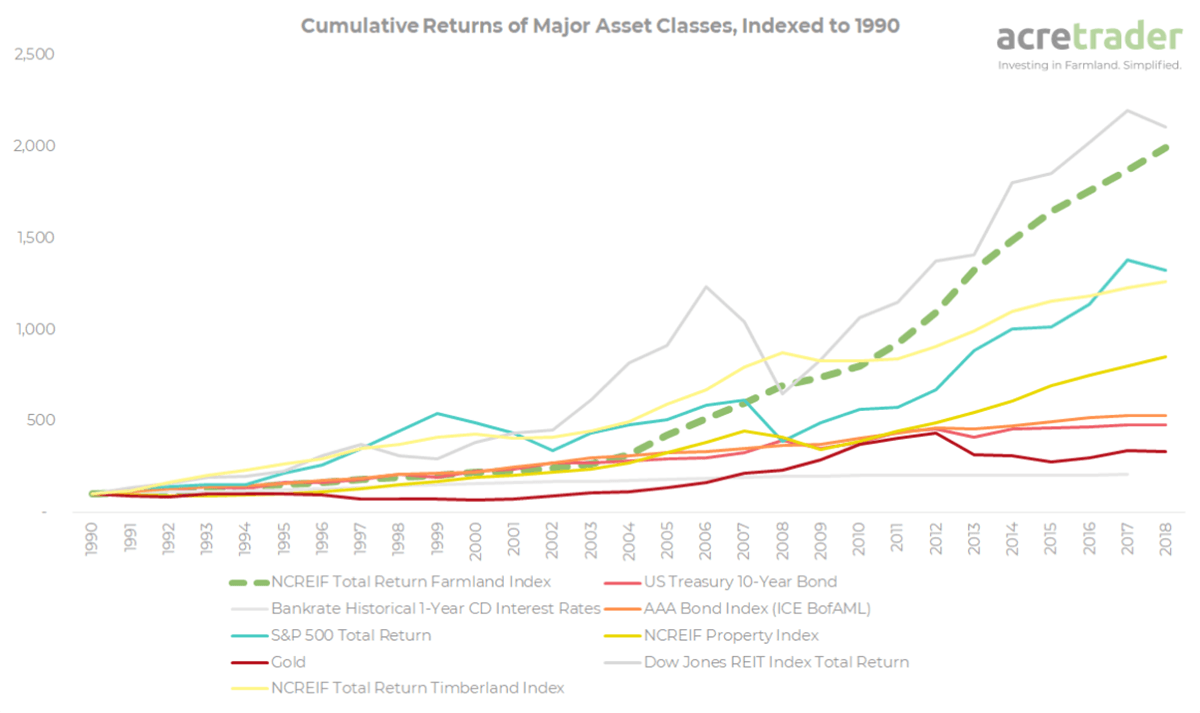

The chart below demonstrates the outperformance of farmland (non-levered) vs. other major asset classes since 1990. Of note is the consistency of returns, including during the great recession.

While farmland has certainly performed well in the past, its effect on a broader, diversified portfolio impresses even the most sophisticated investors (like Bill Gates) as they continue to add it to their portfolios. TIAA recently published a paper titled Private Real Assets which recognizes this attribute of investing in farmland. They found that portfolios which included farmland were able to achieve an exceptional Sharpe ratio (a commonly used measure of risk-adjusted returns). This point is further demonstrated in the graph below, which shows the -0.03 correlation between the S&P 500 returns and Farmland returns since 1991.

Given these unique properties of farmland as an asset class, it is no surprise that institutional capital has been moving towards farmland for the last decade. Family offices and private equity funds now account for over $30B of U.S. farmland ownership. However, that is just 1% of this three trillion-dollar market, leaving it still very fragmented and inefficient. The opportunity for investors to take advantage during the early innings of the professionalization of the asset class appears significant.

While institutional capital has begun to allocate funds to farmland, the vast majority of U.S. investors have not had viable opportunities for direct farmland exposure to their portfolio. The option of purchasing an entire farm, and managing it has always been available, but it requires a level of time, capital, and farm management experience that makes it a non-starter for many. Thankfully, new trends are emerging. There are private online securitizations of farms as well as a few publicly listed REITs which provide new ways for investors to participate in this asset class.

While REITs are fairly common and well understood, it may be worth explaining private securitization of farms a bit more. In recent history, new trends have emerged in commercial and residential real estate allowing investors access to private opportunities through crowdfunding vehicles that are now allowed under the JOBS act of 2012. Now, the same opportunity exists in farmland, allowing investors access to the asset class in a much more passive manner than ever before. This previously overlooked investment has started to gain mainstream attention as new investment vehicles emerge.

Conclusion

Farmland has historically been an exceptional asset class - generating investors an average return of 11.5% over the last three decades. Returns have been consistently positive with low volatility, but the barriers to entry have remained high, making the asset class relatively “off-limits” for the vast majority of investors. As new investment vehicles are now available, investors should consider if farmland ownership would be a healthy addition to their portfolio.

About Carter Malloy:

Carter is the Founder and CEO of AcreTrader Inc, a farmland investment platform. He grew up in an Arkansas farming family and has had a lifelong passion for investing, agriculture, and conservation. Prior to founding AcreTrader, he was part of a long/short equity investment firm and a Managing Director with Stephens, Inc., a large private investment bank. For more information visit: https://www.acretrader.com/