Sven Carlin along with Hamish Hodder share their Disney stock analysis and value the different segments of the company.

Disney Stock Analysis And Value – Featuring Hamish Hodder

Q3 2019 hedge fund letters, conferences and more

Transcript

Good day fellow investors. We are a small value investing community healer here on YouTube so it's great if we can share our work and help each other out. So I'm very very happy to share Hamish Hodder's work here and his channel so please check the link in the description below and subscribe to his channel for another value investor a little bit more modern I think that I am. And he's going to show that by discussing a great company, a great business Walt Disney Co (NYSE:DIS). So enjoy the video subscribe to both channels. And let's make value investing stronger here on YouTube.

Hey everyone, my name is Hamish Hodder and a very big thank you to Sven for having me on the channel me and Sven have been in contact for quite some time. Now. Some of you may be aware that we actually had Sven on the Young Investors Podcast a few months ago, and we had a great conversation about a range of different topics relating to value investing. So I'm excited to do this collaboration with Sven once again. And in today's video, I thought that I would do an individual stock analysis breakdown and go through my analysis process when it comes to the company, The Walt Disney Company.

Disney management

So generally how I go through these analyses is I like to start by looking at the business itself. I like to look at the industry and what sort of components make up the business, what markets are they operating and that sort of thing. Then what I like to do is I like to see if we can identify any types of competitive advantages. Is there anything about the Walt Disney Company that separates it from its competition, that's going to give us confidence that the business can thrive over the long term and that we will have safety of our capital in the investment? Then what we like to do is we like to look at management and we look at management in three key ways. We start by looking at the integrity of management, do we trust them are their values aligned with ours?

Then we like to look at the return on invested capital to see how effectively they've been investing within the business. And finally, when it comes to management, we're looking for companies that have low levels of debt relative to other companies so that we're not going to be losing a lot of money in an investment, we certainly don't want to be making investments in companies that have a lot of debt and a high risk of going bankrupt. And then finally, to wrap it all together, I like to do an intrinsic valuation, which is where I'm essentially trying to come up with an estimate of how much cash we can get out of a business, we can reasonably expect to get out of a business over the next 10 years, and therefore put a price on how much we're willing to pay.

So let's get started in this analysis by going through the business, its industry and its competition now, The Walt Disney Company operates four major operating segments they have studio entertainment, media networks, parks, experiences and consumer products, and then their direct to consumer and international segment. The media network segment includes all of the cable and broadcast television networks, such as the Disney Channel, ESPN and ABC.

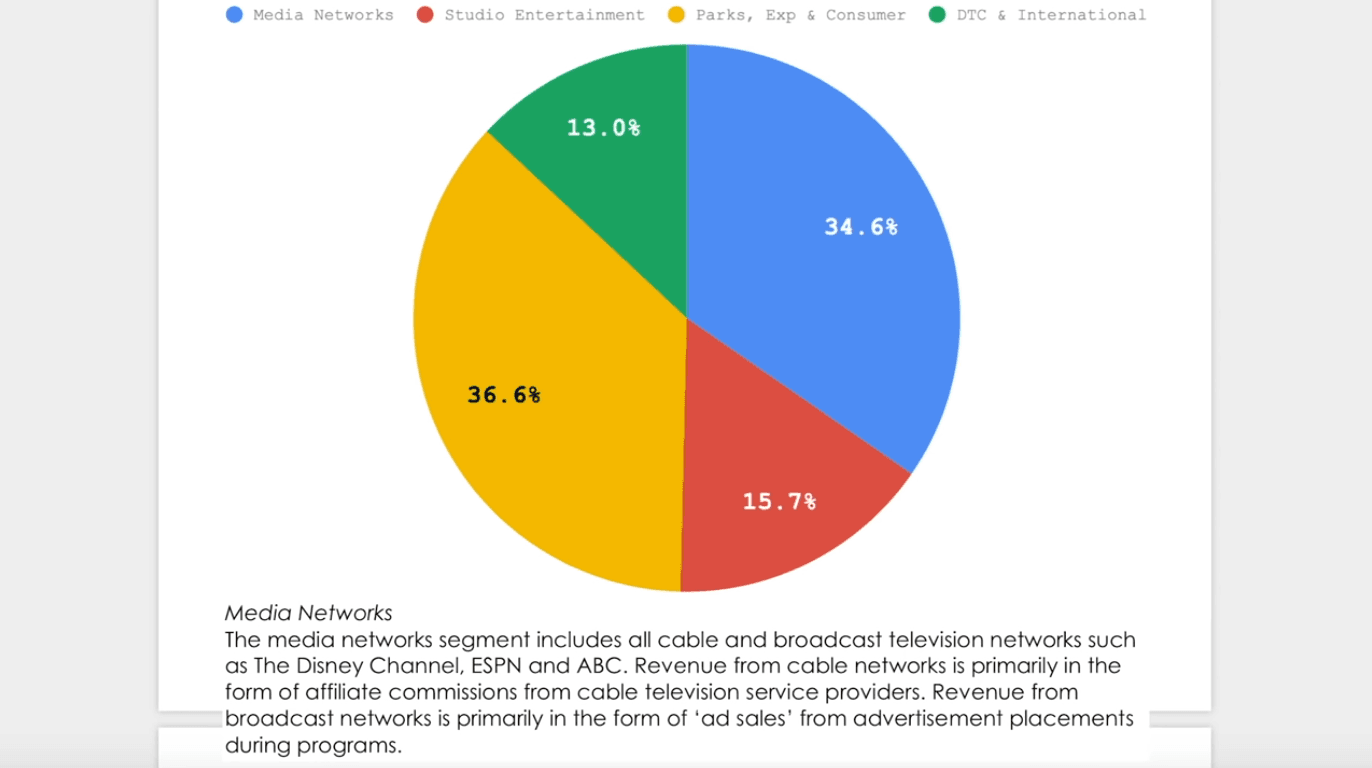

Revenue from the cable network is primarily in the form of affiliate commissions were saved from Cable TV providers, whereas the revenue from broadcast networks they have free to end networks is primarily in the form of ad sales, meaning they place advertisements during their programmes. And in 2019 media networks was the second largest segment of their total business representing 34.6% of their total revenue. The largest segment was their parts, experiences and consumer products, which represented 36.6% of their total revenue.

Disney stock analysis: A look at segments

This segment is a consolidation of two prior segments, which was pocs and results and then consumer products and includes all of these nice theme park experience offerings, results, cruise lines and more, as well as generating revenue from consumers spending money at the parks of course, and licencing the companies trade names and characters to manufacturers, game developers and publishers.

The studio entertainment segment includes live action and animated motion pictures, musical recordings, and the live stage play. Most of the revenue in this segment is generated from the distribution of film and licencing. And this segment represented about 15.7% of their total revenue in 2019. And to the final segment, which is direct to consumer and international, which represented 13% of their total revenue in 2019.

This is a new operating segment of Disney's business and includes four major online streaming services, which are Disney plus, ESPN plus, Hulu and hot star with each providing a different offering for video consumption online and generating reoccurring revenue with a subscription model. And even though direct to consumer is the smallest component of Disney's business at the current time, I think it is arguably the best and most exciting component of Disney's business going forward. Particularly with the launch of Disney plus just happening in November they see the direct to consumer video market is growing at a 37% compounded annual growth.