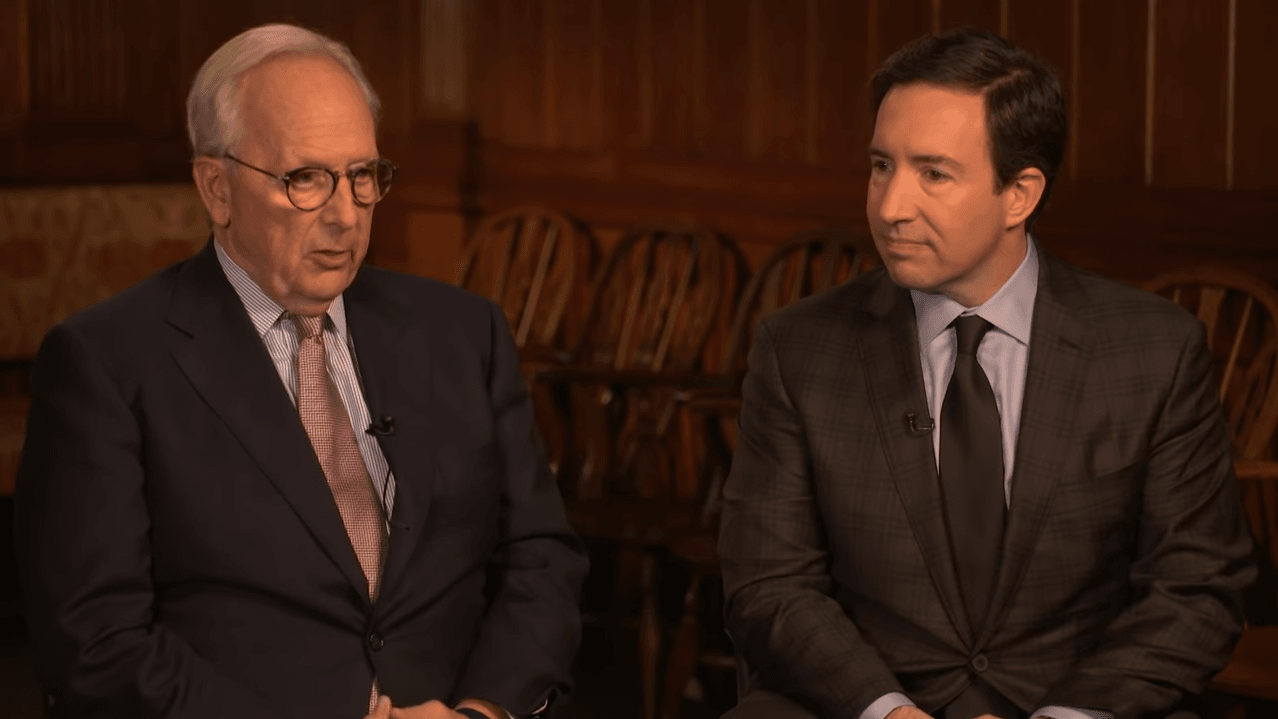

A rare WEALTHTRACK interview is Chuck Akre and John Neff of Akre Capital Management.

Chuck Akre and John Neff: Interest Compounding Machines

Q3 2019 hedge fund letters, conferences and more

Transcript

I began the interview by asking Akre to describe his investment approach.

We have in our conference room, a number of slogans that are on the ground moulding around the room. And the first one you see says the bottom line of all investing is rate of return. And we believe that's in our DNA. So everything we do about selecting investment goes to the issue about how can we best understand what the rate of return opportunity is in that investment.

We believe that whatever return the business has itself will be reflected in the share price over a period of time. Additionally, we do some simple little arithmetic to reinforce that then when we when we find a business, we've really focused on three issues. And we've in a shorthand, and we've all talked about that called the three legged stool. And so the first leg is understanding Exactly what the nature of the business is and what kind of returns on the owner's capital does it produce.

Then we want to see if it has the ability to do that for a long time. If the runway is wide and long, we say. So what's causing that hot that above average rate of return to exist? What's, what's going on? What's unusual about that business, so on. The second leg that we look at is the people who run the business. And we're very focused on the skill level of the people who run the business and look at their record, whatnot. But we also want to know that they're acting in the best interest of all shareholders.

Reinvestment

That is, we see that what happens in the business, happens to us on a per share basis. And then the last leg of it is the issue of reinvestment. So we examine how it is they have reinvested free cash flow in the past, what the outcomes have been, and they rarely break those out, by the way, we have to do our own work. And then what the opportunity for reinvestment going forward is, because the fact that they can reinvest all of their free cash flow to earn above average returns, enhances our compounding effect. And that's what we're after. At the end of the day, we want to compound our shareholders, our clients capital, at an above average rate, while assuming a below average level of risk.

And the below average level of risk piece for us has got nothing to do with volatility. It has to do with the fact that the businesses we own on average are have more returns on capital, have higher growth rates, have stronger balance sheets, and very frequently have lower valuations than the market at the time we purchased them. So on their face, they have less risk than than the market than average.

John listening to Chuck, you join Akre Capital Management 10 years ago and as an analyst and then you became a portfolio manager several years later, big transition. You described yourself as a true believer in this approach, what is it that attracted you to Akre Capital Management?

Chuck Akre and John Neff on compounding machines

It was several things and the interesting thing about the philosophy and what Chuck is practised and preached all these years, is that there's a real integrity to it. And what I mean by that is that one thing follows naturally from the next. So the first thing is that, as he likes to say, we aren't speculators in the price movement of shares, we own businesses. The focus is on owning the most exceptional businesses that we can find. And if you're really limiting yourself to exceptional businesses, the list of businesses that you would ever own is going to be a short list. And that's why we're incredibly concentrated. If you've identified a great business and you've purchased it, well, why would you be in a rush to sell it, so the turnover is very low.

We're not trading in and out of these names. And sort of, lastly, it was very clear to me that that Chuck didn't operate under a lot of the sort of institutional imperatives that a lot of money managers do in terms of diversification, in terms of willingness to hold cash. So in fact, I actually before submitting my resume, I watched an interview that Chuck did on TV, I think it was in 2008. And he said at the time, I believe he was 35% cash, and whether being 35% cash was a good thing or not what it said to me very clearly is that here's somebody who thinks and operates independently. So I found that very attractive.

And extraordinary companies...

Compounding Machines.

The compounding machines, right. So why is it so hard to find those companies?

Well, they're scarce. They have something unusual going on and often.