On August 19, 2019, the influential US Group Business Roundtable published an upgraded version of its mission statement that signaled a shift of emphasis among the firms represented by its 181 member CEOs. The new view was summarized by JP Morgan CEO, Jamie Dimon, who stated, “The American dream is alive, but fraying. Major employers are investing in their workers and communities because they know it is the only way to be successful over the long term.” The new view was that companies should broaden their scope beyond maximizing shareholder value, the standard finance theory objective of the corporation, to take account of the welfare of all stakeholders such as employees, customers, the local community, and society at large.

Part of the reason for this new view was related to an earlier concern also expressed by Mr. Dimon, in conjunction with Warren Buffett, in article published in the Wall Street Journal on June 5, 2018. Buffett and Dimon argued that, “The pressure to meet short-term earnings estimates has contributed to the decline in the number of public companies in America over the past two decades. Short-term-oriented capital markets have discouraged companies with a longer-term view from going public at all, depriving the economy of innovation and opportunity.” The implication is also that this short-term orientation is a factor the contributes to the failure of companies to take account of the long-run impact of their actions on stakeholders.

Q3 2019 hedge fund letters, conferences and more

The view that companies and the market are short-term oriented is a direct challenge to the conventional financial economic proposition that the stock market prices equal the present value of a company’s expected future cash flows – cash flows that can extend into perpetuity. If this is the way the market is valuing companies then short-termism could not be a problem. But how do you tell if the market really works that way? The growth of financial websites provides a simple way to test the theory using published data on discounted cash flow (DCF) valuations. One prominent example is Finbox.io. Finbox provides DCF valuations, based largely on their extrapolations of analyst cash flow forecasts, for a wide variety of U.S. listed companies. This makes it easy to compare the DCF values with the current market prices. Of course, you would expect there to be some discrepancies between the DCF values and market prices because the cash flow projections that Finbox uses are not identical to market expectations. Presumably, the correlation between the DCF values and the market prices would be higher if the DCF valuation models were based on consensus analyst forecasts. Nonetheless, the discrepancies caused by using Finbox’s cash flow projections should be small compared to the cross-sectional variation in market values if the market values do in fact equal the present value of expected future cash flows. Consequently, comparing the market values and the long-term (10-year) Finbox DCF valuations, provides a direct test of whether the market is long-term oriented.

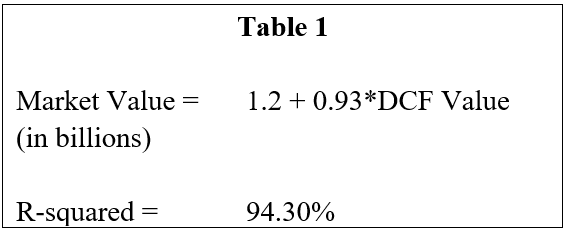

To conduct such a test, I downloaded the Finbox DCF valuations and the market values for all U.S. companies with a market capitalization in excess of $75 billion as of November 15, 2019. I then ran a simple regression of the market value on the Finbox DCF value. The regression results are reported in Table 1. The coefficient on the DCF value is 0.93 and the R-squared of the regression is 94.3%. This demonstrates that the DCF values explain most all the cross-sectional variation in market values implying that the market does indeed take a long-term view when valuing companies.

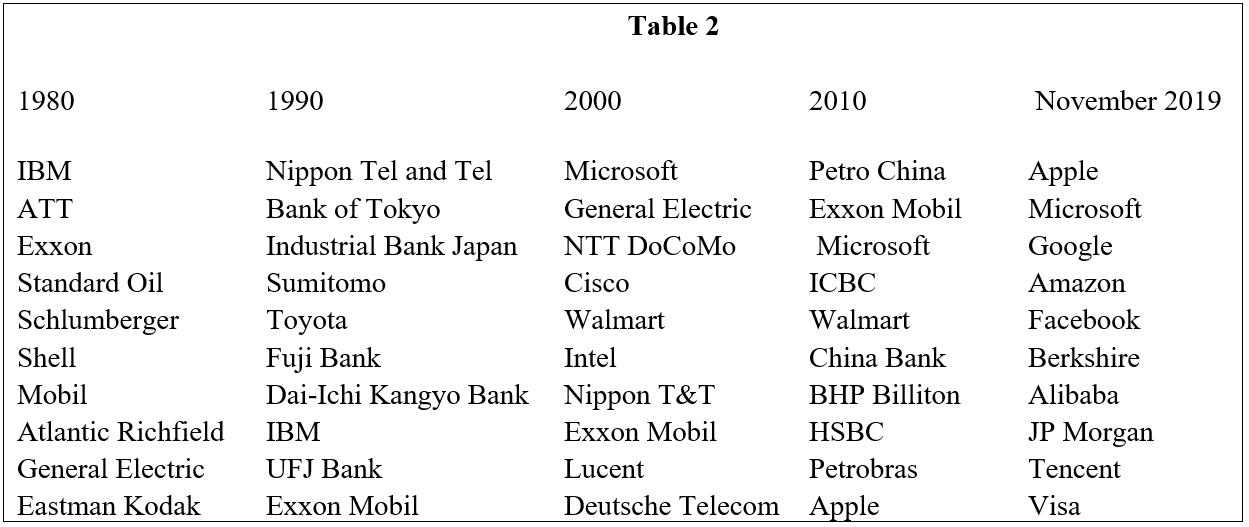

Another way to test whether the market properly evaluates the long-term prospects of companies is to examine how the list of the top 10 most valuable companies in the world has changed over time. Do companies enter and fall off the list because of short-term phenomenon or because of fundamental changes in their long-term prospects? Table 2 presents the 10 largest companies in the world by market capitalization at the end of each decade from 1980 to 2010 and as of November 2019. The most notable feature of the table is the dramatic turnover. In 1980, the top 10 is dominated by oil companies. By1990, the oil companies virtually disappear, and most all the top 10 companies are Japanese as a result of the massive stock market run-up in Japan. By 2000, all but two of the Japanese companies are gone and tech firms are on the rise. A Chinese firm first appears in 2010 and the top 10 is a diverse group. In 2019, the diversity gives way and the top 10 is composed almost exclusively of tech giants. Say what you will about this turnover, it was dominated by major shifts in the world economy and consumer preferences not short-term earnings management by companies. Just as in the cross-sectional regression, over time market values reflect the long-run opportunities of companies. Thus, while it may be important to distinguish the interests of shareholders and stakeholders for other reasons as discussed below, the alleged short-term orientation of the market is not one of them.

A more direct reason for advocating a new corporate form is to protect the interests of non-shareholder stakeholders, primarily employees, customers, surrounding communities, and society as a whole. I start with employees and customers. Under what circumstances will companies attempting to maximize shareholder value fail to treat employees and customers properly? The key here is competition in the marketplace. If businesses operate in highly competitive markets, then they had better treat their employees and customers well– both in the short term and the long run. Businesses that fail to do so will find that their shareholders are punished because they will lose both employees and customers to competing firms. In a competitive market, there is no divide between the interests of shareholders, employees and customers.

In an economy dominated by huge firms like Apple, Google, Amazon and Facebook, the situation may be different. Such firms may have sufficient market power that they can (which is not to say that they do) treat employees and customers less well without fear of losing them to competitors. As a result, employee wages may stagnate, product innovation may lag, and consumers may end up paying higher prices. Under such circumstances, however, the solution to the problem is not a new corporate form but more competition. In fact, a cynic might argue that major companies are promoting the new stakeholder platform because they fear that alternative less than regulations designed to promote competition. For instance, a special report published by the Economist in November 2018 referred to the United States as a capitalist dystopia; a system of extraction by entrenched giants and argued for more vigorous anti-trust policies.

With respect to communities and society in general, most of the cited concerns relate to externalities, one way or another. Perhaps the largest concern in this regard is climate change. The argument is that responsible corporations should adjust their policies to take account of the impact of their actions on the environment. Here again the argument misses a key point. There is no question that society should address critical issues involving externalities of which climate change is a prime example. The question is whether corporations are proper agents for making the decisions regarding how to cope with such issues. Dealing with climate change, for instance, will require comprehensive public policies that result from open and transparent debate in which the public is an active participant. It is unclear, therefore, why companies that have their own interests and disclosure policies should be making decisions regarding how best to respond to climate change. A better alternative is to have the government set the rules, such as instituting a carbon tax, and letting companies respond to prices that properly reflect the externalities.

The bottom line is that what is needed is not a new corporate form, but better public policy. New policies are required to ensure competition in the economy and to allow prices to reflect externalities. If we can solve those problems, no small task, the old corporate model should work just fine. If we do not address those problems, it far from clear that switching to a new corporate model would be beneficial. The divide is not between shareholders and stakeholders but between wise and relevant public policies and the current political dysfunction in Washington.