Whitney Tilson’s email to investors discussing Nathan Weiss’s write up on Tesla, Tesla’s surprise looks strangely familiar, Doug Kass on never shorting Tesla.

1) An outstanding analysis by Nathan Weiss of Weiss, Harrington and Associates:

Q3 2019 hedge fund letters, conferences and more

Tesla Third Quarter Earnings Update

Overall Financial Results

After the close, Tesla (TSLA) reported GAAP third quarter revenue of $6,303 mln, well below our estimate of $6,885 mln and consensus expectations of $6,448 mln. The shortfall was almost entirely due to lower than expected automotive sales revenue, which came in at $5,132 mln versus our forecast of $5,590 mln. We suspect Tesla sold heavily written-down inventory during the quarter, but no meaning insight was provided in the press release (or rather summary slide show) or earnings call.

..........

Accounting

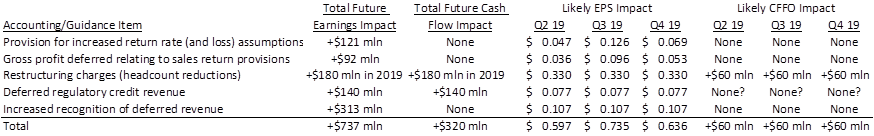

Tesla’s third quarter profit most certainly benefited from asset write-downs and accounting provisions made during the first half of the year – most notably the write-down of $500.5 mln of leased vehicle assets in the first quarter and the $160.8 mln combined first and second quarter restructuring charges. In our June 14th upgrade note (from ‘Sell’ to ‘Neutral’) we showed (on page five) the following table of Tesla’s first quarter accounting charges and their likely impact to future earnings:

At the time, we believed Tesla would realize the benefit of their accounting ‘piggy bank’ in the second, third and fourth quarters, but Tesla subsequently took a $117 mln charge in the second quarter and missed consensus (and our) estimates by a wide margin – likely indicating they were ‘kitchen sinking’ second quarter results and pushing potential accounting gains into the second half of the year. We assumed Tesla would once again accept their losses in the third quarter and instead flatter fourth quarter results, but this was obviously not the case. It can be incredibly difficult predicting quarterly earnings for companies which have recently written down assets held for sale and/or taken restructuring charges: The timing of realization of the subsequent accounting benefits is often at the discretion of management.

................

Tesla reported first quarter capital expenditures of $385 mln – just below our $400 mln estimate. Tesla spent just $914 mln on CapEx in the first three quarters of 2019 but failed to update their full year guidance ($1,500 mln to $2,000 mln), which we found somewhat surprising. That said, we read little into Tesla’s CapEx guidance given their reliance on third-party CapEx which Tesla repays with purchase commitments (their Panasonic agreement, for example).

Cash Flows

..............

Adjusting for the $154 mln decrease in working capital and the $35 mln increase in customer deposits, adjusted third quarter cash flows from operations were $567 mln, below the $762 mln generated in the second quarter despite meaningfully higher earnings. Third quarter earnings were very ‘low quality’ from a cash flow perspective.

.............

Conclusions

Last quarter we wrote “Tesla now has adequate provisions and write-downs to ensure that 100,000 third quarter deliveries - combined with modest ZEV and European emission credit revenue ($35 to $50 mln) - could generate a GAAP profit, significantly exceeding consensus estimates.” Unfortunately, we backed away from the forecast (instead forecasting an $.82 per share GAAP loss) as deliveries came in weaker than expected (particularly for Model S/X) and we felt Tesla would hold back from harvesting meaningful accounting reserves until the fourth quarter. With Tesla share up 20.15% in after hours (+$51.32 to $306.00), we clearly missed an opportunity to temporarily upgrade our ‘Neutral’ rating.

Going forward, it is hard to say if the 10-Q will bring sufficient disclosures to diminish the positive investor sentiment Tesla generated tonight with their ‘shocking’ third quarter profit. We also believe Tesla has sufficient accounting flexibility (or rather provisions) to show an even greater profit in the fourth quarter, making the shares uninvestable barring an extreme price movement in either direction. Perhaps more than before, ‘neutral’ is the right rating for Tesla.

(that said, we still believe Tesla could have a disastrous first quarter and Chinese Model 3 sales will disappoint. But Q1 results are a long ways out…)

As always, feel free to call with any questions.

2) A spot-on Bloomberg article, Tesla's Surprise Looks Strangely Familiar. Excerpt:

The profit and free cash flow figures also require scrutiny. Despite a slight drop in revenue, Tesla’s pre-tax profit swung up by almost $550 million from the second quarter. Of that, $126 million, or almost a quarter, was due to a positive swing in “other income,” including foreign-exchange gains. Another $117 million reflected restructuring charges going to zero. Tesla’s spending on SG&A also fell to its lowest share of revenue since the final quarter of 2018, the last time it reported a GAAP net profit. At less than $600 million, it was also the lowest in absolute terms since the second quarter of 2017, when Tesla sold less than a quarter the number of vehicles. By far the biggest swing, worth $317 million, was the improvement in gross profit margin.

3) Words of wisdom from Doug Kass:

Why I Will Never Short Tesla

* This missive delivers an important lesson in short selling that will likely save you a lot of money and sleep

* Trust me, please!

..............

Nearly two years ago I wrote, "Why I Won't Short Tesla." To wit:

This morning Tesla's (TSLA) shares are trading +$17 on better-than-anticipated production results.

I receive more emails, mostly from suffering short sellers on Tesla than any stock I write about. The higher the share price, the greater the desperation from the Bears.

I will never short Tesla in the future.

In shorting a stock, remember risk/reward is asymmetric. A short can only return 100% (a bankruptcy) but can rise to indefinite heights.

As it relates to Tesla, never short conceptual shorts or high valuation without a catalyst. I have the investment scars on my back, from speculative booms years ago (that I resisted), to make that statement.

Most importantly, avoid shorts when the outstanding short interest exceeds five days of average trading volume and/or a high percentage (greater than 7%) of the float.

Life is too short to be caught in short squeezes (like currently seen in Tesla).

Trust me on this, please.

My Tesla Street Cred

Over the last decade I have written more about Tesla than any other company extant.

Almost all of my analysis was downbeat.

Here are some examples of only some of the columns I have posted in only the last two years:

- Tesla has gone plaid.

- On making money, good ideas and chasing shiny objects.

- Tesla's downward spiral is no surprise to me.

- More intel on Tesla.

- Still stay away from Tesla.

- Tesla talk.

- Another short-selling lesson.

- Tesla: Never mind!

- Can Lucid Air take on Tesla?

- The absurdity of a Tesla takeover.

- Examining Elon Musk's blog.

- Riddle me this, Tesla.

- Five reasons why I doubt Tesla will go private.

- The Tesla Twitter fiasco.

- My view on Tesla bonds.

- A Tesla analysis.

Bottom Line

I always begin with the notion that short selling is not for most; it requires far more price discipline than long buying as reward vs. risk is asymmetric and it also requires more of a deep analytical dive as Wall Street tends to usually have a positive spin on companies, sectors and markets.

Trafficking in high short-interest stocks makes short selling much more difficult and dangerous, as Tesla shorts have realized here on Thursday.

Avoid selling short a company with a high short interest.

This is a core short-selling doctrine that will save you a large amount of money and sleep.

Position: None (and never will)

4) Comments from readers:

- Wonder if they are overcharging for a service call ie customer who has an issue with their vehicle brings it in and they up-charge for the 10k mike check ups, software reboot, new tires, auto pilot instal, et al? Margins went up a lot...while price and volumes down. What else explains 300mm higher in gross profit and 200mm lower in capex?

- I think the crux of the matter probably has to do with the second VIC comment, referring to the strange inventory increase. It is very strange indeed that inventory would increase by $200M in a quarter in which vehicle sales exceeded production. Bill Maurer briefly touched on this in his Seeking Alpha article on the earnings report, but I think Tesla was probably carrying a significant amount of inventory that had been written down over time. If they were to sell this inventory this quarter, COGS would be substantially lower, improving gross margins. As this written down inventory is replaced with new inventory the dollar amount rises, even if there is a slight decline in units.

- I keep hearing this nonsense about Teslas being double the cost to insure. I paid $60 less per year for a brand new Model 3 performance than I did for my three year old Audi S4. The Tesla is much more powerful and almost $10k more expensive and brand new. Just got my renewal notice and rate dropped $6. Same experience with several friends. I have no doubt there are people that received outrageous quotes, but a little shopping around and they can find reasonable rates. Plenty of reasons to be short TSLA and I am, but insurance is not one of them.