In this tutorial, you’ll get an overview of growth equity, learn what to expect in case studies, and see some highlights of how to complete a financial model and make an investment recommendation.

The Growth Equity Case Study 2.0: The Atlassian Model

Q3 2019 hedge fund letters, conferences and more

Transcript

Hello, and welcome to another tutorial video. This time around, we're going to be going over what I call growth equity case study 2.0. We did cover this topic before, and we have featured Atlassian in this channel, but this is a new version of an older case study here. And we're going to be discussing what you might expect in growth equity in interviews and case studies like this

2.0

So let's start by talking about what growth equity is, and explaining where to find some of the information files and resources for this video. So this entire tutorial corresponds to an M&I article on the same topic, you can just go to mergersandinquisitions.com/growth-equity/, or just type M&I growth equity, and you'll eventually get to it like that. We're going to expand on the M&I article here and then show you more of the XL parts in video format. Because I think it's just easier to understand when you see someone actually going through the file and looking at and entering the formulas.

So our plan for this tutorial will be to cover what growth equity is first, then I'll give you some of the highlights of the growth equity case study for Atlassian, here and the model that we build for it. And then a part three, I will explain how to use the model and some of the numbers to make an investment recommendation.

So what is growth equity? The basic idea is that it's a mix of private equity. In other words, firms that execute traditional leveraged buyouts of mature cash flow positive companies, and venture capital firms that invest in risky, but potentially high growth startups. The first difference between these three fields is that growth equity similar to venture capital, only invest minority stakes in companies.

So it's completely different from private equity, where they usually acquire the entire company or a very high percentage of it. The second difference is that companies need to have proven markets and business models. In other words, they must have actual revenue.

Cash flow vs income

Even if they're not profitable, they need to be on some type of path to profitability or being cash flow positive, which makes it different from venture capital.

And then the third difference is that the companies need to use the investment for a specific growth purpose such as market or geographic expansion, hiring more sales reps, buying more factories, completing add on or both on or tuck in acquisitions, whatever you want to call them. And this difference really makes it different from both private equity and venture capital because the same type of requirement doesn't exactly exist in those fields.

There are a few other differences related to the financial characteristics of deals as well. First off, the targeted multiple in growth equity is often somewhere in the three to five x range, and the IRR might be around 30 to 40% as the target. A lot of VC firms are looking for more like a five to 10 x multiple, and a lot of PE firms are looking more for a two to three x multiple, and maybe a 20 25% or up to 30% IRR.

The returns sources and growth equity deals as the name implies are primarily from growth, whether it's organic, or other types of growth from partnerships or acquisitions or things like that.

Private equity

There is very rarely any debt pay down because debt is not often used in these deals. And there may be some returns from multiple expansion. But really, you want to see most of the returns coming from the company's revenue and EBITDA and operating income growing over time. Finally, in terms of leverage, unlike in private equity, there is minimal debt used here.

But sometimes group equity firms do use preferred stock with liquidation preferences, or hybrid securities like convertible bonds to mitigate some of the risk and some in case something goes horribly wrong in the deal.

Let's now go to part two and talk about some of the highlights for this growth equity case study. You can get the entire document for it below this video and go through it's only a few pages long and be succinctly described the scenario and the different parts there. But I'm going to give you an overview in PowerPoint format now and jump into Excel for certain key parts of this.

Growth equity modelling

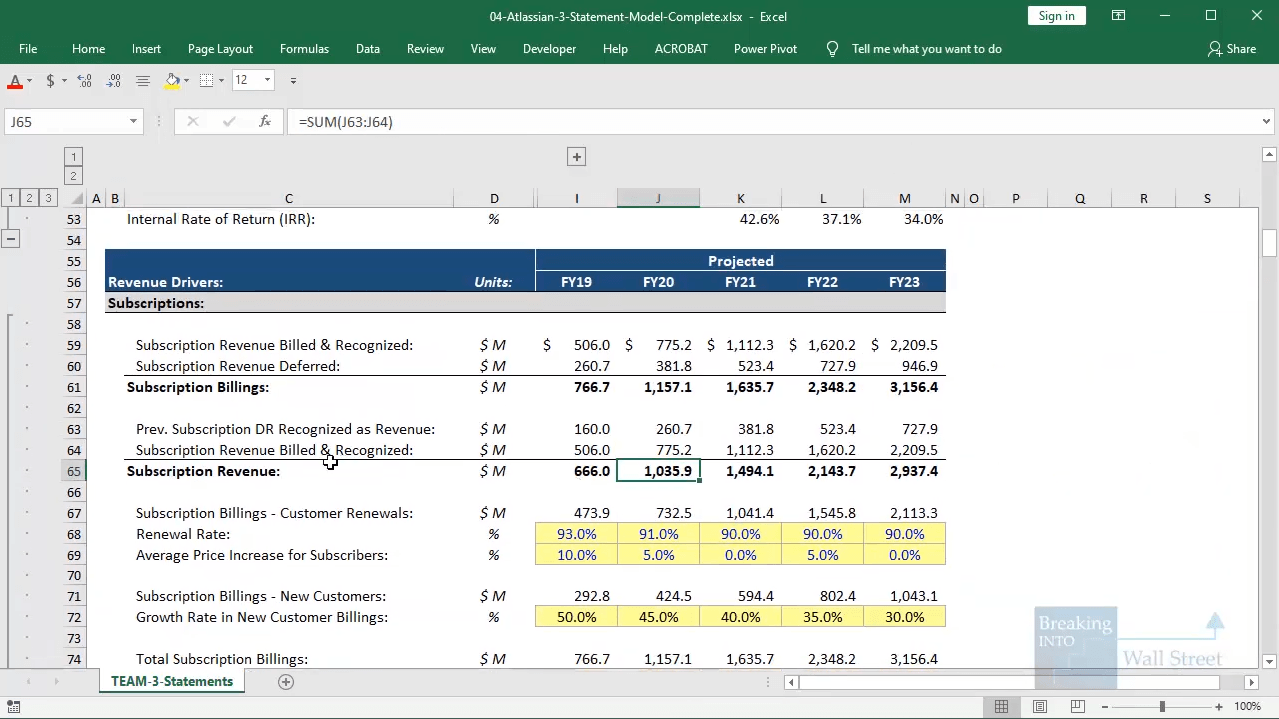

So as I mentioned, this comes from our Excel and fundamentals financial modelling course, based on its Atlassian, which is a software company that creates tools and products for other programmers to make them more productive. It had just under a billion in revenue, slightly negative operating income and run 40% revenue growth at the time of this case study and it was transitioning from a one time purchase model to a subscription model with recurring revenue.

The key question here is should we invest $2 billion for a small stake around eight or 9% in Atlassian, so they can use the funds to acquire other high growth software companies and get more customers and cross selling opportunities like that.

Now, this case study I should mention is a bit weird because Atlassian at the 10s of billions in market cap is far too big for traditional growth equity deal. 2 billion is much bigger than any single firm would ever commit to a deal like this in most cases. So it's a bit of an unusual scenario, but we're just going to go with it because of the rest of the key study here. Pretty much lines up with what you'd expect in this type of exercise.