In light of today’s release of the US September unemployed persons and jobs report, Jeoff Hall, Managing Economist, Refinitiv, assigns a ‘B’ grade to the overall report.

Jeoff Hall, Managing Economist, Refinitiv says, “The jobs data were rather dull in the so-called Current Employment Statistics (i.e., the establishment survey), but very impressive in the so-called Current Population Survey (i.e., the household survey). If we were to assign a grade to the overall report, we’d give it a B.

Q2 hedge fund letters, conference, scoops etc

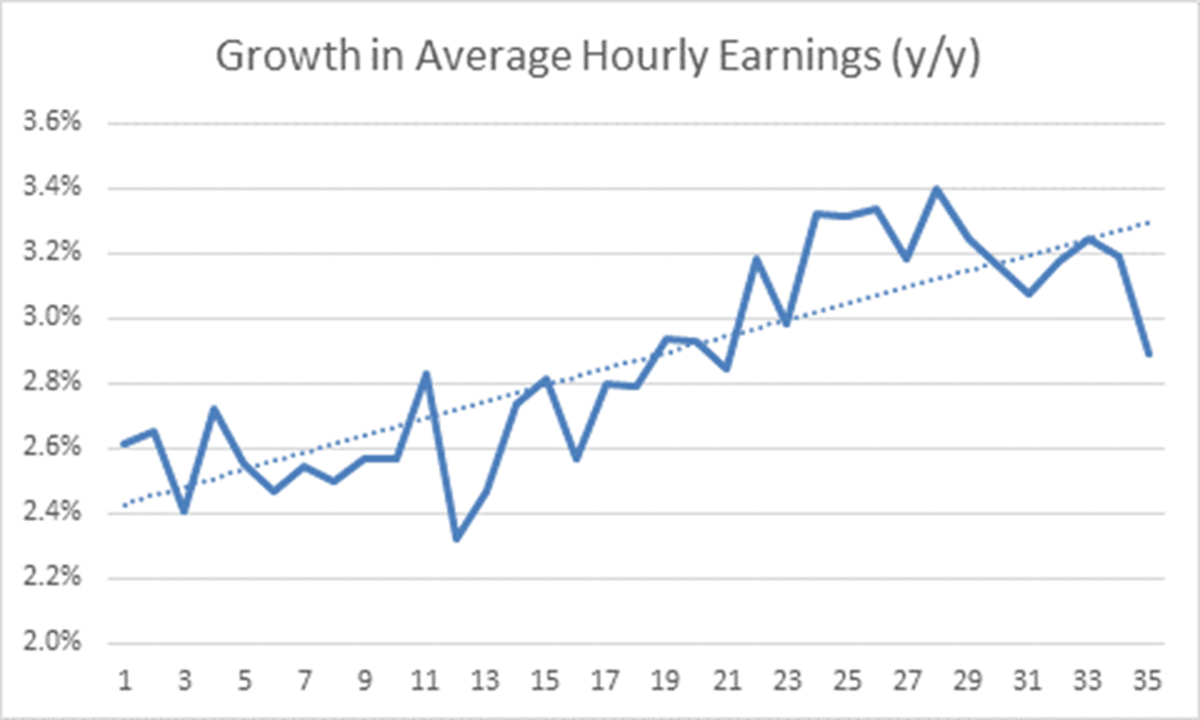

In the establishment survey, job growth of 136k total was only slightly behind the market consensus derived from the Reuters economist poll (+145k). If we add the 38k upward revision to August payrolls, employment is 174k higher than it was last month. That’s pretty good. The disappointment then came from the wage component, where average hourly earnings were flat on the month, missing expectations of a gain of 0.3% and following an increase of 0.4% m/m in August.

Number of unemployed persons drop

Although they were statistically unchanged on a rounded basis, average hourly earnings actually fell by a penny in September, the first decrease in 23 months and only the second drop in the last 5.5 years. None of the 78 respondents in the Reuters poll had earnings growth coming in so soft. The lack of change on the month meant the year-on-year change slowed to 2.9% in September from 3.2% in August. It was the slowest 12-month accrual to wages since July 2018.

In the household survey, employment rose by 391k in September, almost three times the job growth in the establishment survey. This has been the trend in recent months. In fact, from May to September, the household survey shows employment rising by 1.624 mn (325k per month), or an annualized rate of 3.898 mn. That’s more than twice the growth shown in the establishment survey during the same 5-month period, which was 710k (142k per month), or an annualized rate of 1.704 mn.

Conclusion

Also in the household survey, the number of unemployed persons fell by 275k in September, the largest 1-month drop in five months. The unemployment level declined to 5.769 mn, the lowest since December 2000. Meanwhile, the labor force expanded by another 117k, building on gains of 370k in July and 571k in August. The size of the labor force (164.039 mn) has hit record highs in each of the last three months. The fall in the number of unemployed persons and the rise in the labor force resulted in a 0.17-percentage point drop in the official unemployment rate to 3.5%, the lowest since November 1969. Some 61.0% of the U.S. population is now employed, the highest percentage since November 2008.

The bottom line: According to the jobs data at least, recession fears are overblown. There are concerns about employment and wages in the manufacturing sector, mostly due to ongoing uncertainty about when and how trade disputes will be settled. For now though, most sectors of the labor economy are growing at a healthy clip.”