Horos Value Internacional and Horos Value Iberia letter to investors for the third quarter ended September 30, 2019.

Dear co-investor,

We finish the third quarter of 2019, a period of continuity with respect to previous quarters, in which investors’ money continues to flow towards certainty, at any price, and flees from the most illiquid and/or cyclical companies, despite the attractiveness of their valuation.

Q3 2019 hedge fund letters, conferences and more

This situation is causing an unsatisfactory relative (and absolute) return on our portfolios in the short term, but nevertheless contributes to generating great opportunities for appreciation in the long-term. At Horos it is clear to us that we must flee from the "fashionable", as comfortable as it may seem to follow them, because our main objective as managers (and co-investors) of our funds is to maximise returns (in the long term) while minimising the risk we incur.

Periods like the present should not make us despair, nor call into question an investment process built with this sole objective in mind. From the fruits we are sowing (our potentials are at historical highs) we will reap the rewards.

As always, I would like to take this opportunity to thank you, on behalf of the entire Horos team, for your trust.

Yours sincerely,

Javier Ruiz, CFA

CIO

Horos Asset Management

The great evasion

We have in effect put all our rotten eggs in one basket. And we intend to watch this basket carefully. - Von Luger, the Kommandant (Great Escape, 1963)

In the last quarterly letter (read letter) we discuss how various factors may be contributing to the relative poor performance of our portfolios when compared to benchmarks. In particular, we highlight three situations that have been going on for some quarters and that, far from being reversed, seem to be escalating in recent months.

The first of them is the important divergence that exists between the evolution of companies perceived by investors as safe, i.e. companies that are large and are involved in business with a more stable and, apparently, more predictable cash generation relative to companies of a smaller size and/or of a more cyclical nature and, therefore, with a more volatile and, supposedly, less predictable cash generation.

A clear example of this trend can be found in the American company Procter & Gamble (P&G). This giant, owner of famous consumer brands such as Gillete, Oral-B, Pantene and Ariel, to name but a few, has maintained an extraordinary evolution in the stock market in recent months. In fact, since May 2018, the date on which we could place the beginning of this stock market divergence, P&G's shares have recorded a revaluation of close to 80%, including dividends, an evolution more typical of a smaller company and a great future prospects of growth in its business. However, in the case of P&G, we are talking about a company with a collection of high-quality businesses, but limited growth. In the same period, its free cash flow, the true earnings of a company, grew 6% (11% in terms per share, thanks to the impact of the buyback of its own shares).

That discrepancy has led P&G to trade, at the time of writing, nearly 30 times its current free cash generation, in contrast to the less than 20 times it traded a little over a year ago. Does it make sense for a business like P&G to throw up these valuations? The same has happened with companies such as Nestlé (+50% from 2018 lows and a current 30 times PE) or Nike (+35% and 35 times PE).

Of course, the investment community, faced with the lack of "safe" investment alternatives (remember that fixed income offers, in many cases, negative returns), has decided to flee to this type of business, regardless of the price at which they are trading. In Horos, however, it is clear to us that the best way to grow your (and our) savings is to invest in companies that offer a high margin of safety and, in our opinion, companies such as P&G, however stable their cash flows may be, do not offer a minimally satisfactory potential for investing in them.

One cannot help but be reminded of the time of the dotcom bubble and the comments that legendary value investors like Seth Klarman offered their investors at those difficult times, given the growing similarities between the two periods:

While the major stock market indices have never been so expensive, the range of valuation in today's markets is also extraordinarily wide. As a result, there are numerous undervalued small to medium capitalization stocks even as there are dozens of astonishingly overvalued large capitalization companies.1

Finally, we cannot lose sight of the fact that when a company trades at such high valuations, the market is discounting perfection in the future of its business and any negative deviation from that view of the investors can trigger a strong stock market correction. Such is the case in the tobacco industry. This sector, which has always been considered one of the most defensive in the world, has been suffering on the stock market for a couple of years now, with accumulated falls of more than 40% and companies that used to trade at demanding multiples can now be bought at 10 times their free cash flow. The reason? On the one hand, the fall in tobacco consumption in many developed countries. On the other hand, the rise of new products that may be displacing tobacco (although studies are beginning to appear indicating the opposite), such as vaporizers or marijuana (legalized in some parts of the world).

What has happened with tobacco is therefore a good reminder that there are no certainties as far as business and investment is concerned. If we pay a high price for this apparent certainty, it can cost us dearly, especially if the perception of a company's business takes an unexpected turn.

The second situation we commented on last quarter is the high volatility of the shares of an ever-increasing number of companies. These movements are often accompanied by (abrupt) changes in the expectations of the investment community about a particular business or sector. In others, as we will see below, the mere inflows and outflows of investment funds may be behind these ups and downs.

Of course, one sector that absolutely exemplifies this volatility, heightened by changes in investor sentiment, is found in the oil industry. Let's take the case of Valaris (formerly Ensco), one of our investments in oil platform companies. There is some debate about what to expect from the supply and demand dynamics of oil in the short and medium term. On the one hand, there is the fear that demand will contract due to the general slowdown of economies, especially China, and that, in addition, supply will continue to grow, despite cuts by important players in the sector, thanks to continuous increases in production from the United States and its shale oil. On the other hand, however, there is the argument that demand growth will remain stable in the future and that, if oil from the United States grows less than expected (as some data begin to indicate2), then supply will not satisfy that demand, causing a significant bottleneck in the market and a potentially significant appreciation in the price of crude oil.

Obviously, as sentiment shifts to one side or the other, the sector tends to reflect it in its stock prices and in a very exaggerated way. At the beginning of the quarter, the prevailing narrative was the thesis of oversupply, which triggered the fear that the utilization rates of oil platforms will take longer to recover than expected (if there is oversupply, the price of oil is not attractive enough to encourage new investments, limiting the leasing of platforms) and, therefore, that the future debt refinancing of these oil service companies may be called into question. With these arguments on the table, Valaris lost more than 60% on the stock market in just over a month.

The curious thing is that, shortly afterwards, one of Saudi Arabia's most important infrastructures suffered a drone missile attack, causing 5% of the world's oil supply to disappear at the same time. The supply shock triggered an instantaneous change in market sentiment,3 pushing up the price of oil and the stock prices of the sector, with Valaris appreciating, from the August lows, 100%. With the passing of days and the reassuring messages pointing to a rapid recovery of Saudi Arabia's productive capacity,4 sentiment turned again and, with it, the Valaris share price, which depreciated by nearly 40% until the end of September.

In short, in just over a month and a half, Valaris has seen its share price divided by more than two, then doubled and then halved again. Is it reasonable to think that all this range of movement is justified by the progress we can expect from your business? Or, perhaps, the investor's sensitivity to cyclical companies is extreme today and any news precipitates huge oscillations in their prices? In Horos we answer affirmatively to this last question and we try to take advantage of this extreme volatility of the companies, sowing our future returns.

It is of paramount importance that investors brace themselves for a stern test of their investment will. Avoiding overpriced speculations and maintaining a strict value discipline are more important than ever because the overpricings are so egregious and the bargains so pronounced. Yet the price swings are so severe and swift, and not always in the desired direction, that investors must be braced for mark to market losses. Those sufficiently disciplined and unwavering will be generously rewarded.5

The third and last situation that is influencing the different evolution of some and other companies in the stock exchange, would be caused by the behaviour of investors themselves, both fund managers and their investors. One of the biggest risks for an employee of a company is obviously losing his job. Fund managers are not immune to this risk, with the peculiarity that, on many occasions, they have to work against the interests of their investors, so that they are not abandoned and end up unemployed. The explanation for this apparent contradiction is very simple and responds to what is called career risk. Fund investors tends to "forgive" a manager who makes a mistake made by most managers but do not usually forgive the manager who messes up investing in a company that is, for example, small, illiquid and little known.

For this reason, many managers follow the herd and seek to invest in what is performing best on the stock market at the time, regardless of the economic sense of that investment. If the majority of professionals are guided by this herd behaviour, there is a vicious circle which eventually, if history serves as a guide, ends disastrously:

A vicious circle has been working against these smaller stocks (even as a virtuous circle propels the high flyers) in that their recent period of protracted underperformance causes disappointed holders to sell. This produces illiquidity and further declines, resulting in even greater underperformance which then triggers new waves of selling. Many small-cap value managers have been facing investor redemptions, further fueling the selloff.6

Possibly, this effect is occurring today, with most managers investing in companies of greater size and apparent certainty, leaving aside the rest of the listed companies. In fact, some studies indicate that we are in one of the moments where the similarity of portfolios among investment fund managers is at its greatest7. We don't know if history is repeating itself, but it's certainly starting to rhyme.

In addition, we are faced with the potential effect of passive management. Without entering into the debate of whether there is simply a correlation or a causality between ETFs inflows (quoted funds that replicate stock indices) and the behaviour of the indices, the reality is that the ETFs with the greatest assets under management are precisely those that replicate the large American stock exchange indices, where more companies of great size and future visibility can be found to invest. Curiously, some studies8 today show the American stock market with a valuation twice as high as that of other global categories, such as the Asian (it is no coincidence that our international portfolio has nearly 25% of its assets concentrated in this continent).

The same can be said, although we do not like to use this type of label, about investment styles: strategies that invest in large companies with a growth profile are trading, according to some metrics, as three times more expensive than those that invest in small growth companies and, more shockingly, about five times more expensive than strategies with small value companies. 9 In fact, the same is happening in active management. It should be noted that 2019 is becoming the year with the least money managed by asset value managers in the last decade.10

If I may, I would like to repeat one last comment by Seth Klarman from June 1999, which is still valid today:

One particularly irksome development is that fundamental research is today a significant impediment to good short-term results, as the most overvalued securities have steadily been the best performers and the most undervalued the worst.11

In conclusion, at Horos we think that today it is more important than ever to have an organisational structure that allows us to isolate ourselves from the thunderous background noise and makes it easier for us to think independently and develop the temperance and patience to take advantage of the (great) opportunities that today's markets offer us. Likewise, having investors like you, who understand and share our work and investment philosophy, is an advantage in times like these, times when your trust becomes an indispensable asset to capitalising on our investments.

More is less?

If everyone's thinking alike then NO ONE is thinking. - Benjamin Franklin

Although it is true that some of our investments have suffered a deterioration in their businesses and deserve a poorer stock market evolution (it is another thing if the magnitude of their corrections seems excessive), we find ourselves with other cases in which businesses have evolved as we might expect or, in some cases, even better than expected, given the prevailing environment, and yet their price seems to interpret it as something negative.

Without wishing to be exhaustive, I would like to review the following "eye-catching" examples:

Uranium (8% Horos Value International)

Our exposure to uranium is realized, as you know, through financial vehicles that buy uranium for storage (Uranium Participation y Yellow Cake) because, in our view, they offer a more attractive risk-return binomial than uranium investment through mine operators.

Well, since we started investing in these companies more than a year ago, our thesis on a recovery in the uranium sector has been vindicated. On the supply side, Kazatomprom, the world's leading uranium producer, announced in August its extension of a 20% production cut until 2021, one year longer than initially announced. In fact, at its first event for investors and analysts on September 30, its management team stressed that they are far from considering a return to increased production if the fundamentals (price of uranium) do not improve.

Meanwhile, on the demand side, popular and political sentiment seems to be shifting towards a future in which nuclear energy must play an important role in the energy mix, if we want to meet the emissions targets and the great energy needs anticipated in the coming years. This has been reflected in the recent report published by the World Nuclear Association,12 in which, for the first time in eight years, ALL the scenarios examined, including the negative, assume a growth in installed nuclear generation capacity in the world. All this is thanks to the expected growth of new reactors in economies such as China, India and Russia, which helps to compensate for (and overcome) the gradual fall or zero growth in more mature economies, such as those of the European continent.

Therefore, significant improvements in the fundamentals of demand and supply have been reflected, this quarter, in a rise of nearly 5% in the price of uranium. However, in this same period, Uranium Participation has remained stable and Yellow Cake has fallen 5%, increasing the discount with which they trade against the value of their uranium inventories (up to almost 20%, at times, in the case of Yellow Cake). The reason? Important shareholders forcibly selling their stake, in the face of the massive outflows from investors that have led them to close their fund.13 Given this opportunity, we decided to increase our exposure to Yellow Cake.

Small-Cap Chinese companies (17% Horos Value International)

We are referring to our investments in Keck Seng Investments, Asia Standard International, Time Watch Investments and the recent additions of Value Partners y Clear Media.

In order not to make this exercise excessively long, let us quickly comment on the two most surprising cases:

- Asia Standard International: At the end of June the company published an annual adjusted profit of more than 1 billion Hong Kong dollars, after improving its expectations for the year in the previous weeks. To give you an idea of how undervalued the company is, Asia Standard has a market value of HKD 1.7 billion, i.e. it trades at a PE of less than 2 times. Despite all this, its share fell -15% in the quarter and accumulated -25% since mid-April.

- Value Partners: The company is a fund manager with a (mainly) value philosophy, that we were shareholders in a few years ago and which once again offers an interesting investment opportunity. In the latest earnings release, Value Partners exceeded $18 billion in assets under management, 20 percent higher than at the end of 2018 and the largest volume under management in the company's history. In addition, Value Partners has a cash position that is approximately half its market value, including a direct investment in the funds it manages that accounts for one-third of market capitalisation. The evolution of the share price? A fall of 25% in the quarter and 42% since mid-April. Today the company trades at 5 times its free cash flow estimated for this year.

Aperam (5.3% Horos Value Iberia and 4.6% Horos Value Internacional)

This case is different from the previous ones because Aperam belongs to an industry that has suffered a deterioration in its fundamentals. However, what we must ask ourselves as investors is, to what extent does this deterioration justify the correction that the stock has suffered. The stainless steel sector has experienced a perfect storm over the last year and a half, severely impacting the companies' business. Specifically, events such as the interminable brexit, the enormous growth of nickel production by Indonesia in recent years,14 exported to China as cheap raw material to manufacture Nickel Pig Iron (NPI) and, subsequently, stainless steel with which they have flooded the European market and, finally, the trade wars of the United States with the rest of the world.

This was a very complicated situation that led to a 9% correction in the quarter and, 50% since the beginning of 2018. As we have made clear, although we understand that the deterioration impacts the business, it is also true that the company is in an enviable financial situation (with practically no debt) and with an expectation of generating 140-150 million euros (8% yield). As we understand it, the market does not discount any improvement for the future, despite the fact that the company has generated more than 250 million euros of free cash in recent years, with steel prices in Europe below the historical average, which is why it is one of our main positions.

We could continue to give other similar examples, but I believe that those already given provide a clear idea of what has been happening, in recent months, in the market. We don't have a crystal ball. We do not know when this divergence will reverse and when the market will recognize the value of the companies in which we invest. However, we are convinced that our portfolios have the greatest potential in their history and that of the seeds we are sowing, let us hope sooner rather than later, we will reap the rewards.

Current Affairs

This quarter I would like to highlight the following current events. I had the pleasure of participating again this year in the Summer Course of Azvalor and the Universidad Complutense de Madrid, where I explained the Horos investment method, with examples of some of our investments (view talk). Additionally, I was proud to give the commencement address at the 2019 Graduation Ceremony of the Master's in Value Investing and Cycle Theory of the OMMA Center of Higher Studies, where I gave a brief speech on the attributes that I humbly believe every investor should have (view speech).

Our manager Alejandro Martín was interviewed in the value investing program Iceberg de Valor, where he commented on our form of investing and some of our portfolio holdings (listen to podcast). In addition, he recently recorded for our YouTube channel a video updating our investment thesis on Keck Seng Investments (see thesis).

Horos Value Iberia

The fund can invest up to 20% in stocks listed in Portugal and at least 80% in stocks listed in Spain. In addition, it can invest up to 10% in Spanish or Portuguese companies listed on other markets.

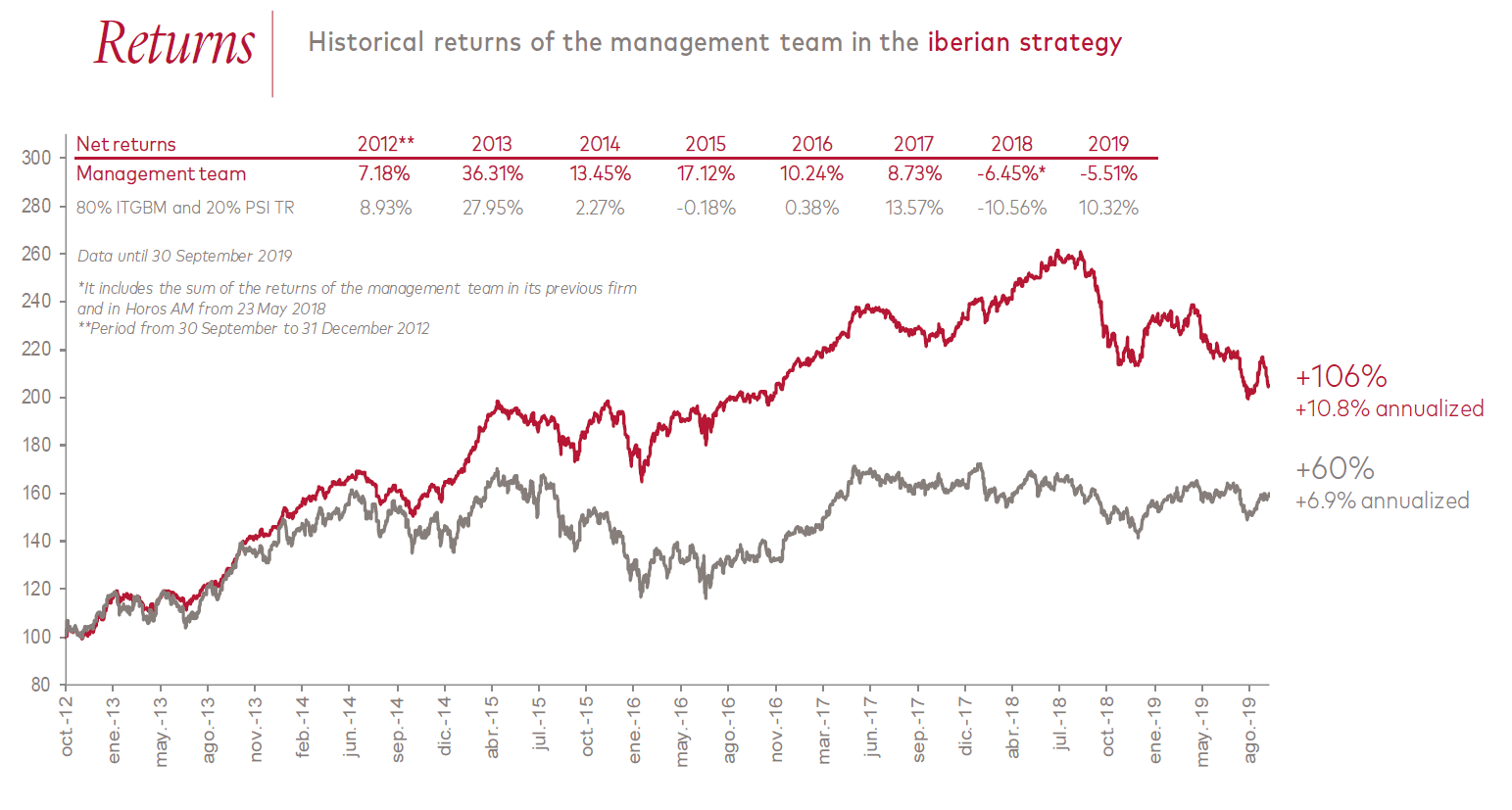

Horos Value Iberia returned -5.8% in the third quarter, compared to its benchmark index, which returned -0.3%. Since its inception on the 21st of May of last year to 30th September this year, the fund's cumulative return has been -17.9%. In the same period, its benchmark performance was -4.7%. The results achieved in such a short period of time are merely anecdotal and should be considered as such. As an indication of the importance of long-term investment (remember that the minimum recommended investment period for our products is five years) the annualized return obtained by an investor who has been with this management team since its inception would be 10.8 % versus 6.9% of its benchmark (for more information, you can consult the annex in the final part of this document).

In this quarter, the investments that have contributed most positively are Miquel y Costas and Bolsas y Mercado Españoles (BME). The former benefited from the publication of half-yearly results, showing a better evolution than expected by the market. BME, for its part, saw its price improve by the corporate movements experienced in the stock market sector, such as the (rejected) launch of a takeover bid for the London Stock Exchange by the Hong Kong Stock Exchange.

On the negative side, the stand outs are Meliá Hotels International and Sonae Capital. With respect to the hotel group, it appears that the global economic downturn, as well as some problems that directly impact the company (such as the invasion of sargasso seaweed on Mexico's beaches), have continued to put pressure on the stock. As for the Portuguese holding company, its fall on the stock market seems to correspond more to movements in investor flows than to any fundamentals. In both cases, it seems to us that their current valuations show a very high margin of safety, so we keep them among our main holdings.

The fund's portfolio had three exits in the quarter (Barón de Ley, CAF and Corticeira Amorim) and no entries.

The three exits occurred because of lower potential in relation to other alternatives already present in the portfolio, such as the Portuguese holding Sonae Capital, the chemical company Ercros and the paper group Iberpapel, whose weights we have increased in the period.

At the end of the quarter, the theoretical potential of the fund for the next three years is around 89%, which would be equivalent to an annualized return of 23.6%. For the calculation of this potential, we performed an individual study of each holding that makes up the portfolio. These theoretical returns are no guarantee that the fund will perform well over the next three years, but they do give an idea of how attractive the current time is for investing in Horos Value Iberia.

Portfolio Structure

At the end of December, the portfolio of Horos Value Iberia comprised 23 holdings and was concentrated in two important blocks. On one hand, over 70% of the part invested from the portfolio comprises companies that we have known for years that are managed by families with an important presence in the shareholding (which guarantees an alignment of interests with shareholders).

The second block (13%) is made up of companies that have been forgotten or even "hated" by the investment community, because they have historically been unsatisfactory for shareholders, but that are very attractive to invest in today.

Horos Value Iberia also invests in Horos Value Internacional (5.0%). In this way, the potential of the Iberian fund is increased, increasing the quality of the portfolio and generating greater value for our co-investors in the long-term. Of course, NO commission is charged on that percentage invested in the house funds.

Lastly, the cash position of the fund at the end of the quarter stood at 3.6%.

Main Positions

Melia Hotels International (7.3%, family-owned): hotel group with a presence in over 40 countries, of which the Escarrer family controls 52% and has been a shareholder for over 60 years. The company is the leading hotel chain in Latin America and the Caribbean and is the largest global player in resorts and “bleisure” (a combination of business and leisure). Meliá's objective is to migrate to an asset-light business model, which focusses on the management of hotels without owning them. Currently, hotel management accounts for nearly 30% of EBITDA and they expect to reach 50% in seven years. The interesting thing about this investment lies in the valuation of its hotel assets, (much higher than its current market capitalisation, which allows us to take the hotel management business “for free”) and what this business can contribute to the company in the future.

Ercros (6.8%, forgotten): company forgotten by analysts due to the complicated situation it experienced a few years ago. It is an industrial group dedicated to the production of chlorine derivatives (necessary, for example, for the manufacture of PVC), intermediate chemicals (formaldehydes, glues and resins, etc.) and pharmaceuticals (raw materials and intermediary products). After almost ten years of continuous decline in demand for PVC, the capacity shut-downs of the sector in recent years, together with the additional restriction of supply that is taking place, following the ban by the European regulator on the use of mercury technology in chlorine production processes, gives us reasonable expectations for a good evolution of this industry in the coming years.

Renta Corporación (6.1%, forgotten): the company, focussed on acquiring real estate assets for transformation and sale, has gone through a restructuring process, both financial and business (they use options to purchase the properties to be reformed), which avoids the risks to the balance sheet that are typical of this industry. In addition, it has reached an agreement with the Dutch pension fund APG to manage its SOCIMI specialised in residential assets. This SOCIMI has the goal of reaching 1,500 million euros in assets and Renta Corporación, in addition to owning 3% of the SOCIMI, charges a 1.5% fee for its management. In 2019, Renta Corporación has announced its intention to launch two more similar vehicles, which will contribute to increasing the cash generation capacity and visibility of the company's results. Finally, it should be noted that we are working hand in hand with a professional and highly experienced management team, which has been able to restructure its business toward a model of high returns on capital employed.

Sonae Capital (6.0%, family-owned): it is a Portuguese investment vehicle managed by the Azevedo family, which owns real estate assets and operates in the tourism, energy and industrial sectors. The company seeks to invest in Portuguese niche companies that may have an export potential. We believe that the value for the sum of parts of the different businesses is substantially higher than Sonae's current market cap.

Semapa (5.5%, family-owned): Portuguese investment vehicle managed by the Queiroz family, which controls close to 70% of the paper company Navigator and 100% of the cement company Secil and the animal by-products treatment company ETSA. We believe that the holding company is trading at an excessive discount compared to the valuation of its assets.

Horos Value Internacional

Our international portfolio can invest without geographical restrictions in most of the world's stock exchanges, including the Iberian market. Therefore, Horos Value Internacional can count on the best investment ideas that this management team currently finds available.

Horos Value Internacional returned -2.8% in the fourth quarter, compared to its benchmark index, which returned 4.4%. Since its inception on the 21st of May of last year to 30th September this year, its return has been -19.6%. In the same period, its benchmark performance was 11.5%. The results obtained in such a short period of time are merely anecdotal and should be considered as such. As an indication of the importance of long-term investment (remember that the minimum recommended investment period for our products is five years) the annualized return obtained by an investor who has been with this management team since its inception would be 9.6% versus 12.0% of its benchmark (for more information, you can consult the annex in the final part of this document).

In this period, the holdings that have contributed most to the fund's portfolio are Teekay Corp, Qiwi and Alphabet. The American holding company, the controlling shareholder of Teekay LNG and Teekay Tankers, recovered part of the ground lost in the previous months during the quarter, as its Investor's Day was approaching, announced for the beginning of October, in which news was expected on the dividend distribution agreement (IDR) that it maintains with Teekay LNG. However, although outside the period covered by this commentary, it is worth noting that this event has been suspended after the negative impact and uncertainty caused to Teekay LNG by the blockade of the Yamal LNG Joint Venture that maintains with Teekay LNG one of the subsidiaries of China COSCO, which has been harmed by the sanctions imposed by the United States for allegedly transporting oil to Iran. Teekay hopes to resolve this issue soon, but, right now, the uncertainty about this important JV is very high.

For their part, Qiwi and Alphabet have continued to perform well following the increase in recommendations from some analysts and the good performance of their respective businesses.

On the negative side, the following companies stand out: Valaris (old Ensco), Pendragon and Borr Drilling. There is little to add about the evolution of oil platform companies that we have not commented on in previous communications. This quarter has also been one of enormous volatility, with large falls and rises, which we have taken advantage of to restructure our positioning in the sector. Specifically, we have reduced our position in Valaris to enter another company in the sector, Shelf Drilling, the financial profile and cash generation capacity of which we consider to be less risky, without renouncing a high potential for revaluation, supported by an interesting programme of repurchase of own shares.

With regard to Pendragon the bad evolution of the business and the continuous changes in the management of the company are harming the stock. We think that Pendragon trades at very attractive multiples, but we have preferred to limit our exposure until the situation of the management team and its potential future decisions are clarified.

The international portfolio has had three entries (Clear Media, Shelf Drilling and Value Partners) in the period and one exit (Booking Holdings).

Clear Media is a company that we have known for years and in which we have decided to invest again after its great correction in recent months. China's leading outdoor advertising company (bus shelters), it is suffering one of its worst economic periods after the slowdown in advertising spending that has occurred in the country, exacerbated by the concentration of Clear Media in customers from the technology sector. The company is taking steps to reverse the situation, implementing efficiency improvements, reorganizing the sales team and diversifying its customer base into more defensive sectors. Its current financial position and its capacity to generate cash, as well as its attractive valuation, have led us to take advantage of what we see as a conjunctural situation for the company.

Value Partners is another Hong Kong investment fund management company with a value bias that we also know very well. The fear of a slowdown in China has led the company to suffer a significant market fall to levels not seen in years, even though Value Partners manages the largest AUM in its history and has a much more diversified range of products. The company maintains a significant cash position that it uses, in part, to invest in the funds it manages, which contributes to compounding value for its shareholders. Finally, Value Partners trades at a very attractive multiple of 5 times its current cash generation.

As for the sale of Booking Holdings, this is due to its low potential compared to other investment alternatives.

Finally, this quarter saw a change in the capital structure of Naspers. The South African holding carried out the spin-off of its international internet platform business (such as Tencent) into a new holding called Prosus and listed in the Netherlands. The objective of this move is to reduce Naspers' weight in South Africa's stock index, since, with the strong appreciation of its stake in the Chinese company Tencent in recent years, it had increased to unsustainable levels, forcing the sale of local fund managements who, by regulation, could not maintain such a high concentration in the same holding, contributing to increasing the discount with which Naspers trades to its NAV. Following the move, Naspers now controls 74% of Prosus and maintains 100% of its (residual) businesses in South Africa.

For our part, we have decided to maintain our investment in the Naspers businesses via this holding company, as Prosus trades at a lower discount compared to its NAV and therefore has a lower revaluation potential. On the other hand, it is important to point out that Prosus' management team maintains long-term remuneration incentives linked to the performance of Naspers shares, so we do not rule out capital allocation aimed at continuing to work to reduce the discount with which Naspers trades to its NAV.

At the end of the quarter, the potential of the international strategy for the next three years is around 158%, which would be equivalent to a theoretical annualized return of 37.1%. For the calculation of this potential, we performed an individual study of each holding that makes up the portfolio. These theoretical returns are no guarantee that the fund will perform well over the next three years, but they do give an idea of how attractive the current time is for investing in Horos Value Internacional.

Portfolio Structure

The portfolio has 36 holdings and four blocks that account for the bulk of it. The main one is made up of companies linked to raw materials (30%), especially uranium, stainless steel and petroleum. Another important block is the one that includes forgotten emerging stocks (20%) or little followed by the investment community, mainly from Asia. The investment in technological platforms (11%) with a powerful network effect that are still trading at very attractive prices to invest and in UK companies (8%), impacted by brexit, would be the other two important investment blocks.

Finally, the liquidity of the portfolio at the end of the quarter is 3.8%.

Main Positions

Keck Seng Investments (5.4%, forgotten emerging company): a Hong Kong family company founded in the early 1940s by the Ho family, owner of 75% of the vehicle, so its interests are aligned with those of its shareholders. The holding company specialises in the ownership and management of hotels in the United States, China, Japan, Vietnam and Canada. Keck Seng also has an important residential portfolio in Macao that we expect will benefit from the recent opening of the bridge that connects Hong Kong with this city. The poor liquidity of the share or the fact that the assets are valued at acquisition cost on the balance sheet have contributed to a market inefficiency, which in our opinion is unjustified.

Uranium Participation Corporation (5.2%, raw materials): Investment vehicle that buys and stores uranium for later sale. Given our positive outlook for uranium prices and the limited cost structure of this vehicle, we have decided to concentrate our investment in this type of company (we are also shareholders in Yellow Cake, a similar vehicle listed in London) and renounce, at these prices, exposure via mining companies, where we would have to assume a greater risk of loss in an adverse scenario, as well as operational risks linked to the management and development of projects and mines.

Aperam (4.8%, family-owned): one of the world's leading stainless-steel producers, with strong exposure to Europe and Latin America. After a couple of years of good stock performance, as a result of the rationalisation of the sector's supply and the anti-dumping measures imposed by Europe against Asian producers, the impact of US President Trump's tariffs on this metal have, in our opinion, had an excessively negative impact on the stock.

Aercap Holdings (4.7%, others): one of the world's leading aircraft leasing companies. This is a business with a high recurring revenues and good future prospects, given the expected growth in aircraft production and demand for aircraft in the coming years, mainly derived from the needs of developed economies and the expected growth of emerging economies. Although this is a business with significant financial leverage, we believe that the stability of the revenue streams generated by the business, as well as the correct capital allocation in recent years, acquiring ILFC at very attractive prices in 2013 or repurchasing shares at a significant discount, justify investing in a company that achieves historical ROEs of 12% and is trading today with a discount on its book value and at less than 10x earnings.

Teekay Corp. (4.2%, raw materials): is a holding company that owns shipping companies that use methane carriers (Teekay LNG) and tankers (Teekay Tankers). Teekay Corporation owns approx. 33% of Teekay LNG, the world's largest liquified natural gas shipping company by fleet size. Teekay Corporation, for the management of Teekay LNG, charges a fee that increases depending on the distribution of cash that Teekay LNG makes. Today, Teekay LNG's cash distribution is low (although it has risen 36% by 2019) due to the objective of deleveraging the company, which hides from the market the value of the increase in distributions we expect for the coming years.