Gold and silver manipulation explained, the FED are buying treasurys again and a lot of them but they don’t want to call it QE… Fed treasury buying, market manipulations explained, precious metals charts & analysis.

Gold and Silver Manipulation Explained – FED Treasury Buying Again

Q3 2019 hedge fund letters, conferences and more

Welcome back to Golden Rule radio, your weekly recap of the precious metals markets and the inflation that moves those markets. And as we look into the Fed manipulation of our equities and currency markets, we definitely want to comment on how gold has been responding to the substantial sum of money we're expecting to see flood into the market over the next at least three quarters into the beginning to middle part of next year. And then the question, of course, being what does that end up looking like and how does that extend and how does that actually affect the other markets?

So before we dive immediately into the charts this week, I think it's worth talking a little bit about what we're looking at over the next six months. And how does that compare to the first quantitative easing package about 10 years ago, and tarp money? So Tori, what you got?

Transcript

Yeah, we got a lot of listener questions about the manipulation issue, right and the response to the manipulation issue, saying well, why are you showing If the prices are manipulated, every market is manipulated. Okay, what they're doing by expanding the Fed balance sheet, again is manipulation. That's absolutely what they're doing. Now, going back to your point on the initial QE, the Federal Reserve does not want to call this quantitative easing, okay?

Because they're, they're buying t bills, essentially to the tune of $60 billion a month. And they've committed to do that through the end of the second quarter of 2020. So now, even though we've exceeded that to your point, we're over 200 billion, I think in October because the first issuance ended up being four times the expected amount.

With all that being said, they're pumping the system with money. All right, this is the creation of money that by the Federal Reserve, increasing its balance sheet, they're countering what they just brought to a close in the spring of this year, so in March, they said, Okay, we're going to shrink the balance sheet.

In fact, we're going to end the balance sheet and they were doing quantitative tightening and Everybody was upset because it's economically stifling to do so. Well, here we are six months later, and they've had a complete reversal. That's a replay of what we saw back in 2009 and 10. So quantitative easing, one was announced November 25 2008. All right, and this is comparable to that one.

Economic collapse?

Let's replay here for a sec. We had a major economic crisis going on at the time. And so they justified this massive quantitative easing. This one is comparable to that. And yet this morning, you're reading how this is the healthiest US economy in history.

Well, some people are writing that it's the healthiest US economy in history, or tweeting.

Yeah, I think Eric tweeted that this morning. So sorry, Eric. I've got a counter economic health comments, but no, three and a half percent unemployment rate. Sounds great. Right? Well, the way they measure is change, but 3% economic growth sounds great. We've had better so whether it's the best US economy ever not. I'm not sure but even arguing that it's healthy. Why then is this necessary? Why Why are the repo markets telling us that this is something that's critically necessary? Well, what this also shows me is that there is total uncertainty. Nobody knows every time they make a decision, it ends up changing. So back with QE one, they paused that in March of 2010.

Okay, they terminated it, I shouldn't say positive terminated. By November, they had already re initiated QE two, right? So they said it's no longer necessary. So now november of 2010, here comes QE two, and that's going to run you all the way into 2012.

Gold and silver manipulation

Later on, okay, and they say, okay, QE two is now terminated June 12 2012. And then suddenly, six months later, QE three is initiated. What did we just see again, in March, they said, Okay, we're going to end the Fed balance sheet, growth, and we're going to tighten, and we're going to, you know, shrink the balance sheet completely down. And now six months later, like clockwork, here we are again, complete reversal in policy.

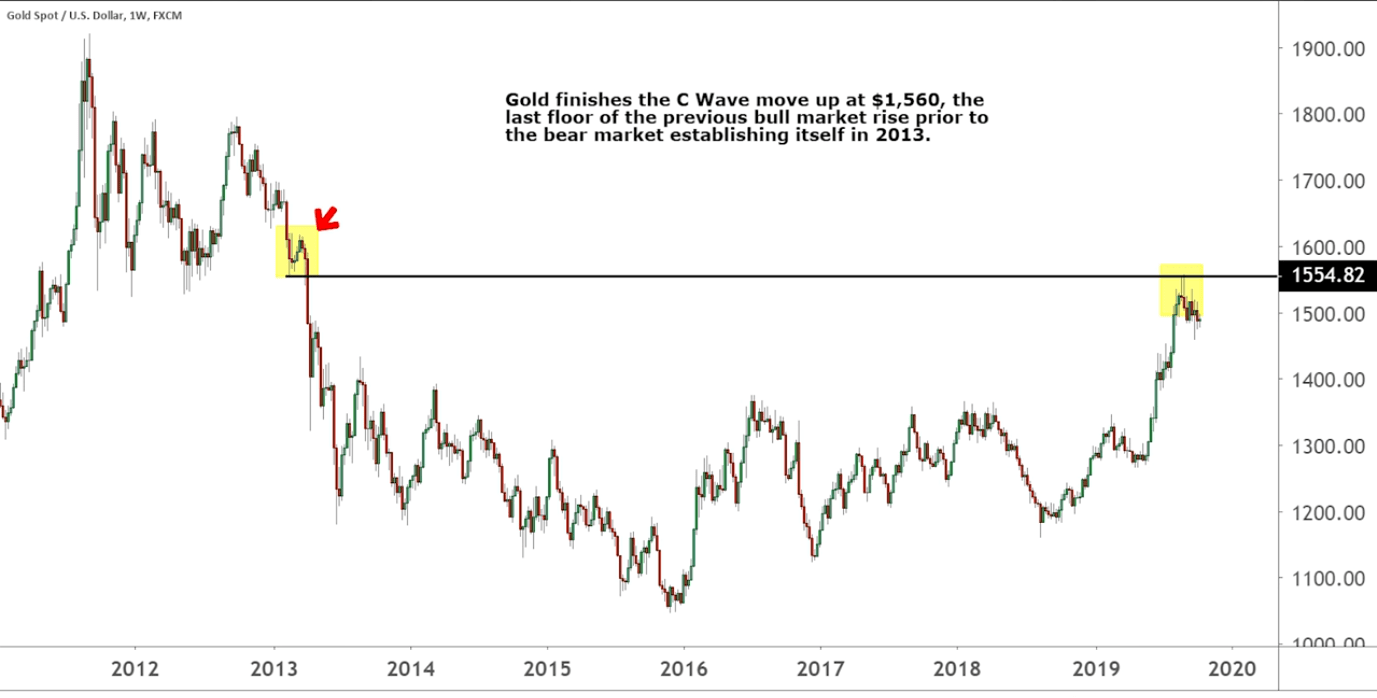

So yes, that's a way that they're gold and silver manipulation. But we get so many comments about the metals markets being manipulated, and that the charts aren't making sense or aren't valuable miles. So why don't you speak to that?

Well, the biggest way you see market manipulation, especially in commodities in the futures and options market, right, because the leverage that you can build into those transactions. So similar to what we saw during the last market crash, you know, when you have a systemic crisis, where you have a number of people all trying to get out at the same time, and you're in things like futures and options on a leveraged positions, you have a price built into these leveraged options or futures contracts where the bank's going to call your margin if the price drops to a certain point.