Ford Stock, GM stock, Daimler Stock, FCAU stock, Tesla stock etc. Their dividends are not worth the risk of bankruptcy and big losses.

Avoid Ford Stock, Tesla Stock, Daimler Stock – Car Debt Pressure Too Risky

Ford

Good day, fellow investors, let's discuss a little bit the automotive industry. There is something very, very important that I want to share with you here. Because one thing is the development. This is the outlook. This is the future electric vehicles, and everything really a beautiful, beautiful future ahead, but between the future, and now, there is still a big big ocean of debt. And I want to quickly discuss and touch on something very important when it comes to investing sector fundamentals. It's not only about the stock, it's crucial to understand understand the sector fundamentals, the situation where those company work in and how that situation can change. Many look at the fundamentals of a company to see how great those are, and think it will be a great investment. However, things are not that easy.

If you look at Ford, we look at the fundamentals pricing ratio of 10, dividend yield of 6.7%, you shouldn't think okay, the dividend yield is 3-4 times what the S&P 500 offers. Cars are expected to do well in the future economic growth, development, more sales, more cars, shifts to electric vehicles, so everything should be very positive. However, the fundamentals of the industry are a bit different. Those are not that great. And that's why Ford is trading at the dividend yield of 6.75%.

WSJ

Recent article in the Wall Street Journal discuss debt and car purchases. And I really want to give this micro perspective and later close with the macro perspective on the industry. And then again on micro on Daimler stock and how things actually work. The seven year auto loan, America's middle class can can't afford its cars. Automakers are lending more and more money for longer periods in order to facilitate the sale of those cars. And if we look at household debt and the composition of it, of course, mortgage has picked up as home prices picked up.

But if we look at the growth of student loans and car loans, then we see that there is something important going on car loans are getting bigger and bigger in perspective of what's going on car loans are much shorter than mortgages, and therefore also put pressure on consumers. Longer loans make for lower monthly payments. But this also means that the time when you renew to buy a new car will be further in the future.

Daimler stock and sales

So also car makers are sacrificing future sales to sell more cars now because they cannot sell less cars. And we'll see later how they is detrimental immediately immediately to the company. Also something very important the negative equity trading due to longer loans is growing very very fast. So share of trade in with negative equity is already above 30% when it was below 20% in 2009. So carmakers are happy to trade in for new cars just fail.

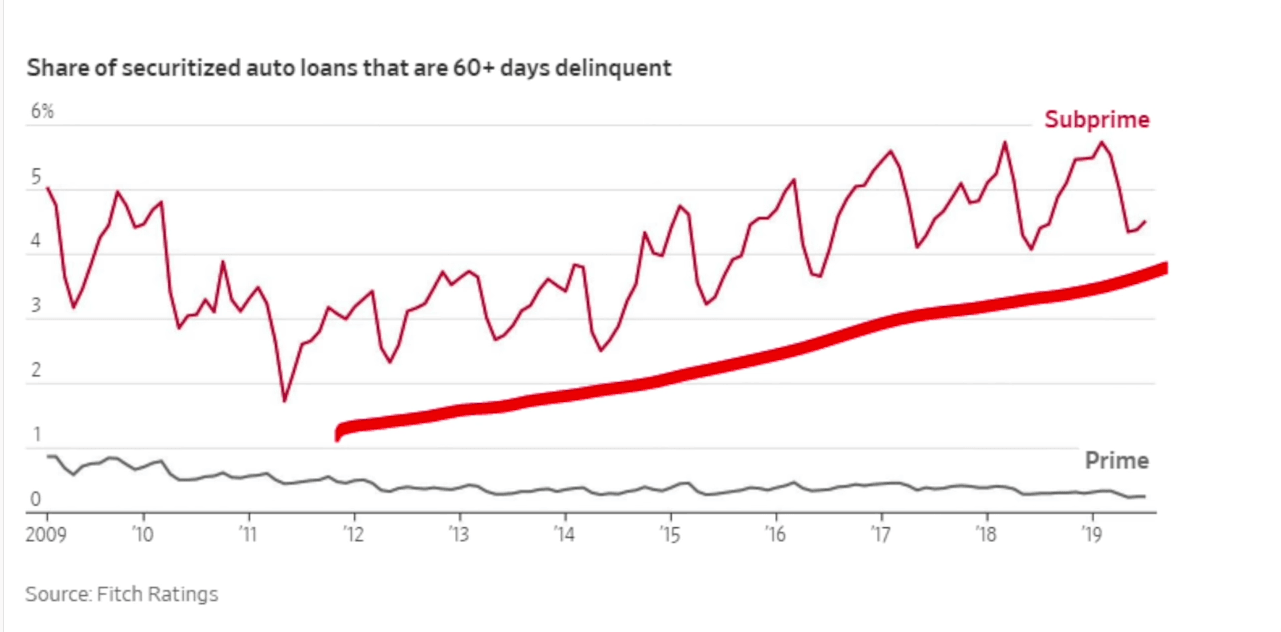

They just worry about selling cars and not about the long term sustainability of what they are doing. There is again a bond boom. So cars are being sold the financial arms of those companies or other banks, take those loans, repackage them and then sell them to the market for wall street investors, repackaging loans, bonds, etc. Something very, very familiar to what was going on in 2007. Eight with mortgage loans now goes on with car loans, which really destabilizes the long term fundamentals of the system.

Daimler stock and dealerships

Further, if you look at car dealerships, when they sell a car, they should make a profit on the car, but no, they are making more and more profits on the financing and insurance part of the car. And we recently bought a second pan car for and the guy said I would prefer you to buy a car on financing on the zero rental financing programme zero interest rate, then you buying it with cash as we did it was not a big deal. So we've just paid cash not to think about and to leave room in our salaries for perhaps a mortgage loan down the road. But he would have preferred a financing and insurance sale so that he makes even more money in the deal further compared to 2008-09.