Last month, the SPDR Gold Trust ETF GLD dropped 2.4% in one day following the biggest dollar loss for gold in three years, on news that:

the U.S. and China agreed to work toward a fresh round of trade talks and stronger than expected U.S. private sector employment data

Q2 hedge fund letters, conference, scoops etc

The market reaction last month brought to mind Benjamin Graham's classic "Mr. Market" allegory, in which, the market is analogized to a mentally unstable man who swings between panic and euphoria. The U.S. and China agreed to talk about trade - that's why investors dumped their gold? It doesn't make sense. It's hard to think of any mutually agreeable solution to the trade war between the U.S. and China between now and 2021. Those who think President Trump will accept a face-saving deal that doesn't substantively reduce America's enormous trade deficit with China must be unfamiliar with how long trade deficits have been a concern of his. As I noted in 2016:

It's true that Trump has modified some of his impolitic statements (an example), but on economic policy, he's been fairly consistent for decades. See, for example, this 1990 Playboy Magazine interview. In it, Trump raises similar concerns about trade as he has in his current campaign. Essentially, Trump was an economic nationalist decades ago, and remains one today.

Given that, it seems unlikely that Trump will surrender to China on trade. Similarly, China's President Xi Jinping has little incentive to concede on trade before seeing the results of next year's election in the U.S. Why not wait to see if Trump loses reelection and his successor is more accommodating? That suggests trade uncertainty will continue to weigh on markets between now and November of 2020, and the Federal Reserve likely won't be in a position to tighten between now and then, which should support gold prices.

Four Ways Of Adding Downside Protection To GLD

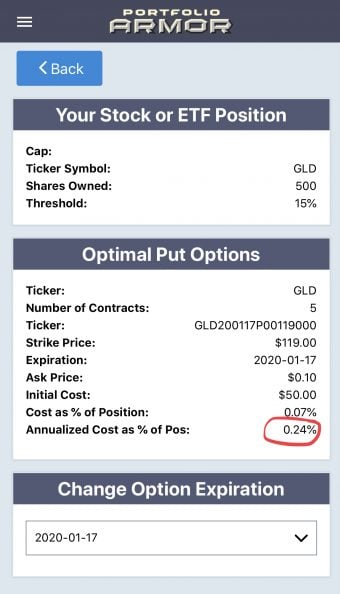

In the event my take is wrong, though, here are four ways cautious GLD bulls can stay long while strictly limiting their risk. For these examples, I am assuming you own 500 shares of GLD and can tolerate a drawdown of up to 15%, but not one larger than that. Since two of these hedges expire in January and two expire in June, I have circled each hedge's annualized cost as a percentage of position value, to facilitate an apples-to-apples cost comparison. The screen captures below come from the Portfolio Armor iPhone app.

Uncapped Upside, Expiring In January

As of Monday's close, these were the optimal, or least expensive, put options to hedge 1,000 shares of GLD against a >20% decline by mid January.

The cost of this protection was $50, or 0.07% of position value, calculated conservatively, using the ask price of the puts (Remember: in practice, you can often buy and sell options at some price between the bid and ask). That worked out to an annualized cost as a percentage of position value of 0.24%.

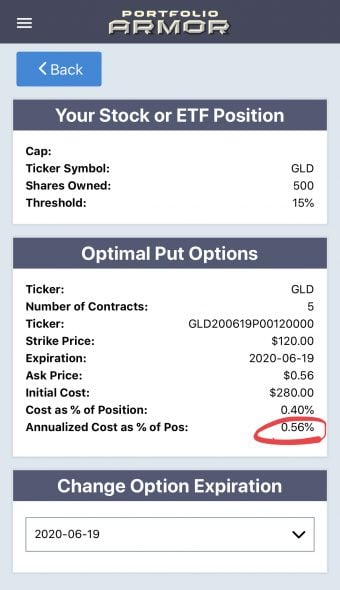

Uncapped Upside, Expiring In June

This hedge uses the same parameters as the previous one, except it expires six months later.

In this case, the cost was higher in absolute terms, as we'd expect, given the longer time to expiration: $280, or 0.4% of position value, again calculated conservatively, at the ask. But the annualized cost was a bit higher too: 0.56% of position value. You can use the change option expiration feature in our hedging app to compare the annualized cost across all available option expirations for GLD.

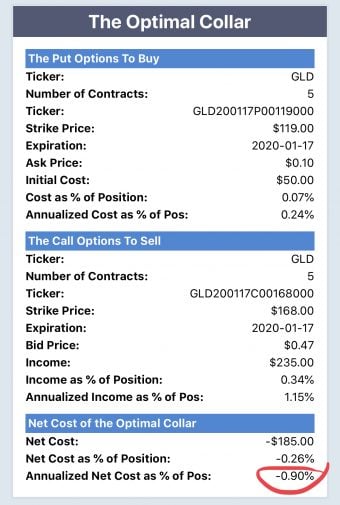

Capped Upside, Expires In January

If you were willing to cap your possible upside at 20% by then, this was the optimal, or least expensive, collar to give you protection against the same, >15% decline by mid-January.

Here the cost was negative, meaning you would have collected a net credit of $185, or 0.26% of position value, when opening this collar, assuming you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads. That worked out to an annualized cost of -0.9% of position value.

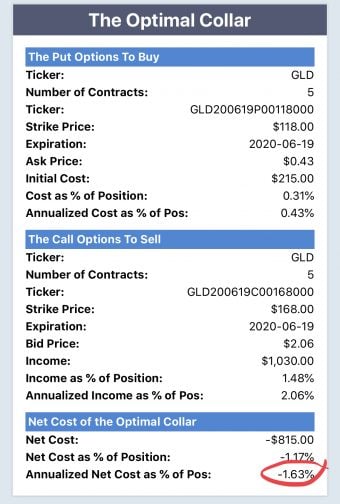

Capped Upside, Expiring In June

This collar has the same parameters as the one above, except that it expires in April.

Here the cost was negative again, but more so: in opening this hedge, you would have had a net credit of $815, or 1.17% of position value, calculated conservatively. That worked out to an annualized cost of -1.63% of position value.

Wrapping Up

Readers looking for less expensive ways of hedging GLD without capping their upside risk can scan for optimal put hedges with closer expirations, such as one month out. At some point, though, there may be trade-offs in terms of convenience with that. For large enough positions, the app may also mention another form of protection that doesn't involve options.