Companies of all types and sizes constantly need to look for growth opportunities. Sometimes the solution to growth can be internally, by offering new products / services or by targeting new audiences or customers, but sometimes the solution can be externally in the form of acquiring or conducting value mergers with another company.

Company mergers and acquisitions can be hugely beneficial from a business growth perspective, but they can also be risky and potentially damaging in the long term. History is littered with cases of small and largely insignificant mergers and acquisitions at one end of the spectrum, while at the other are cases like Facebook’s acquisition of Instagram which changed the face of technology and social media for good.

Q2 hedge fund letters, conference, scoops etc

Whatever the motivation behind a merger or acquisition, it can sometimes be hard to put into context the enormity of the scale of funds often involved. Take the example of AT&T’s acquisition of Time Warner in 2018, a deal which closed for over $85 billion, or $85,400,000,000 to be more precise. That amount of zeros can be hard to visualise, so the team over at FXTM have put together an interactive mergers and acquisitions index to help.

FXTM have analysed seventy of the biggest mergers and acquisitions to discover which deals were worth more than some countries’ entire GDP. They also examined the stock prices prior and post completion to identify which deals were the most and least successful.

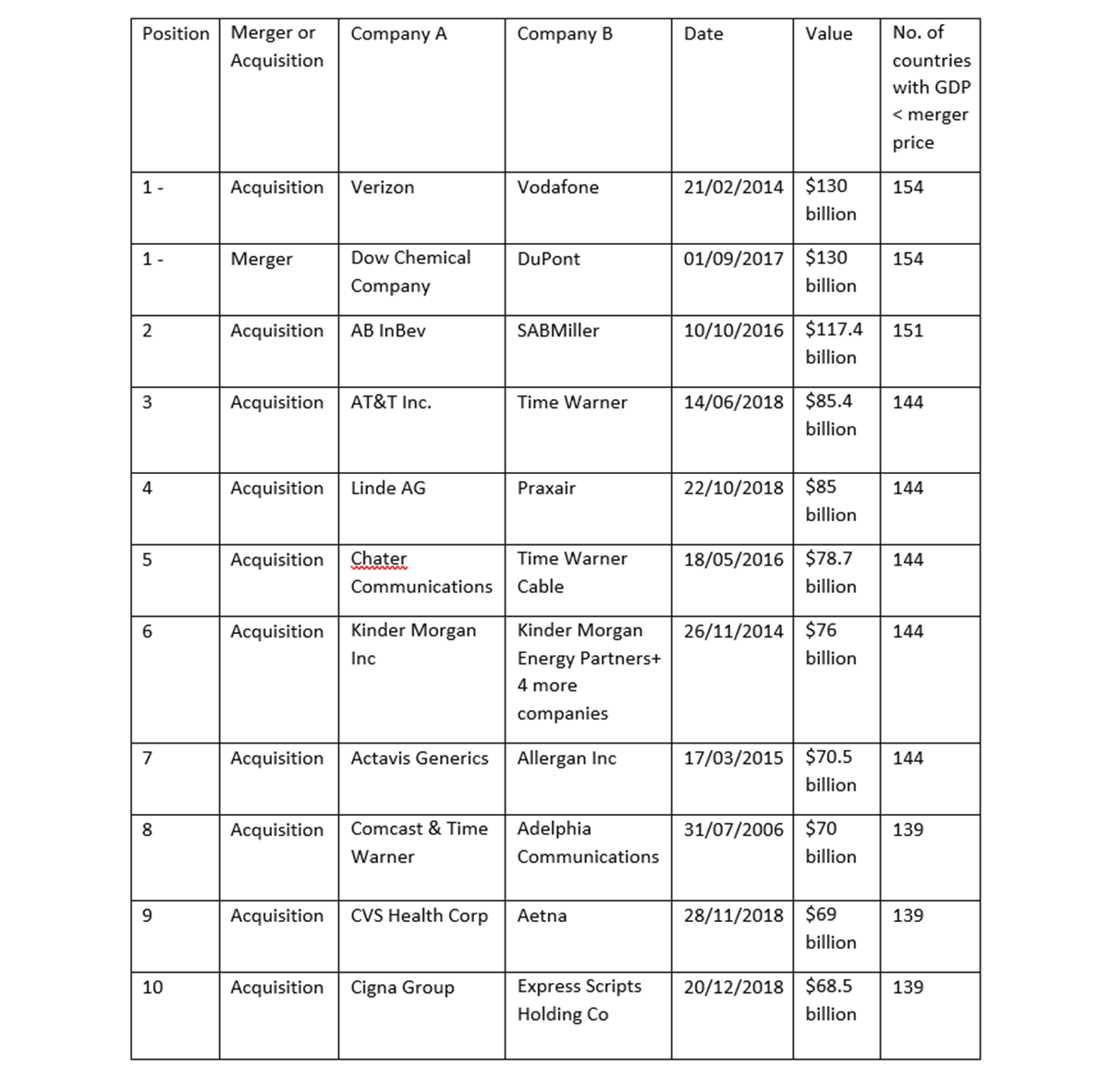

Out of the mergers and acquisitions included in the study, the top ten alone equated to over $980 billion in value:

Top 10 Highest Value Mergers and Acquisitions 2013-2018

The joint highest-value mergers and acquisitions occurred in 2014 and 2017. Both valued at $130 billion, they surpassed the GDP of 154 countries or, put another way, 72 percent of African nations and the entirety of Central America.

The first was when Verizon bought out Verizon Wireless Stake from Vodafone. The complex offer, which included cash and stock for Vodafone's 45 percent stake in Verizon, was the third-largest acquisition of any type in history and required the biggest corporate bond issuance on record.

The deal was worth the equivalent to the entirety of Angola’s GDP (and 153 other countries’ GDP). Its stock price 12 months on was approximately $48.97, a 519% increase from its first ever stock price of $7.90.

The second, also worth $130 billion, was the merger between Dow Chemical Company and DuPont in 2017 — which took many by surprise at the time.

The plan was to divide the combined chemical giant into three smaller companies, reducing research spend for both corporations. While continuing to this day, the merger paid off in the short-term, with the stock price reaching $69.72 a year after completion compared to $5.11 when it was first launched.

Bottom 10 Lowest Value Mergers and Acquisitions 2013-2018

Apple Stats

At $400 million, Shazam is one of Apple’s biggest acquisitions, emphasising the amount of investment the company is willing to put into the services that run on said hardware.

However, the deal is one of the smallest of those studied and pales in comparison to Apple’s $3 billion acquisition of Beats in 2014, which was to become the foundation of Apple Music.

This is perhaps down to the fact that music identification is not an exclusive feature that Apple can buy given the competition in the industry. It is also not an asset with clear potential to prevent users from switching to other brands.

Once completed, the stock price deal was $220.79. However, whether it has been worthwhile has yet to be seen as the acquisition only took place in September 2018.

While the acquisition is the smallest recorded, its GDP is still equivalent to Tonga and more than ten other countries, including the Cook Islands, the Marshall Islands and the Federated States of Micronesia.

Take a look at FXTM’s interactive index to explore all 70 mergers and acquisitions.