Elliott Management has built a stake in timeshare company Hilton Grand Vacations Inc (NYSE:HGV) and wants it to find a buyer, joining activists on the register that already own 7.5% of the company, Bloomberg reported Wednesday. Hilton Grand Vacations has traded up 26% since its 2017 initial public offering but is down 24% from its peak in February 2018. The business was spun off from hotel company Hilton Worldwide.

The new stake is good news for Activist Insight Vulnerability, which argued in December that an activist could push to halt the company’s growth strategy and demand more share repurchases.

Q2 hedge fund letters, conference, scoops etc

The activist behemoth reportedly also took a 3% stake in $15 billion truckmaker CNH Industrial and hopes to strike up a good working relationship with the controlling Agnelli family. CNH is currently in the process of breaking up its agricultural and commercial segments and Elliott is thought to see value in the split. It has held constructive talks with CNH's management and Exor, the Agnelli family holding company, Bloomberg reported, citing sources close to the matter.

What We'll Be Watching For This Week: Hilton Grand Vacations In Focus

- How will Veris shareholders vote regarding Craig Chapman and former CEO Brian Mangano’s push to overhaul the board tomorrow?

- Will Telecom Italia Chairman Fulvio Conti resign at the board meeting on Thursday?

- Will Elliott Management make any public demands at new investment Hilton Grand Vacations?

Activist Shorts Update

Hindenburg Investment Research placed a bet against Bloom Energy last week, contending that the firm’s technology is "not sustainable, clean, green, or remotely profitable." Shares in the company tumbled nearly 25% in afternoon trading on news of the report, in which the short seller claimed that Bloom obtained over $1.1 billion in federal, state, and local subsidies, often under the pretense of being green, clean, or renewable.

To make matters worse, the short seller The short seller noted that Bloom is unprofitable and does not expect any revenue growth for 2020, adding that Bloom has an unsustainable debt burden. The short seller said the firm’s large debt maturities in 2020 and 2021, which amount to nearly $520 million, make it a likely bankruptcy candidate.

The next day, Bloom responded to the claims, saying that the short report contains "factual inaccuracies, misleading allegations, and drew erroneous conclusions, including about the future viability of Bloom." The company said it felt "obligated to correct the record with respect to certain allegations." Specifically, Bloom said its technology produces "significantly lower" emissions than the power grid in all the states in which it operates. Moreover, the company estimated future service revenue will exceed future service cost, resulting in longer-term service profit. It also said its debt is manageable.

"Bloom Energy is an innovative and growing company that delivers important power resiliency and sustainability benefits to customers," the company stated. "Our mission is to make clean, reliable, and affordable energy for everyone in the world."

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

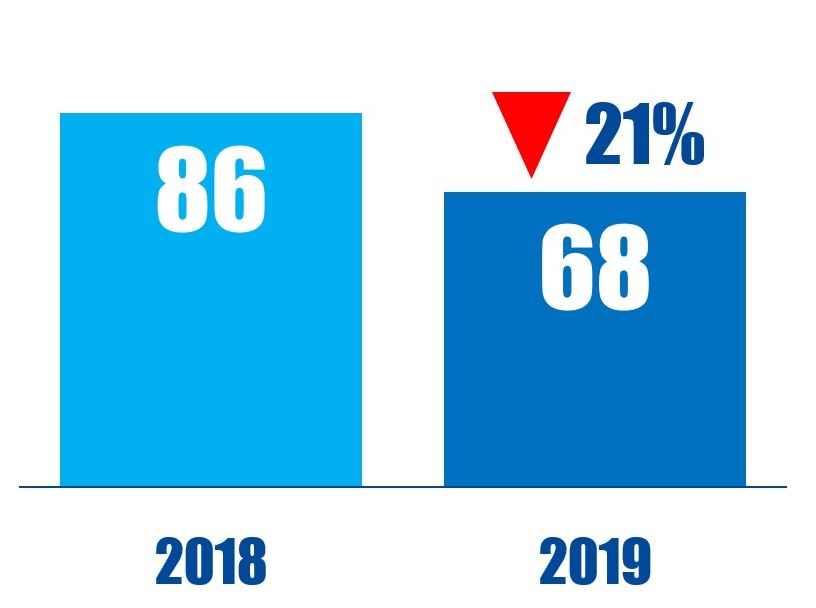

Chart Of The Week

The number of Europe-based companies with a market-cap of under $2 billion publicly subjected to activist demands between January 01 and September 20 in respective years.