The 11th Annual Invest For Kids Conference is scheduled to take place on October 30, 2019 at 1:00-5:00 PM and the Harris Theater, Millennium Park. The great conference which is for an excellent cause is hosting another stellar line up.

You can see our notes from the 2018 conference here.

Please stay tuned for all of our coverage!

The 11th Annual Invest For Kids Conference will feature presentations from successful investment managers across multiple asset classes.

Q2 hedge fund letters, conference, scoops etc

Managers present their market views and specific investment ideas in concise 15 minute presentations.

This year’s conference features Former US Secretary of Treasury, Hank Paulson, and legendary investor, Sam Zell, in two separate fireside chats.

The Conference draws over 1,000 attendees and includes a wide cross-section of investment professionals, family offices, and private investors.

Importantly, proceeds from the event will be donated to seven high-performing organizations that support Chicago’s underserved youth.

The Co-Founders underwrite all of the conference expenses so that 100% of funds raised go directly to these organizations.

Invest For Kids: Fireside Chat Speakers

- Bruce Heyman, Uncharted LLC – Chicago, Illinois

- Brad Keywell, Uptake Technologies – Chicago, Illinois

- Hank Paulson, Paulson Institute – Chicago, Illinois

- Sam Zell, Equity Group Investments – Chicago, Illinois

Invest For Kids: Conference Speakers

- Rupal J. Bhansali, Ariel Investments – Chicago, Illinois

- Jay Kahn, Light Street – San Francisco, Californa

- Scott Rupp, BITKRAFT Esports Ventures – San Francisco, Californa

- Ron Suber, Prosper – San Francisco, Californa

- Kevin Ulrich, Anchorage Capital Group, LLC – New York, New York

- Jeffrey N. Vinik, Vinik Asset Management – Tampa, Florida

- Arthur Young, Tensile Capital Management – San Francisco, Californa

For detailed bios www.investforkidschicago.org.

Invest For Kids: 2019 Beneficiaries

CHARITABLE PROCESS Since inception, Invest For Kids has donated nearly $14 million to 70 carefully selected organizations supporting Chicago’s underserved children. Each year we conduct a rigorous due diligence process resulting in the selection of our 7 beneficiaries from over 100 worthy applications. We target smaller organizations where we believe our grants will be most impactful, enhancing and widening the reach of their programs.

Invest For Kids is proud to support this year’s recipients and commend the extraordinary efforts they make every day on behalf of our city’s youth.

Invest For Kids: Team

- Ben Kovler, Co-Founder, Invest For Kids

- Ron Levin, Co-Founder, Invest For Kids

- Jamie Carmell, Executive Director, Invest For Kids

- Barbara Wolf, Director of Giving, Invest For Kids

- Brian T. Burke, The Kovler Family Office

- Andrea Dawkins, West Family Investments

- Jessie Harrison, Goldman Sachs & Co. LLC

- Gina Rosanova, The Kovler Family Office

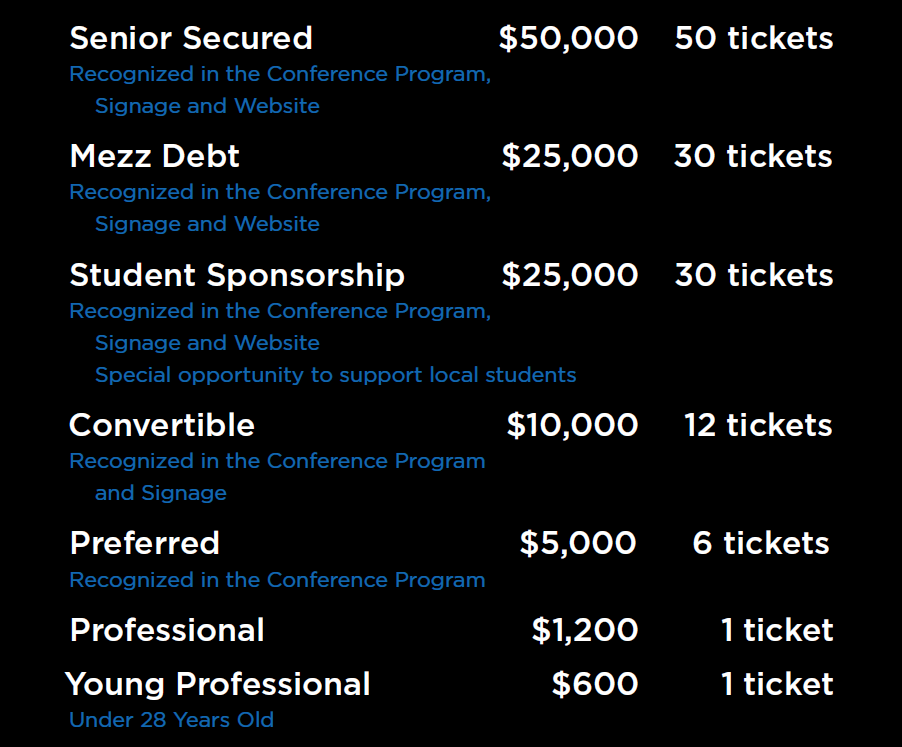

Invest For Kids: Sponsorship Levels

Deadline for program inclusion is October 21, 2019 100% of all funds go toward helping our city’s most at-risk children.

For questions, please contact us at: 312.664.5050; [email protected]

Invest For Kids is a recognized 501(c)3. Contributions are tax-deductible as provided by law.