Qualivian Focus Fund letter to investors for the second quarter ended June 30, 2019.

“Human nature desires quick results, there is a particular zest in making money quickly, and remoter gains are discounted by the average man at a very high rate.” – John Maynard Keynes

Q2 hedge fund letters, conference, scoops etc

Overview

The Qualivian Focus Fund is an investment partnership focused on long-only public equities. The fund is designed for long-term investors who focus on the power of compounding. We do not short securities, nor do we take on leverage. We focus on stock picking rather than macro investing. The fund primarily focuses on US companies of all sizes but can have 20% of its portfolio outside the US. We focus our investing on companies with sustainable advantages, long reinvestment runways, and shareholder-oriented teams. We are concentrated investors and typically hold 15-25 positions at a time with low turnover.

This letter discusses our Q2 2019 performance, recaps our core beliefs and thinking, and discusses an existing and potential investment. Our investors should understand how we invest so they make the right decision (both for them and us). We are not right for all investors.

Performance

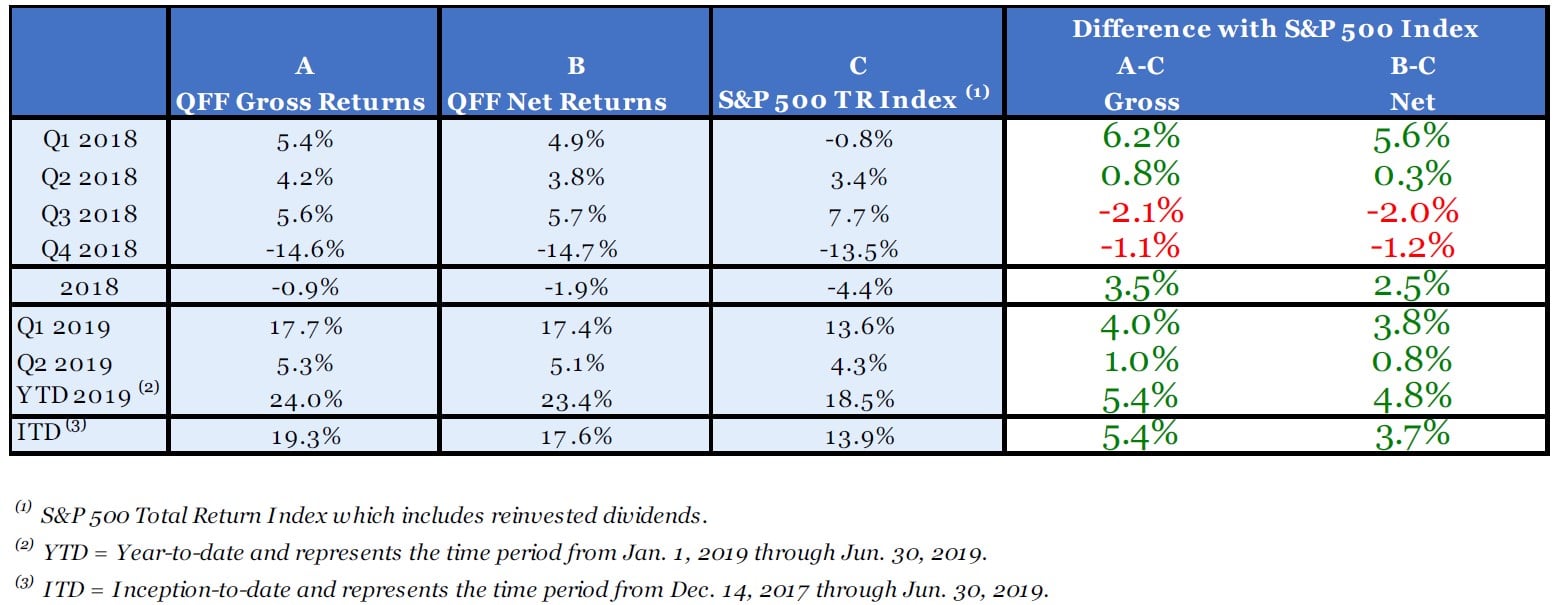

From inception on December 14, 2017 to June 30, 2019, the Qualivian Focus Fund (QFF) gained 19.3% and 17.6% on a gross and net basis respectively versus the S&P’s 13.9% return, an outperformance of 540 and 370 bps respectively. In the second quarter of 2019, the QFF was up 5.3% and 5.1% on a gross and net basis, while the S&P 500 increased by 4.3%. For H1 2019, QFF increased by 24.0% and 23.4% on a gross and net return basis versus the S&P 500’s climb of 18.5%, outperforming the US equity benchmark, by 550 and 490 bps respectively. The top three contributors to our performance from inception through June 30, 2019 were Mastercard (MA), Amazon (AMZN), and Visa (V). The bottom three contributors were JD.com (JD), Altria Group (MO), and Wyndham Hotels & Resorts (WH). The top 3 contributors in Q2 2019 were Mastercard (MA), Visa (V), and Facebook (FB), and the bottom 3 contributors were TJX (TJX), O’Reilly Automotive (ORLY), and Alphabet (GOOGL).

Summarizing Our Value Proposition

We own a concentrated portfolio of superior shareholder-oriented businesses that can compound capital at a mid-teens rate. We hold them for an extended period, with shareholders that understand the power of long-term investing. We think of ourselves as having a private equity approach to public equities. We are investment reptiles, not investment mammals. A few good ideas per year is all we need, and we are willing to wait for the right price. We prefer to switch off the Bloomberg, read, think, and wait for the light bulb to light up. Substantial industry research has indicated that active managers who outperform are likely to (1) have high active share (2) be concentrated (3) have low turnover and (4) have low fees.1

In our prior investment letter, we presented a formula that encapsulated our value proposition, capturing our investment focus, style and process that we believe gives us an edge. To set the context for our discussion below, here it is again.

Long-Term Orientation+ Long-Term Investors + Focused Portfolio + Quality Compounders = Maximizing Chance for Outperformance.

We will not purchase a stock if it is not a Quality Compounder, although it may look attractively valued. We think non-Quality Compounders are more easily subject to investment errors described below.

Quality Compounders

Quality Compounders are characterized by:

- High returns on capital due to sustainable competitive advantages,

- Ample reinvestment opportunities over a long runway, generating sustainable above average growth rates, and

- Shareholder-oriented managements that have demonstrated ability to create value from their capital allocation decisions.

If purchased at a reasonable valuation, Quality Compounders have a better chance of outperforming than the average stock. Why? After all, other investors can also see the positive long-term characteristics of these firms. So why don’t they buy these firms and bid up the price to fair value? It is here that we would point out several market inefficiencies in pricing Quality Compounders.

The Market Inefficiencies that we Arbitrage

We believe that “Quality Compounders” get systemically underpriced by the market for two main reasons:

1. Institutional Inefficiencies

We have discussed these in our previous letters as well as our Guiding Principles. To remind our readers, it comes down to the short-term orientation of most institutional investors, driven by:

- Misaligned Incentives: institutional portfolio managers often focus on short-term earnings movements with the aim of maximizing their year-end bonus, causing them to favor firms with perceived short-term gains or momentum.

- A focus on asset gathering: institutions create new products that focus on flavor of the month investment themes.

- Overdiversification: portfolio managers often own 60-100+ companies in their portfolio, resulting in a lack of deep knowledge and conviction in their holdings, and using price as a proxy for value, causing them to make wrong buy and sell decisions.

- Institutional Dysfunctions: False confidence resulting from large research staffs and budgets because firms need to justify their fees.

- Bureaucratic Diversions: Portfolio managers in large firms spend excessive time in management and committee work which detracts from the hard and independent thinking required for investment insights.

2. Cognitive/Behavioral Inefficiencies

(A) Cognitive Myopia

Another reason is optical. Quality Compounders are likely to look optically expensive on next year’s earnings but not on earnings five years out. However, investors tend to focus on the next year and thereby undervalue the stock. Qualivian looks at the business first, and then filters on valuation. One of the core valuation metrics we look at is the price to cash earnings three to five years out.

(B) Human Minds do not Evaluate Probabilities Correctly

Investing is ultimately a function of how investors evaluate and assess probabilities of different outcomes. Investment theory often assumes a perfectly rational investor weighing perfectly measurable probabilities. However, the real world is inherently fraught with hard to measure unknowns, and often investors’ emotions impact how they assess and weigh various probability outcomes in their investment decisions. Behavioral economic research by Daniel Kahneman, elucidated in his book Thinking, Fast and Slow2, showcases how the human mind has some built in biases that can be exploited.

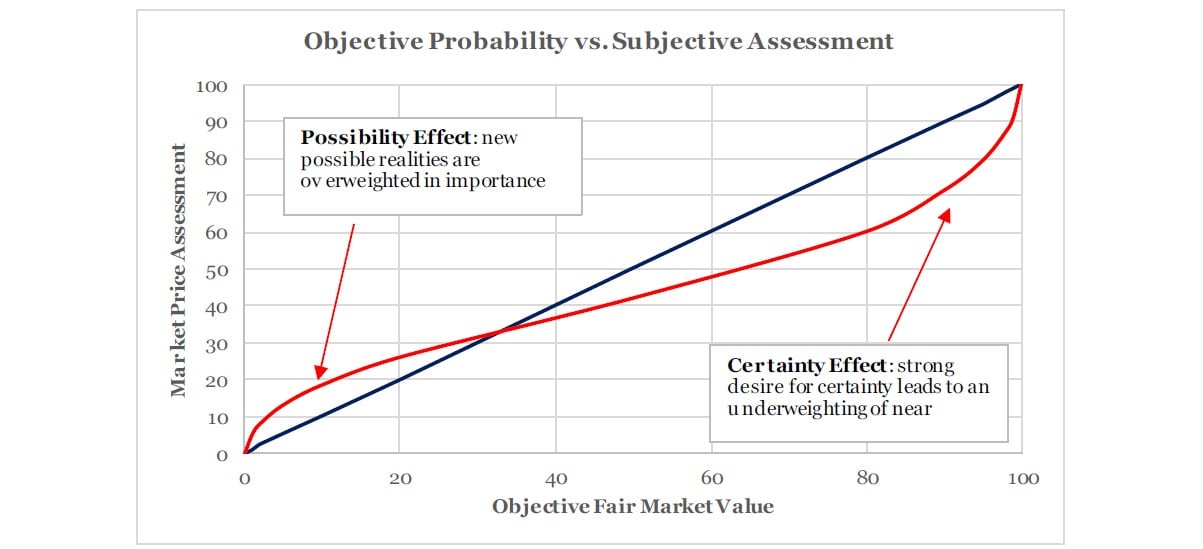

Consider the following case: the expected or fair value of a lottery that has an x% chance of winning $1 dollar is x cents, viz., a lottery that has a 5% chance of winning $1 is fairly valued at 5 cents. That is what rational lottery buyers should be willing to pay for the lottery. However, experimental work (discussed in Kahnehman, Chapter 29) shows that human beings overpay at the low end and underpay at the high end.

This is illustrated in the following table3:

We have graphed this below:

Now consider the following scenarios, where for example, scenario A improves an outcome from not happening (0%) to a 5% chance of happening, versus scenario B that improves the probability of an outcome occurring from a 5% to a 10% chance, and so on:

A. From 0 to 5%

B. From 5% to 10%

C. From 60% to 65%

D. From 95% to 100%

Most would agree that cases A and D are in some sense, transformational. A creates the possibility of winning something out of nothing, creating a qualitative change, akin to a lottery ticket (Possibility Effect). In comparison, case B only reflects a quantitative improvement that does not meaningfully add to case A. Similarly, scenario D represents a qualitative change, creating certainty, while C only reflects once again a quantitative improvement. The graph above shows that from 0% to 42%, the observed price (corresponding to a market price) is greater than the fair value. This is due to the lottery effect. From 42% to 99%, the observed price is less than the fair value. The discrepancy is highest around 85% to 90%. This is a clear market inefficiency.

Let us bring this back to why we think Quality compounders are serially underpriced. Clearly quality compounders do not offer certainty, but their high quality, give them, in our opinion, a high (80% plus) chance of outperforming the average publicly traded company. However, they are not a sure bet (100% chance of outperformance) but have a high probability 80% to 90% of outperformance, and therefore, may be underpriced.

(C) Upside Optionality is Often Not Priced In

Several of our holdings can be described as “Platforms.” We discussed platforms in the last letter via review of the book Modern Monopolies4. Why are platforms so powerful and why do they get mispriced by conventional valuation techniques? They differ from conventional firms in several important ways. First, they are business model equivalents of cuckoo birds. A conventional firm needs to invest its own money to grow. This is far less true of a platform, which benefits from the R&D and capital expenditure of other firms, which need the platforms to flourish. Think of how Paypal rides on Visa and Mastercard’s rails, or how Booking and Expedia use Google’s platform. Platforms go further than those firms that have negative working capital, in that they have negative R&D and/or capital expenditure. This is a new phenomenon that many investors have not fully assimilated. GAAP accounting also does not capture it.

Second, they benefit from positive optionality. That option value is not properly captured by discounted cash flow methodologies. What is missed is positive optionality: new businesses and possibilities that have not yet been invented that use their platform can emerge. This cannot be captured by projecting the current business and revenue model forward. Think of how Amazon has transformed from a bookseller to the all-encompassing retailer that it is today to a cloud services company. Similarly, how Facebook is developing payments and shopping revenues beyond its core advertising revenue streams. Moreover, platform firms benefit from innovation, spillover effects, and new ideas from firms outside the platform since those can be slotted onto the platform. Again, this positive optionality is often not priced in. Applying conventional valuation techniques leads to mispricing and investment errors.

(D) Irreducible Uncertainty Leads to Investment Mistakes

In making an investment decision, we can calculate to a point, beyond which lies irreducible uncertainty, which is unquantifiable and mentally uncomfortable. Investors deal with it by manufacturing fictional narratives, stories, and conventions which relate past and present to the future in an emotionally believable way and so manage the day-to-day cognitive and emotional elements created by irreducible uncertainty. The problem is that we are fabricating our understanding – stories make us feel as if we can clearly perceive or even predict a chain of events, when that is far from the case. Narratives can be useful in stable, ordered environments where there is an observable cause and effect, but financial markets are more random. The human mind tends to oversimplify. Our focus on narratives leads us to massively understate randomness and is a major driver of serious investment mistakes.

The mix of calculation vs. uncertainty varies with different stocks. It is here that quality compounders have an advantage. For quality compounders, there is a framework that enables greater predictive accuracy: (1) the presence of a deep moat, (2) coupled with more understandable businesses, (3) and a management that behaves in a foreseeable (pro shareholder) manner to allocate capital. This mutes the effect of exogenous forces and randomness-causing irreducible uncertainty and reduces the incidence of forced business decisions which may destroy value. For example, retail has been threatened by online commerce for the last decade. Existing value propositions no longer work as effectively and management teams are scrambling to find a business model (online subsidiary, omnichannel, or changes in store size and composition) that work. Our retail holding TJX, has had a defensible moat based on its differentiated treasure hunt model. They have been less affected by the disruptions hurting most retailers and did not need to make major changes to their business model. They have continued to execute, and their stock price has followed.

A Deeper Dive into the Qualivian Focus Fund

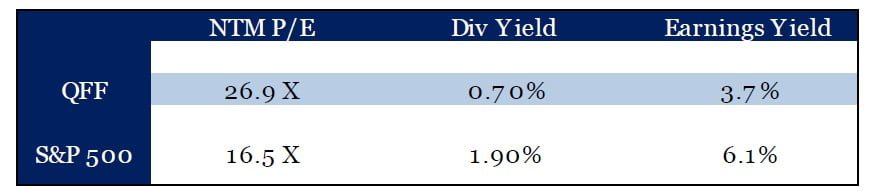

Now let’s look at our portfolio which is characterized by long duration, high ROE and sustained earnings growth. The table below lists some key statistics for our fund, the Qualivian Focus Fund (QFF), showing the weighted average PE, earnings yield, and dividend yield as they sit today5. When compared to the S&P 500, most investors would reflexively surmise that the QFF looks optically expensive. But is it?

Do these figures tell the whole story? We use two different approaches to think about QFF valuation.

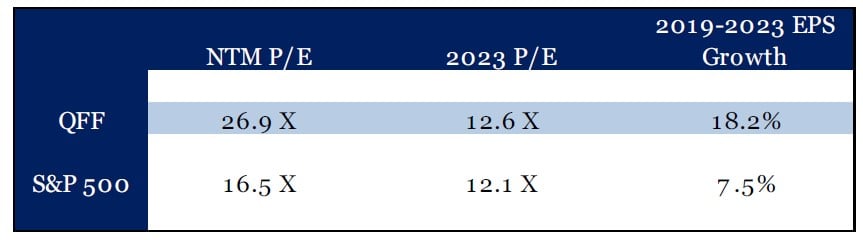

In the first approach, we look at the valuation ratios for our portfolio five years out and compare that with the S&P500. On this basis our portfolio is not overvalued. The table below shows that on consensus estimates, the QFF valuation on 2023 earnings is in line with the S&P6.

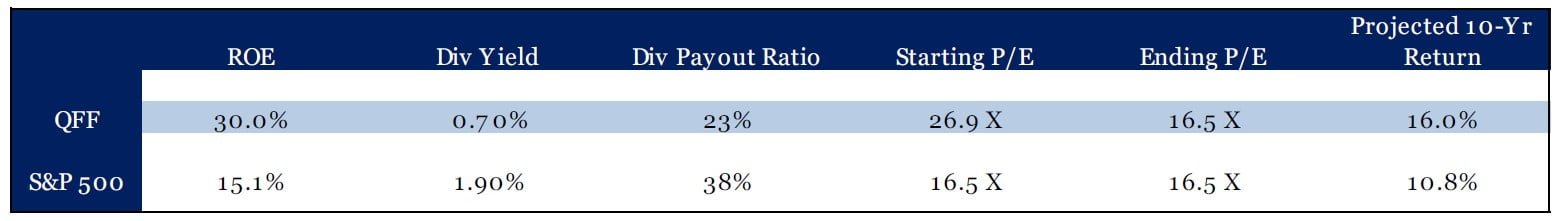

In our second approach demonstrated in the table below, we assume that (1) the current ROE is sustained for 10 years going forward, (2) the P/E ratio will, over that 10 year period, decline from its current level (26.9X) to the market ‘s current 16.5X, and (3) the dividend yield will remain at its current level. With these assumptions, the projected returns of our portfolio versus the S&P500 is illustrated in the next table.

To simplify the analysis above, we have chosen to use the Gordon growth dividend discount model7, which predicates a constant return and growth rate. We are not suggesting that this is meant to be a projection of what our portfolio is going to do in the future but, rather, the intent is to show comparatively why the power of compounding higher than market returns gives us confidence in our ability to outperform the market going forward and why cursory valuation assessments on a stock or portfolio’s next year earnings (many investors’ preferred valuation methodology), does not capture the whole story when you own high quality compounding stocks that embed sustained growth and higher than market returns.

A Key Mental Model And its Applications to a Potential Investment

Many key decision makers, investors, problem solvers, and forecasters rely on a set of frameworks and heuristics that cut through complexity and filter good options from bad ones. They are referred to as mental models. For example, chess masters do not think in terms of individual pieces and moves. Rather, they think in terms of archetypal patterns that continually recur (the passed pawn formation, control of the center squares, etc.) By identifying them, and pinpointing their relevance, strength, and weaknesses, we can use these models more effectively. One mental model that we utilize is the digital technology-driven consolidation of fragmented distribution-oriented industries which we describe now.

Industries often go through cycles of consolidation and fragmentation. These are driven by different factors at various times: new technologies (railways, electricity, telegraph, internet), new financing techniques (junk bonds), changes in regulation, even management fashions (conglomerates in the 1960’s). These changes shift competitive advantage and lead to permanent shifts in value from some players to others.

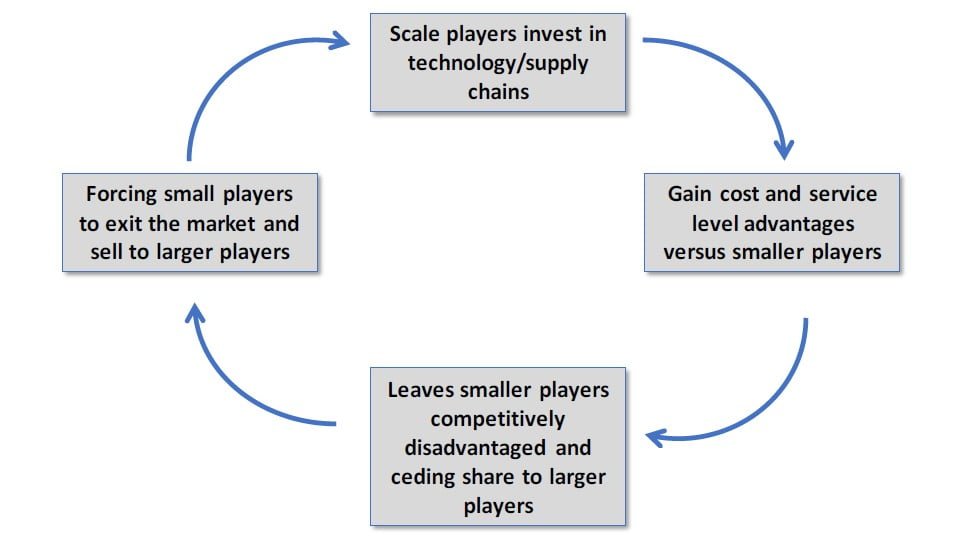

Some distribution/logistics industries (industrial supplies, moving vans, air conditioning and heating equipment, hardware supplies, pool supplies) have been sharply impacted by the digital revolution. New technologies have enabled better inventory management, quicker delivery to customers via embedding within their supply chains, ordering via mobile devices, to name a few. Making the investments to enable and benefit from these technologies is more difficult for small players rather than larger ones. Some distribution-oriented industries are characterized by many “Mom and Pop” operations and a few dominant firms. The Mom and Pop firms are often reluctant to invest because they lack the inclination to spend now for a later payoff, or they lack access to financial resources. By not investing in new technologies, they fall competitively further behind the larger firms and often are forced to be acquired at a distressed multiple. Some of these larger firms have created a competency in these roll-up acquisitions: they purchase these smaller firms at, for example, 7 times EBITDA, when they are trading at 11 times EBITDA, making the consolidation accretive, even before any business synergies are realized. They have a long runway of consolidation since their market share is still in the low teens in many instances. The larger they become, the greater their ability to invest, increasing their competitive advantage versus smaller firms. This is a self-reinforcing trend that can go on for a long time.

The logistics/distribution firms with the best investment returns have a well worked out model based on organic growth and serial tuck-in acquisitions. These best in class firms grow by methodically adding adjacent geographic regions to an existing logistics and distribution base.

There are several industries where this trend is occurring. Names like Fastenal, Copart, Rollins, Watsco, Amerco (which we have written about in our previous letter), Richelieu, and Pool illustrate this pattern.

We will now discuss two names: one is on our watchlist and benefits from the investment theme that is discussed above, and one that we own.

Watsco (WSO)

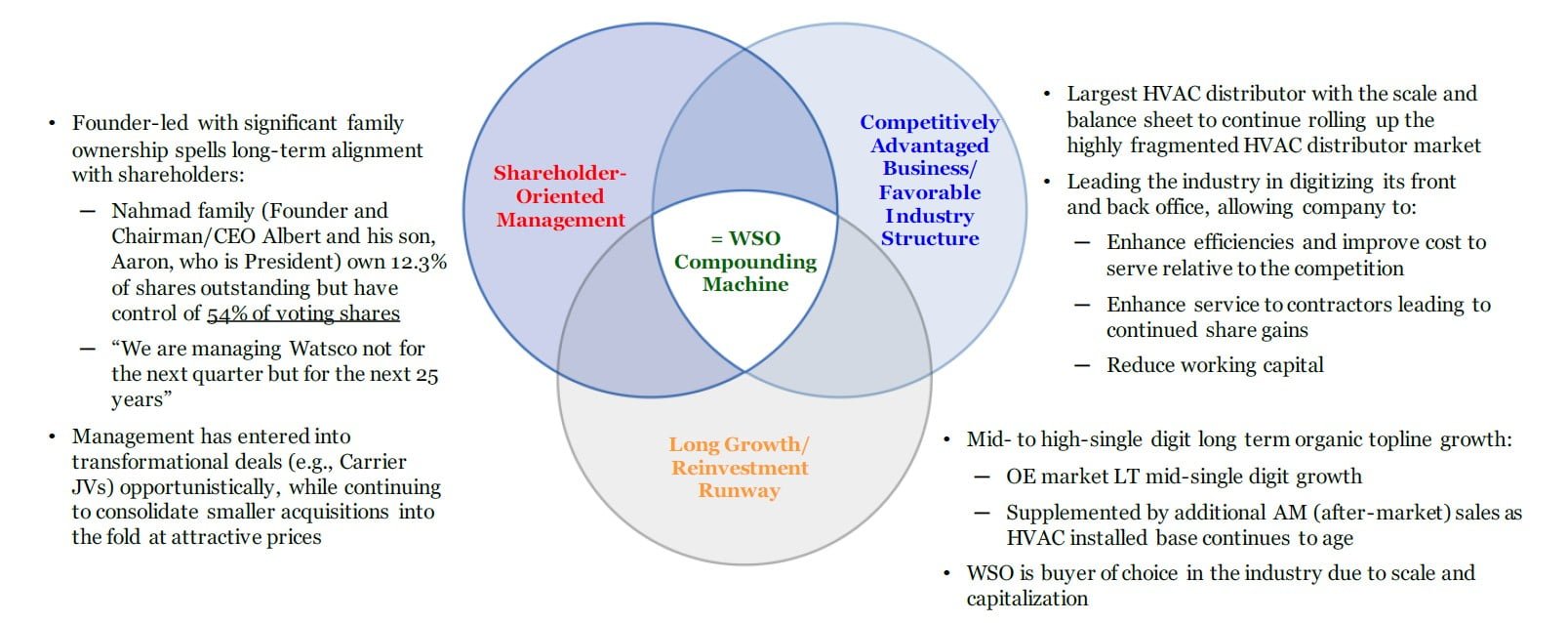

Watsco is a founder led HVAC distributor that serves contractors in this highly fragmented industry. It is the only publicly traded distributor, almost three times larger than its closest competitor. Contractors value availability and speedy fulfillment as their customers need heating and air conditioning equipment fixed quickly. Watsco has a widening moat based on:

- Greater investment in digital technology which gives them an edge. The supply chain from OEM to HVAC distributor to contractor is undergoing a digital transformation which is replacing phone and paper with faster inventory management and mobile ordering. Watsco is in the leadership position of this nascent transformation in the HVAC industry.

- Its larger size enables it to have more and deeper relationships with OEMs, so they have access to a greater variety of parts and equipment.

The HVAC market has attractive growth: there has been 4.1%-unit growth since 1980. HVAC equipment and parts are not just a “flow” business (7 million units are shipped per year) but are also a “stock” business since, of the existing base of 110 million units, 92 million are 10 plus years old and require new parts.

Many smaller distributors do not have the resources to make the required investments in inventory management and digital technology, so they fall behind larger players like Watsco in competitiveness. This causes many of them to sell out. Watsco has a well-honed acquisition model whereby it purchases these firms in an economically accretive price. (paying an EBITDA multiple of 7X, lower than their current EBITDA multiple of 11X). Watsco finances these deals through internally generated cash flow and not debt. This consolidation has a long runway since Watsco’s market share is still 12% and demand for HVAC installation and servicing is stable and predictable.

Watsco has excellent returns on capital, it is run by the founding family which has a 12.3% ownership interest (but controls 54% of the voting shares). The management has allocated capital opportunistically in transformational deals, such as the joint ventures with Carrier, and rationally with ongoing smaller tuck-in acquisitions of HVAC distributors, creating enormous shareholder value over time. We buy into the management team’s moniker that they are running the company “for the next 25 years and not the next quarter.” That long-term orientation aligns nicely with our view of how we like to invest and how we want our management teams to create value for shareholders over the long haul. We expect that Watsco will continue to execute going forward and are monitoring the stock for our portfolio.

We now discuss a current portfolio holding.

Nordson Technologies – An Overlooked Gem in the Industrials Space

In our view, Nordson is one of the highest quality Industrial companies. It is under followed by Wall Street (we prefer that) and under appreciated by investors (we think that will self-correct over time). We have owned the company since the inception of the fund. Nordson is among the most profitable multi-industry Industrial companies, boasting 55% gross margins, with 27% EBITDA margins, and an organic growth trajectory that has and should continue to grow at 2X global GDP. The company has historically augmented it’s 5% - 7% organic revenue growth track record with another 2% - 4% in acquired growth, helping it consolidate smaller competitors in its core businesses and growing its capabilities in adjacent technologies and end markets. Over the past five years, the company has grown its revenues at an 8% CAGR, comprised roughly of 5% organic and 4% acquired growth offset by a 1% headwind from unfavorable foreign currency effects. Over the same time period, it has been able to translate its 8% topline growth into 13.5% EPS compound growth via the embedded operating leverage from growing its topline as well as driving cost reduction programs from facilities consolidation and six sigma process improvements across its manufacturing and back office footprints, as well as opportunistic share buyback programs in 2014 and 2015.

Brief Overview

Nordson designs and manufactures differentiated products used for precision dispensing of adhesives, coatings, sealants, biomaterials and other materials; for fluid management; for test and inspection; and for UV curing and plasma surface treatment. The company operates across three segments: 1) Adhesive Dispensing, 2) Advanced Technology, and 3) Industrial Coatings.

Investment Thesis

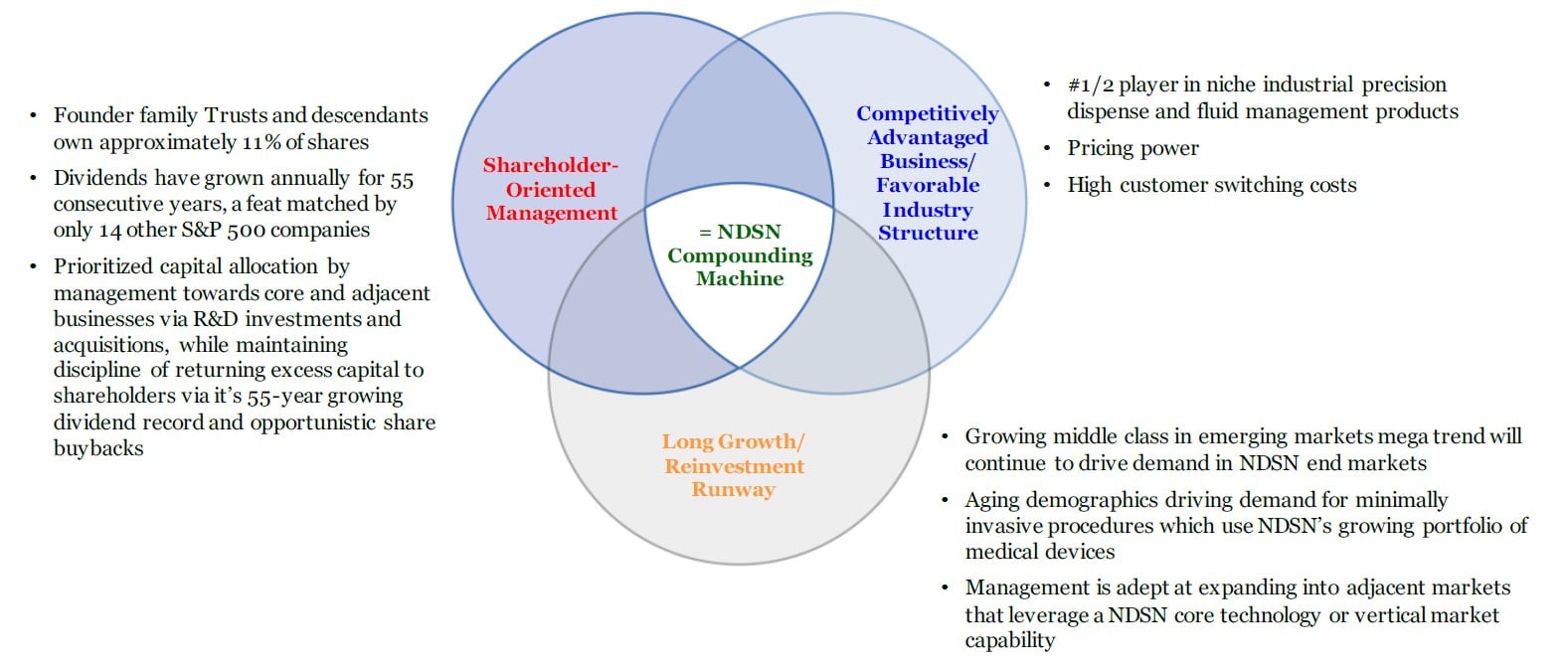

1. A Sustainable Competitive Moat Generates High Returns on Capital Due to High Barriers to Entry, Pricing Power, and High Customer Switching Costs:

Nordson holds the #1 or #2 position in its niche precision dispense and fluid management product categories across consumer non-durable and durable, electronics, industrial and medical end markets. It is the only global player competing across the portfolio of its businesses, often competing with smaller regional players that do not have the same resources and scale. Its scale has allowed it to invest significantly in R&D to maintain an edge in delivering superior product capabilities and performance for its customers relative to less well capitalized competitors. Its size and scale have also allowed it to use its capital to acquire smaller competitors that may deliver a new technology and/or product/customer adjacency allowing Nordson to continue to invigorate its growth trajectory. Furthermore, Nordson sells mission critical components that represent a small fraction of an OEM’s manufacturing line/process, generating significant pricing power. For example, Nordson’s adhesive dispensing equipment may represent $100-$150K of content on a $2 million consumer goods packaging line. In that scenario, the Consumer Goods OE is not as focused on squeezing pricing on 5%-7% of their cost base, especially when that portion of the line is critical in maintaining critical uptime and product throughput. Finally, given that it is often the only global competitor with superior resources, and given that its products are mission critical, once Nordson is specified into an OE customer’s process, it is often very disruptive and costly for customers to try to replace Nordson with a competing product, resulting in customer stickiness.

2. Nordson Markets Are Benefitting from key Mega Trends That Should Support A Sustainable Growth Path:

We believe Nordson benefits from several key durable trends that should allow it to grow organically at 2X Global GDP rates sustainably for the foreseeable future. Growing middle class in emerging markets will continue to drive consumption of consumer-packaged foods and goods, plastics and electronics that NDSN’s equipment is used to manufacture for many years to come. We believe the growth rates in consumer goods should be 2X global GDP growth rates, whereas the growth in key electronic/mobile markets should be closer to 3X global GDP.

Furthermore, the aging demographics in developed countries is driving demand in two key product areas that Nordson is active in: 1) adult diapers in Nordson’s nonwovens adhesive dispense business and 2) for minimally invasive medical procedures which use NDSN’s growing portfolio of medical devices, such as catheters, balloons, fluid connection components, and specialty tubing, all of which tend to be high margin single use products, which tend to have recurring revenue features to them.

3. Excellent Capital Allocation

Nordson’s successive management teams over its history have delivered very strong returns for its shareholders in large measure due to their adept use of capital in sculpting the company’s portfolio of businesses. The priority has been to reinvest in its core capabilities via R&D (NDSN ranks in the top quartile of US Industrial companies in terms of R&D spend as a % of Revenues). Despite this high level of reinvestment, the company converts >100% of Net Income into Free Cash Flow (FCF) and it has used its FCF strength opportunistically to acquire smaller regional competitors to supplement its core technologies, add adjacent product capabilities and/or customers/end markets. This has served the company well and allowed it to supplement its mid- to high-single digit organic growth with another few percentage points of acquired growth, leading to consistent high single-digit topline growth. The company is typically the purchaser of choice (being the only player of scale in its core markets) allowing it to be patient and disciplined in the price it pays for acquisitions.

The company has a moderate dividend payout ratio but given its consistent growth since inception, this has allowed the company to grow its dividend in 55 consecutive years, a feat only matched by another 14 companies in the S&P 500. Finally, this current management team has shown that it is willing to be opportunistic in the use of its cash to buy back shares in size when the stock price retrenches significantly, as it did in 2014 and 2015.

4. Nordson is reasonably valued at a P/E of 20X and a Free Cash Flow yield of 5% for 12%-15% EPS Growth for the next 3-5 years

The company has generated outstanding long-term total shareholder returns of 22% per year over the past 20 years (2008-2018). Where do we see things going from here?

We believe the company can continue to sustainably deliver 6%-8% topline growth and 12%-15% cash earnings growth for the foreseeable future. On NTM consensus estimates, the stock is currently trading at 20.3X, a little higher than its 10-year average of 18X but in line with its ten-year average relative to the S&P 500 at 1.2X. Without any multiple expansion or deterioration, we would expect the stock to deliver its earnings growth of low to mid-teens plus its 1% dividend yield.

Nordson is probably one of the best Industrial companies that most investors have not heard of.

Q2 2109 Portfolio Update

We made a few changes in the portfolio in the second quarter as well. We exited Booking.com (BKNG), formerly Priceline (PCLN), a core holding which we held since inception, and used the proceeds to fund two new positions – Broadridge Financial Solutions (BR) and Brookfield Asset Management (BAM).

Our decision to exit Booking.com was driven by the specter of increasing competition from core on-line travel (OTA) companies like Expedia and Trip Advisor, but more importantly from encroaching competition from AirBnB and Alphabet, which has been a primary channel of customer acquisition for Booking. The company built a classical two-sided network that benefited from positive flywheel effects, allowing it to capture share from the offline travel agency market for well over a decade, especially in its core European markets. However, our work has suggested that OTA penetration has begun to mature, and this in combination, with increased competition from traditional OTA players, as well as newcomer AirBnB and others, has manifested itself in a slowing growth trajectory for BKNG, combined with higher customer acquisition costs which we believe will begin to place growth and margin pressures on the company.

Broadridge Financial, a global Fintech leader, provides the financial industry with outsourcing services and software solutions. Formerly part of Automatic Data Processing, Broadridge supplies investor communications solutions (proxy distribution and processing), as well as securities processing and clearing services. With over $4 billion in revenues Broadridge provides communications, technology, data and analytics that help financial services clients reduce operating costs and to remain at the forefront of technology in the investor communications, investment banking and asset management end markets. We were attracted to Broadridge because it is benefiting from long-term growth drivers driven by trends like mutualization (i.e., trend to outsource non-differentiated workflows to third-party service providers), digitization (i.e., paper to electronic migration), and increasing use of data analytics (i.e., use of big data to provide insights for clients). It occupies the dominant services position in the Investor Communications market, handling 2+ billion investor communications and handling 80% of US share proxies and 50%+ in non-US proxies. In its capital markets business, it has 10 of the top 10 global banks as its client and provides the plumbing that processes $5+ trillion in average daily fixed income and equity trades. Broadridge has very high recurring revenue, resulting from multi-year sticky customer contracts that benefit from high customer retention rates of 98%+. Furthermore, the company drives strong operating leverage from its high single digit topline growth to drive mid-teens cash earnings growth consistently.

We also funded a new position in Brookfield Asset Management, a unique alternative asset manager that has leveraged public capital markets via it four operating platforms as well as private capital markets to fund it private fund vehicles across its real estate, infrastructure, renewable energy and private equity asset classes. The asset manager’s size and scale and unique public and private sources of funding have allowed it to make investments in its four asset classes that very few other asset managers could make. BAM has been steadily growing its AUM and gaining share as institutional investors have and continue to look for higher returns in the alternatives space in a low interest rate environment. BAM’s management has been adept at allocating its capital via its public and private investment vehicles at advantageous terms to the firm and its investors, which we believe is a unique source of competitive advantage to the firm. Stay tuned for more to come on BR and BAM in future letters.

An (Oblique) Recommendation

What is relevant to investing is not always about investing. We would encourage our investors to dip into the Tao de Ching, an ancient Chinese classic, which we find centers us, and enables the long-term framework we espouse. What the Tao de Ching does, time and time again, is to show us how we might see things if we could spend more time in awareness, and less in naming. "Practice not-doing, and everything will fall into place." This, from the third verse, sounds positively heretical to the time, work, and productivity-obsessed modern mind. Perhaps if we were more aware, we would worry less, and could see the world more clearly.

There are few activities more satisfying than doing something you enjoy doing…for a living.

As investors, we are constantly reading, thinking, meeting management teams, forming hypotheses, challenging them, and discussing investment ideas. It is intellectually fulfilling and engaging. We would rather be doing this than anything else. We look forward daily to managing our investors’ money and doing what we love.

Please feel free contact us with any questions.