The bitcoin price soared back over $11,000 in early July, showing no signs of slowing down. The cryptocurrency was up some 40% in June and is now up more than 200% since December. So where is all this bitcoin demand coming from? One analyst thinks institutional investors could be driving the cryptocurrency now.

Clues on bitcoin demand from Google

In his “Bitcoin Monthly” report for July, Canaccord Genuity analyst Michael Graham noted that the surge in bitcoin demand in 2017 was probably led by retail investors, given that more than 100,000 new Coinbase accounts were being set up every day at the time. However, he believes recent Google Trends data — or lack thereof — now suggests institutional investors could be driving bitcoin demand in 2019. The data shows that search interest for bitcoin is nowhere close to where it was previously.

Q2 hedge fund letters, conference, scoops etc

Instead, he notes that open interest in CME bitcoin futures reached record highs in late June. He believes this suggests that new capital from institutional investors could be what's driving the rally in the bitcoin price.

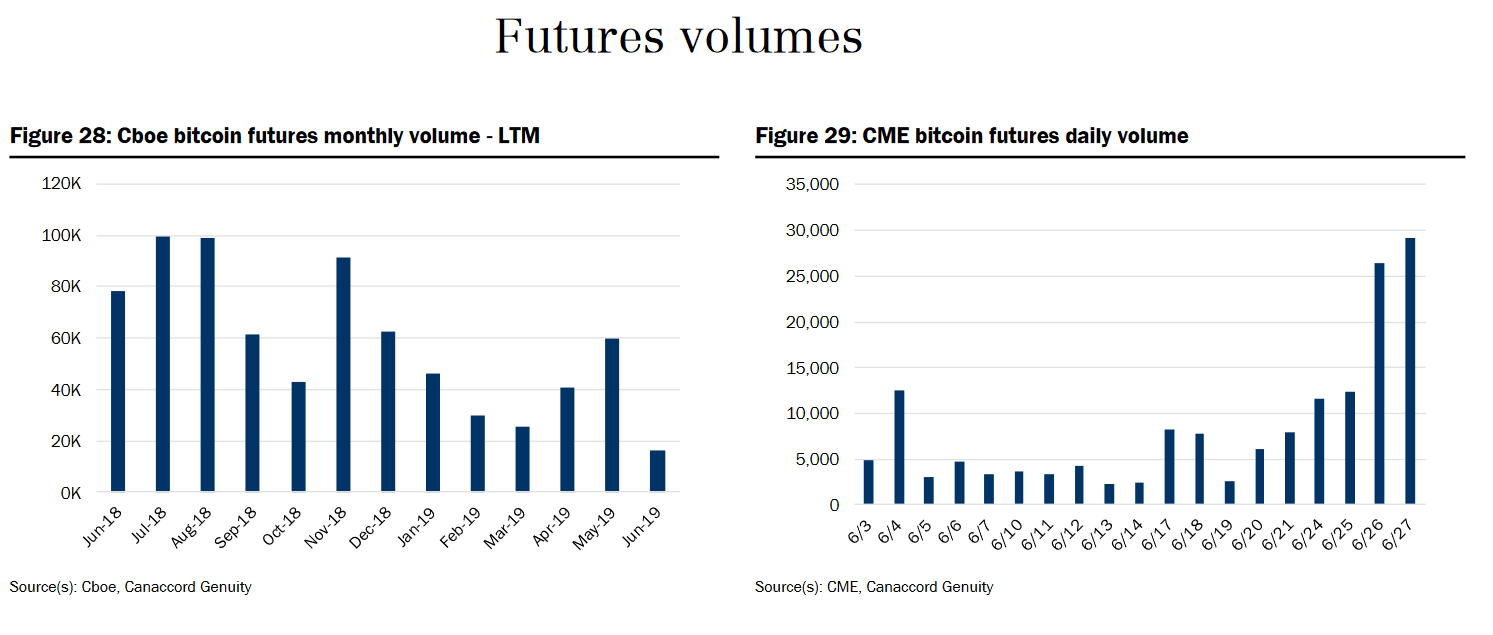

CBOE bitcoin futures volume plummeted from 52,000 in May to 16,000 in June, which was the first monthly decline since March. CME bitcoin futures declined initially as well, falling from a daily average of 13,600 in May to 8,247 in June. However, CME bitcoin futures picked up toward the end of June and surged past 29,000 on June 27.

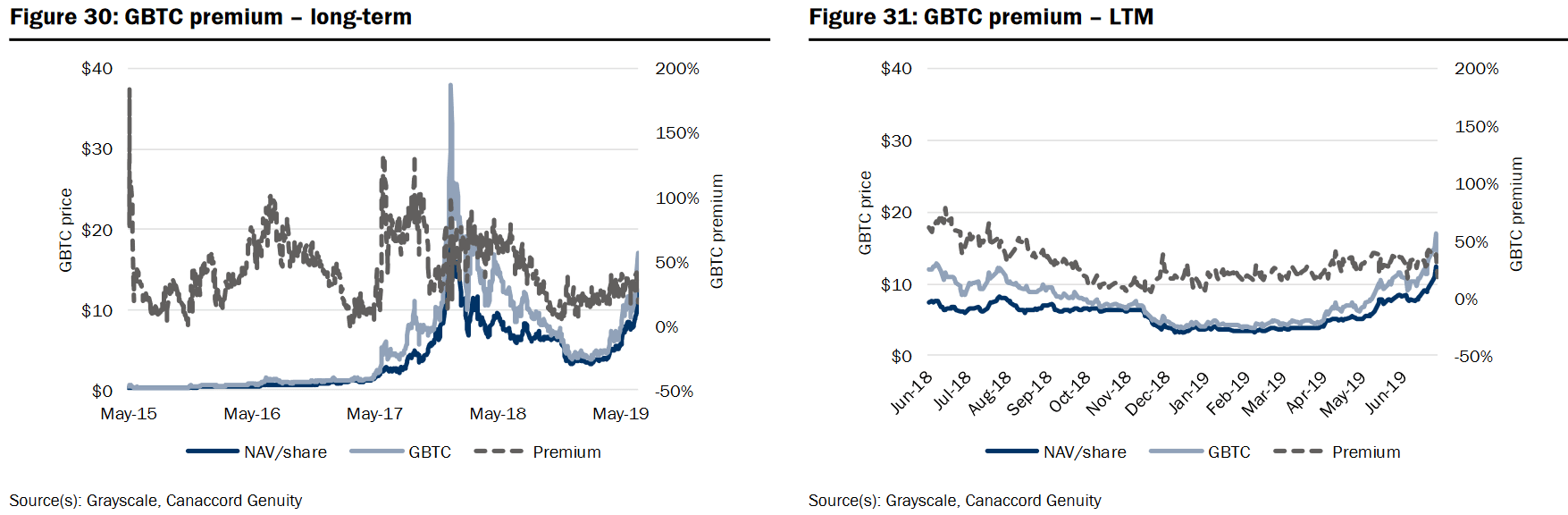

Graham also noted that the Bitcoin Investment Trust (GBTC)'s premium is on the rise. The GBTC is "the first publicly-quoted security solely invested in and deriving value" from the bitcoin price, he explained. He explained that the Bitcoin Investment Trust has become a popular product with institutional investors due to the "lack of sufficient custody solutions to store physical bitcoin."

As of June 27, the GBTC's premium to its net asset value was at 19% after trending higher over the last month or so.

Not everyone is convinced that institutional investors are the ones driving bitcoin demand, however. Delphi Digital, Kraken CEO Jesse Powell and Bitmex CEO Arthur Hayes have all stated that retail investors are actually the ones driving demand. The increase in the premium of the Bitcoin Investment Trust was given by Delphi Digital as a reason to believe retail investors are driving bitcoin demand, although institutional investors also use it. Unlike Canaccord's Graham, Delphi Digital argues that this year's parabolic move is indeed eerily similar to the 2017 move, although Graham has argued several times that the two rallies in the bitcoin price are quite different.

Bullish breakout for the bitcoin price?

Technicians often point to the 200-day moving average in the bitcoin price as a resistance and support levels, and Graham notes that this average started to turn upward in the middle of May. Since that inflection point, the bitcoin price has climbed 88%, Graham added.

According to him, the average daily estimated transaction value climbed to $1.5 billion in June from $1.2 billion in May and $743 million in April. It was the highest level observed since January 2018. He found the average transaction size for June at $4,292, a 39% increase from May's average at $3,089 and an increase of 111% from April's average.

It's anyone's guess where the bitcoin price will go next, but FX Street pegs the next major resistance level at $11,464. If bitcoin demand pushes the cryptocurrency above that level, then the next target to watch will be $12,350.

This article first appeared on ValueWalk Premium