Hayden Capital commentary for the second quarter ended June 30, 2019.

Dear Partners and Friends,

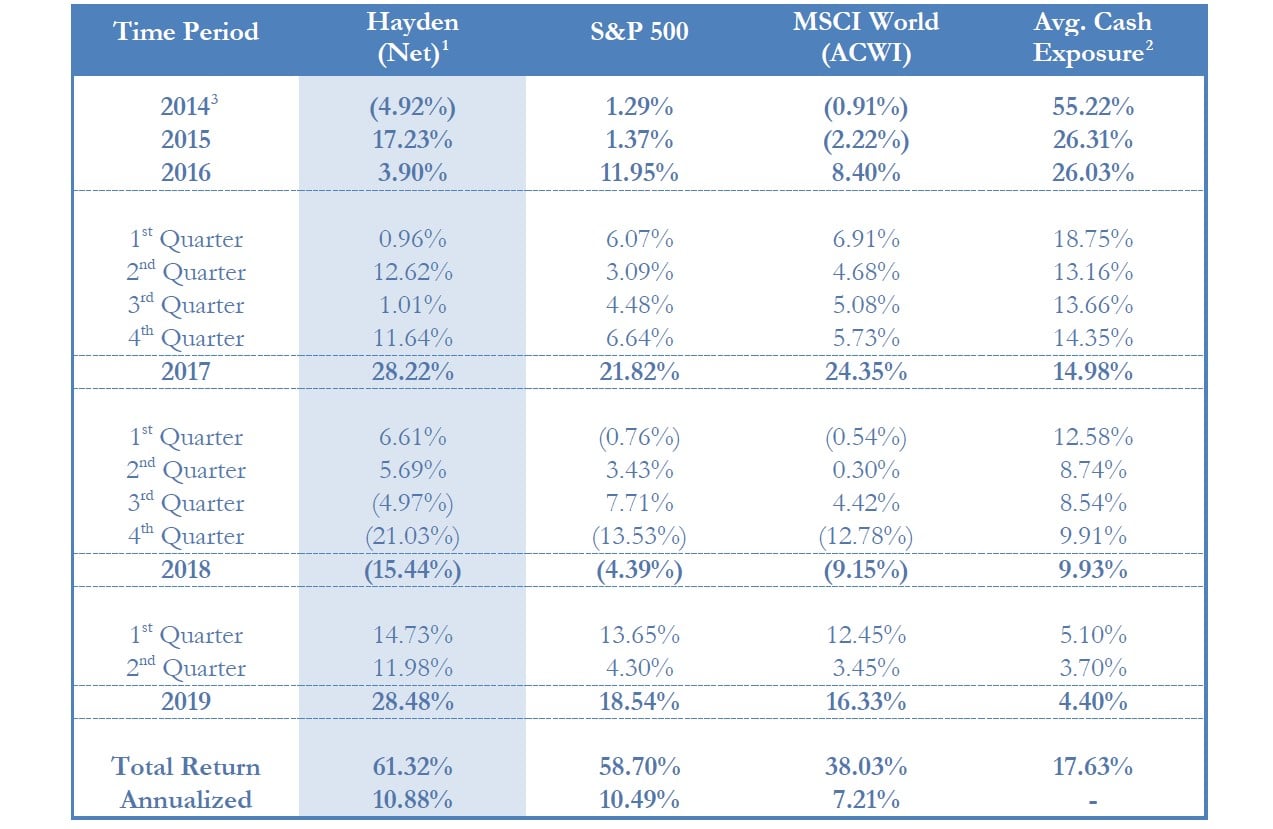

Our portfolio continued its recovery in the second quarter, and at a stronger pace than the broader market indices. During the second quarter, our portfolio appreciated +11.98% (net of fees), compared with the S&P 500 at +4.30% and the MSCI World index at +3.45%.

Q2 hedge fund letters, conference, scoops etc

This brings our year-to-date performance to +28.48% vs. +18.54% for the S&P 500 and +16.33% for the MSCI World. The performance was led by our newest positions in Sea Ltd and Carvana, which have appreciated +193.6% and +92.3% year-to-date, respectively.

OPM: Other People’s Money

Last quarter I spoke at length about our recent investments in earlier-stage companies, and the mental frameworks we apply to them (LINK). A few questions I received, were specifically around these company’s use of external capital, and how we can be confident the capital is used wisely, especially when the results of the capital spend isn’t evident in the financials yet4.

First off, I think we need to disregard the notion that younger businesses are somehow completely different than more mature businesses. For companies that are reinvesting their capital into growth opportunities, the investment framework, mental models, and research process are the exact same. The only thing that should matter, is whether this incremental investment is making the company stronger and creating value, or just temporarily plugging a loss-making money pit and accelerating value destruction in the process. The only differences are where the company is in its lifecycle (younger companies theoretically have more runway left), and whether external capital should be used to accelerate growth. Theoretically, the earlier lifecycle a company is, the more likely attractive opportunities to reinvest capital internally will exceed the capital available. This is where using “other people’s money” comes in.

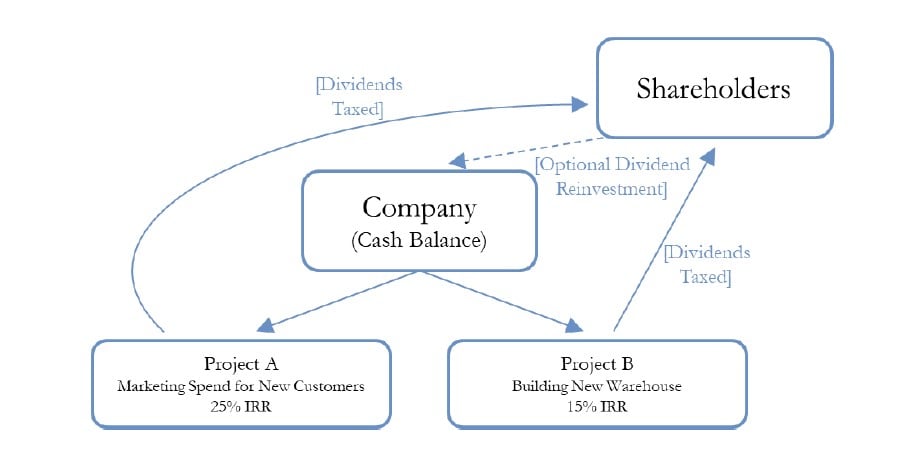

Mature Company – 0% Reinvestment Scenario

All profits are returned to shareholders

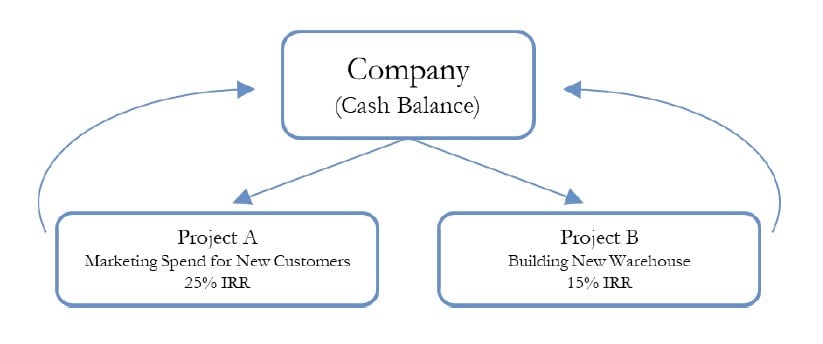

Growing Company – 100% Reinvestment Scenario

All profits are reinvested back into the business

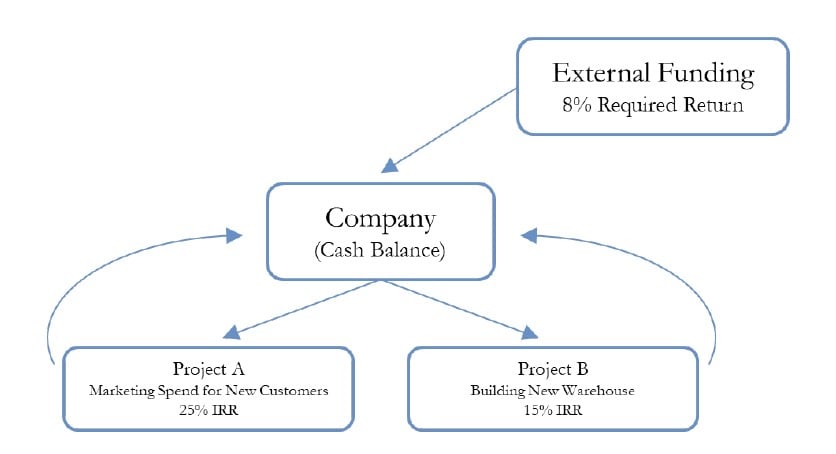

Early-Stage Company – 100% Reinvestment + External Funding Scenario

All profits are reinvested back into the business, along with selective use of external capital

If you look at the above scenarios, you’ll see that the business structures are relatively similar. The only differences are whether internally generated profits are reinvested back into the business or returned to shareholders – which is dependent upon the businesses’ opportunities to reinvest capital, and in turn is dependent upon how mature the company is. In the “Mature Company” and the “Growing Company” scenarios, it’s obvious to the market that both businesses are self-sustainable.

What investors fear most with newer businesses, is that they often have external funding as well. When a business is showing losses and also taking in more capital, the fear is that the business would be unsustainable without that external capital to fill the hole in the cash balance. Thus, most investors put all these companies into the “too hard” pile, and wait for the financials to become more evident.

You see this structure very often in industries where management believes it’s a winner-take-all market5. Winner-take-all markets require you to get big, fast (benefits to scale, gobbling up customers before competitors do, etc.), especially if there are competitors trying to do the same. And most times, this is due to the potential for network effects, where reaching a “tipping point” is critical (see our Q1 2019 letter, LINK).

By hitting that “tipping point”, the idea is that you assure your business of a viable monetization model (there’s enough liquidity in the network for participants to get value from it, and thus the company can start charging for it). Additionally, if external capital accelerates the amount of time it takes to reach that tipping point, it means that future positive cash flows (if it exists) are pulled forward.

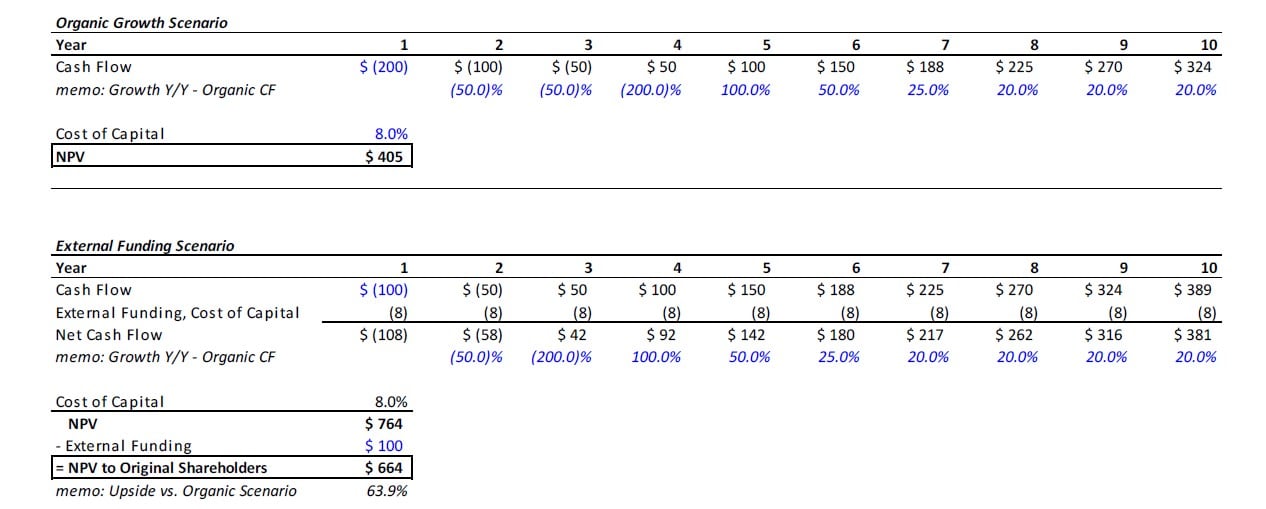

Let’s use the scenario below as an example. Under the organic growth scenario, this company is losing money for 3 years, before it turns profitable in year 4. If the projections are accurate, the company is worth $405 today.

But if using $100 of external funding means that the company can get to profitability just 1 year faster (profitability in year 3), it results in a company value today of $664. That’s a 64% return on using external funding! This is essentially the PE / VC - Growth Equity model, of “pouring gasoline” on proven business models to make it bigger, faster6.

"Good" Business Model

Business model and industry structure allows for profits in later years

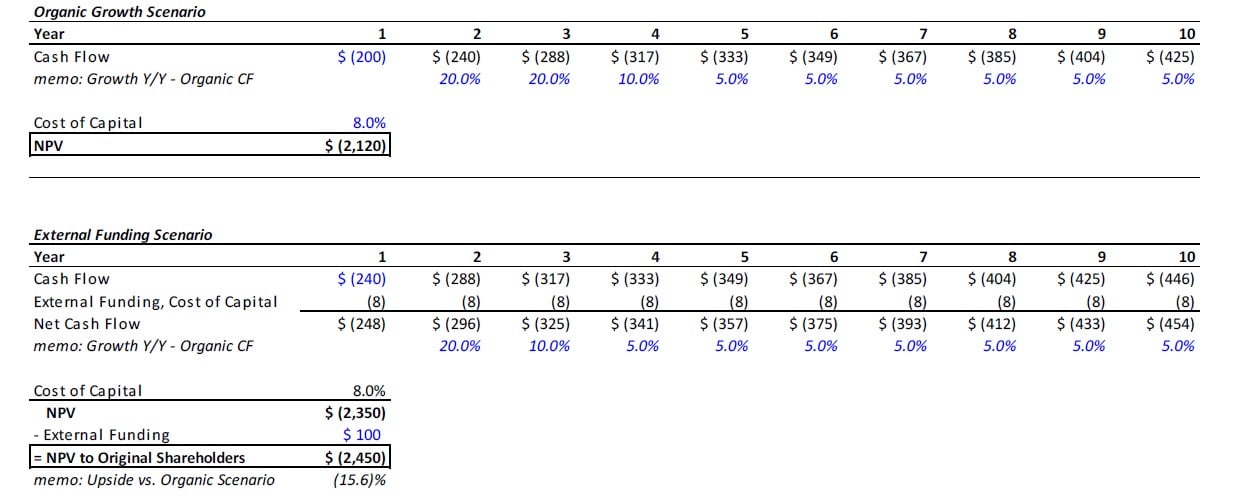

Notice, external capital only enhances a business model… it’s not going to magically turn a poor business into a great one. For a “bad” business model, it only accelerates the losses and drives it into bankruptcy faster (the bike-sharing companies that generate losses on a per-ride level, come to mind)7.

Investing at the core is all the same – whether it’s early-stage businesses, stable growth businesses, or mature no-growth business – it’s all about predicting future cash flows. External funding simply accelerates the inevitable, so therefore the most important thing is just getting the inevitable right (what is the company’s terminal state / “normalized profits”?)8.

"Bad" Business Model

Poor business model and industry structure doesn’t allow for profits in the foreseeable future

But doesn’t external funding make a company riskier, especially during a downturn? Capital markets and access to capital tends to dry up when everyone’s panicking. If a company relies upon external funding like Voldemort’s Horcrux, carrying an otherwise dead company along until the day it can reach self-sustainability and profitability (ahem, Uber / Lyft), then yes. But if the business model is already self-sustainable, and the external funding is simply being used like fuel to grow faster, then no. As long as the incremental growth generated is more profitable than the existing business, then this is actually a good decision.

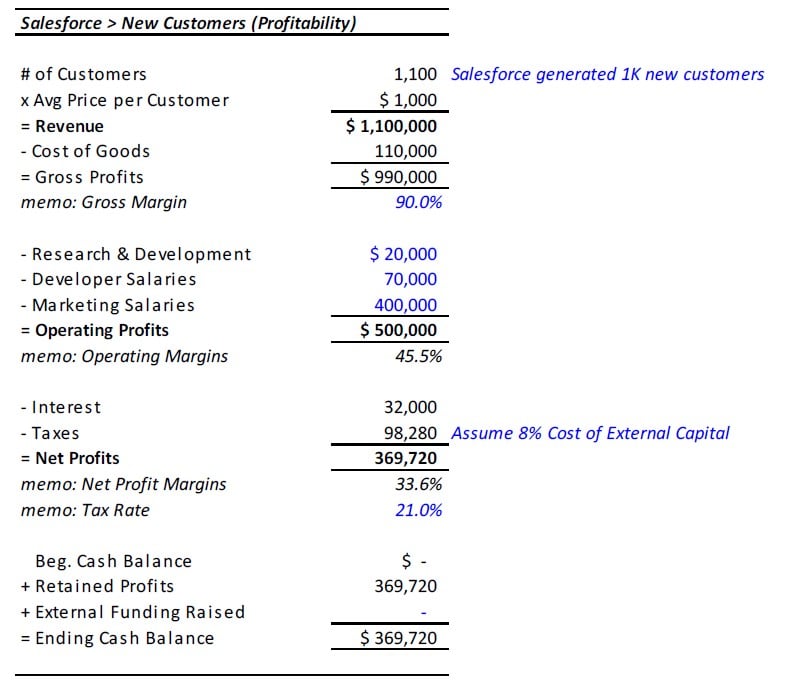

The key is to look for certain companies where the external capital is discretionary. These companies are actually a “Growing Company” (self-sustainable), but actively choose to take on external capital to accelerate (profitable) growth. When you can borrow at an 8% cost of capital (example above), and reinvest it into projects returning 15 - 25% with relatively low risk, wouldn’t you want your business to do that9?

In these circumstances, there’s no difference in the analytical process of judging whether a company will be able to grow earnings from $1 to $10, versus a younger company going from losing -$5 to earning +$5 in the future. It’s the same analysis. At the end of the day, all investing is making a judgement call on [how much future cash flows will be] x [when investors can expect to receive them].

The caveat is, in order to “pull forward” positive cash flows, as in our previous example, it requires the incremental growth (new customers, factories, etc) to be profitable, which usually requires leveraging the existing infrastructure / fixed cost base as much as possible.

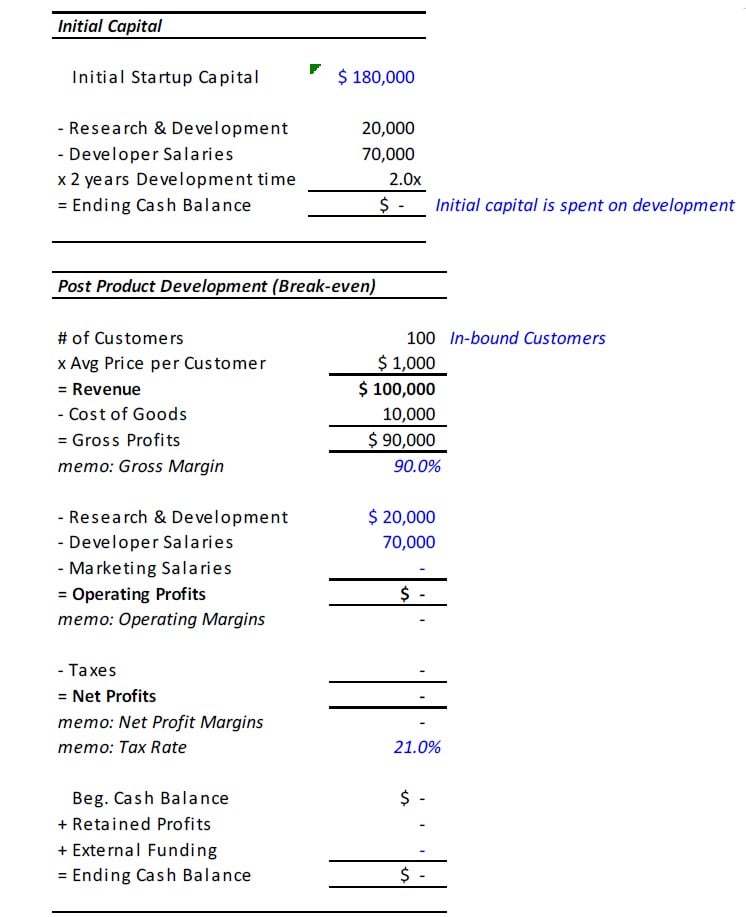

To illustrate the concept, software is an often-cited example of this. Once the developers are hired and code is written, it costs almost nothing to provide the software to one more customer. If the customer found you organically, the margins on the new customer is almost 100%. You’ve already spent the salary and R&D costs to build the product, and incremental margins are high. You should aim to sell as many copies as quickly as possible.

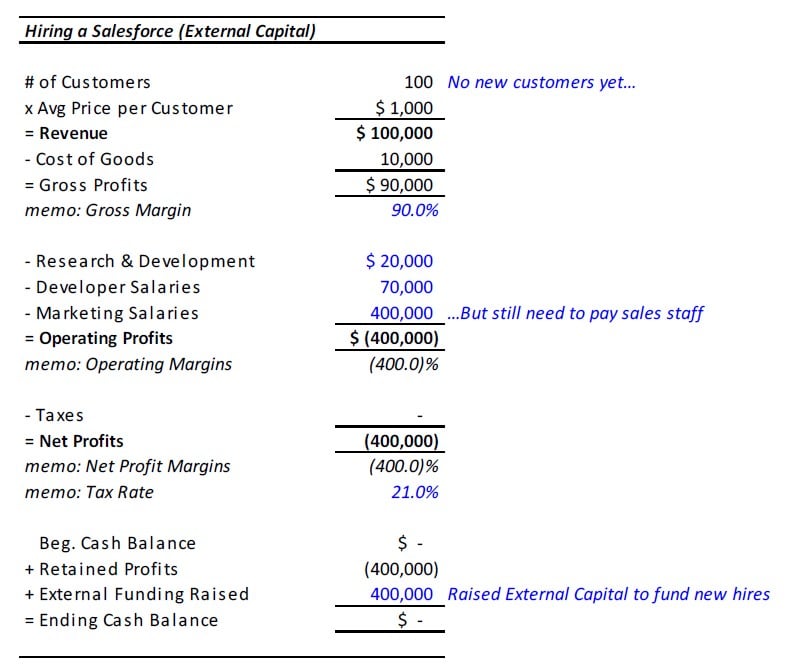

But very few customers will find you themselves, so you need to hire a salesforce if you’re to add significantly more customers. But as a young company, you already spent all your cash on developing the product, plus every month you still have to pay your developers and other costs to update / maintain the software. Luckily, you’ve found enough in-bound customers to cover these costs / reach sustainability, but it’s not enough cash in the bank to hire more sales people and grow quickly. But based on previous experience, you’re confident that spending $400K on a few sales people will generate another $1M in sales. What are you to do?

Well, the correct answer would be to borrow that money in the form of either debt or equity (especially at today’s low interest rates). It’s a great example of external capital adding value – it’s an extra $500K of operating profits you wouldn’t have had previously.

But if you were to look at the financials of this company immediately after this decision, it might look like they’re bleeding cash and the fundamentals are getting worse / going in the opposite direction. They’d be going from break-even to losing -$400K per year! This is because you have to pay your salesforce starting Day 1 but they might not bring in sales for a year or more. In the short-term, it may look to the market like a big bonfire of cash.

As those salespeople bring in new customers though, and as you reinvest those proceeds into hiring even more sales people, you’ll get that much closer to showing profitability again on the overall financial statements.

Unfortunately, software investors tend to understand this business model today, so you probably won’t see a large sell-off in the “investment phase” anymore (instead, they’d rather trade at lofty 20 - 50x sales!). But luckily for us, this dynamic still occurs in other industries or geographies, where the shareholders are not as astute.

No doubt, it requires work to distinguish a good business model vs. a bad business model – and using external capital doesn’t change that. It just accentuates it. This is especially true for businesses that have increasing returns to scale, versus the traditional economic model of diminishing returns. In the former, capital becomes more efficient as these companies grow10.

At Hayden, we’re paid to do the hard work and look for these pockets of inefficiencies. This is just one investment framework that’s in our toolkit. When most investors have a heuristic that leads them to put an entire group of companies into the “too hard” pile, that’s where I go sifting for deals.

Portfolio Updates

Cimpress (CMPR): This quarter, I sold our position in Cimpress after almost 4 years of ownership (initially purchased August 2015). During this period, our returns on the investment have been disappointing, to say the least.

If partners remember back to our initial thesis, it was originally distilled down to a bet on the shift to the “higher-expectation” customers, which was complemented by the acquisition of Upload and Print businesses in Europe to serve this new customer-set. These customers spent 5x more on printed materials compared to Cimpress’ historical customer base. The result was better incremental customer economics, once they were onboarded as customers.

At the time, Cimpress was spending ~50% of its gross profit on marketing expenses (both retaining and acquiring new customers), and ~50% of remaining discretionary capital allocation (excluding share repurchases) towards acquiring these Upload & Print businesses. I estimated the return on marketing spend was north of 30% IRR, and the Upload and Print acquisitions were yielding +16% after-synergies.

Issues cropped up the last few years though, as Cimpress faced heavier competition, which drove up the cost of acquiring customers (particularly on Google), which eroded those marketing returns. Although no single competitor came close to Cimpress’ scale, a collection of smaller competitors that provided a better customer / website experience put pressure on them. Executional mistakes also exacerbated the issue. This result was Vistaprint revenues (54% - 68% of total revenues) growing only ~6% y/y and profits ~8% y/y.

At the same time, Cimpress tried to fix these and other issues by making several strategic changes – most notably pivoting from trying to centralize corporate functions, to trying to decentralize the business units. This shifting back and forth resulted in some wasted investments, which are evident in the relatively flat steady-state cash flow generation capabilities. But more importantly, it was a distraction for the organization.

We initially purchased the position at ~$67, and ultimately sold out of it at ~$89 this spring11. While our return on investment has been positive, it underperformed both the rest of Hayden’s portfolio as well as comparable benchmarks.

While I think Cimpress will continue to rise in value and maintain its competitive position in the industry, I question whether it has ability to outperform our other investment opportunities going forward. In short, I have lost confidence in management’s judgement and ability to execute. We have since redeployed the proceeds into our other portfolio holdings.

JD.com (JD): This quarter, I also finalized the sale of our position in JD.com. I’ve laid out our detailed thesis on the company in past letters, which unfortunately haven’t panned out.

We originally bought the position in March 2017, predicated on the thesis that as Chinese GDP per capita rises, consumers would increasingly place emphasis on shipping times and name brand / authentic products. In addition, as the consumer base widened and shoppers got in the habit of instant gratification (due to same day / next day shipping), they would engage with the platform more often. The thesis was that this engagement and resulting loyalty to the platform, would allow JD to branch out into higher-margin general merchandise categories (which also have higher order frequencies) vs. their traditional electronics & appliances (lower margin, low order frequency), which would result in higher profits and margins.

Two years later, the broader theses points came true. GDP per capita has risen +21% in just the last two years ($9.8K in 2018 vs. $8.1K in 2016; LINK), which has led to a greater focus on quality products vs. cheap price. But the beneficiary of this was Alibaba and not JD.

For example, Alibaba’s Taobao platform (consumer-to-consumer marketplace), which historically was known for cheap products but of questionable authenticity, has grown GMV +18.9% annually the last two years. This is compared to Tmall, Alibaba’s business-to-consumer platform, where brands sell authentic goods directly to consumers, which has grown +10% faster (+29.2% annually) over the same time frame.

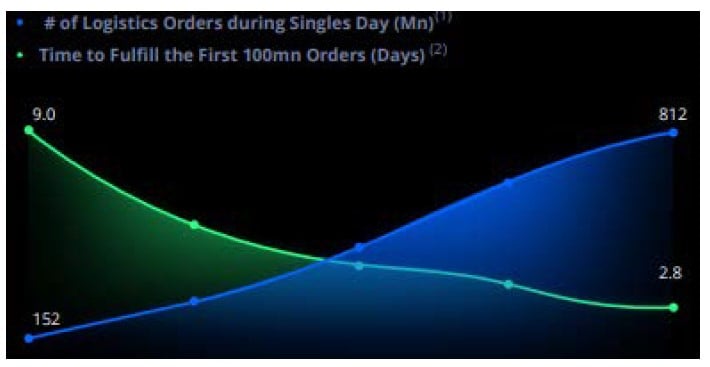

Alibaba’s Cainiao Delivery Times

Time to fulfill first 100M orders during Singles Day, from Alibaba Investor Day 2018

At the same time, Alibaba did a great job implementing Cainiao, its network of 3rd party logistics operators. Just look at the decrease in shipping times over these past few years. Alibaba’s delivery times have improved even further since this graph, and is now able to delivery packages the same day in many Tier 1 cities. This drastically lowered the attractiveness of JD’s value proposition, which combined with the Tmall offering, narrowed JD’s competitive advantage.

Anecdotally, I’ve also heard more and more stories of employees looking to leave the firm. Tech startups in China don’t recruit from JD (a negative signal for JD’s technological abilities), most commonly preferring instead Alibaba, Bytedance, or Huawei (at least among those I’ve spoken to)12.

Note, while the scandal around founder Richard Liu added another layer to the thesis, it didn’t play a major role in our decision to sell. After the incident, and more importantly after digging deeper into his personal background, my opinion of Richard’s integrity worsened. But it was clear he hadn’t committed a crime in this particular case, and would be acquitted13.

In our Q3 2018 letter, I outlined some of these issues but mentioned my view that the drop in the stock price due to the allegation, was too much. I decided to wait for shares to recover, and ultimately sold in April and May this year at ~$29.

We owned the shares for approximately two years, building a full position at an average price of $37. During this period, we recognized a total loss of -22%. Rest assured, many of the lessons from this experience, will be applied to future investments. One example, understanding the ability of a 3P Marketplace to successfully drive engagement and build a complementary network of logistics partners without owning the assets, has already benefited our mental model for Shopee / Sea Ltd.

I’ve taken the opportunity this quarter, to clean up our portfolio. Over the course of an investment career, I’m sure I’ll make many more mistakes and some of our theses simply won’t pan out. That comes with the nature of the business. More importantly though, is to learn from these experiences and apply them to how we think about future investments – we never want a good learning opportunity to go to waste.

Conclusion

This fall, I’ll be restarting the travel schedule with an extended trip to Asia during late September and most of October. I’ll be in Hong Kong, Shenzhen, Jakarta, Singapore, and possibly a few other cities in China / Southeast Asia.

Partners will notice that we haven’t found anything new worth buying in the last 10 months. Hopefully on this trip, I’ll be able to learn about some interesting businesses that will deserve a place in our collection of high-quality companies in coming years. If you’re a public or private markets investor, or an entrepreneur with an interesting business that’s based in one of these cities, I’d love to grab a coffee and compare notes. If you’re interested in joining the Hayden Capital family by becoming a partner with us, I would love to meet as well.

This quarter, I’d like to thank Professor Van de Walle at NYU, for inviting me to speak to the Emerging Markets Finance class. I had a blast talking about our investment process, and how it can be applied to developing markets.

Also, I’d like to thank Tilman of valueDACH for inviting me to speak with himself and Steven Wood of GreenWood Investors, in a wide ranging interview. We covered everything from investing in Europe & Asia, the impact shareholder culture has on corporate decision making, to specific investment cases for Zooplus and Sea Ltd. The recorded conversations can be found here (LINK 1, LINK 2). While there, please check out valueDACH’s other interviews too – there are plenty of great interviews to learn from (LINK).

Over the next few months, hopefully I’ll have the chance to connect with many of our partners in NYC and elsewhere. In the meantime, please email me or pick up the phone if there’s anything I can help with.

Sincerely,

Fred Liu, CFA

Managing Partner