Forge First Asset Management commentary for the month ended July 31, 2019.

Unlike the 19th century proverb which spoke to the weather entering March like a lion and exiting like a lamb, Fed Chair Jerome Powell‘s press conference last week ensured the reverse happened for the market’s exit from July. Fueled by valuation multiples that have expanded more than 20% year to date & driven 95% of the upside in U.S. stocks, equities continued to grind higher during July on hopes that the Fed would complete its 180 degree turn from December’s hawkish policy stance and announce its first interest rate cut in eleven years with guidance of several more to follow. Unfortunately, Chair Powell’s history of difficulties in communicating policy intentions continued at his press conference on the last afternoon of July, causing the S&P 500 to have its first 1% down day since the last day of May. Predictably with Powell’s more ‘hawkish than expected’ tone, the US dollar moved to two year highs, gold was clubbed and the yield curve bull flattened. But these price moves didn’t even last a day.

Q2 hedge fund letters, conference, scoops etc

Less than 24 hours later, on August 1st, shortly after tweeting his displeasure with Powell's performance, President Trump rashly announced new tariffs on $300B of Chinese exports. The US dollar fell, gold spiked and the yield curve bear flattened. We've long doubted the willingness of the Chinese to acquiesce to Trump's demands, so presumably Trump's now got that same message, but the course of action he chose is troublesome. If in fact these tariffs go live on September 1st, Cornerstone Macro estimates they'll add 0.3% to headline CPI, with a parallel hit to real purchasing power. And since this basket is heavily skewed toward consumer items (diapers to flat screen TVs), there could be damage to confidence that exaggerates the spending hit. Ultimately the negative multiplier effect of heightened trade wars could ensure Trump gets his 2 desired rate cuts by the end of this year. But markets don't need this incremental source of instability, in particular Trump's theft from Draghi's playbook to do "whatever it takes" to force the Fed to cut interest rates. Remember, August & September have historically been the two roughest calendar months for equity markets. However, while August has truly lunged like a lion out of the starting gate, July was quite uneventful.

Driven by the anticipation of synchronous global rate cuts, the S&P 500 was positive for July at all times, both intraday & end of day, yet gained just 1.44%, closing only 1.2% above its close of 3 months earlier. Shares in technology and banks led the way in the U.S. Here at home, the TSX was modestly positive, up 0.15% on price, 0.34% including dividends, while July was flat for gold and bonds, modestly negative for oil & natural gas, mixed for base metals and outright lousy for agricultural commodities.

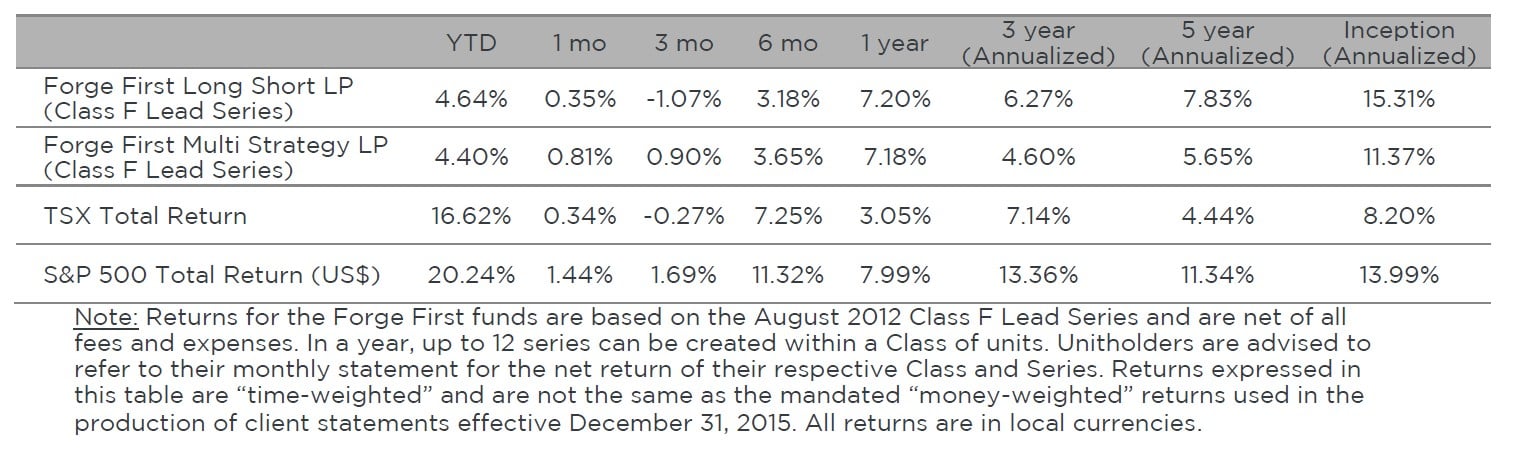

July was also good for each of our two funds at Forge First, as they both generated positive net returns. As can be seen in the above table, the Forge First Long Short LP Class F Lead Series gained +0.35% net of fees, boosting the year to date net return to +4.64%. Also, the table below shows that the five year net return of the Long Short CL F Lead Series now sits at +7.83%, while the Sharpe ratio is 1.85 and the upside downside capture remains a solid +75%/-31%. Our more conservative fund, the Forge First Multi Strategy LP had a great month, as the Class F lead series gained +0.81%, increasing its year to date net return to +4.40%. The five year compound net return for Multi Strategy has been +5.65% almost smack dab in the middle of its +5-7% net return target.

After being managed as a lower volatility version of our Long Short fund from our August 2012 inception through the Fall of 2018, the risk profile of Multi Strategy was actively reduced to become a low beta, low net exposure fund, one more akin to a market neutral strategy, early in Q4 of 2018. So while the since inception market correlation, beta and standard deviation of the fund show to be 0.22, 0.15 and 5.97% respectively, since the late 2018 repositioning of the fund, beta has been consistently less than 0.10 while the annualized volatility of the fund has been in the range of 3-4%. Given our view that markets are likely to be tougher during the next couple of years relative to the conditions of the past 2-3 years, the Multi Strategy now represents an attractive option for investors who seek market neutral type risk metrics yet a competitive net return.

With respect to performance attribution for July, gains and losses were generally small across the board, with the majority of sectors generating modest profits for the funds. Leading sectors were Financials, Industrials, Consumer and Energy stocks. In Financials, for example, winners included core holding goeasy (GSY.CA) and recent addition Genworth MI Canada (MIC.CA). Our biggest loser in Financials was our short position in Discover Financial (DFS.US), a US credit card company whose shares advanced strongly after the release of Q2 results which included better than expected improvement in NIM, but also benefited from continued lower provisioning & unusually low levels of reward payouts. Fortunately, as per standard practice to mitigate risk on short sales, we owned call options on Discover going into the quarter, minimizing the pain from the move higher in this stock. Each of the funds remains modestly net short the Financials sector.

In reviewing our Energy exposure, a position that we've fielded several questions about of late, this sleeve of our portfolios has benefited from our positioning of long Canadian oil and short US oil. Aside from the gain in core holding Parex Resources (PXT.CN), a Canadian company that conducts operations in Columbia, sector profits were focused around Canadian heavy oil companies, MEG Energy (MEG.CN) and Cenovus Energy (CVE.CA). Profits were also generated on our since-covered short position in Apache Corp (APA.US). Conversely the only notable detractor in the group was our long position in Tidewater Midstream (TWM.CN). At this juncture, Long Short is 9% net long Energy, 6% in producers & 3% in infrastructure, while Multi Strategy's weight sits at 5%.

Thinking bigger picture, our thesis on oil is evolving largely as expected, with the wheels slowly coming off the bus of the US shale revolution. The result should be a slow but steady re-emphasis on assets that do not exhibit unsustainable rates of decline and thus enormous sustaining capital requirements, a characteristic found in every shale basin. Continued declines (12% YTD) in active rigs utilized in the lower 48 states, partially due to a near complete withdrawal of capital from Wall Street will yield US oil production numbers that should dramatically undershoot long held growth expectations for the balance of the year.

That's why we're short US shale producers including the shares of EOG Resources (EOG.US) and Devon Energy (DVN.US), while owning Canadian producers. The contrast is stark, with the likes of MEG, Cenovus, Suncor Energy (SU.CA) and Canadian Natural Resources (CNQ.CA) generating billions in free cash flow and using that cash to reward shareholders with equity and debt buybacks as well as dividend increases while their US counterparts struggle just to stay on their treadmill that only seems to speed up. Look no further than Concho Resources(CXO.US) and Whiting Petroleum (WLL.US), the largest Permian oil producer and a top three Bakken player respectively, trading down 25% and 35% the day after releasing Q2 results since it's become apparent that it's nearly impossible to make real money in shale, even with scale.

Looking ahead we expect positioning of our two funds to remain conservative, as while Q2 earnings results & forward guidance have been better than feared, aside from the potential for central banks to please investors, wesee a plethora of troubling issues. This list includes anything to do with Trump, not just trade wars, geopolitical situations in the Middle East & North Asia, Brexit, the strength of the US dollar and, of course, the global economy.

But amidst the deteriorating global economic conditions we're seeing, exacerbated by Chinese American trade talks that are going nowhere, through the end of July stocks have continued to benefit from the hope of additional stimulus from central banks. True, such action could further compress cap rates taking asset prices higher, but presumably unless the trajectory of global growth is reversed by even easier monetary policy, revenue growth, hence profit growth will inevitably succumb to lower levels too. Consequently while US$14T of negative yielding sovereign debt, roughly 23% of the world's total amount of government debt, is driving TINA (there is no alternative to stocks), we're in the camp that there's a point of inflection when having everything low could trigger a Minsky Moment (MM).

Named after economist Hyman Minsky, the MM (https://bit.ly/2OzjVZf) refers to the onset of a market collapse brought on by the reckless speculative activity that defines a unsustainable bullish period. While we're not suggesting such an event is imminent, there are enough troubling macro & geopolitical factors in the mix to raise our antennae and be thankful for our discipline of always including a diversified short book in our portfolios.

In contrast, the bullish scenario for stocks comes in two flavours. First, global growth reaccelerates, the yield curve bull steepens & reflation-oriented or value stocks finally get up off the mat. Alternatively, since typical late cycle stress factors have yet to surface, such as wage pressures or capacity constraints, GDP growth, while far from robust, could carry on for another few years. Under this scenario, it's probable that central banks would remain highly accommodative, as the structural anchors of unfavourable demographics & too much debt combine with the disinflationary impact of technology to keep inflation well under control. Bulls suggest this playbook would enable much more upside to stocks due to even greater valuation expansion. We understand the logic of this pitch but don't place a high probability of this outcome as it strikes us that there's an inflection point at which falling rates & slowing earnings growth becomes problematic for equities. In addition, as value investors focused on buying free cash flow, it's not in our DNA to be 70-100% net long when valuation multiples are as high as they are today.

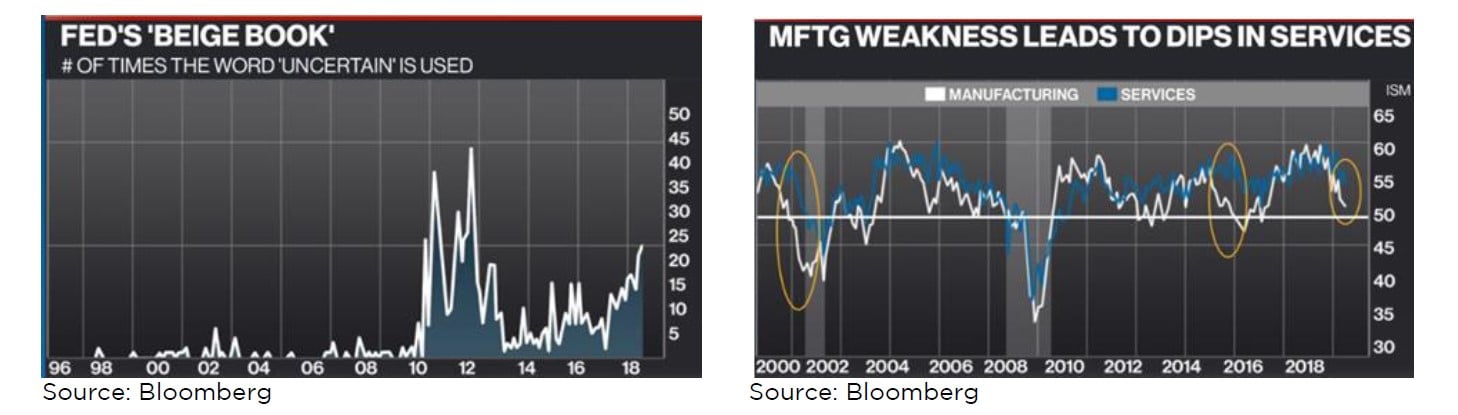

Months ago we questioned the likelihood that the 'green chutes' seen during March would blossom into reinvigorated growth post Labour Day. The effect of Trump's trade tactics have now pretty much ensured that this will be the case. The graph on the below left shows the word 'uncertain' was seen in the latest Fed Beige Book the most often since Draghi's 'whatever it takes' in 2012. Meanwhile, the correlation between ISM manufacturing & services data shown on the 20 year graph on the below right suggests that big moves down in manufacturing (please see the ovals) precede significant declines in the services sector. Given the already low level of interest rates, further Fed cuts are unlikely to change this trajectory.

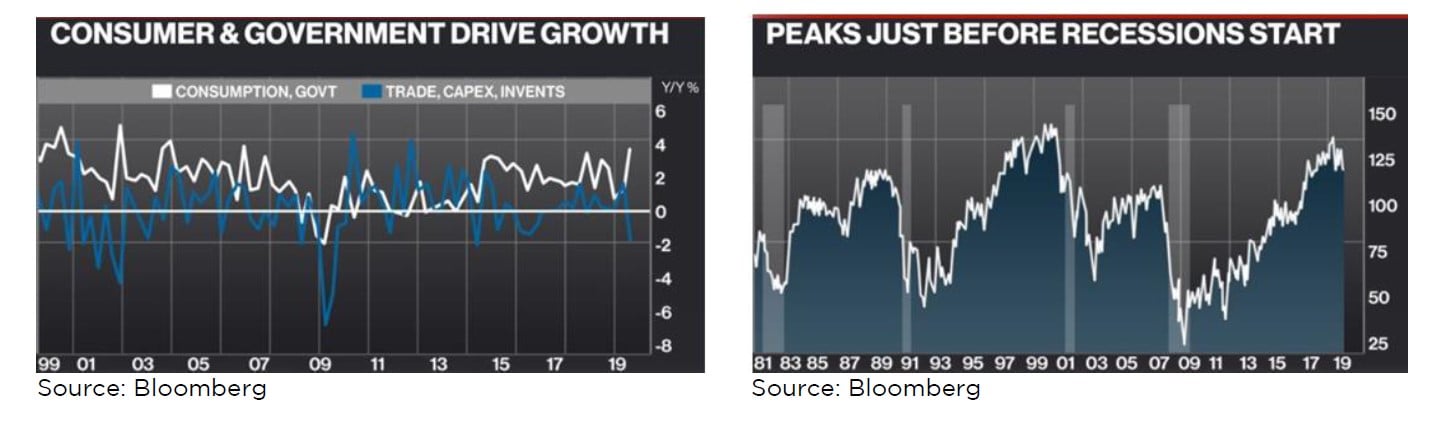

In fact the white line on the 20 year graph seen on the below left implies only two segments of the U.S. economy account for more than 100% of the year over year growth in the US GDP, consumption and government spending. In contrast, trade, capital spending & inventories, the blue line, contributed to an almost 2% year over year decline in the rate of growth in GDP. The US consumer remains in decent shape, as confirmed by the continued strength in consumer confidence shown on the below right. However, there's little question that unless current trends change, there's a strong possibility that consumer confidence will ultimately roll over, increasing the risk of a recession, marked by the grey vertical bars on the same graph.

The Forge First team will remain vigilant on assessing the likelihood that global affairs cause financial markets to get ugly. In the meantime, the funds will run with prudent levels of net long exposure, complimented by use of index put options as hedges beyond the defense that provided by our short books. Alternatively, if we see signs that incoming ECB head Lagarde could convince Germany to catalyze EU-wide fiscal stimulus, Trump backs off on trade, amidst continued Central Bank accommodation, we're glad to reassess our conservative positioning.

As always, thank you for your consideration. Please visit our website at www.forgefirst.com for information on our funds. Should you have any questions, please contact us.

Thank you,

Daniel Lloyd

Portfolio Manager

Andrew McCreath, CFA

President and CEO