Whitney Tilson’s email to investors discussing what to do with all that cash; the charmed life of a young tiger cub with a $4.6 billion fortune; asset managers who grow up poor tend to outperform those who grow up rich; Matt Levine and Barry Ritholtz; Mark Spiegel’s monthly letter on Tesla Inc (NASDAQ:TSLA).

1) When analyzing a company and estimating its intrinsic value to determine whether its stock is undervalued, most investors focus on the free cash flows it will generate in the future. This is, indeed, critical information to determining what it’s worth.

Q1 hedge fund letters, conference, scoops etc

But often overlooked is the other half of this equation: what a company does with its cash flows – in other words, capital allocation. It turns out that this can create (or destroy) as much value as how much cash it generates.

How many times, for example, have you seen a company run into trouble by taking on too much debt or buying back its shares when they're richly valued?

The first step to evaluating capital-allocation decisions is to understand what the possibilities are, which I discuss in a new article: What to Do With All That Cash... The Dilemma Profitable Companies Face.

In the article, I discuss auto-parts retailer AutoZone, Inc. (NYSE:AZO):

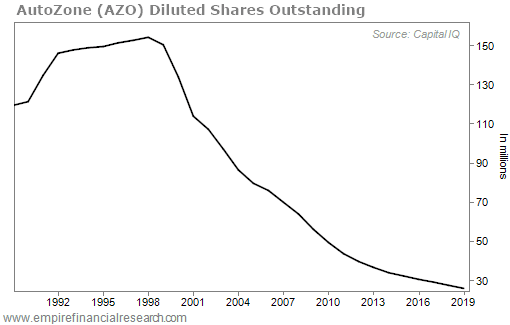

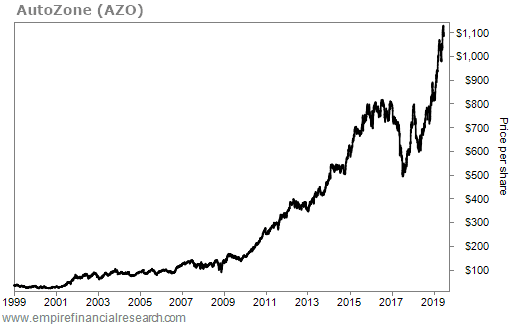

In the two decades since hedge-fund manager Eddie Lampert invested in the company in 1999 and pushed for big share repurchases, it's been buying back an average of 8.5% of its shares every year. This has caused the share count to decline by a stunning 83%. Thus, in a period when earnings rose a healthy six times, earnings per share skyrocketed 34 times – and, not surprisingly, so did the stock...

Here's a chart I put together showing AutoZone's diluted shares outstanding over time...

And the stock...

2) In Friday's e-mail, I talked about the difficulty of starting a hedge fund and raising money these days. This Bloomberg article is about someone with the opposite problem – too much money! The Charmed Life of a Young Tiger Cub With a $4.6 Billion Fortune. Excerpt:

Today, at 44, [Chase] Coleman sits astride a $30 billion behemoth, Tiger Global Management. Bets on public and private technology companies have helped him amass a $4.6 billion fortune and made him the youngest financier among the world's 500 richest people, according to the Bloomberg Billionaires Index.

It's hard to criticize a hedge fund up 25.5% in the first five months of this year, or a private equity unit that made $5 billion on a single investment. Not everything's perfect, though, of course. For one thing, the firm may actually have too much money-something Coleman himself addressed recently.

"It's not easy to manage a big pool of capital, and I'm challenged every day," Coleman said last week at a Morgan Stanley conference, according to people who attended the event. You have to be deliberate in how you do it, he added, which is why he spreads his investments across public and private markets.

3) In commenting on this article, Bloomberg columnist Matt Levine had an interesting aside on why asset managers who grow up poor tend to outperform those who grow up rich, and the difference between correlation and causation:

A good statistical fact about asset management is that asset managers who grow up poor tend to outperform those who grow up rich.

./..............

Meanwhile there are hundreds of poor kids who don't get those breaks and who face nothing but skeptical audiences, and so virtually none of them end up running hedge funds. But if one does, she got through a lot of filters that were supposed to screen her out, and the only way for her to do that was by being really good at investing.

...................

Like, there you are, investing your bar mitzvah millions in the leveraged-loan market, sitting in on family-office investment committee meetings as a teen, getting your first ISDA as a graduation present, I don't know, surely being exposed early and often to financial assets gives you valuable familiarity and comfort with them?

Best regards,

Whitney