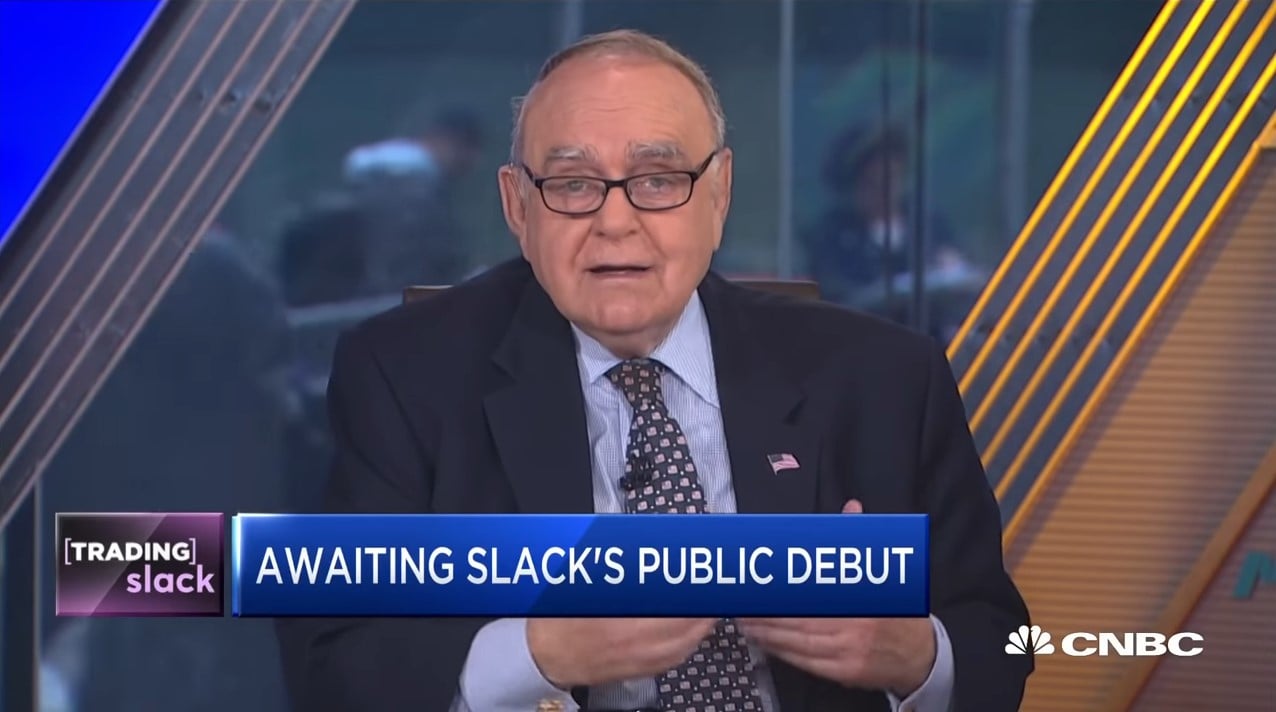

Leon Cooperman, Omega Advisors founder, joins CNBC’s “Fast Money Halftime Report” to discuss the Fed‘s looming potential interest rate cut.

H/T Dataroma

Leon Cooperman Questions The Needs Of The Fed To Cut Rate

Leon Cooperman: You don’t need a rate cut, no bear market conditions present

Billionaire investor Leon Cooperman, Omega Advisors founder, join CNBC’s “Fast Money Halftime Report” to discuss why he doesn’t believe a rate cut is necessary and his take on this earnings season.

Transcript

Welcome back to halftime. So nice to talk to you today.

Thank you and listen to all your geniuses there. And a lot of good things being said. You don’t think they should go? Well, they’re going to go. They’re gonna go 25. In my opinion, I think they’re going to basically imply the data dependent going forward. I just raised the question whether they should go. I think on CNBC the other day, Eric Rosengren, the head of the bus and fed was interviewed. And I thought he made a very, a lot of very good points. And he seemed questioning the need to go the way I look at it, I see consumer confidence high retail sales recently strong employment is strong. Interest rates are already quite low. Okay. The economy is growing a trend is not going below trend trend growth is about 2%. And it’s was growing at wealth, is it a record level, and obviously due to the stock market, corporate profits, a decent editor coming in stronger than was expected in the quarter and stop purchase activity to me, which suggested businessmen are not pessimistic. And I think what’s going on is we’re rewarding one questionable policy with another questionable policy, the question of policy with the indiscriminate threats of keras. I understand what we’re doing with China, it makes sense. But threatening Europe, threatening Canada threatening Mexico debt has created a lot of business uncertainty, and is it you know, wait on capital investment, okay. And now we’re rewarding that policy by cutting interest rates when interest rates were already very low. And we’re just forcing people out on the risk curve, you know, where’s, you know, what’s what’s going on is very simple. You know, 10 years ago, five years ago, eight years ago, people that bought t bills, so I can survive on the zero, I’m going to buy t bonds to T bond buyers, I can’t survive in 2%, I’m going to buy industrial credits. And that’s 4%. Before the industrial credit person says 4% doesn’t impress me, I’m going to buy high yield. The high yield person says I can’t get by and 67% I’m going to buy structured credit coos, and the clo guy or gal says I’m going to put 25% of my fund in equities. And so we’re pushing people out in the risk curve. I have to admit, you know, I’m of two minds. My number one, the more practical end is the conditions for a big decline in the market. And that presents I’ve been said that consistently on your program. Okay. You know, we need accelerating or problematic inflation. We don’t have it. We need a hospital said we don’t have it. We need an oncoming recession. I don’t think we have it. And that old line that have used repeatedly for system so john templeton, bull market born pessimism a growing skepticism mature and optimism a dying euphoria. The only place I see euphoria is the IPO market. I don’t see euphoria in the overall stock market. You know, people are missing a teeth over Google at 21 or 22 times earnings in 2000. Cisco was 100 times earnings. So I see the conditions are ok for the market. But my view is a substantial rise, Amir substantial core 32 and the s&p that I think would put you in the land of euphoria, and that would mark the end of the cycle. But for now, I think the markets, okay, but I do question the needs of the Fed to cut rate, you know, short rate to 2%, you return after tax inflation is already negative. That’s not restricting the economy and what’s going on? Simply we’re all getting tied to European Monetary policy. But the ECB, they’re crazy over there. They should not be pushing, you know, negative interest rates, they should be resorting to stand with the fiscal policy, but Germany will let them okay, so they’re relying completely on monetary policy. And just ask yourself the following question. Is it make any sense to you you lend money to Germany for 10 years, they give you back less than you lent them? 10 years from now? Same, same in France, same in Sweden, same in the Netherlands, same in Japan. Okay. very significant negative race in Switzerland, Greece degrees 10 year bond isn’t slightly below the US 10 year bond, I mean, a 40% of time Greece’s into fault. So, you know, we we have this crazy monetary environment that does not seem to be warranted by economic conditions. And I think if we had more fiscal policy, we would probably get more positive slope to do you expect?

Do you expect the stock market to go up meaningfully into that euphoria place that you just spoke about? I would say, the trend looks up.

You know, I became a family or for some of my own money now, I’m 65 70% exposed to risk assets and 30% in cash. And I find a lot of things to be done. I find funny things that are good value. But I do personally believe that there are issues out there that would suggest any substantial rise quickly, will be taking away from future returns. things that bother me our profit margins are well above normal. They tend to be mean reverting. Secondly, I saw 12 Santa Clauses on the stage last night, the country’s moving to the left, that’s an issue. Third is we basically have a debt structure is concerning. The debt is going up at a fairly rapid rate, you know, when the economy doing as well as it is, and the economy approaching full employment endeavors should be declining, that rising, okay, I’m very concerned about market structure. step back and think about it. Okay. In the fourth quarter, last year, we had decline rivaling 29 when it was no economic justification. And the reason is if you look at the market, there’s no stabilizing influences anymore. You know, in when I joined the industry 51 years ago, the brokerage firms traded stocks for 25 to 50 cents a share, the Volcker Rule didn’t exist. Now we’re you know, Penny two cents of shares comes cases zero and you had the Volcker rule. So the brokerage industry is not to stabilize, they cannot legally do it, and they can’t afford to do it. napping compensated. Secondly, the vast bulk of I’m right came to the industry was done in the New York Stock Exchange. Now 80% of the volume is off the exchange, and especially the system doesn’t have any relevancy anymore.