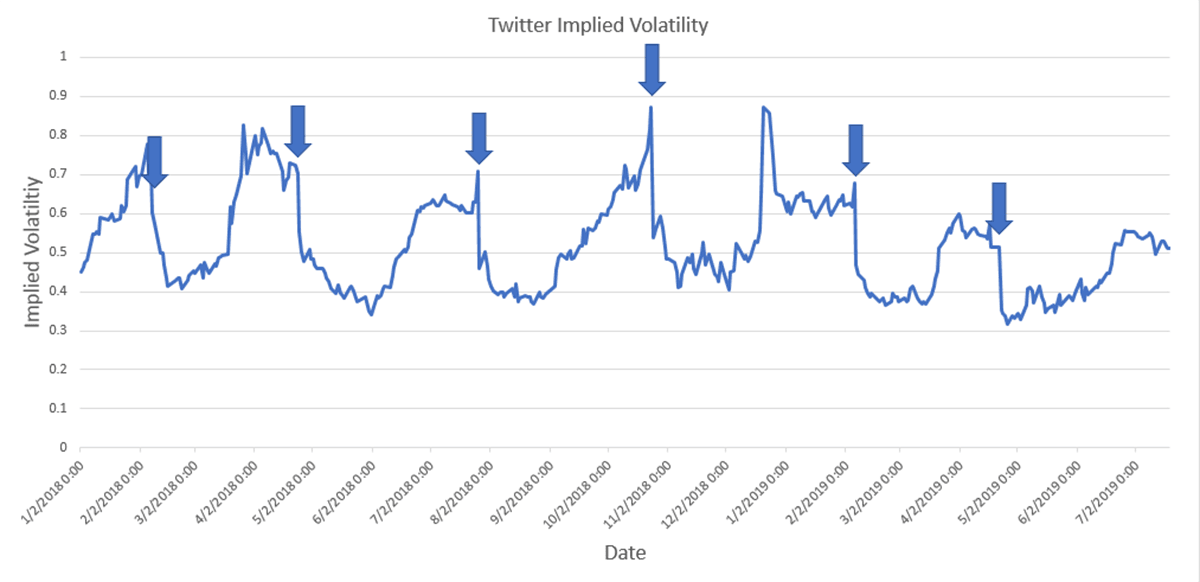

The option market does not appear anxious about Twitter earnings, expected to be announced later this week. Implied volatility (IV) from options prices is at the lowest levels it has been ahead of Twitter Inc (NYSE:TWTR) Q2 earnings, signifying the stock is not expecting a large move in price.

Implied volatility is a predictive measure of stocks’ future volatility. The graph shows the historical IV before each earnings event since 2018. This is rather surprising given risk factors that could impact earnings, ranging from trade-war implications, and potential increased regulation.

Q2 hedge fund letters, conference, scoops etc

The benefit of low IV is that it signals option premiums are relatively low, making long volatility strategies relatively inexpensive. An investor can cheaply take advantage of potential surprise earnings by purchasing a straddle, which involves buying a call and put at the same strike and maturity. This strategy benefits from large security price jumps in either direction. This is a limited risk options play, since the maximum loss is contained only to the premiums paid.

If an investor is bullish on TWTR, she/he can engage in a riskier strategy called an out-of-the-money (OTM) risk reversal. This involves selling an OTM put and buying an OTM call. The downside to this strategy is significant, since the put is naked. However, since the put is typically more expensive than the call, this strategy benefits even when there is little underlying movement since the investor can collect the difference in premium."

What do you expect Twitter's stock to do following earnings? Tell us by leaving your opinion in our comments section.