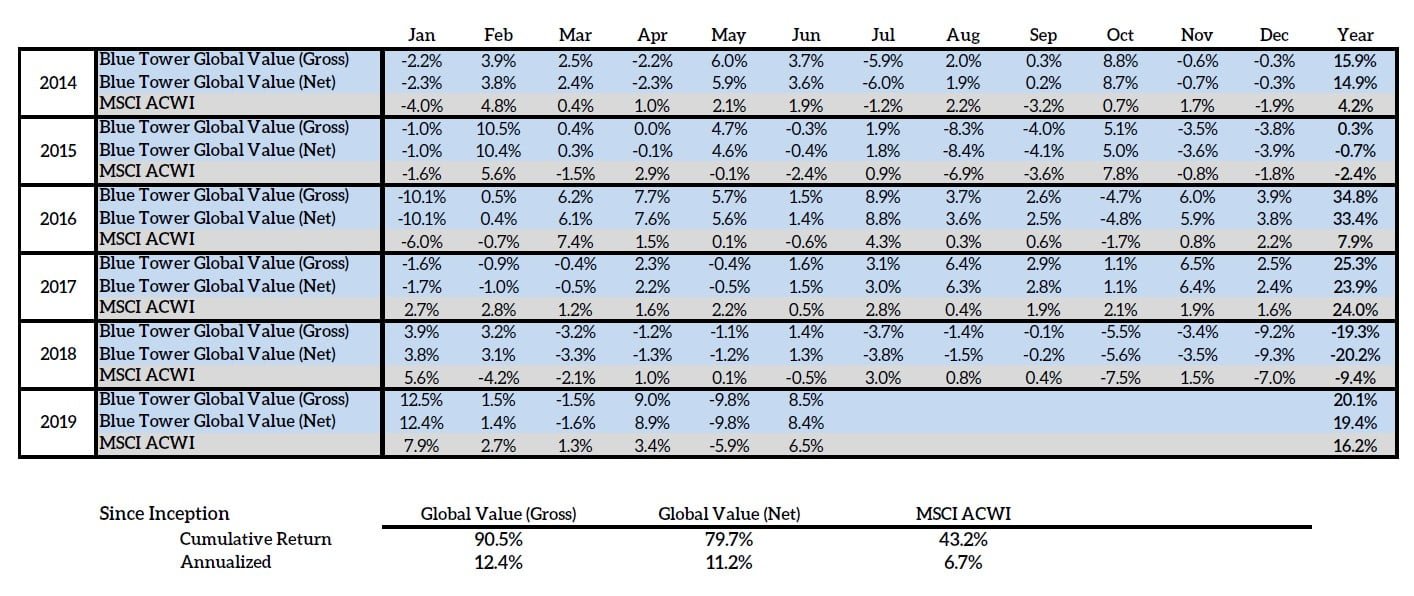

Blue Tower Asset Management commentary for the second quarter ended June 30, 2019.

The Blue Tower Global Value strategy returned 6.5% net of fees in the 2nd quarter of this year. In this letter we discuss our new position in Cornerstone Building Brands (CNR), a North American construction materials company resulting from a series of private equity transactions and mergers. The company was named NCI Building Systems when we made our initial purchases and has since been rebranded. We will also discuss several stocks that we have exited in order to provide capital for the opportunity-rich environment we are currently seeing.

Q2 hedge fund letters, conference, scoops etc

Portfolio Exits

This quarter we made several changes to the portfolio, with the liquidation of our positions in Fujitsu Frontech, Apple, and two other stocks. Apple is a solid business with the most valuable brand in the world. Their walled garden combination of their app marketplace, operating software, content production, and hardware development gives them significant pricing power relative to other smartphone and PC manufacturers. Since 2014, our investment in Apple had nearly tripled when dividends are taken into account. Our exit from Apple is due to the prospects of the business having slower growth going forward and that it is trading at a high multiple of free cash flow relative to its recent past. The replacement frequency of devices by Apple customers is slowing significantly with some customers owning phones for several years. In China, the US/China trade conflict and falling domestic demand pose dual issues for the company. Apple is a stock where the market’s opinion has fluctuated between euphoria and gloom. I believe that at some point, we may have the opportunity to reenter at a lower multiple to its current levels. Our exit was at a little above $205/share or 16.4x trailing free cash flow.

For Fujitsu Frontech, their global products segment has experienced declines in sales that exceeded our expectations. As the world transitions to a cashless society, we expect that ATMs will eventually become less common and demand for them will decrease. Although we realized the business was a melting ice cube, it melted faster than we expected. With the decline of that business segment, it appears even at a lower stock price, we would not receive adequate returns going forward. We have a target-rich environment currently for our capital and we should make sure we do not fall victim to the loss aversion cognitive bias1. Therefore, we liquidated the position and reinvested the capital.

Daiichi and Tyson Foods were also sold to free up capital for other investments. There were no changes in our views of the businesses but our requirements for forward rates of return have increased due to the opportunity set of other investments available. These stocks did not make the cut that would allow them to continue in the portfolio at this time.

Cornerstone Building Brands

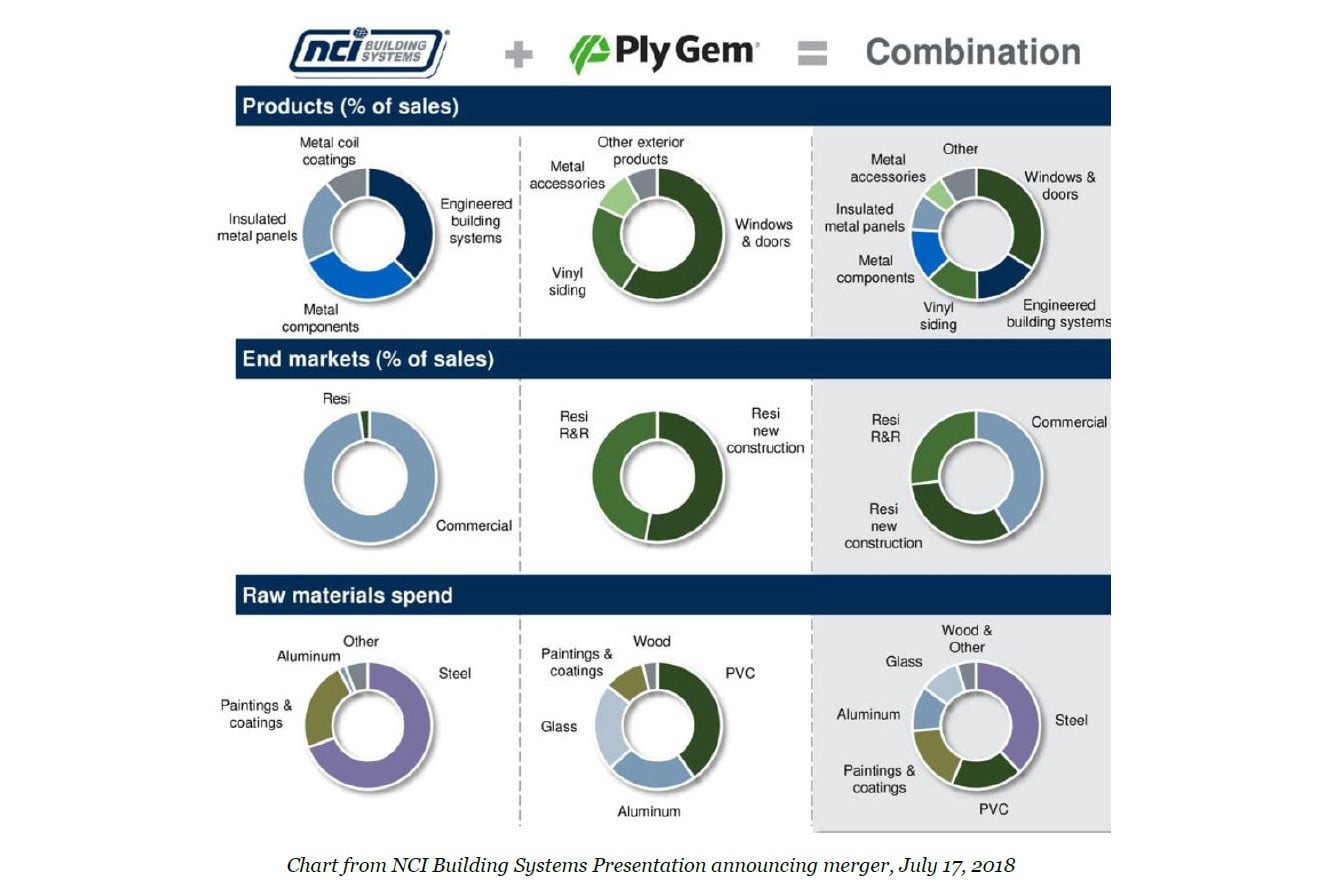

A recent purchase made in our portfolio was our position in Cornerstone Building Brands (which was named NCI Building Systems when we made our initial purchases). This company in its current form was created by the private equity firm, Clayton Dubilier & Rice, through the merger of NCI Building Systems with Ply-Gem. The concentrated private equity ownership, high debt levels, and succession of acquisitions may have made the market confused about the company leading to the current mispricing. The debt levels also allow an optionality if someone is bullish on construction outperforming. It was the use of leverage that gave private equity their decades of wonderful performance in the 1980s and 1990s. Besides CD&R, which has a little under 50% of the company, a second private equity firm, Golden Gate Capital, owns about 16% of the stock.

Cornerstone Building Brands currently has high debt (long-term debt of $3.3 Billion) relative to its market capitalization ($722 million). A highly leveraged company can be a good investment under certain circumstances. Leverage expands the range of investment outcomes. Increases in the value of a leveraged company’s assets could quickly build its equity. A company with a 4x debt to equity that has a 40% increase in the value of its assets will triple the value of its equity. However, as a shareholder the most you can lose is 100% of your position. Debt can also act as an inflation hedge as the true value of physical assets will remain constant while the debt is denominated in depreciating dollars. With the US national debt at a record high, there is always the risk that the government may decide to partially monetize the debt in the future through inflation. Therefore, we should hold some positions in leveraged equities within our portfolio to balance against this inflation risk.

Spinoffs are often highly leveraged as the parent company will often decide to spinoff a division that they feel they cannot sell at their desired market price. In these spinoff scenarios, ladening the spinoff entity with debt can be a way of capturing the cash value of the subsidiary for the parent. Enova, one of our financial stock holdings, was spun off in this manner.

All highly leveraged companies must contend with the risk of deep recessions. In a deep recession, construction demand falls. In such a situation, the profitability of Cornerstone would fall or turn negative and coverage ratios would shrink. In a deflationary environment, the value of Cornerstone’s tangible assets would shrink relative to their debt. If the company is unable to service the debt, the equity could lose all of its value. After the merger, over a quarter of the new company’s revenues will come from the residential repair and remodeling market which is less cyclical than new construction.

Even if there was an economic crisis, there could be a silver lining in this investment outcome if the government guides the economy towards an inflationary deleveraging. In an inflationary deleveraging, the value of the company’s assets would expand in nominal terms just as the debt burden would fall in real terms. Therefore, in an inflationary environment, the value of Cornerstone’s equity should be expected to expand.

Construction Sector

The construction sector in the US has been weak for several years. Construction stocks have trailed the overall market for several years now and are trading at cheaper earnings multiples. This underperformance is strange considering that we believe construction-related companies are poised to outperform the overall economy for the next few years. Despite being in the tenth year of a large economic expansion with extremely low interest rates, figure 1 shows that new housing starts are still much below their historical levels.

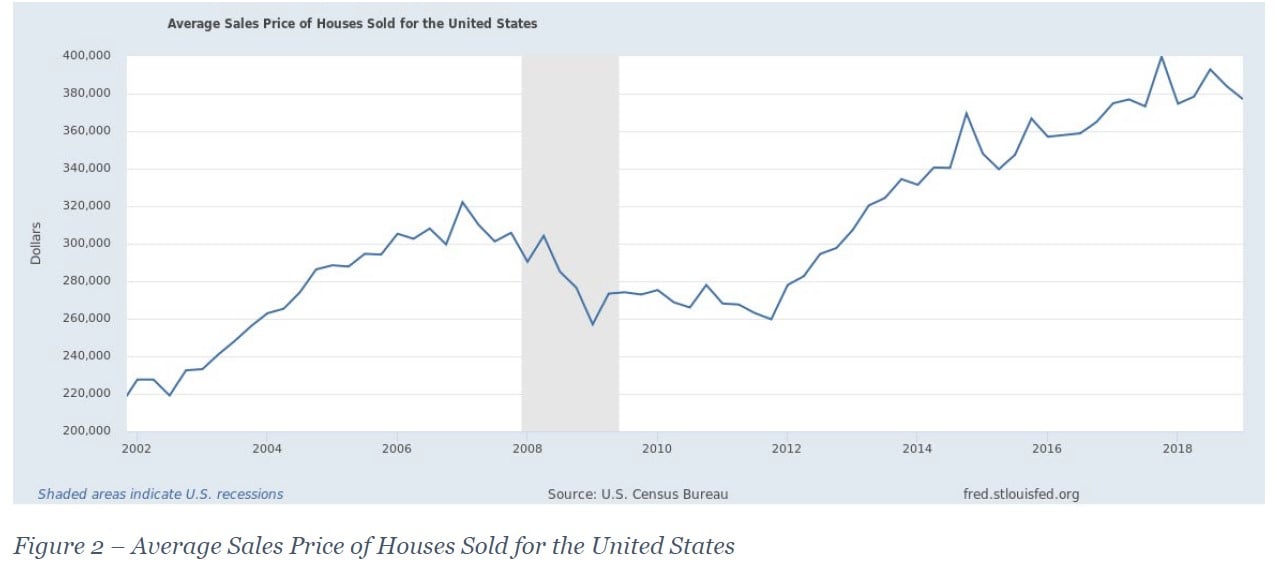

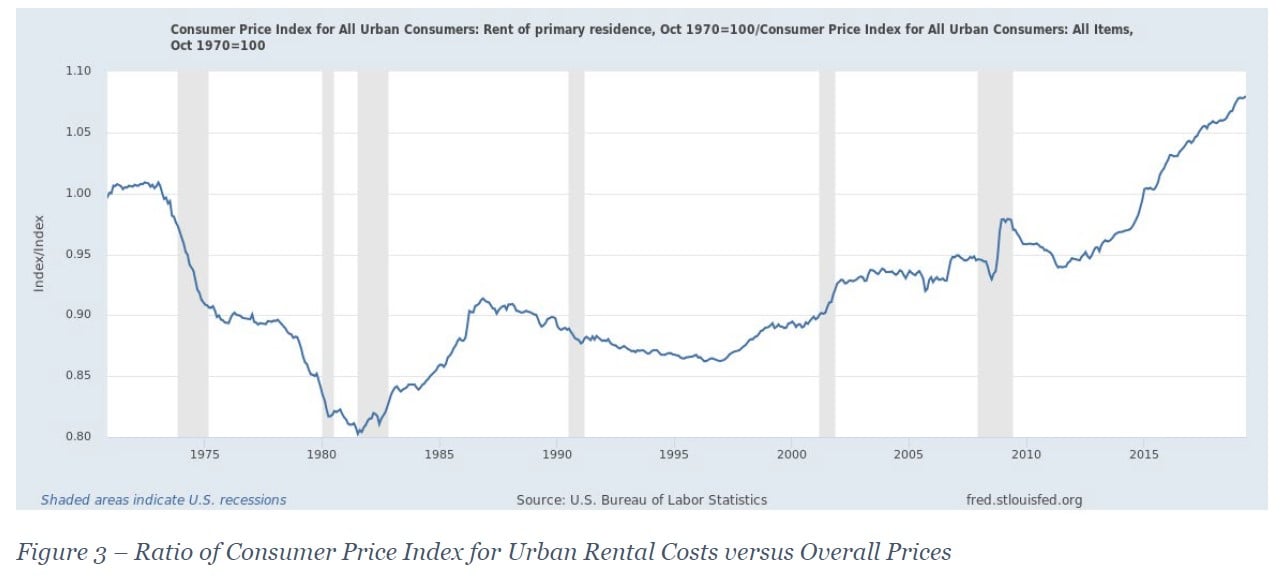

Mortgage rates also are at low levels which supports the ability of consumers to finance new purchases. Unemployment is at record low levels which should soon lead to wage increases. Figure 2 shows that home prices have been rising and are now at record high levels. This increase in housing cost can also be seen in the ratio of the consumer price index (CPI) for urban rental expenses compared to the overall CPI. This ratio is also currently at a historic high, indicating that rent costs have increased faster than inflation. Since rents are increasing, this is clearly not a purely speculative boom in real estate prices driven by low interest rates. All of these indicate that we are overdue for a boom in construction and renovations.

Investors are fearful of a potential slowdown in the economy, and housing-related stocks fared poorly in previous recessions. These fears may be driving this value opportunity. However, the above figures demonstrate that housing demand does not have as much room to fall as it did in previous economic cycles. Investing in US construction material suppliers therefore gives an asymmetric potential upside.

Capital Expenditures and Revenue Mix

The management of the company laid out much of their future plans for the combined company in their merger documents. They plan on using some capital expenditures to achieve the synergies of the new business, build out additional capacity to grow their product lines, especially growth products like their insulated metal panels. Their biggest use of excess FCF from the business will be to pay down their debt and deleverage the business. This deleveraging through excess free cash flow and growth essentially makes this stock an opportunity to invest with the economics of typical private equity deals. The high debt allows the business to achieve high returns on equity. If the company is successful in deleveraging their balance sheet and achieving the targeted merger efficiencies, the stock will trade at a much higher price in several years.

After the merger, the previous segments of Ply Gem and NCI will be replaced with a commercial segment (38% of revenues), windows (39%), and siding (23%). Their high-growth insulated metal panel business, in which they are an industry leader, is included within the commercial segment along with all other legacy NCI products.

Integrating acquisitions

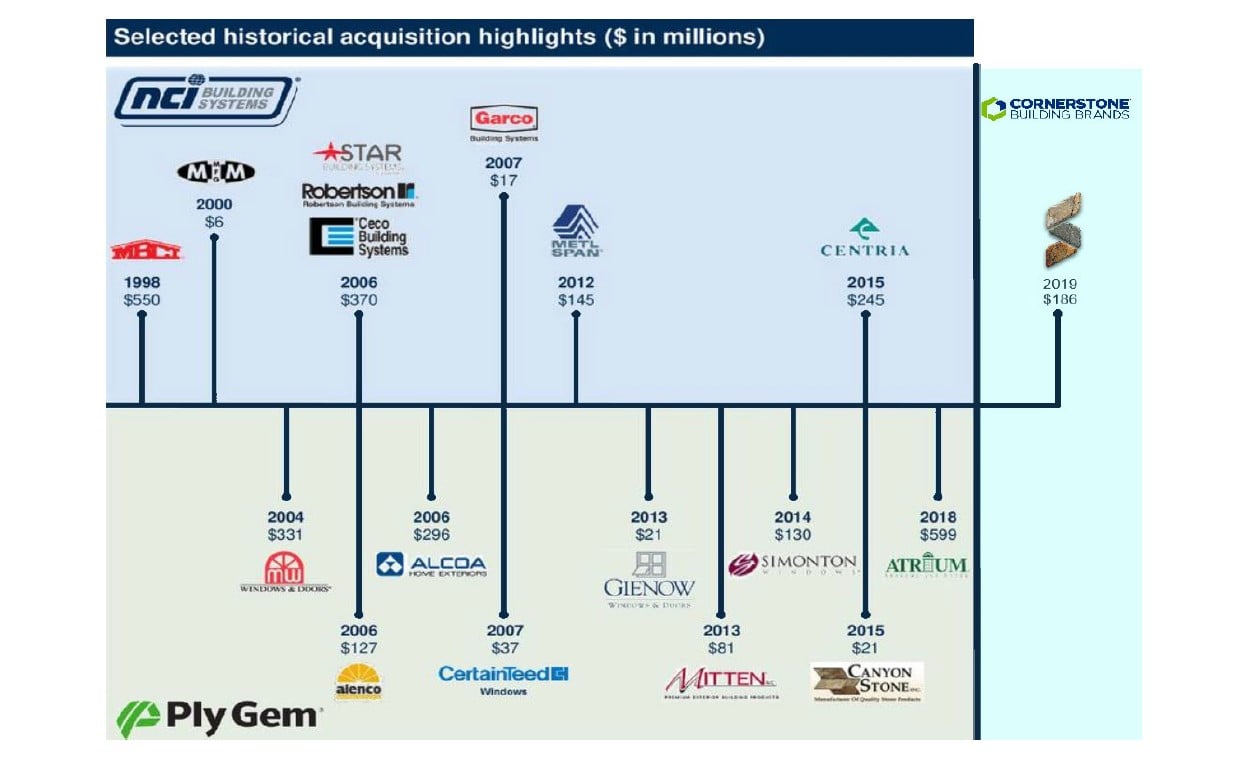

Of course, this opportunity is not without its risks. There are the execution risks of tying up the various brands and businesses together into one integrated organization. Since there is little overlap between the residential-focused Ply Gem business and commercial-focused NCI, there will likely be minimal cannibalization between their businesses. The current management of Cornerstone is well suited to handling this as they have deep industry experience and have executed on mergers in the past. Cornerstone’s management has experience with integrating acquisitions as seen below in the chart highlighting their acquisitions over the last 20 years2.

Selected Financials of Cornerstone and Largest Competitors

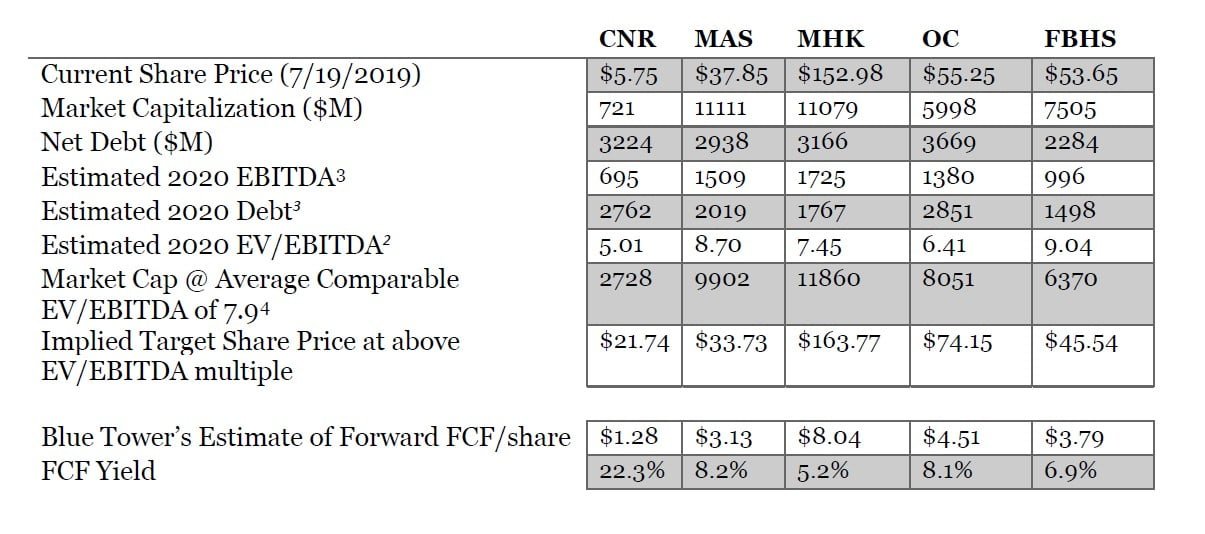

Making comparisons between Cornerstone and its industry competitors is complicated due to the differing levels of leverage, growth rates, and product segment mixes. To get a rough estimate of a

target value, we compared Cornerstone’s enterprise value over earnings before interest, taxes, depreciation, and amortization (EBITDA) to its four largest US building materials competitors. Using analyst estimates of EBITDA and net debt for these companies and holding market price and shares outstanding constant, we can get a forward estimate of EV/EBITDA. Building materials companies have traded at 7-9x unlevered EBITDA in previous late stages of the business cycle, so these multiples appear in line with that range. There is a large dispersion of potential outcomes for Cornerstone, but it is clear that the company is trading below the range of their competition even on an unlevered basis. Based on comments in their most recent earnings call and the pro forma financials of their merger documents, we expect the company to generate $163M of free cash flow in the next twelve months, or $1.28/share. For FY2020, the realization of merger efficiencies and organic growth may put their free cash flow in the $1.90-$2.00/share range. Their free cash flow generation relative to their share price is very large, giving this stock one of the highest FCF yields of any of the companies in our portfolio.

Insider Buys

While corporate executives may sell their stock for any number of reasons including personal spending, estate planning, or portfolio diversification, they generally only buy their company’s stock for one reason; they believe it to be undervalued. Therefore, purchases have more informational value than sales. There has been a cluster of insider purchases by Cornerstone executives, which is confirmatory evidence of the thesis as well as further aligning executives with shareholders.

I hope that this letter has been helpful in understanding our thesis for investing in Cornerstone Building Brands and the care we put into initiating a new position.

Thank you for your entrusting your capital with Blue Tower. I always enjoy the questions I receive from investors and look forward to receiving more.

Best regards,

Andrew Oskoui, CFA

Portfolio Manager

https://valuewalkpremium.com/2019/07/blue-tower-asset-management-2q19-commentary/