Barriers to accessing state unemployment benefits threaten a core program that stabilizes the economy during economic downturns

NEW YORK, NY – With bond markets flashing warning signs of a possible recession on the horizon, a new paper from the National Employment Law Project examines how state unemployment insurance programs have been weakened by benefit cuts and policies discouraging unemployed workers from applying for jobless aid. The paper calls into question whether state UI programs are still up to the task of helping communities and the broader economy weather and mitigate the next recession.

Q1 hedge fund letters, conference, scoops etc

“As the employment rates have fallen to record lows, states have quietly undercut their unemployment insurance programs. These cuts have stayed out of the spotlight because many fewer people have had to deal with these systems,” said NELP researcher Michele Evermore, co-author of the new paper. “The real test of this social experiment will come when the next recession hits – will enough people have sufficient compensation to avoid catastrophe?”

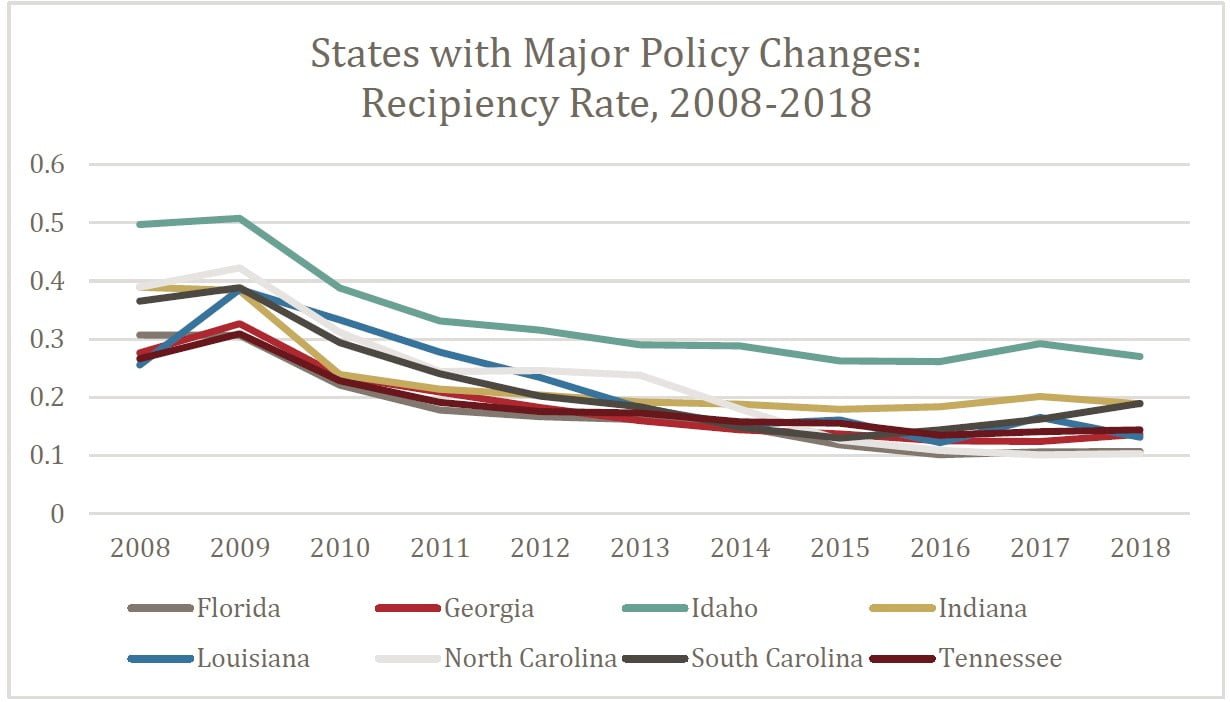

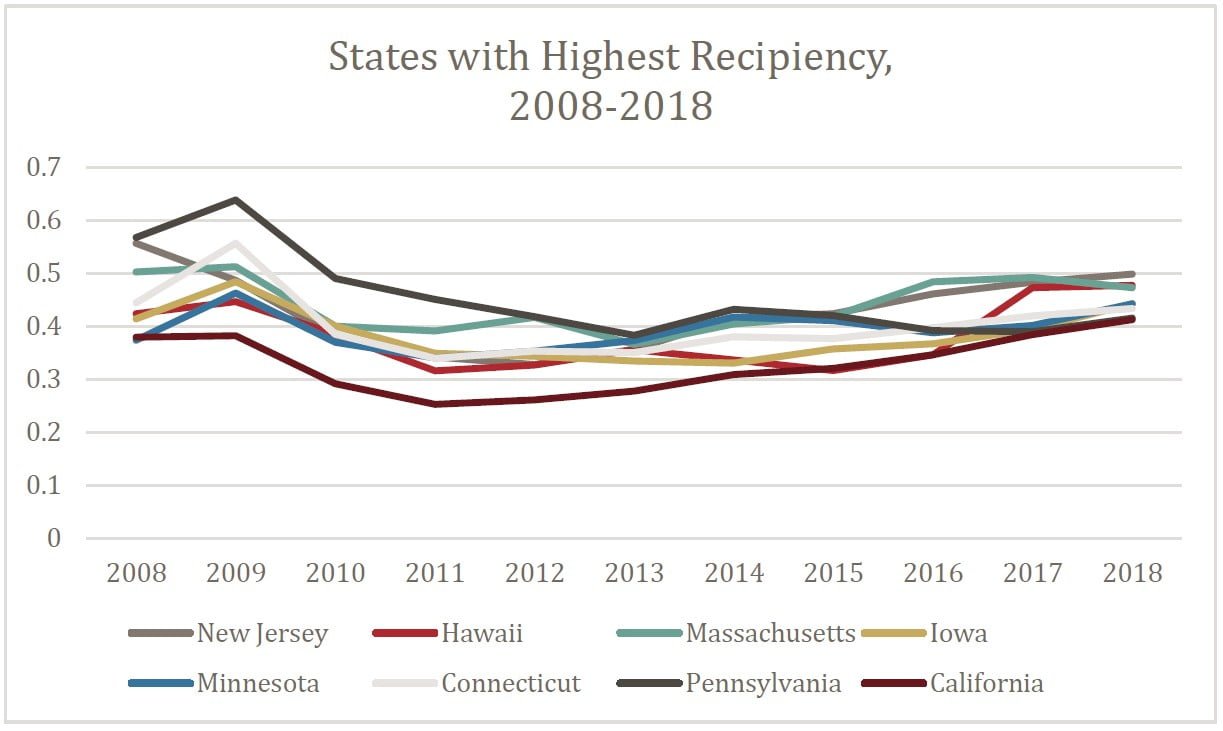

NELP researchers looked at a disturbing trend—that workers are both applying for and receiving jobless aid at much lower rates than in the past—and found that, to the extent that these lower rates are the product of legislative and administrative policies intended to discourage application for and receipt of benefits, there is evidence to suggest states may not be prepared to withstand future recessions.

Unemployment insurance provides more than a benefit for workers who are involuntarily unemployed. When mass unemployment takes place, the collective buying power that this benefit bolsters helps to stabilize the entire economy and limit the depths of a recession.

During the last recession, states appropriately spent the money in their unemployment trust funds to pay benefits. The system is designed so that money is set aside when the economy is doing well to pay benefits when the economy declines. States can do two things to replenish that trust fund – ensure sufficient contributions, or cut benefits. Cutting benefits may contribute to a positive trust fund balance, but creates risk that the system will not maintain enough buying power to recover from subsequent recessions.

State legislatures looking to reduce the number of people eligible for unemployment insurance have cut benefits:

(a) increasing the amount of earned wages needed to qualify

(b) redefining who qualifies

(c) reducing duration of benefits

(d) imposing stricter ongoing eligibility requirements.

In addition, many states have narrowed workers’ access to UI benefits by implementing technologies that may limit accessibility of the application processes. As fewer people are eligible for lower benefits, workers become discouraged and some do not even apply for benefits.

If there is time to restore benefit levels and access before the next recession, the paper recommends several policy solutions to help blunt future economic downturns. Key recommendations include reversing cuts, improving system transparency, and improving public education efforts.

Are State Unemployment Systems Still Able to Counter Recessions

Introduction

The share of eligible jobless workers who actually apply for and receive unemployment insurance—referred to as the “take up” rate—is important in three ways. First, and most obviously, it is important that people have access to needed benefits so that they can make ends meet when they find themselves involuntarily unemployed. Second, these benefits are important to the broader economy, serving both as stabilizer and stimulus when there is a financial downturn. Finally, a stable take-up rate is important for understanding and interpreting economic trends. When policy decisions drive the take-up rate downward, it can rob analysts of an important tool in understanding the economy.

This paper seeks to examine the declining take-up-rate trend; the intersection of take-up rates and recipiency; and the need for policy changes that would increase UI take-up and recipiency for workers who have earned these benefits. These are necessary in order to maintain the reliability of UI as a counter-recessionary tool and also the validity of initial claims data as an economic indicator.

Understanding Recipiency and Replacement Rates

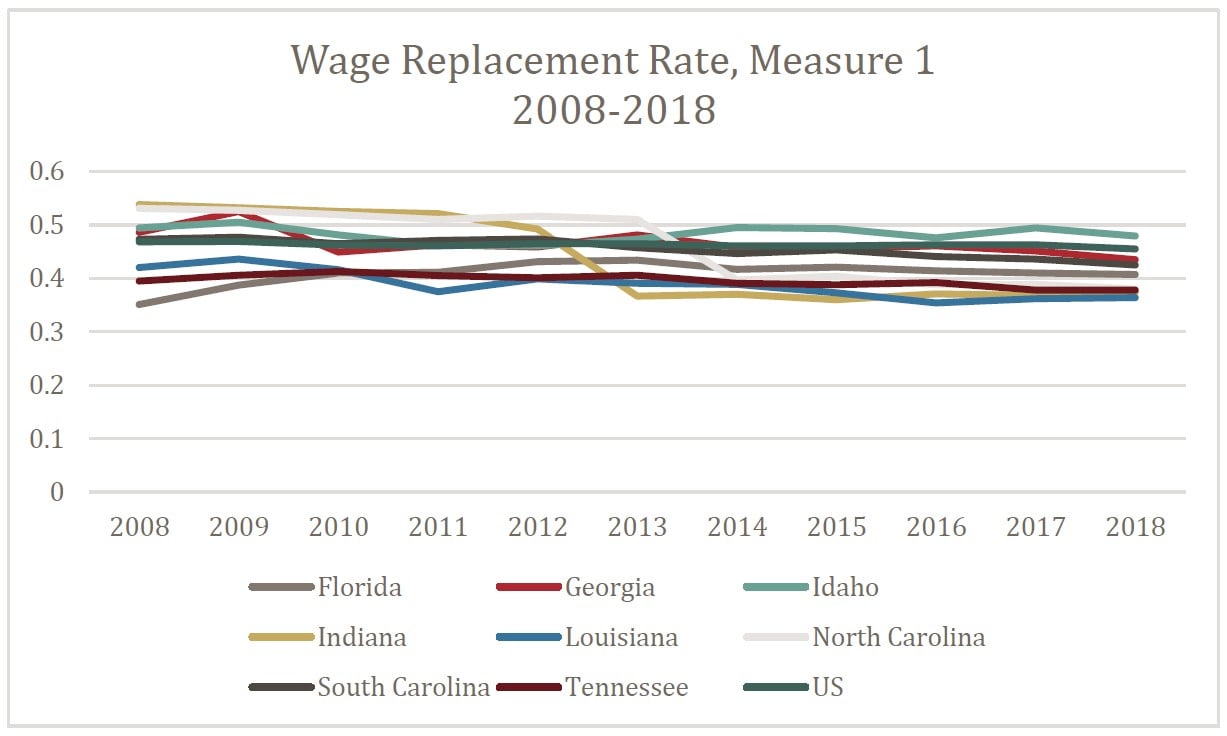

An important metric that intersects with take-up is the recipiency rate—the overall percentage of jobless workers who are receiving UI benefits. Workers may take-up benefits but lose them later because of continuing eligibility requirements, affecting overall recipiency. Another important metric to understand is the replacement rate—that is, how much income unemployment insurance replaces.

In December 2017, we published Closing Doors on the Unemployed, an extensive examination of the dramatic decline in UI recipiency since the Great Recession. We found that states, faced with the challenge of replenishing diminished UI trust funds, chose cutting benefits over replenishing those funds as the means to restore solvency. This approach ignores the reality that entering a recession with an underfunded UI trust fund is a highly unwise and substantial risk for any state; cutting benefits to get to solvency is certainly the wrong avenue to take when preparing for a recession.

Entering a recession with recipiency and replacement rates that are too low to provide economic stimulus is also a significant risk. A major policy goal of the UI system is to maintain economic activity levels during downturns by giving involuntarily unemployed workers enough spending power to keep their families and communities afloat. Reducing both the recipiency and the purchasing power of these benefits discourages people from applying at all, and these factors combined erode more than the quality of individual lives; it is dangerous for the entire community.

How States Are Limiting Access to Unemployment Insurance

It is important to understand how workers apply and qualify for UI in order to identify where states have constructed barriers throughout the process to thwart claimants’ access to benefits.

When a worker leaves a job, state UI agencies look at two main sets of factors to decide if that person is entitled to compensation: monetary and non-monetary factors. Standards for both vary by state. Monetary qualifications are generally based on how much money workers have earned in the “base period,” which typically consists of the four calendar quarters preceding the most recent quarter.1 Non-monetary factors include issues related to separation from the job or issues of continuing eligibility.

Involuntary separations such as layoffs and firings are generally qualifying unless the claimant was discharged for some form of willful misconduct. Conversely, employees who voluntarily quit jobs are generally disqualified unless they can demonstrate they had good cause to do so. These “good cause” definitions vary widely from state to state. Eligibility for continuing benefits after initial qualification generally involve issues relating to availability for work, willingness to accept suitable employment, and compliance with varying work search requirements.

State legislatures looking to reduce the number of people eligible for unemployment insurance have turned to a variety of benefit restrictions, including: (a) increasing the amount of wages earned needed to qualify; (b) shifting the definition of qualifying separation events; (c) reducing duration of benefits; and (d) imposing stricter work search requirements. In addition, many states have narrowed workers’ access to UI benefits by implementing technologies that may limit accessibility of the application processes.

If UI take-up is to be an indicator of economic health, we must acknowledge that policies that discourage filing for benefits reduce the reliability of that measure. Take-up rates decline when workers are disqualified for monetary and non-monetary reasons but also when jobless workers do not apply at all.

Read the full report here.

The National Employment Law Project is a non-partisan, not-for-profit organization that conducts research and advocates on issues affecting low-wage and unemployed workers. For more about NELP, visit www.nelp.org. Follow NELP on Twitter at @NelpNews.