Whitney Tilson’s email to investors discussing buying stocks with a high short interest; The Outlandish Story of Ollie’s; The Coddling of the American Investor; Multi-Level Marketing Schemes; snipping tool.

1) One of my readers asked me an excellent question:

You’ve said to be wary of stocks with high short interest and to respect short-sellers because they often know something we don’t… but your first recommendation of Lumber Liquidators Holdings Inc (NYSE:LL) has a huge 34% short interest. What gives?

Q1 hedge fund letters, conference, scoops etc

Here was my reply:

The key to being a successful investor is the ability to think independently. Over the years, I've found great ideas among both widely beloved stocks with virtually no short interest (as, for example, Berkshire Hathaway is today) as well as totally hated ones with a high short interest (as Lumber Liquidators Holdings is today).

I have tremendous respect for short sellers, so when I'm considering buying a stock with a high short interest, I always do extra work to make sure I fully understand the short thesis and am certain it's wrong.

Given my history with Lumber Liquidators Holdings (I brought the story to 60 Minutes about how the company was selling formaldehyde-drenched Chinese-made laminate flooring – you can watch it here), I feel comfortable saying that nobody knows the short case for the stock better than I do.

So I say with confidence that the shorts are wrong and are going to get burned. They're making the common mistake of falling in love with a stock and sticking around too long. Making money on a stock can blind investors to what I call "inflection points" – either a stock about to soar (i.e. Lumber Liquidators Holdings), in which you want to, at the very least, cover your short position and, ideally, go long... or a stock about to crash, which you want to sell or short.

Short sellers stuck around much too long in the cases of the two most profitable long investments of my career, General Growth Properties and Netflix, Inc. (NASDAQ:NFLX). In both cases, I had been short the stocks, covered, and then went long when they were totally beaten down and out of favor – and made a fortune. For example, Netflix had a 28.7% short interest the day it bottomed at $7.78 on October 1, 2012 – just before it skyrocketed more than 50 times!

But for stocks with a wide range of outcomes, you need to size them appropriately. General Growth Properties and Netflix were initially 3%-5% positions, similar to what I'm recommending today for Lumber Liquidators Holdings.

By the way... I'm even more convinced that Lumber Liquidators Holdings is going to work after my analyst Steve Culbertson and I met with CEO Dennis Knowles and other members of management for more than two hours at the company's headquarters in Toano, Virginia a few weeks ago.

We'll share what we learned in the next issue of the Empire Investment Report, which subscribers will receive on Wednesday afternoon. Click here to get started with your 30-day, risk-free trial today.

Here's a picture of Steve and me outside of Lumber Liquidators Holdings' headquarters...

2) I loved this Forbes article about Ollie's Bargain Outlet (OLLI), a retailer that is thriving despite selling nothing online because it offers extreme bargains.

One analyst compared "the prices of 32 items from Ollie's with their prices on Amazon" and found that "Ollie's on average was 42% cheaper." The Outlandish Story of Ollie's: A $5 Billion Retail Empire That Sells Nothing Online (But Is Beating Amazon). Excerpt:

Ollie's is very possibly the only company in America whose brick-and-mortar stores are not just surviving but thriving. Butler focuses exclusively on traditional retailing, selling not a thing online. Read that again: nothing sold online. Nonetheless, Ollie's sales have doubled in four years. It moves more than $1 billion a year of low-priced goods from its large (30,000 square feet or so), no-frills stores like the one in Sterling. Profits are at a high, nearly $130 million.

It reminds me of what TJX (TJX) and Ross Stores (ROST) have done so successfully over the years in clothing. As a result, they've been two of the greatest growth stocks of all time (no joke – look at their charts).

I wish I had discovered Ollie's earlier, as it's now trading at 42 times trailing earnings...

3) Some wise words here, especially this line: "Trying to eliminate dangers could potentially make investors more sensitive and more fragile to ordinary adversity that exists in all risk markets." The Coddling of the American Investor. Excerpt:

Now stocks are 7% off their highs and already the alarm bells are starting to percolate. There is now talk of the Fed cutting interest rates. I am not joking. Apparently a decade of ZIRP, over 100 consecutive months of job growth, a quadrupling of the stock market, and E-scooter alternatives wasn't enough.

We are walking on eggshells, people.

I've been thinking about this idea for a while now, and the seed was planted when I read The Coddling of the American Mind. The book can be summed up in the following sentence:

When children are raised in a culture of safetyism, which teaches them to be "emotionally safe" while protecting them from every imaginable danger, it may set up a feedback loop: kids become more fragile and less resilient, which signals to adults that they need more protection, which then makes them even more fragile and less resilient.

Investors have had a comfortable decade. Sure we had just experienced one of the worst crises of the last century, but since then, it's been a relatively smooth ride, all things considered. And so what's happened to the psyche of the American Investor is similar to what's happened to American children writ large: "We adapt to our new and improved circumstances and then lower the bar for what we count as intolerable levels of discomfort and risk. By the standards of our great-grandparents, nearly all of us are coddled"...

It feels like we arrived at a point where extraordinary attempts are being made to shield investors from further discomfort. Trying to eliminate dangers could potentially make investors more sensitive and more fragile to ordinary adversity that exists in all risk markets.

I'm not saying that people should put 100% of their portfolio in index funds and hold on come hell or high water. What I am saying that it's time for the American investor to abandon their safe space. There are risks to investing. There always have and there always will be. Bear markets happen. Recessions are a natural part of the business cycle. They will happen, and we will get stronger as a result of it. Trying to ban their existence is infantile.

4) Kudos to comedian and political commentator Samantha Bee for shining a light on the scammy multilevel marketing industry, which particularly preys on women: Multi-Level Marketing Schemes.

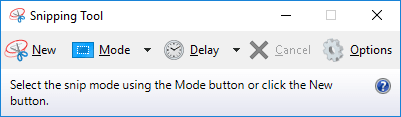

5) I regularly want to capture an image on my computer screen, but never knew how until I discovered a free utility app built into Windows called Snipping Tool.

To access it, select the Start button, search for "Snipping Tool" and, when it pops up, right-click it and select "Pin to taskbar" so it'll always be handy. Here's what it looks like when opened:

Best regards,

Whitney