Nick Kalivas provided recent insight into the historical performance of the Invesco S&P 500 Low Volatility ETF (SPLV) and why low volatility strategies have the potential to outperform over time. His comments are below.

The Low Volatility rewarded factor is well known for outperforming during an underperforming equity market, however in the past year Invesco’s Low Volatility Suite has generated excess return over its benchmarks in an equity market rally.

Q1 hedge fund letters, conference, scoops etc

There is a robust relationship between the excess returns of the Invesco S&P 500 Low Volatility ETF (SPLV), Invesco S&P MidCap Low Volatility ETF (XMLV) and Invesco S&P SmallCap High Dividend Low Volatility ETF (XSLV), and the potential for a global economic slowdown shown in several economic indicators. The elevation of the US Economic Uncertainty Index and the decline of the ISM Manufacturing Index over the past year suggest Low Volatility will remain in favor. If you want to examine correlations, the 12-month rolling excess return correlations between S&P 500 Low Volatility and industrial production, and the ISM Manufacturing Survey are -0.47 and -0.51 respectively. The US Economic Policy Uncertainty Index, which helps quantify economic uncertainty, has been elevated most of the year but has cycled. In April, the Economic Policy Uncertainty Index was down 73.3 from a peak of 149[1] in December 2018. The last reading is 117.6 reflecting the recent flaring of trade tensions. I believe backdrop of trade tensions and geopolitics have also been supportive to Low Volatility, but these dynamics have cycled as illustrated by the rolling pessimism and optimism about a trade deal with China.

In addition, there has been a strong showing of what is known as the “Low Volatility anomaly.” Per S&P Dow Jones Indices expert Craig Lazzara, the anomaly challenges conventional wisdom about risk and return, “Low Volatility stocks, by definition, exhibit lower risk but have also universally outperformed their benchmarks over time.”

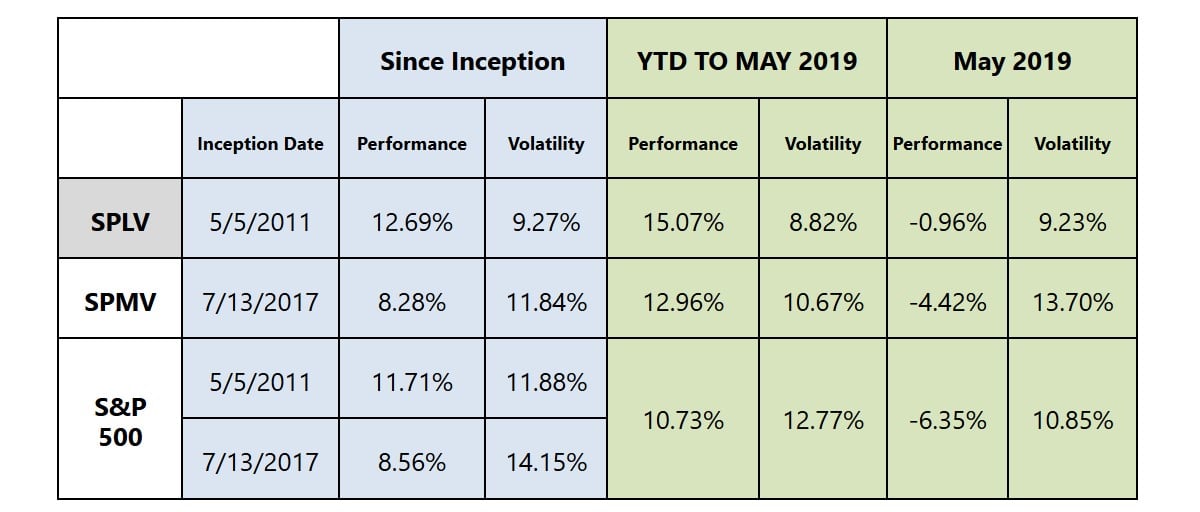

The Low Volatility strategy has also outperformed other defensive rewarded factors, including Quality and Minimum Variance, primarily because of the structure of its methodology. SPLV invests in stocks based on their trailing 12-month volatility, thus only investing in Low Volatility stocks, while Invesco S&P 500 Minimum Variance ETF (SPMV) employs a managed-volatility methodology that includes sector constraints, potentially diluting the exposure to the Low Volatility stocks.

Since its inception in May 2011, SPLV has outperformed the S&P 500 by 0.98% despite the fact that we have been in a bull market for the past decade. And last month, when the S&P 500 fell 6.35%, SPLV only saw a decline of 0.96%[2].

Market Value as of May 31, 2019

1 Economic Uncertainty Index levels

2 Market prices as of May 31, 2019

For more information on the Invesco ETF Low Volatility Suite please visit the Invesco ETF Factor Website:

https://www.invesco.com/us/factor-investing/low-volatility-suite/

For more information on the ETFs please visit: Invesco.com

An investment cannot be made in an index.

The opinions expressed are those of the Nick Kalivas are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Before investing, investors should carefully read the prospectus and consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund, investors should ask their advisor(s) for a prospectus or download one at invesco.com

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments. SPLV: There is no assurance that the Fund will provide low volatility. SPMV: The Fund is non-diversified and may experience greater volatility than a more diversified investment.

Shares are not individually redeemable and owners of the Shares may acquire those Shares from the Fund and tender those Shares for redemption to the Fund in Creation Unit aggregations only, typically consisting of 10,000, 50,000, 75,000, 80,000, 100,000, 150,000 or 200,000 Shares.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GAURANTEE

Invesco Distributors, Inc.