Last week, veteran activist investor Carl Icahn filed a lawsuit against Occidental Petroleum Corporation (NYSE:OXY) to gain access to corporate records related to the “fundamentally misguided and hugely overpriced” Anadarko Petroleum Corporation (NYSE:APC) deal, according to Reuters. The legal action filed by a group of Icahn companies in a Delaware court on Thursday revealed that the activist may seek a special meeting to replace several directors. The investor believes that Occidental’s “board and management are in far over their heads, have made numerous blunders in recent months, and might continue to trip over their feet if the board is not strengthened,” according to the documents.

The suit raised doubt over Occidental CEO Vicki Hollub’s dealmaking experience and argued that the bidder sold Anadarko’s Africa Assets to French petroleum refining company Total in “a quickly arranged fire sale before it even owned them.”

Q1 hedge fund letters, conference, scoops etc

The activist regards the entire Anadarko Petroleum deal as inappropriate given the current market environment and made the case that oil prices below $45 could force Occidental to cut its dividend. Icahn concluded that the company "should have been a seller - not a buyer."

What We'll Be Watching For This Week

- Will South Korean investor ILJIN SNT name the four candidates it threatened to nominate for election to the board of Canadian firm Aurinia Pharmaceuticals?

- Will Medley Capital shareholders vote in NexPoint Advisors’ two board nominees or stick to the status quo at today’s vote?

- Will Israeli pharmaceutical company Can-Fite BioPharma decide a date for the meeting requisitioned by Capital Point, which seeks the replacement of all four directors with the activist’s five new candidates.

Activist Shorts Update

Grizzly Research disclosed a short position in Intelligent Systems, a week after Aurelius Value claimed the fintech’s “prospects are dramatically over-hyped.” Grizzly said it believes Intelligent employees are setting up or taking control of undisclosed shell companies in Asia to participate in undisclosed related-party transactions with Intelligent intended to either “round-trip" revenue back to the firm or siphon money out of the company.

Grizzly predicted an 85% downside while Aurelius concluded that the stock will drop by 70%, contending that said Intelligent is “merely a glorified Indian business process outsourcing company” that is unlikely to produce the kind of growth its market capitalization reflects.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

Chart Of The Week

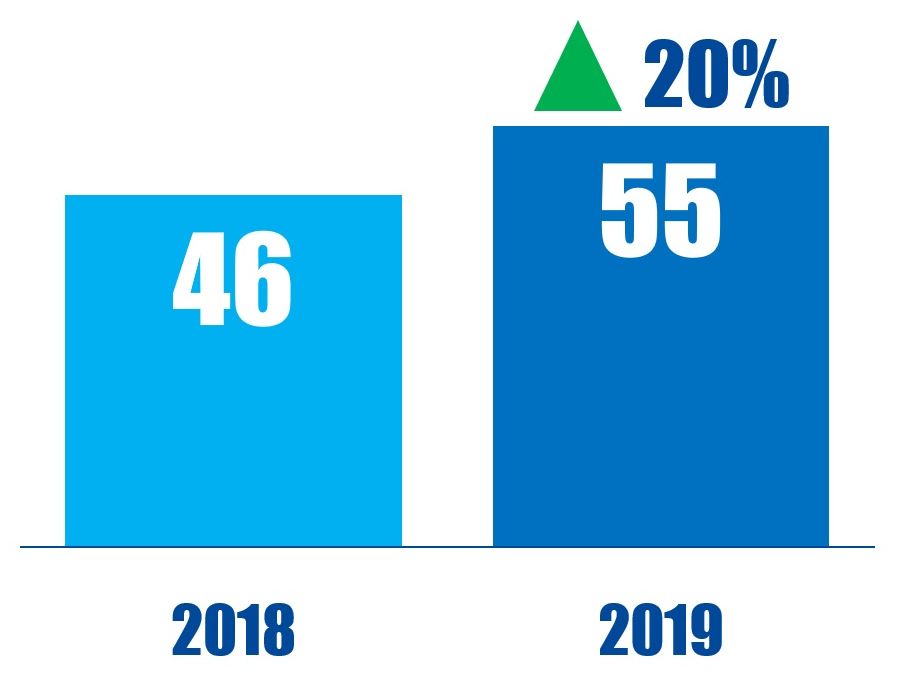

The number of U.K.-based companies to have been publicly subjected to activist demands in the 12 months ending May 31 in respective years.