A thriller about a genius algorithm builder who dared to stand up against Wall Street. Haim Bodek, aka The Algo Arms Dealer. After Quants: the Alchemists of Wall Street and Money & Speed: Inside the Black Box. This is the final episode of a trilogy in search of the winners and losers of the tech revolution on Wall Street. Trading on the financial market is not longer dominated by humans, but by super fast computers and algorithms. The result of this digital revolution on Wall Street is a complex and fragmented financial system that is hard to understand and overseen. A system that we are all connected to. The only people who understand the system a bit, are the people who built it.

Haim Bodek started his own high frequency trading in 2007 and built a from his point of view perfect and fast algorithm. One day it just stopped working. Profits disappeared en he went looking for the cause. He decided to go public with his search to display the rotten system.

Haim Bodek: The Wall Street Code – 2013 VPRO Documentary

Q1 hedge fund letters, conference, scoops etc

Transcript

Super quick computers and advanced mathematics formulas have largely taken over trading on the financial markets from human beings. Algorithms which seem to have a life of their own. Algorithms secretly lie waiting for the moment that your Apple share or your pension money gets on the market.

The only ones who understand this system in any way are its architects. The algorithm developers Haim Bodek is one such algo developer. After finding some strange wrongdoings he sets out on a personal crusade against this elusive system.

It's a step that goes directly against the unwritten Wall Street code of silence and secrecy. This is what's in store for.

There's kind of a rule never blame other people never blaming the market. Never blame the other trader it's always you your code your gear code is wrong. You're on Wall Street. You just assume you're being ripped off unless you're the one doing the ripping off. You know on Wall Street you know we talked about the culture of secrecy. You just don't go to the S.E.C..

This is back night. Welcome to the twisted nooks and crannies of our financial markets.

This is all about just a one cent move in the stock. That's all it is. How a single tech know how a price changes. That's when the game is played.

And when that one tech happens the world is divided into winners and losers.

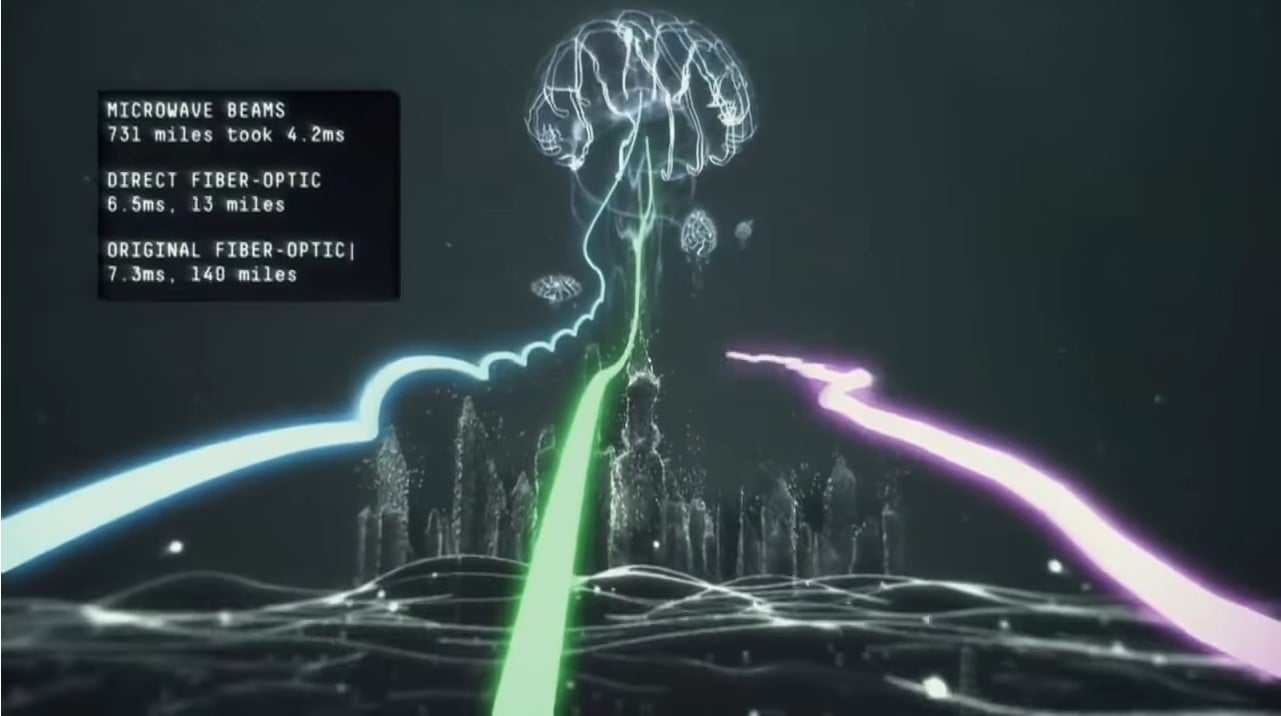

The machinery behind our financial markets consisting of mathematical models data centers and miles and miles of fiber optic cables is disguised by technological complexity and secrecy.

The builders of this financial system are a new breed of Wall Street employees quants mathematicians and physicists who are responsible for a technological revolution. Haim Bodek is a quant he specialized in artificial intelligence and worked for whole trading and Goldman Sachs. He knows the system from the inside. He helped build it.

One day I got a call that said hey you've got to get in touch with this individual's name is Haim Bodek. He's got some revolutionary information about high frequency trading which is one of the subjects that we cover at the battle the Quantum. I said Sure I'll give him a call. So what's going on. Having Haim Bodek speak was like opening Pandora's box and he machine gunned his way through these series of slides with information that frankly I heard back from people in the audience and said they were astounded.

Nobody ever talked about order types until time came around. I mean it wasn't even part of the conversation. And when I heard what Haim was talking about he's looking at or types say you know if used properly guarantee your profit.

There were definitely people in the audience that were aware of this and cowering in their seats saying you know how to who is this guy and why would he allow this information to be out and and potentially ruin our fantastic opportunity for generating revenue in the marketplace. There are actually quite a lot of Russians then one guy came up to me and he says you know I know what you're doing and I'm behind you and if you need anybody and you need any help.

You know I've got some friends.

And I'm like aren't I am I had a client conference. And these were just other people's reactions right.

I'm thinking to myself Look it's a bunch of geeks who did this.

I'm not going I don't think I'm going against like the mob or something like that.

In 2011 Botox own high frequency trading company trading machines went under according to biotech. The reason was a wrong order type or the way in which he told the exchange to execute his order.

Well this isn't the setup I used to have too much. Do. You know when we launched Trading Machines.