After weeks of being locked in negotiations, Caesars Entertainment Corporation (NASDAQ:CZR) and casino operator Eldorado Resorts Inc (NASDAQ:ERI) have emerged with a $17.3 billion merger. Eldorado will acquire the outstanding shares in Caesars for a total value of $12.75 per share, which will consist of $8.40 in cash and 0.0899 Eldorado shares for each Caesars common stock. Eldorado and Caesars shareholders will respectively hold approximately 51% and 49% of the combined company’s outstanding shares, should the merger be completed.

Eldorado will retain the Caesars name for commercial purposes and has announced that the newly created company will trade on the Nasdaq Global Select Market.

Q1 hedge fund letters, conference, scoops etc

Carl Icahn, who has a 28.5% stake in Caesars with swaps, has been pushing the firm to consider a sale. After disclosing his huge stake, Icahn reached an agreement with the company to add three new directors to the board, namely Keith Cozza, Courtney Mather, and James Nelson. "This merger is the quintessential example of how an activist shareholder, working collaboratively with the board, can greatly enhance value for all stockholders," Icahn said in a statement after the deal was announced.

What We'll Be Watching For This Week

- What is next for Lixil now that shareholders have voted former CEO Kinya Seto and his eight-strong slate onto the board?

- Will Aurinia Pharmaceuticals shareholders vote in ILJIN SNT’s three-person slate or stick to the status quo at the meeting on Wednesday?

- Will Rurelec shareholders vote for or against YF Finance’s board nominee at the meeting on Thursday?

Activist Shorts Update

Shares in Bosideng were down around 25% on Monday before trading was halted after activist short seller Bonitas Research issued a report claiming the company's chairman has been stealing from minority shareholders. Bonitas said the clothing products retailer, which boasts around 7,500 retail outlets in China, fabricated 807 million renminbi of profits "to generate investor interest." In addition, Bonitas said the company paid 2 billion renminbi for multiple acquisitions from insiders while disposing of real assets at bargain prices.

The trading of Bosideng shares was halted at around 11 a.m. Hong Kong time Monday at the request of the company. The firm, which has a market capitalization of HK$18 billion ($2.3 billion) said Bonitas' report contains "untrue and misleading information." A clarification announcement will follow soon, Bosideng said.

Bonitas has recently been caught up in litigation proceedings, after Singaporean skincare distributor Best World International sued the activist short seller for defamation in May. Best World stock dropped more than 30% on April 25 before it was halted, following accusations from Bonitas that the company inflated its Chinese sales. Shares resumed trading on May 9 and fell an additional 16%. They were again halted by the Singapore Exchange as the regulator looked into the accuracy of the company's 40-page rebuttal report, in which it denied the short seller's allegations that its Chinese sales are non-existent.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

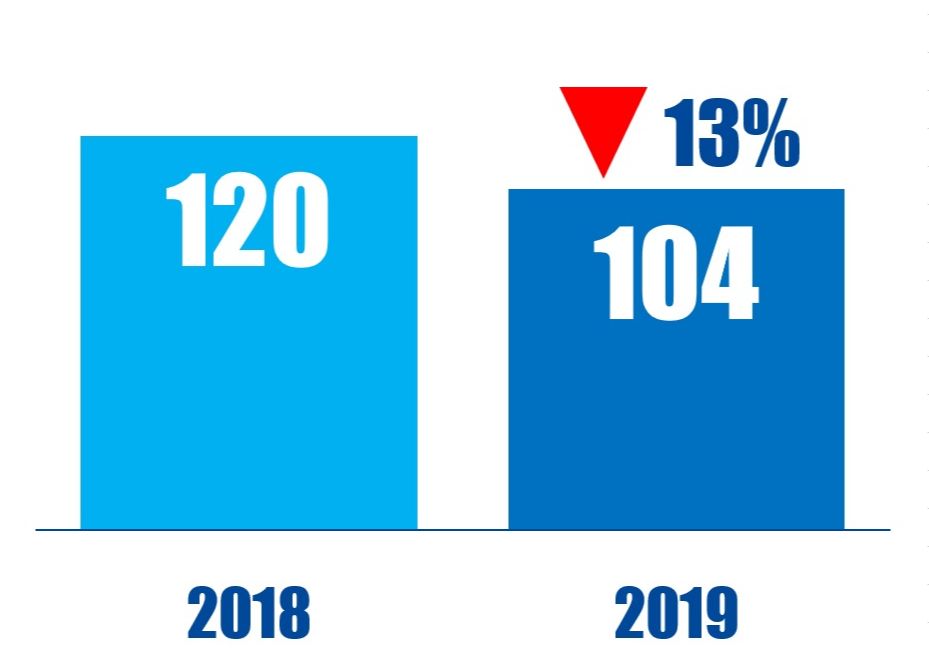

Chart Of The Week

The number of U.S.-based companies to have been publicly subjected to activist demands for board representation between January 01 and June 21 in respective years.