Vilas Capital Fund performance review for the month ended April 30, 2019.

Dear Partners,

The Fund had a good April, rising 17.7% +/-. Further, due to an earnings beat, CVS and a few other stocks we own are up materially today, May 1. This brings our year-to-date performance up to a roughly 65% gain. Making our way back slowly but surely.

Q1 hedge fund letters, conference, scoops etc

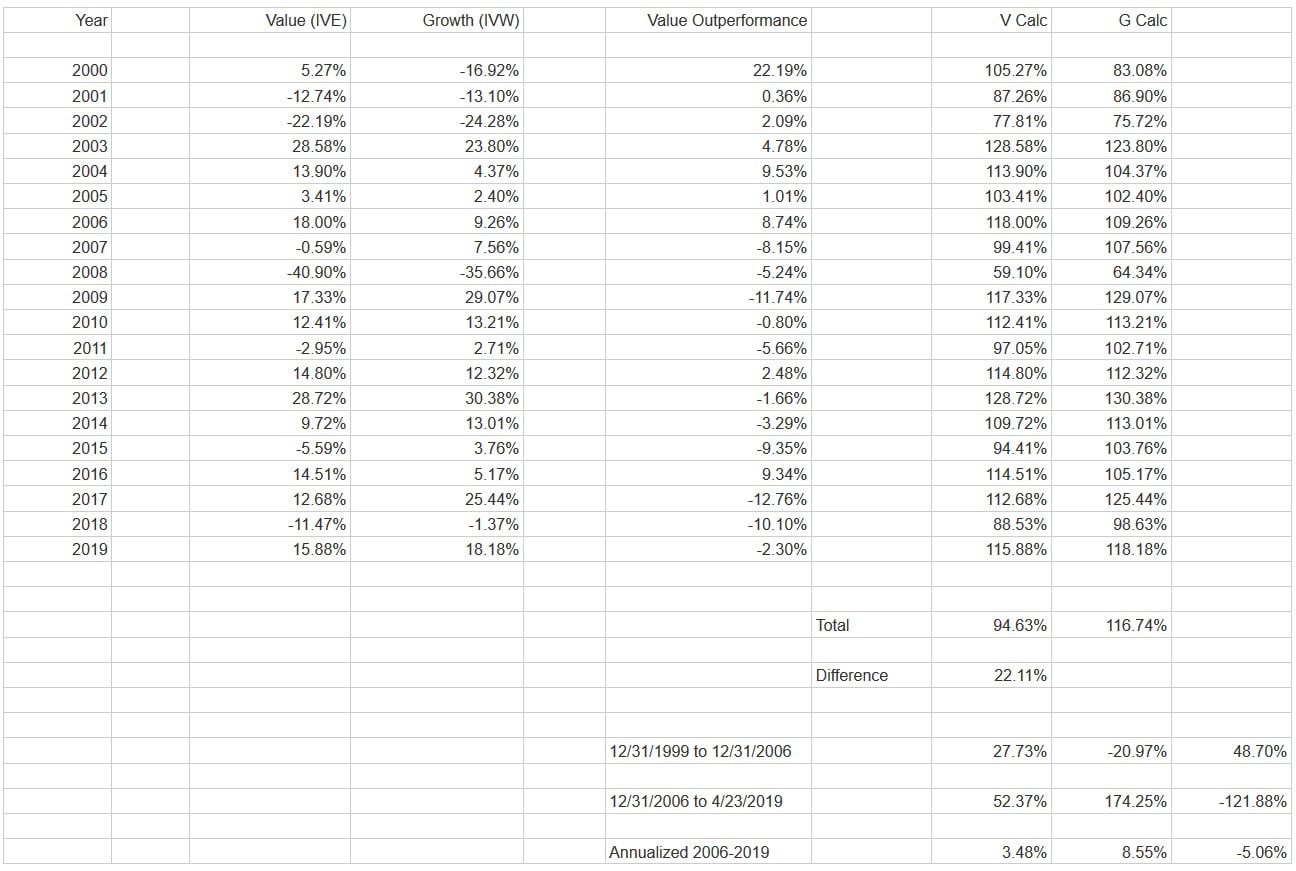

The table below shows the year by year performance of value stocks vs growth stocks since 1999. Value stocks are only up 3.5% per year since 2006, which basically can be accounted for by their dividends alone. Thus, despite earnings power that has roughly doubled over this 12+ year period, the stocks are flat, and therefore they have seen their valuations cut in half. This will eventually reverse and go our way. Our best days lie ahead as value stocks have underperformed by so much for so long that they are like a coiled spring.

Hope you are having a good start to spring!

John C. Thompson, CFA

CEO and Chief Investment Officer

Vilas Capital Management, LLC

Web: www.vilascapital.com

This article first appeared on ValueWalk Premium