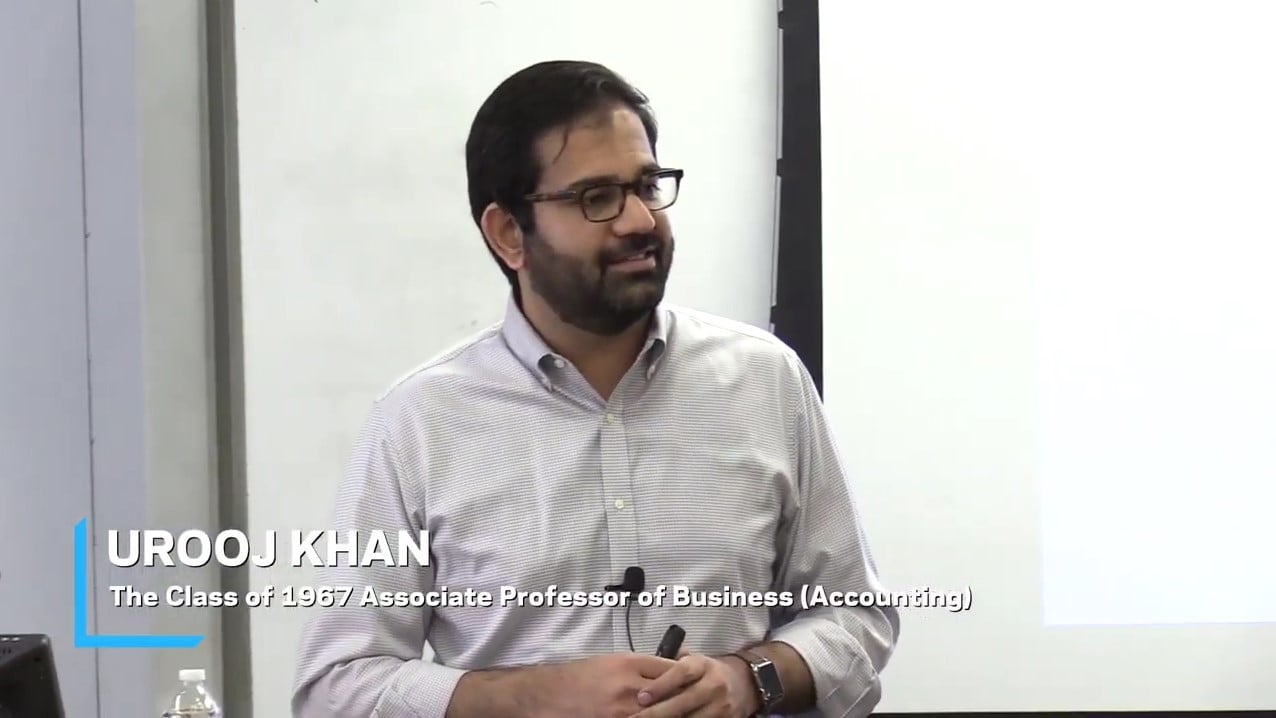

On March 26, 2019, Urooj Khan, The Class of 1967 Associate Professor of Business in Accounting, presented Earnings Quality on the Street. The presentation was part of the Program for Financial Studies’ No Free Lunch Seminar Series.

The Program for Financial Studies’ No Free Lunch Seminar Series provides broader community access to Columbia Business School faculty research. At each seminar, attended by invited MBA, Masters and PhD students, faculty members introduce their current research within an informal lunch setting.

Urooj Khan: Earnings Quality On The Street

Q1 hedge fund letters, conference, scoops etc

Transcript

So I'm a huge fan. I'm in the accounting division. I see a lot of familiar faces people in my current class and my previous classes. So thank you for coming to attend this talk and the research that I'm going to present is it strong on paper that's type of earnings quality on the street. It's co-authored with current future students at Columbia. Make it better ready. And another accounting faculty show around roads could not go public. So I thought I'd use this paper. It sort of fits well with the you know what the motivation behind CFS is to sort of bridge practice with what we do in academic research. I'm an accounting professor and many of you have heard me say this but Warren Buffet who the alarm of our school describes accounting as the language of business. So that's how funds communicate with their stakeholders. And one of the most important products of the accounting system.

Our earnings. It's a very important summary measure of a company's financial performance. There's a lot of focus on earnings. From different practitioners investors and in the academic community. We have spent a lot of time trying to understand whether the reported earnings are of what we call good quality or bad quality. So what I mean by good about quantity is two companies with similar businesses similar asset bases reporting the same earnings no need not be earnings which are of a similar quality. What I mean by quantity is is the accounting information or earnings doing a good job in presenting the picture of the underlying fundamentals of the business. So earnings which will not be a good quality will be earnings where the far might have used some accounting or financial reporting choices to mask what the underlying fundamentals of the underlying economics of the business might be. It's a hot topic in practice in the investor community and as academics we spend a lot of time trying to understand this. But here's the interesting part. The way I teach you or the way you learn to assess accounting quality or earnings quality is sort of similar to what's done in practice.

Typically if you think of investors who are one set of practitioners the way they would assess earnings quality is they do bottoms up fundamental analysis. So they will do granular industry specific analysis of a company. They will get information from from their financial statements obviously from the footnotes from other public sources they use the information of their competitors. All of this to sort of build a picture about what the underlying fundamentals of the business are and other reported earnings that are the reported accounting disclosures doing a fair job in describing the state of those fundamentals very similar to what very many in my class and I talk about financial sector analysis. I tell you that this is what we should be doing. In academic research hasn't spent a lot of time systematically analyzing how earnings quality is operationalized in the field. What academic research has largely done is they have developed these large sample models through which this sort of model the quantity of a company's accruals. There's some other models but I'm just going to pick on the abnormal accruals that we have and they sort of estimate these these are relatively easy to estimate from the machine readable data that's available in different databases. And. This is an example of a very early on equality model that's used in academic research. So without getting into these details basically what this is telling you is that. Current actuals. In the current period are a function of a company's change in sales and lagged current accruals. You can ignore this other time those are just dummies for different quarters but this is a quarterly was enough a model and these have become extremely popular and academic research and to a large extent to some extent in quantitative investing. If you go to practice firms that have quant models of investing if they're using some accounting based strategy they might be using models very similar sheets but there is a problem with these models. There's a reason why they became so popular. They're easy to estimate most of times in academic research. We are not doing.