Rowan Street Capital letter to investors for the first quarter ended March 31, 2019.

Dear Partners,

We have just closed on our best quarter yet since inception. In the first quarter of 2019, Rowan Street was up +19% (gross) vs. +13% for the S&P 500 Index. April has been a good month for us as well: year-to-date as of this letter the fund is up +28% (gross).

Q1 hedge fund letters, conference, scoops etc

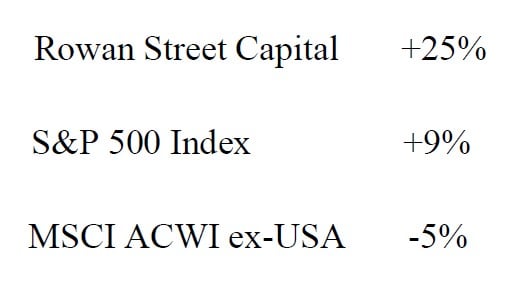

Here is how we stacked up over the past 15 months from January 1, 2018 until March 31, 2019 (gross of fees):

When you received your 2018 end-of-year statements, your investment returns for 2018 did not look very exciting, although you did much better than the overall stock market. However, if you add just three more months of return on top of your 2018 return, the past 15 months have been the best wealth creation period in the history of Rowan Street Capital.

There are many lessons here, as our returns did not come in a straight line, by any means. December was a difficult month in the market as we explained in our 2018 year-end letter. However, we stuck to our guns and took advantage of newly created opportunities in December, and our convictions have already started to pay off as you can tell from our 2019 results.

Section for Limited Partners only

At the end of March, you should have received your K-1s for 2018. You will notice significant realized gains there. We wanted to make sure that you understand that the gains we realized in 2018 were necessary in order to reinvest the proceeds into very attractive opportunities that we were finding in the month of December. Your first quarter statements that you should have received in your email show your gains thus far in 2019. These gains were created by the opportunities that we were able to take advantage of in December.

Taxes will always be a significant consideration in all our investment decisions, however your long-term net investment return always takes precedence. For example, we could have taken losses in December and reduced your 2018 tax bill, but by doing so you would miss out on the best performance month in our history (+19% in January). We don’t imagine that would be a trade-off any rational investor would be willing to make.

Main lesson from the past 15 months: Volatility and How to Think About It?

Volatility always scares investors. Most people go into investing, knowing the history of the stock market and the extraordinary wealth it has generated over time. Then market volatility happens, and investors experience 10%, 20%, 30% (we experienced a 20% drawdown in Rowan’s portfolio in December) and sometimes 40%+ drawdowns in their portfolios, and that is when fear takes over and all rational thought goes out the window. This is when you have a large legion of investors that say, “This is wrong, this is broken, I need to make myself safer and get out.” And most important, they do that with the mindset that they are making themselves safer. They are taking out their family’s money, their retirement money, their kids' college money, and they think they are injecting safety into their life. They do this without realizing what they are almost certainly doing is reducing their long-term returns (most of the time significantly so), which is one of the biggest risks that they can take as an investor.

When you study the history of the stock market, volatility is not the real risk. Volatility is part of the course of investing. In fact, there is no wealth creation without volatility! That is just the price of admission that the market demands you to pay. But that's just not how most people look at it.

At Rowan Street, the #1 foundational principle of everything we do is we have a mindset of a business owner - this is how we approach all our investments. When you start looking at the world through the lens of a business owner, you start paying less and less attention to the stock tickers that bounce up and down every day and realize that most of the time these daily stock price gyrations have very little to do with the long-term intrinsic value of the business. Over the long run, however, stock prices accurately reflect the fundamentals of businesses. For example, when you purchase a house or a commercial property or buy into a small business, you do not get a quote on it every single moment or every single day. You are in it for the long run, and you make your investment decision based on the earnings that your property or business can generate over the next 5-10 years in relation to the capital that you have to put up up-front. You don’t worry about what the Federal Reserve is going to do at their next meeting or what the next Trump’s tweet will be on trade with China. Why should your approach to investing in stocks, which represent fractional ownership of businesses, be any different?

What are you going to do if the next recession comes in the next 12-18 months and the market drops? Are you going to go to cash to protect capital?

This is the question that I get asked by almost everyone I had spoken to recently! There must have been some sort of fair where they handed out crystal balls that predicted a recession in the next 12-18 months and I had completely missed it. Darn it! Yes, we have been in one of the longest economic expansions of all time, but we do derive some comfort in that there is a widely-held consensus out there that this economic cycle will soon die of old age. I would be significantly more concerned if there was a consensus out there that the stock market is going into stratosphere and there’s no recessionary risks in sight (Remember 1999 and 2007? Or “crypto-consensus” of 2017? Yes, I just made up this word).

But if you really think about, when people ask me this question, what they are really asking is how are you going to react to volatility in the stock market? This takes us back to our lesson above: Volatility and How to Think About. Just to recap, what happens when investors approach volatility with a mindset that they will make themselves and their families safer by pulling money out of the stock market because their crystal ball told them so? At the risk of being redundant, what they are doing is they are significantly reducing their long term returns and are, in fact, making their families significantly poorer over the long run.

It was Peter Lynch (one of the best investors of the 20th century) that said it best: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Ladies and gentlemen, our view on all the macroeconomic worries that take over investors emotions from time to time is the same as it always has been. We think it's worthwhile to repeat what we wrote in our Q1 2018 letter:

We have no idea what the market is going to do over the next quarter or the next year, and we make no attempt to make such predictions. There is nothing in our record that suggests that we can add any value by making those predictions and trying to time the market (in contrast to an inordinate amount of energy and resources that is spent on these activities on Wall Street). We remain focused on what we do well -- identifying high quality, well-run businesses that are likely to compound our capital at double-digit rates of return over the long run, and we try to acquire those opportunistically when Mr. Market offers us an attractive price. This approach has proven to be successful for us throughout our investment careers, and we will continue to focus on that because we think it’s logical, repeatable, simple and straightforward.

Now, since we missed the “crystal ball fair” and have no clue when the next recession is going to come or when the next market downturn will happen (we definitely did not predict the 20% correction in December 2018), all we can do is stick to our own rules of why we would sell (see below). Please note that the average stock market investor was a net withdrawer of funds in 2018, but poor timing caused a loss of 9.4% on the year compared to the S&P 500 index that retreated only 4.4% (we are certain that these investors had extraordinary results when the market quickly rebounded in Q1 2019).

There are, however, plenty of economists and news media sources that will make recession predictions with surprising precision - their records are unblemished with accurate predictions of 2000-2002 and 2008-2009 recessions (we all knew they were coming 12-18 months in advance and prepared well for it).

Why we would sell a position?

- Overvaluation: If the stock price is egregiously overvalued and discounts earnings very aggressively into the future; when the risk/reward is no longer on our side.

- Deteriorating Fundamentals: For each company we invest in, we document our investment thesis. We don’t think of ourselves as “buy-and-hold” investors, rather we are “buy-and-verify investors. If the competitive advantage of a company we own is eroding, or the management is not executing well or not allocating capital well, we will sell and reinvest in more attractive opportunities.

- Better Ideas: If we have a more compelling investment idea with more attractive long-term prospects and/or where we have more conviction, we will sell. This is exactly what we did in December 2018.

- Mistakes: We will sell when we recognize our original thesis was flawed.

Thank you for your confidence and trust in our investment discipline. We will continue to invest with a long-time horizon like it is our own money – because it is. We appreciate the opportunity to grow your family capital alongside ours. As always, should you have any questions or comments, we would be very happy to hear from you.

Sincerely,

Alex Kopelevich, CFA

Joe Maas, CFA

This article first appeared on ValueWalk Premium