Ben Strubel’s letter to investors for the month of May 2019, titled, “The US-China Trade War Heats Up.”

Dear Investors,

I had just finished writing our monthly newsletter when the US trade war with China heated up again. I decided to quickly write another letter, this time focusing on tariffs.

Q1 hedge fund letters, conference, scoops etc

Basically everything you’ve read about who pays tariffs is simultaneous right and wrong. It seems that everyone writing about them has an ulterior motive. The Trump administration is relentless in claiming China pays for tariffs while the business community is emphatic that it’s consumers bearing the full brunt.

In reality, there are basically four different scenarios (not counting foreign currency exchange rate fluctuations) on who pays tariffs. The following are slides taken from the annual presentation I give to my business clients.

The first situation is the most benign. Companies can just change suppliers and life goes on. Right now this situation is probably the rarest as it’s difficult for businesses, especially in manufacturing, to change their supply chain in a matter of weeks or months.

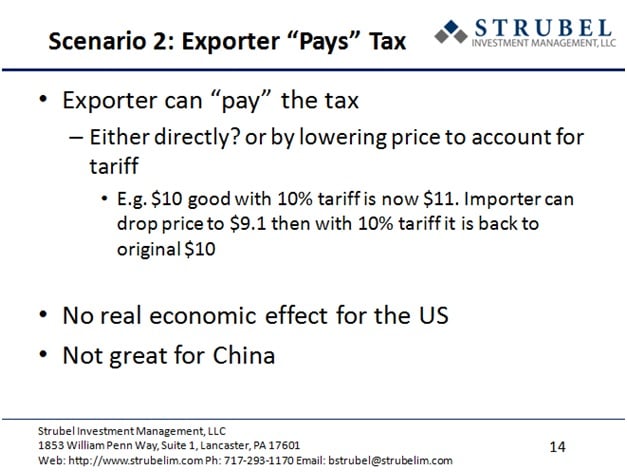

In this scenario the exporter either pays indirectly by lowering their prices so that with the tariff added the good is the same price as before. Although I’m fuzzy on the legal details, it may be possible for a US based but Chinese owned importer to pay the tariff tax directly if they import the product. Even if this is not the case, they can accomplish the same thing by simply lowering the price. The economic results are roughly the same so for investors purposes the legal details are immaterial.

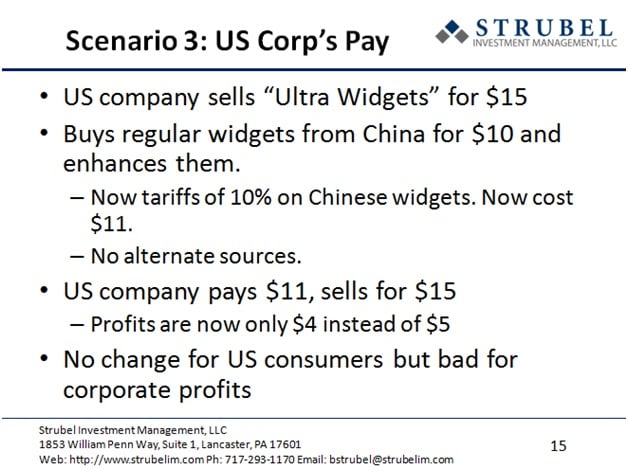

In this scenario, businesses are forced to eat the extra costs. This scenario tends to happen in fragmented, competitive industries.

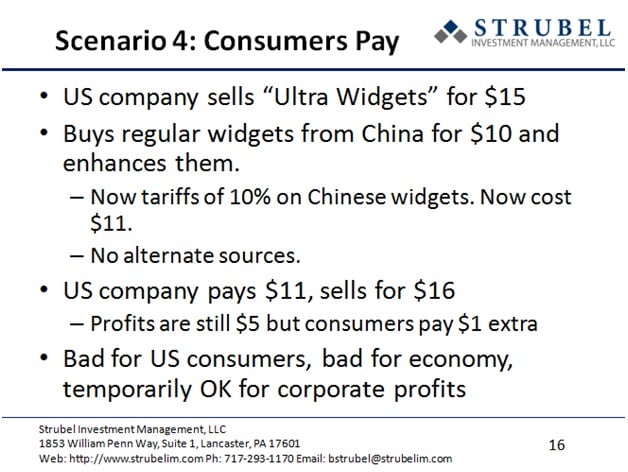

In the final scenario it’s consumer that pay the costs of the tariffs. This scenario tends to happen in more consolidated industries with less competition, which makes it easier for businesses to raise prices.

Right now, the US imports about $540B worth of goods from China. A 25% tariff on all of those goods would represent a tax increase of about $135B. Remember that it’s possible for companies to source goods from other countries. It’s also reasonable to imagine that over time companies will shift more production out of China if the tariffs remain in place. However, it would take years if not decades to completely realign global supply chains. I’ve seen estimates that the alternative sourcing that can be accomplished near term could reduce the tariff tax to about $100B.

That remaining $100B tax will likely be split between corporations and consumers. In highly competitive, fragmented industries like retail or auto manufacturing it can be difficult to raise prices and pass on costs. The auto industry essentially had to eat the costs of the steel and aluminum tariffs. On the other hand, in consolidated industries with little competition business can more easily pass on price increases. I’ve seen this happen in architectural (house) paint and with HVAC equipment manufacturers.

As of last quarter, the size of the US economy was $21,063B. So, the new tariffs both implemented and announced would amount to a tax increase of about half of one percent of the size of the economy.

On the plus side of the ledger, Federal spending is up $172B so far this calendar year compared to last year. So, the economy is getting a fairly large boost from that and if extrapolated over the full year would be about a $500B increase in spending. There is also the high likelihood of another large aid package to farmers that will help alleviate some of the economic damage from the trade war (the previous amount was $12B so you’d expect the coming aid package to be around that amount or more).

Right now, it appears the economic damage from Trump’s trade war and the tariff increases will be offset by higher Federal spending. That means we can expect to the same roughly 2% GDP growth that we have been around since the Great Recession as the benefits of tax cuts and increased spending are being undone by the increase in tariff taxes.

It’s also important to remember that the stock market is more exposed to global trade than the US economy. We’d expect the stock market to react more negatively than the US economy given it’s more sensitive to trade issues. Right now, there doesn’t seem to be any economic reason for investors to panic but given the trade tensions and effective tax increases there is also no reason for euphoria either. Investors should be prepared for market gyrations up or down based trade news.

Disclaimer

Historical results are not indicative of future performance. Positive returns are not guaranteed. Individual results will vary depending on market conditions and investing may cause capital loss.

The performance data presented prior to 2011:

- Represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time clients have made special requests that SIM hold securities in their account that are not included in SIMs recommended equity portfolio, those investments are excluded from the composite results shown.

- Performance is calculated using a holding period return formula.

- Reflect the deduction of a management fee of 1% of assets per year.

- Reflect the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after:

- Represents the performance of the model portfolio that client accounts are linked too.

- Reflect the deduction of management fees of 1% of assets per year.

- Reflect the reinvestment of capital gains and dividends.

The S&P 500, used for comparison purposes may have a significantly different volatility than the portfolios used for the presentation of SIM’s composite returns.

The publication of this performance data is in no way a solicitation or offer to sell securities or investment advisory services.