Why are leases of interest? For companies, the decision to lease or buy assets is an important one since it involves financing considerations and managing risk exposures to full asset ownership. Investors care about leases because they have to factor leases into their analyses of company leverage and liquidity.

In 2016, the Financial Accounting Standards Board (FASB) issued a new accounting standard to increase the transparency and comparability among companies by recognizing lease assets and liabilities on the balance sheet and requiring key additional disclosures on leasing arrangements. This rule came into effect on January 1, 2019.

Q1 hedge fund letters, conference, scoops etc

Under previous lease accounting rules, lease assets or liabilities classified as 'operating' were not required to be recognized on the balance sheet. Conversely, leases classified as ‘capital’ were required to be recognized on the balance sheet. This meant that companies then had incentives to structure their lease agreements in order to avoid meeting the threshold criteria for capital lease treatment and therefore were able to keep the associated asset and liability off the balance sheet (thus, we have the commonly used term ‘off-balance sheet’ financing). Lease classification (operating versus capital) had reporting implications and subsequent deleterious impact on key financial ratios.

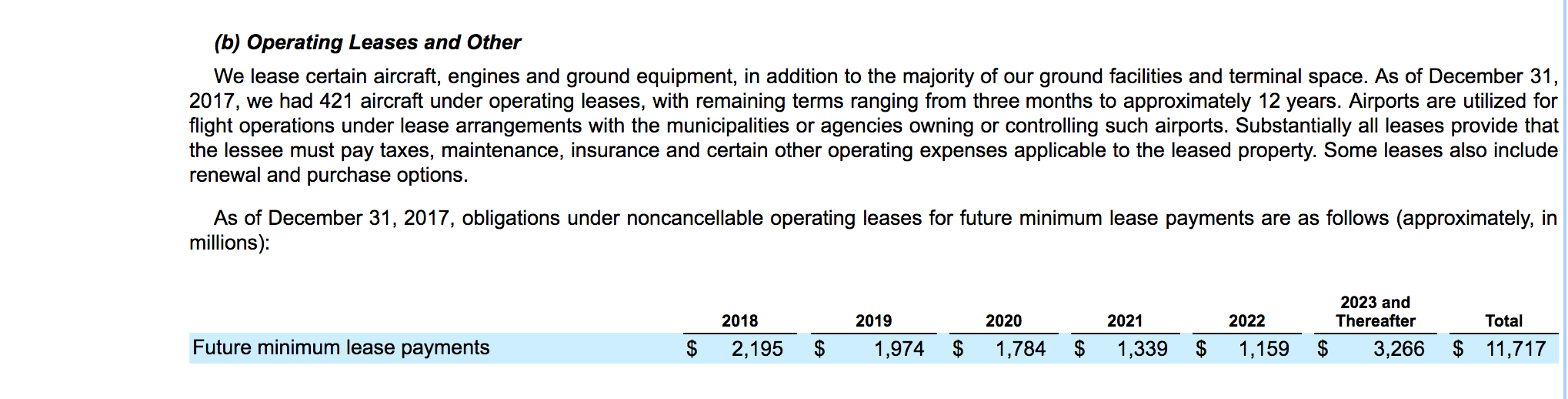

For instance, by classifying a lease as an operating lease instead of a capital lease, American Airlines in 2017 was able to keep approximately $9B of lease liability off the balance sheet (derived by calculating the present value of the future minimum lease payments using the discount rate of 4.6%. Note that the discount rate was disclosed in the 2018 10-K).

Assuming that they had included this liability on the balance sheet as the new lease standard requires, the company would have increased its long-term debt from $22.5B to $31.5B, which is a 40% increase in debt. How would this impact its debt-to-equity ratio? The ratio would have increased from 5.73 (without operating lease liability) to 8.03 (with operating lease liability).

This not only affects the leverage ratio, but profitability ratios like the return on asset ratio (ROA), are also impacted. Now that we also have the corresponding lease assets recorded on the balance sheet (i.e., ‘right of use asset’) as per the new lease guidance, the ROA decreases from 3.7% (calculated using the old lease rules where we do not include operating lease assets in the denominator of the ratio) to 3.2% (calculated using the new lease rules where we include the operating lease assets in the denominator).

It’s not surprising that there traditionally has been a preference for operating leases. When leases are recognized on the balance sheet, leverage ratios increase and profitability ratios decrease - an undesirable outcome for the company. Note that investors and analysts have historically been making their own adjustments and ‘capitalizing’ (or ‘adding back’) the present value of the operating lease payments on the balance sheets when conducting their analyses. Some, like McKinsey & Company[1], have argued that the new lease rules do not necessarily change investors’ and analysts’ assessments of the underlying economic performance of the company, since they have always made these adjustments for operating leases anyway.

So, what are the takeaways from the new lease rules for investors and analysts? The new lease guidance increases the transparency of these lease arrangements by requiring more detailed disclosures (for example, the discount rate for the lease). Prior to this, investors and analysts had been working with a limited set of available information to ‘estimate’ the present value of the minimum lease payments to capitalize the operating leases. Their estimates were only as good as the assumptions they made in deriving the present value of the lease payments. At worse, in some cases, users could not reliably estimate or make adjustments themselves and had to rely on third-party data aggregators to make the adjustments. Since different users make different assumptions, there was information asymmetry amongst analysts and investors relying on this information to make investment decisions. Now, with more specific disclosure details, analysts and investors can more accurately benchmark company performance over a long time period by using the information disclosed under the new guidance to update their prior estimations under the old lease guidance. This is imperative for any time-series analyses and modeling to be meaningful.

About the Author:

Christine Tan, an expert in XBRL, Christine offers her talents and deep financial industry knowledge as idaciti's Chief Research Officer. As Co-Founder of the company, she is passionate about creating an engaging community for investors, analysts, corporations and academics to connect and collaborate around global financial data.

Christine received her Ph.D. in accounting and finance from the University of Melbourne in Australia and has served as an accounting professor at several universities in New York. She has consulted with a number of Fortune 500 companies, government agencies, investment banks and private equity firms. Christine can be reached at [email protected].