Being different from the rest is how you can measure the capability of a business. But even with a unique advantage, good and positive business outcomes don’t always happen. Most small and medium-sized companies nowadays struggle when it comes in managing their cash flows and overdue accounts, which ultimately leads for some to go out of business. You may come up with the idea of fixing this glitch by doing proper budgeting, but are you sure that it would always help you keep up? A growing company is more likely to fulfill more needs and require more assistance. Why settle for less? If you can achieve improvements in your financial performance with the help of debt collectors!

Q1 hedge fund letters, conference, scoops etc

What if you have a choice?

Here’s some knowledge on why you should hire a debt collector:

What do debt collectors do?

Being mindful of what you want to achieve in your business isn’t that easy, especially when the complex issue of managing cash flow matter comes in the middle of your crises in paying your bills. That is why we have debt collectors to do their duty. A Debt Collection Agency is a type of company that provides convenience in every small business owner. This kind of company offers you a hand in collecting debts for your company when you’re facing complication in your company’s cash flow, in that way the business could focus on its other important resources and its growth.

For entrepreneurs who are responsible for maintaining the stability of the business’s foothold on the industry they are operating, having the capabilities of a debt collector agency is surely of great value. As the most affected person on the downfall of the company, having someone to assist in the middle of a crisis is huge relief for every business owner.

Why should you have a debt collector?

Thinking positive and forward can help you achieve your goals, but still, challenges are all over, you can’t avoid them, but you can defeat them. As a growing company, things might not be that easy on your way to success. Deficiencies can go back and forth; what you need is to formulate a better strategic way when it comes in solving things out.

82% out of 100% of small business faces its downfall because of the complications in managing their cash flow. Solving these matters might be that hard, and for that reason, there special and dedicated companies offering their full potential in making things easier and better for your business. They know the struggle of managing delinquent and multitude accounts for small business owners, so as a result, they come up with the idea of helping in organizing and repairing your problems in your company’s cash flow.

Being busy working on the other important resources of the company might end you up, missing the updates on your debtors. This problem can also cause damage to your cash flows. Bringing in your debt collector in the very first arrival of this crisis can avoid you from facing overdue distress. Don’t let small problems end your way up to achieving your goals. Focus on it and set plans for everything; it is important to look for assistance when having a bunch of complications.

How can you be very sure about hiring a Debt Collecting Agency?

First- A business owner must have a background check about the previous partners of the agency. Check for the feedbacks and comments of the previous clients of the agency.

You should always be sure with the reports and information from their previous clients. Make a deeper exploration of how the agency performs its duties and responsibilities. In that way, you can have a bit of idea of how the agency handles its clients.

Second- Look for an updated certification that the agency should have in order for them to have their right to perform their venture.

Certification is a way of describing if a company has met the qualified characteristics, quality of work, and services needed to be verified as a certified agency.

You might be sure with the company’s background information but it is not just the background information that you should check, but also its proof of accreditation. It is one way of assuring whether the debt collecting company your about to have is qualified for hiring or else you might end up having another dilemma instead of the solution.

Third- Ask if the company has the ability to track for the debtors that are smart enough to get lost on your radar, especially when their due date is near.

There are companies that use skip tracing research and database device that can use for tracking all the missing names of debtors in your radar.

When you’re working, you should have the ability to think in advance of the possible consequences in trusting your debtors.

Fourth- Ask how they can secure your partnership and private information.

Look for their ways on how they fully secure their clients. Assurance in security is where you built the trust in your partnership. You must know their way of taking care of your debts and how they can provide full security assistance in your company’s cash flow matter.

As your company grows its people’s knowledge in business, managing should also grow. There is nothing wrong in having someone to lean on when you’re superbly struggling with your business troubles. What matters is that you are very much sure on whom you are trusting and what you are dealing with.

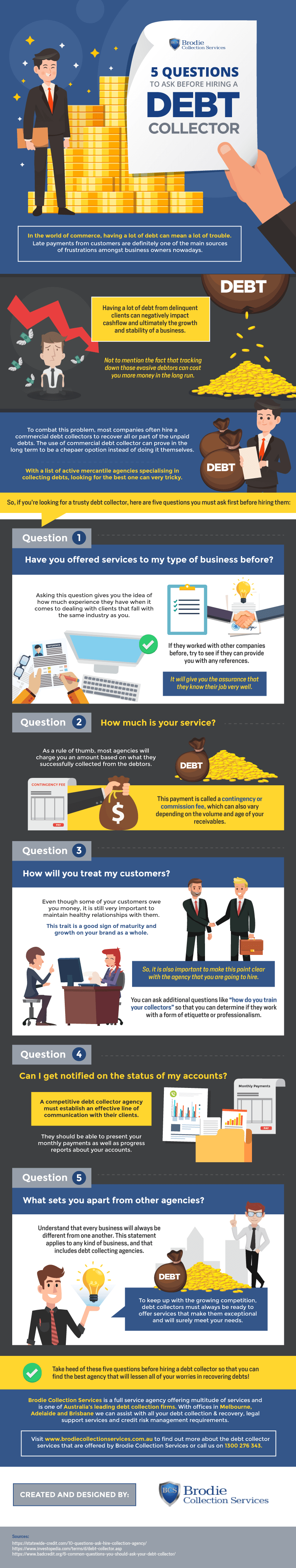

To learn more about debt collection agencies and the advantages of hiring one, check out the full infographic below from Brodie Collection Services.