GreenWood Investors letter to shareholders for the first quarter ended March 31, 2019, titled, “Building Gamma.”

“It used to be about trying to do something. Now it’s about trying to be someone.” -Margaret Thatcher

Dear GreenWood Investor:

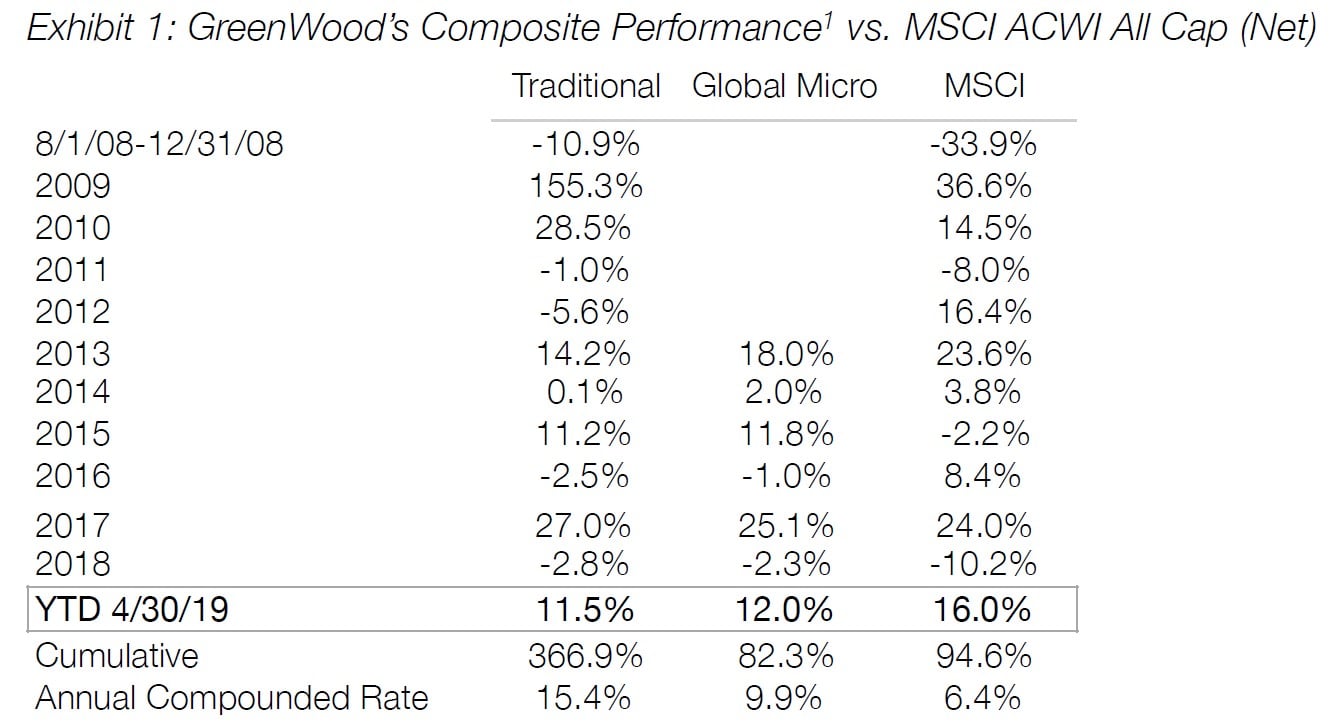

We had a very productive beginning to the year with decent, but not satisfactory returns. As spring approached the northern hemisphere, like good gardeners, we over-planted seeds to ensure a bountiful harvest later. With all value creators, or Builders as we call them, deferred gratification is a key element of significant value creation. Much of our portfolio has delivered solid progress on their transformational paths, and in most cases, the market has barely kept up, or even punished value creation, instead preferring short term profit maximization. We are not only undeterred, but have great excitement about the quarters to come. We relish opportunities where the market is blithely unaware of underlying transformations, as it translates to future positive surprises and alpha. The more significant the gap in expectations, the more significant the alpha generated, in our experience. We have also started generating gamma, which we will discuss in greater detail throughout the year as our plans unfold.

Q1 hedge fund letters, conference, scoops etc

Process Evolution

Our process is ever-evolving, particularly so over the past few years such that our old tag lines of Global, Deep Value and Special Situations no longer capture everything we do. While our style is still very much characterized by these descriptors, we do so much more than just pick global special situations stocks. Due to the intensifying competitive landscape in the investment management industry, we have adapted in order to improve our alpha and gamma generation ability. We feel that our new tag lines, Global, Collaborative, Builders more accurately reflect what we do and why we are here.

Our mission is to help our investors, companies and teammates perform at the top end of their range of possibilities. That mission is first fulfilled by excellent investment performance, regardless of the economic environment we face. Of course we cannot control the timing of the results, but we can control the process, and we can constantly improve it. Furthermore, every position we own requires months of deep fundamental research, which often uncovers areas where our companies can improve. Given our investor base is highly sophisticated, and our portfolio and research is completely transparent, our own investors often uncover areas where both we and our companies can improve. This is the opposite from how the fund industry has been run, as being vulnerable and admitting we don’t know everything runs contrary to “System 1” thinking. Most investment firms bless clients with their wisdom from their penthouse offices while the clients, who are usually wealthier and more productive, have a better idea of what is happening in the real world. We have flipped this ivory tower mentality on its head, and would prefer our highly successful investors to tell us what they know for sure.

This maximizes our group’s ability to have insights, and importantly, these insights come from people who have skin in the game. Having skin in the game not only aligns interests through accountability, but brings a sense of urgency, resilience, and attention to detail that cannot be purchased from any expert. Our brains generate insights when we least expect it, and they are more likely to come in the shower or on a run than from a consultant sitting at a desk under a fluorescent lightbulb. We share the insights derived from our Lonely Planet approach to diligence, which in turn drives further insights, uncovers risks more comprehensively, and keeps us together and on the same page. We believe this is why, when some of our investments suffer temporary stock price setbacks, we regularly receive countercyclical flows, as investors understand the longer-term upside possibilities in these names.

Our collaborative efforts reach well beyond our investor base, as the only way to truly know what the other side of the trade knows is to talk to these counter-parties. We’re constantly wondering what we’re missing, and we’re always trying to maximize the behavioral advantage we have in our portfolio. While we have nearly a hundred investors, we have over three thousand friends keen to read our research with varied industry expertise. We have reached out to many of you to get thoughts on specific positions we are working on, and of course we repay this favor through research updates on the relevant topics. This collective brilliance usually unearths a mosaic of information we use to make connections to better understand reality. And then, when our understanding of reality differs materially from the market’s, we strike.

We think of our portfolio as an idea meritocracy, almost akin to a “best ideas” fund, concentrating in only the most opportunistic securities. We continuously re-underwrite our opportunity set via our ranking framework to ensure a very timely and actionable portfolio. While our past decade provides a foundation upon which we’ve built, the only thing that matters is the next decade’s set of results.

Building Gamma

In the past and at our best, we have backed excellent management teams guiding companies through transformational moments in their history. Most usually, these companies are managed by the founder or a controlling family, who we call Builders, that optimize for long-term value as opposed to short term profits. But other times, we can contribute to the improvement in the underlying strategy and execution when a Builder is not on the scene. Due to the market’s preference for short-term profit maximization, which our historical data correlates strongly to long-term value obsolescence and degradation, we often find situations where the management is doing exactly what we want them to do, but the market trades the stock down because of no near-term catalysts. As we outlined in a research note to investors last week, this dynamic has been most recently highlighted by TripAdvisor stepping on the gas in its Experiences division, significantly increasing its investments in the division. The company is profit maximizing its hotel division in order to build a potential global monopoly in a rare area of consumer spending that has yet to digitalize. The market lamented the profit hit, while we cheered it. We love “dead money,” and we get a double benefit by combining a value-maximizing strategy with a deep value entry price, something our venture capitalist friends do not enjoy.

This is also the situation we face with our largest position. We had argued the company should have eliminated the dividend in order to fund growth initiatives and a share buyback. While the company still paid a reduced dividend, investors over-reacted to the cut earlier this year. We have at least been able to take advantage of the irrationality at the same time we are accelerating a transformation at the company.

Our Builders fund, which launched last year, has brought an ownership mentality to a business that has been run for the benefit of the bureaucracy running it, at least until our board entry last month. After recent and ongoing purchases, we now own roughly 8% of the company, and share a close relationship with two families that own a further 18%. Through our board seats, we are in the process of transforming a former bureaucracy into an owner operator. We are excited to demonstrate the many ideas we are implementing to create value in the short, medium and long-term, and we’re very enthusiastic for a busy summer ahead. Our new CEO has the talent, drive and humility to bring a Builder’s approach to the company. Underlining the CEO’s conviction in the transformation, he has been using his own cash to buy shares in the company; a welcome hard pivot from previous management’s reliance on fixed cash salaries and luxurious benefits. We now have an accountable principal in charge with skin in the game.

Other Builder peers, which we define as companies where insiders own over 20%, or those which the founders maintain control through dual class share structures, have outperformed indices by a large stretch, 8.7% vs 3.4% compounded since 1974. We seek to significantly outperform this venerable class of companies through a renewal of key relationships and new growth investments which will be funded through both balance sheet and administrative actions. Freeing up resources that are being highly underutilized will allow us to first focus on delivering enhanced customer value, and second, more aligned incentives to empower our workforce to work together more effectively to serve our customers. Profit will not be the goal, but only the result of excellent execution.

We’ve sized our Builders Fund subscription to generate a double for our fund if we’re able to obtain our base case objectives over the next few years. Because the business has some counter-cyclical features, we are excited about this set of dynamics at this stage of the market and economic cycle. We look forward to bringing some of our hallmark tools, such as a collaborative multi-pronged plan to win, which is already in full swing, a focus on simplicity and efficiency, and more transparent and honest disclosures with stakeholders.

Transparency & Competitive Advantages

Increased transparency, both within our portfolio and in corporate governance matters, aligns the interests of all involved in long-term value creation. Just as Fiat increased its transparency during the Italian market crisis in 2012, and Rolls-Royce has done during its own significant investment cycle during which it has dramatically under-produced cashflow, increased disclosures allow long-term investors to understand the dynamics and gain conviction in the investment merits. Given our knowledge of the business, we have great conviction Rolls will far surpass its 2020 and 2022 guidance despite current estimates still lagging its conservative guidance. Through our thorough collaboration with investors and industry stakeholders, we have unearthed some very interesting developments which we think have a 50% chance of coming to fruition over the next year. Should such transformational announcements occur, the current bearish consensus will look very much out of touch with reality.

Speaking of jet engines, we can contrast this increased transparency of reporting to the opaque disclosures of Bernie Madoff or General Electric (GE), both of which produced decades of supernatural consistent growth at the expense of the long-term viability of both business models. Of course, transparency and long-term stakeholders on the board are no guarantee that long-term value creation will ensue, as Enron’s disclosures and Volkswagen’s long-term oriented corporate governance starkly shows. There needs to be more than just boxes checked. There needs to be not just skin in the game, but soul in the game, as Nassim Taleb has written in his most recent work.

Of course, total transparency is sometimes self-defeating for competitive reasons. Yet, even Ferrari, which spends €528 million a year trying to win Formula1, will sell its old F1 cars to its most devoted clients on a two-year delay. Not only has the technology typically advanced so dramatically over those two years, but Ferrari chooses to trust its most steadfast customers, which in turn elicits die-hard loyalty from these fortunate Ferraristi. Ferrari’s competitive advantage, like Amazon’s, lies in its speed of innovation, not any patent.

When we first started talking about the merits of any investing operation having a ranking framework, I initially worried that we’d lose what little competitive advantage we had. But we have continued to evolve this framework so quickly that I’m confident we’re leading the leaders despite being continuously under-funded relative to our peers. As Jack Ma dogmatically insisted at the founding of Chinese e-commerce behemoth taobao.com, under-funding a new initiative forces the organization to find efficiencies and shortcuts that simplify its product and differentiates it versus the wellfunded competition. Despite the blank check ebay.com gave to its Chinese division, Ma completely eliminated their monopoly position in a matter of years. The Taobao team was hungry, and they were a little foolish, to paraphrase the Whole Earth Catalog that inspired so many of Silicon Valley’s founders. By restricting our research to only investors with skin in the game, we have largely eliminated any thesis leakage to the broader community, and our investors have repaid our trust in them through industry-leading retention, novel insights and counter-cyclical capital commitments. After nearly every investor interaction, I think to myself, “I don’t deserve the investors we have with us.”

I came from a very humble background, manning the cash register at a local toy store since before I was ten. In hindsight I was a pretty wicked Lego salesman, but it came from a genuine enthusiasm and no urge to “sell.” I’ve taken the same approach with GreenWood. We do not have, and will never have, a marketing person. We let our ideas speak for themselves, and our enthusiasm about the future is genuine and backed by data and very thorough research. We suppose the merits of our ideas were so self-evident that consensus-building for changes at our largest position was just as effortless as it was collaborative.

The Busy Summer Ahead

Our group’s evolution is only just gathering pace, and we are excited for the seeds we have planted to germinate. We have taken steps recently to deepen and broaden our feedback mechanism throughout our collaborative group, and we look forward to introducing further tools beyond the recently launched surveys.

Thankfully, we have the resources and bandwidth to start a Luxembourg fund for our European Builders that have headaches dealing with Cayman structures. Keeping with our tradition, in order to launch the fund with a low cost structure, we are offering a Founders’ class with 0% management fee and a 15% performance fee for the first €5 million committed. Most of this class is already spoken for, but we are happy to broaden this class slightly in order to further reduce the annual expense burden. Just let Kveta know if you’re interested in receiving the information for this next fund, which should be ready in late summer.

As a reminder, we optimize for performance, not size. We have taken steps to pause subscriptions in the past, and anticipate pausing again in July as our strategic plan becomes a hard and fast commitment that will require market disclosures. Our opportunity set has never been better from a risk-reward or quality perspective. Our funds’ risk-reward is over 100x. That stat is hard to believe, but of course relies on shorts to offset any economic hardship our long positions could experience. Most of our investments have non-cyclical characteristics which mitigate much potential economic weakness.

Furthermore, the expectations gap on our portfolio remains very wide, with 2019 being a pivotal year of transformation for our coinvestment, Rolls-Royce, Bolloré (and Vivendi), Cairn Energy, Telecom Italia, and MEI Pharma. Additionally, we believe our counter-parties are dramatically underestimating the magnitude of fundamental improvement occurring this year at TripAdvisor and Piaggio. Conversely, they are materially underestimating the magnitude of the deterioration of the fundamentals of our Canadian and Auto shorts.

As robots continue to take investment flows in our industry, their behemoth legal teams implement corporate governance “best practices” through appointing board members who seek to minimize liabilities. Large institutional investment managers have consistently been motivated not by value creation, but by avoiding mistakes which could get the bureaucracy fired. This is not the story of value creation, it is one of mediocrity. BlackRock and State Street are sowing the seeds of their own under-performance through this liability-minimization approach to corporate governance. And they will make beating the robotic indexes even easier for the Builders going forward. We are happy to have joined the group of Builders this quarter. And we are excited for the gamma, or value-add, we can add to our investment returns through thoughtful, strategic, and patient oversight. We constantly tell ourselves that “mediocrity is not worth the effort,” as Sergio Marchionne frequently reminded us all.

In this industry, being clever is more important than being the biggest. Scale is actually the enemy, contrary to so many other industries. The process of innovation most often occurs in companies with resource constraints and hungry founders. With our passion, sleepless nights, and reputations on the line, it means that we have much more than skin in the game, we have soul in the game.

With that said, we conclude this quarter’s brief and very delayed letter to get back to work, and get back to execution. There is much to do. As one of my heroes, David Hawkins wrote, “Straight and narrow is the path; waste no time.”

Annuit coeptis,

Steven Wood, CFA

This article first appeared on ValueWalk Premium