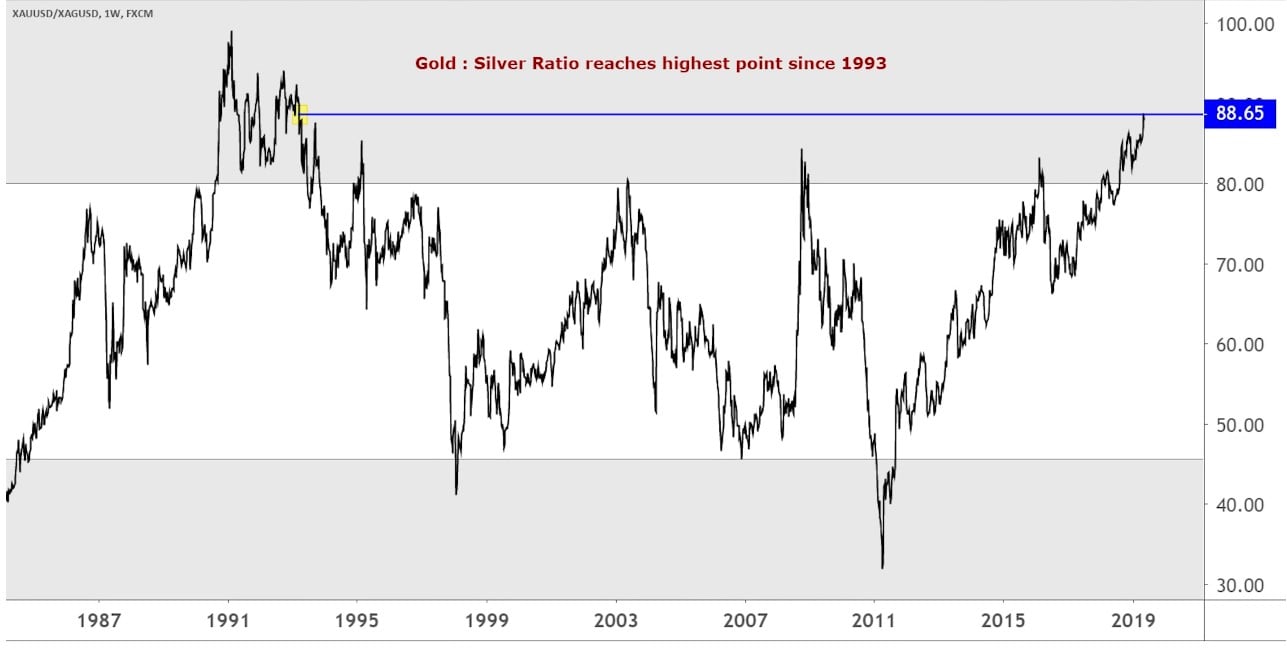

The gold to silver ratio is the highest it has been since 1993. We cover the price movements of gold, silver, platinum, palladium, the U.S. Dollar Index, Equities markets, and more.

Gold Silver Ratio Highest In 25 Years – Golden Rule Radio

Q1 hedge fund letters, conference, scoops etc

Transcript

Welcome to the Golden Rule Radio this week is a historic week in the metals market. Why guys the gold silver ratio baby. Yeah yeah yeah. Yeah. It pushed above eighty nine. Just about love eighty nine and that's the highest it's been since 1993. So what does that mean.

Silver is very undervalued. Just the price of silver in the mid for teens 14-40 ish today on Wednesday recording looks like it wants to turn around. It looks like it is ready to go higher. It's been holding right around here at this fourteen forty level. One thing to note on the daily chart is that the RSI did not break below 30 on the daily chart when it hit its low here. So obviously the trend is still down with Silver but it looks like it could easily turn around here and start moving higher and therefore tighten that gold silver ratio the gold price has held above its previous low around the twelve seventy level and we are watching it closely because this is the seasonal time where we're expecting a bottom with gold in between now and in July. So we're looking at hopefully a little bit of weaker levels in the mid twelve hundreds to have some buying opportunities but we may not get it but that's what we're watching.

Sure and our seasonal pricing seems to be going away. I mean May's almost over I guess we still got June and July for the summer months but we get into the Indian wedding season here later this year and that always ends up pushing the metals prices back up. So following that Indian harvest Indian wedding season the gifts given and you always see a little bit of pop in price in the meantime. Yeah I think we're all kind of in agreement that we see gold possibly if not likely continuing to push down although it seems to be having a little bit of trouble getting below these 2070 marks that's actually encouraging to me.

So how does this correlate to to the U.S. dollar. I mean we're now above 98 on the index again we haven't seen that very frequently at all here. Do you expect that to coincide with the dollar rally this summer.

Dollar to me sort of looks like a like a raccoon inching its way towards a picnic trying to grab something. I mean you look at this movement up in the dollar it's been very slow very measured up and down up and down building this compressing wedge.

I still think the dollar's coming up into a 100 to build that big multi-year head and shoulders pattern where in the world did you hear that analogy of a restaurant industry tour how to seed a racket doing this. His brain works definitely. Absolutely fantastic.

We've got hawks and doves and bears and bulls and now raccoons.

I think the point here is that raccoons head towards trash and they'll eat out of the trash. And therefore I think the dollar will ultimately be trash. However the dollar looks like it wants to actually go a little bit higher it's back above 98 as Terry said and I wouldn't be surprised to see the dollar gaining some strength.

Yeah and if we see consistent interest rate policy you should see consistent movement in the dollar right.

I think so and I don't think that there's going to be a substantial downturn in the dollar until there's weak monetary policy. You know certainly a reversal in interest rates if we if we get that into some point in the coming months and 2019. Well that could certainly be the trigger. But until then there's no reason on the world scene for it to not go to 100.

Exactly yeah. Our interest rate is higher you know than than the other competitive markets.

And since we live in a world where nothing makes sense anymore I mean a increase in the interest rates which I mean mathematically or at least long term you would assume is good for the dollar and dollar value probably ends up causing a decline in the value of the dollar. Just given the way markets work today.

Yeah things are backwards. I mean it's like the recent news that 43 percent of Americans polled think that socialism is a good direction for this country to take. If that's not a reason to buy gold I'm not sure what is. But you know we may be in a holding pattern here for 16 18 months pending the election cycle. Also you know there's more than just the monetary cycles financial economic cycles. There are political cycles and this is going to be a rocky road. A lot of impeachment talk if that gets legs that could also be something that drives gold higher.

Let's move over to the other white metals platinum and palladium this week since the last recording palladium had a solid couple of days had a really good conversation with a client today just his theory interestingly enough was that palladium is just not on the radar of the manipulators and is palladium representative of what silver and platinum and gold would be doing if if unhindered. But anyway just throwing that out there. We did see some strong rallies we've rolled over a little bit today Miles won't you walk us through that that palladium chart.

Sure and I mean platinum is made so much ground over the last month against palladium it's complete.