Global Return Asset Management performance review for the month ended April 30, 2019.

Dear Friends and Partners,

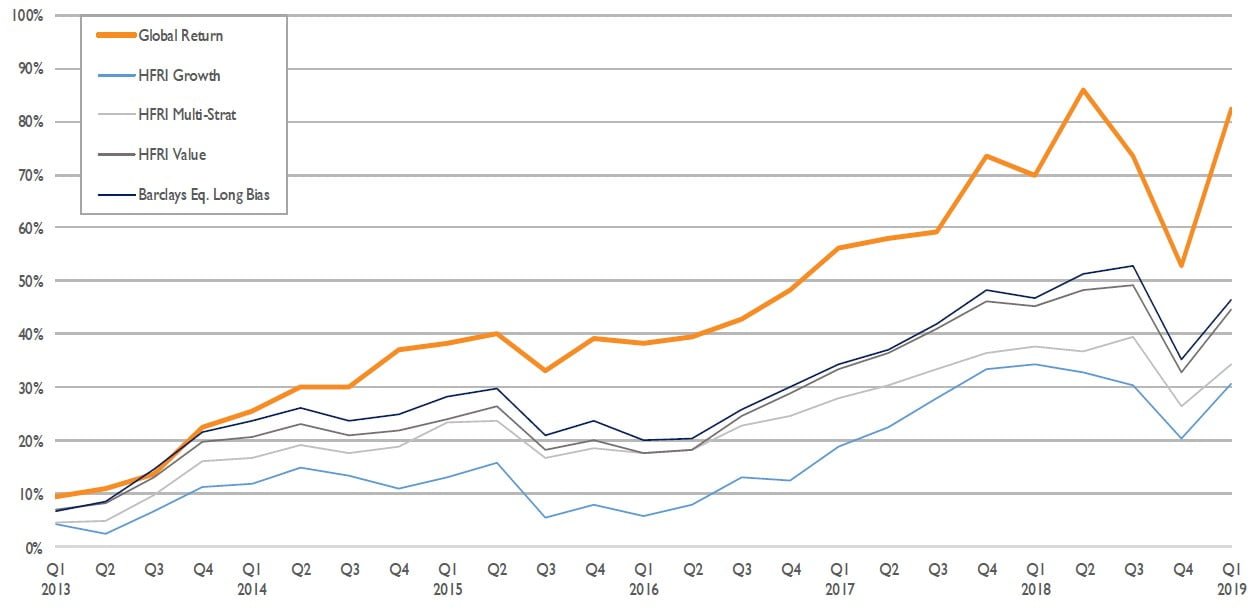

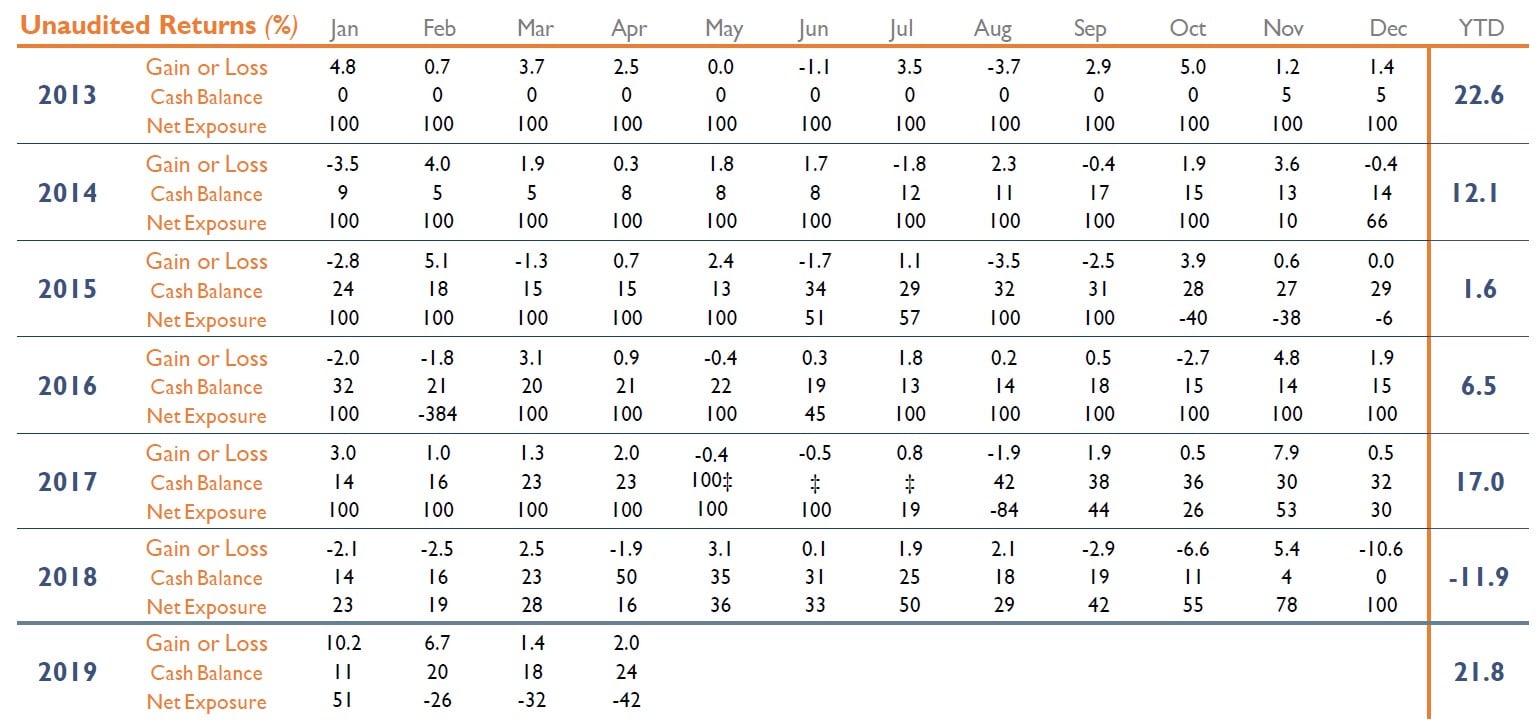

In April we generated a net return of 2.04%. We ended the month with 24% of assets in cash and had a net market exposure of -42%. Year-to-date our portfolio has gained 21.8%, net.

Q1 hedge fund letters, conference, scoops etc

Mid-Month Update

As I write this note (Monday, May 13th), global markets are under significant pressure from the trade war between the U.S. and China. For example, the S&P 500 and the Dow are poised for their worst May performance in nearly 50 years. Conversely, Global Return's performance month-to-date reflects a portfolio that's well-positioned to weather this volatility and capitalize on opportunities as they become available.

Entering the month of May, Global Return had a strong cash balance and negative market exposure. Our cash balance provides us the opportunity to take advantage of the market's volatility by acquiring select investments at attractive valuations. Equally important, our hedges provide crucial downside protection.

My primary responsibility to each of you is a dual mandate to: 1) Consistently execute our value investing strategy focused on risk management, and 2) Opportunistically deploy capital to acquire investments that meet our criteria. In volatile markets, our disciplined execution of this mandate proves essential to delivering results. And it's by executing this mandate, that Global Return has delivered sustained and superior risk-adjusted results.

In the coming week, I'll provide additional insight on the market's volatility and how Global Return plans to navigate this uncertainty. Please stay tuned for more information.

Investment Objective

Seeks long-term capital appreciation and income using value investing strategies focused on risk management.

Investment Highlights

- Concentrated portfolio of U.S. listed stocks

- Long-term focus with low turnover

- Bottom-up fundamental analysis

- Hedged with index options

- Fully integrated ESG

Primarily invests in select high-quality companies that are market leaders with a history of increasing revenues and cash flow, have high returns on invested capital and durable competitive advantages. Short exposure with index options for risk management.

About Global Return

We’re technology-powered value investors focused on risk management. Our advanced technology and proprietary risk management strategies have enabled us to consistently deliver superior risk-adjusted returns since our inception.

This article first appeared on ValueWalk Premium