Farnam Street Investments letter to shareholders for the first quarter ended March 30, 2019, discussing their investment in Fairfax Africa Holdings Corp (OTCMKTS:FFXXF).

It’s been a busy time of shareholder meeting travel. There are a lot of subtleties you can pick up in person that you don’t get just sitting at a desk. It’s worth the effort to monitor the pulses of the businesses we own. The “Woodstock of Capitalism” is this coming weekend as we make the annual pilgrimage to Omaha to learn from Warren and Charlie.

This quarter’s letter discusses all things Africa and the rationale behind a recent investment we made.

Q1 hedge fund letters, conference, scoops etc

Fairfax Africa Holdings Corp [FFXXF]

I’m writing this letter after spending a few productive days in Toronto. The trip allowed me to learn more from Prem Watsa (aka “the Warren Buffett of Canada”), convene with other high-caliber investors, and check up on our various Fairfax investments.

Our quarterly letters tend to focus on the philosophical underpinnings of sound investment strategy. This letter will deviate and provide an in-depth rationale behind a recent investment: Fairfax Africa (Ticker: FFXXF).

“Wait, Africa? Jake, you live in California. Why are you investing in Africa of all places?!”

I teased this investment in last quarter’s letter. If you recall, Mr. Munger had given me the advice to fish where the fish are, and to look where others aren’t looking. I believe Africa qualifies on both fronts. The following will be a deep-dive explanation (read: statistical overload) on “Why Africa?”, “Why FFXXF?”, and “Why Now?”

Why Africa?

“Ricardo, when he invented the law of comparative advantage, did not predict that someday, the law of comparative advantage would greatly accelerate the growth of some poor nation which had a particularly able-bodied populace. Free trade would allow them to come up rapidly and take a lot of power away from the companies that had been on top.” -- Charlie Munger, talking about China

Here’s the quick version of the thesis: Africa has the potential to be the next China (or India) miracle growth story.

Investing is hard. To do it well requires a variant perception that is also eventually right. As famed investor Seth Klarman remarked, “Value investing is at its core the marriage of a contrarian streak and a calculator.”

Are the iPhones best days behind it? Has Facebook impaired its earning power with repeated privacy violations? Can Amazon pull another AWS rabbit out of its hat? Will Netflix sign up half of the humans on earth to justify their relentless content spend? You probably need to know the answers to these tough questions before you buy any of those companies. As Yogi Berra said, “It’s tough to make predictions, especially about the future.” Yet it doesn’t require a bold opinion to make money in Africa when growth is running at 10% per year. A rising GDP tide lifts all boats. (For reference, Africa’s real GDP grew at 5.4% per annum from 2000-2010.)

Demographics

“Demographics are destiny.” -- Richard Scammon

The United Nations projects that 2.4 billion people will be added to the world by 2050. A staggering 1.3 billion of those will be in Africa, and their middle class is projected to grow to 1.1 billion. Humanity’s center of gravity is shifting toward the Continent.

The world is aging. Here are a few surprising statistics about median age demographics: United States is 35, China is 37, Europe is 42, and Japan is 46. Africa is in diapers by comparison with a median age of just 20, and 70% percent of their population is under 30 years old. Wealth equals capital times human effort to the power of the available technology stack.

Watch this one-minute video from Bill Gates on demographics. It’s little wonder why the Gates Foundation focuses so heavily on Africa.

Africans are moving to cities. By 2030, Africa will have 89 cities with a population over 1 million. Theoretical physicist Geoffrey West wrote a terrific book called Scale. In it he examined how size impacts organisms, cities, and companies. One of the takeaways is that cities allow greater outputs like wages and patent production due to their density and network geometry. For every doubling in the size of a city, you increase these effects by 15% more than a mere doubling. This non-linearity holds true across time and geographies. Scale allows you to get more from your infrastructure in what West has dubbed “superlinearly.” (It’s not all good; you also get a more than doubling in crime and illness. You could say cities scale everything human.)

Economics

Industrial revolutions are generally a boon for humanity--and they are picking up speed. From 1820-2015 (roughly 200 years), Europe and America saw their average per capita incomes rise by 20x during the first industrial revolution. From 1960-2015 (55 years), Asia’s average income increased by 10x. The East achieved half of the results in a quarter of the time and is catching up quickly.

Is it that hard to imagine that Africa could be next in line to climb the ladder? Technology will allow them to avoid much of the sunk infrastructure costs the developed world is saddled with (think: skipping landlines straight to cell phones). Africa already has the most mobile payment accounts of any continent. What else will they be able to do cheaper and easier with new technologies?

Africa has cheap labor. The Chinese average hourly wage went from $0.43 in 2000 to $2.88 in 2013 as China flexed its manufacturing muscles. Africa’s labor costs are currently at 2000 China levels. Granted, we’re all competing against robots more every day, but there’s still lots of use for cheap labor in creating the material wealth of the world.

Pop quiz: How many African companies have more than $1 billion in revenue?

If you watch the news, you might guess zero and there’s nothing but tribal infighting. (Most people guess well under 50.) The answer is over 400. We systematically underestimate Africa due to biased, salacious news coverage.

We love shopping in America, spreading only 400 people per retail outlet in the U.S. In Africa there are 60,000 people per establishment! (Not a typo.) Is it a big leap of faith to imagine the potential of a Walmart, McDonald’s or 7/11 rerun in retail as a new army of middle class emerges?

It’s getting easier to do business in Africa. According to studies, 41 of 54 African countries showed measurable improvements in governance and political stability over the last decade. After concerted reform efforts, Rwanda’s ease of doing business rank jumped from 150th in 2008 to 29th in 2018 (U.S. is 8th). Other African countries are now copying Rwanda’s success. Leaders today know they need business to bring jobs and improve the quality of life of their constituents. There have been 5 peaceful elections and leadership changes in the past 2 years in Africa. The goal is to recreate the model of the European Union with open borders and open skies. Such policies are projected to boost GDP by an additional 2% per year above trend.

“If we get infrastructure right, if we get energy right, and if we create a lot of jobs for Africa’s youthful population, I think we’ll have a new dynamism, a new growth process… actually impacting the lives of people and lifting hundreds of millions of people out of poverty.” --Akinwumi Adesina, President of the African Development Bank

Geography and Structure

Africa is HUGE. The Mercator projection distorts land masses near the equator, making them appear smaller. To give you a perspective, Africa is three times the size of Europe at over 11 million square miles. It’s an 8 hour direct flight from Cairo to Johannesburg, farther than from the U.S. to Europe.

Is it all uninhabitable desert? Hardly. Africa has 60% of the world’s arable land and could become a global breadbasket with a favored location between the East and West. Africa currently imports 90% of its food ($65 billion worth), so even feeding itself is a big opportunity. It’s likely humanity needs Africa if we are to fill the bellies of a 10 billion global population.

The Continent is blessed with oil and gas reserves. There are 180 trillion cubic feet of natural gas off the coast of Mozambique alone. For reference, that’s 20 years worth for the EU. Much of Africa’s subsoil remains unexplored--less than 1/5th the level of penetration compared to OECD countries. Who knows what petro-treasures are buried in their geology?

Infrastructure Opportunities

As you’d expect, there are massive infrastructure needs for Africa to catch up. Below are some stats on how Africa compares to other emerging markets (the so-called “BRICs”: Brazil, Russia, India, China), and the U.S.

Electric power consumption (kwh per person):

Africa 632, BRICs 2,622 (4.1x), U.S. 12,071 (19x)

Rail Density (km track/sq km)

Africa 7.1, BRICs 10.4 (1.5x), U.S. 43.7 (6.2x)

Road Density (km road/sq km)

Africa 97, BRICs 485 (5.0x), U.S. 70 (lots of empty space in the Western U.S.)

McKinsey has created a “stability index” based on a score of debt/gdp, trade balances, unemployment levels, incidents of violence, gdp growth rate, etc. They found the best countries to operate in are: Cote D’Ivoire, Ethiopia, Kenya, Morocco, Rwanda, Senegal, Tanzania.

The takeaway is there’s a lot to do, but there’s also a lot to work with in Africa.

Why FFXXF?

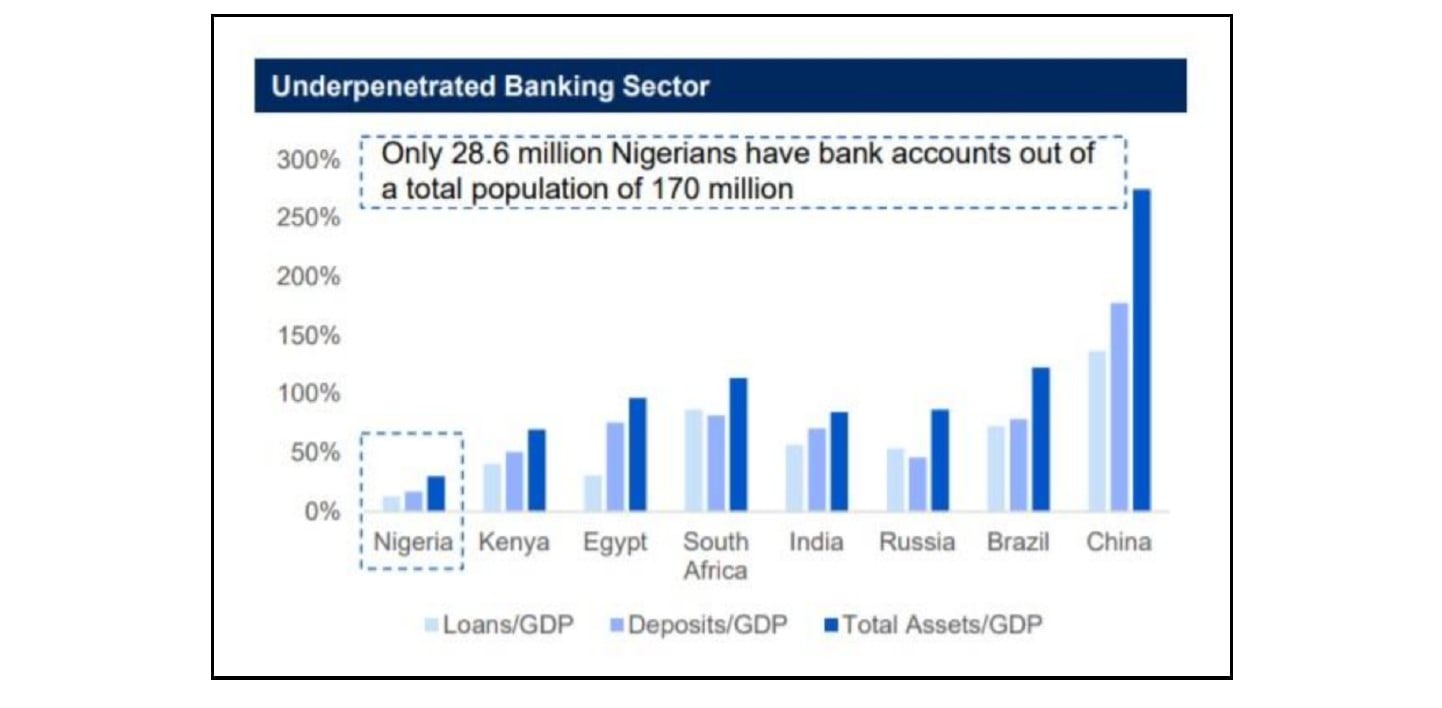

Fairfax Africa is a publicly traded fund that is managed by the team at Fairfax Financial in Canada. It invests in both private and public investments--wherever they find the most opportunity in Africa. FFXXF’s expressed investment targets are infrastructure, financial institutions, consumer services, retail and exports. Fairfax has massive skin in the game, owning 59% of the fund themselves. They have a terrific track record, compounding book value at 18.7% per year over the last 33 years of CEO Prem Watsa’s tenure. They’re proven capital allocators.

What’s Inside: Private Investments

AFGRI -- agricultural services and food processing company that FFXXF bought at 1.2x book value. AFGRI is the largest John Deere distributor outside of the U.S.

GroCapital -- owns South African Bank of Athens.

Philafrica -- food processing company focused on maize, wheat, and cassava milling.

Nova Pioneer -- for profit education network run by former McKinsey partner with 98% CAGR in enrollment.

What’s Inside: Publicly-Traded Securities

Atlas Mara -- financial services and bank. The stock is down 85% since it IPO’ed at $10/share. FFXXF bought 42% of the company at 33% of book value, but still suffered from premature accumulation. CIG -- engineering and infrastructure firm focused on electricity, oil, gas, rail, and building. FFXXF owns 4.6%, bought at .80 price to tangible book value. One CIG subsidiary is particularly interesting. It’s called Conlog, and it’s the largest smart meter manufacturer in the world, selling in 52 countries. Collections for electricity service in Africa were difficult, averaging only 65-70%. Now people can buy pre-paid cards, similar to phone calling cards. A change in business model turns a collections problem into pre-paid float, but it requires smart meters to work.

Why Now?

I’ve been following FFXXF since it launched more than 3 years ago. In 2018, the stock was down 43%, presenting us the opportunity to buy. The main drivers of the poor results were unrealized losses on its investment in Atlas Mara and unrealized currency losses due to the weakening of the South African rand.

What’s interesting about buying a fund is we can get two layers of discount. First, because Prem and his team are value investors, their purchases are done at discounts to intrinsic value. They’re scouring Africa for cheap investments with attractive risk/reward dynamics. Second, we waited until the container that houses those investments went on sale. (We are value investors after all and don’t like paying retail.)

Valuation When We Purchased

Shares Outstanding: 63m

Market Cap: $590m

Book Value (Most Recent Quarter): $651m

Current Price to Book Value: .90

For reference, P/BV peaked at 1.72 last summer and bottomed at .70 in late December. (I was sucking my thumb while .70 ran up to .90.)

Concerns

It’s never all roses--there’s some friction to account for. To operate the fund, Fairfax charges management fees (0.5% on uninvested money, 1.5% on invested). For that fee, they have to provide a CEO, CFO, and other management. Additionally, Fairfax earns a performance fee: 20% above a 5% hurdle, measured every 3 years. Besides owning 59%, they have further skin in the game.

Valuing private businesses is not always clear cut. For a recent example, the food delivery company Blue Apron was valued at $3.2 billion in private transactions. It subsequently IPO’ed, and today it sits at $194m after being subject to public market scrutiny. That’s a 94% loss. All private valuations are massageable and should be treated with a dose of skepticism.

There are accounting rules to follow, but FFXXF has a lot of latitude in valuing their private investments. So far, all of the valuations I’ve seen in the reports have been conservative DCFs with high discount rates and modest growth assumptions. For example, here’s how they’re valuing AFGRI:

At September 30, 2018 the company’s estimated fair value of its indirect equity interest in AFGRI was based on an internal valuation model which consisted of a discounted cash flow analysis based on multiyear free cash flow projections with assumed after-tax discount rates ranging from 12.1% to 25.8% and long term growth rates ranging from 1.0% to 3.0%.

Due to Fairfax being a permanent holder of 59% of the equity (and attracting long-term oriented investors), FFXXF has very little volume in daily trading. Light trading benefits small, nimble investors like us-- the big, smart money find it hard to get in. Yet small volumes also lead to wilder price fluctuations. Daily quotes should be taken with extra grains of salt. This is a decades long thesis anyway, so spare yourself the day-to-day noise of the ticker tape.

Summary

With FFXXF, the hypothesis is we’re buying good capital allocation and unique deal flow with a serious Africa tailwind over the next 30 years. We’re relying on a team with a good track record to do the boots-on-the-ground work on our behalf. We’re paying less than the “retail price” of the $10 IPO for a basket of businesses already bought at a discount--two layers of cheap. As long as the team continues to execute on their mission statement, it stands to reason that we’ll do quite well.

It’s unlikely to be a smooth ride. There will be plenty of ugly stories to come out of Africa: corruption, misallocation of resources, debt defaults. Capitalism is messy, but it’s the best system devised so far. I still believe in the big, glacial trend of global improvement. This holds especially true for Africa as they’re starting from such a low position. It will be a coming-out party just to get to “decent.”

It’s been a tough couple hundred years for Africa. You could say a lot of the same things about 1900-1960 China though. One can make the argument that China started from as bad a place as Africa is now, maybe worse in some respects. Literally millions of Chinese (maybe more than 50m!) starved to death. China was a poor backwater of the world, yet look at them now.

Part of the hypothesis is that technology, and especially the internet, is a game-changer: the ability to catch up with the rest of the world is easier than ever with the cost of sharing information near zero. It’s harder than ever to hide a ruthless dictatorship, a corrupt government, or stolen resources. Useful information that makes lives better like successful ways of doing business, or a youtube video of how to repair a diesel engine can spread like never before. An interconnected world is a disinfectant for bad behavior and propagator of good ideas. It’s possible that the massive industrial transformations that took Europeans and Americans 100 years and the Chinese 30 years, may take Africa only 15. It could surprise everyone how quickly they catch up. We want to paddle now to catch that wave.

My heart is warmed by the prospect of redemption for a place that’s been a perpetual basket case. Consider it tech-enabled reversion to the mean for the bottom quartile of humanity. How can we not root for that?

Quick Housekeeping Item

Part of being a registered investment advisor with the State of California means providing compliance updates and disclosures annually. Here’s where we keep the most up-to-date documents for our clients: https://www.dropbox.com/sh/sp5mqetpcwrjc1b/AABxGZXC6vKI-AFosZam6xita?dl=0

We recently went through a routine State exam, which happens every five years or so. Although it was painfully in-depth (think: colonoscopy), we fared well for a small shop. The exam was a great way to tune up our compliance processes and procedures. We’re now running as tight a ship as ever.

As always, we’re thankful to have such great partners in this wealth creation journey.

Jake & Lonnie

This article first appeared on ValueWalk Premium