We then continued the class by looking at how different companies (Disney, Vale, BP, Microsoft etc.) are treated very differently by markets, when it comes to accumulating cash and why.

Slides: http://www.stern.nyu.edu/

Session 23: Dividend Assessment Continued

Q1 hedge fund letters, conference, scoops etc

Transcript

Did you see the Apple news yesterday. So what did Apple announce. What did they actually announce higher earnings. Higher earnings for. So let's break it down for us. What did they report a button. I mean let's face it this is about last quarter's earnings. Everything else is kind of hypothetical. What are they reported by last quarter's earnings. That iPhone shipments were down 70 Gendron. If you looked at the report basically said I hate things I know we're not a growth company. And then they added something to the report. They will focus but they also increase their dividend.

Remember we talked about dividends as a signal. I don't know if this is dividends as a camouflage dividend to the distraction but they increase dividend. So today you're going to see the market work through that information. The initial reaction is very positive. But I don't think people are reacting to the right thing. So by the end of today we've figured out what people actually thought about the report. Because what I see Apple signaling Like Crazy is we're a mature company. Our growth days are behind us. Trust us on this one. And the reason they keep signaling it is people don't seem to believe them. They keep thinking oh well Apple is a growth company where's the growth. And Apple keeps growing say we had a growth company. Look we'll increase Lebanon's were buying back stock. In fact they also announce they're going to buy back more stock. Essentially telling the world look where we're not finding great investments with this cash we're going to return the cash so that dividend signaling story you're going to see it play out with Apple.

Today. So let's continue with that dividend story.

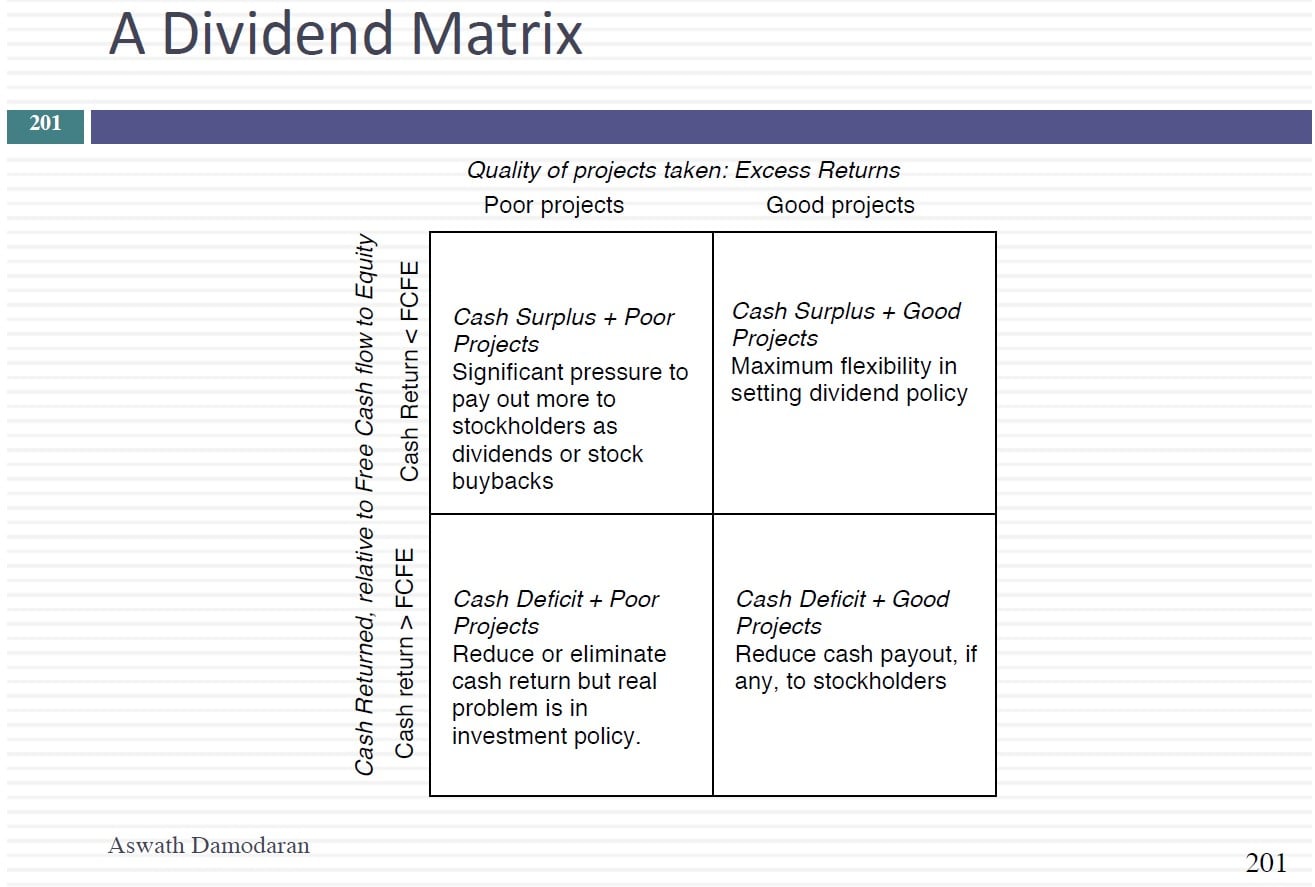

We looked at the dividend matrix. Basically the the two things you look at when you assess dividends are what are the dividends relative to free cash flow as equity. Paying out more less or about what you can and then we looked at the good projects bad projects are neutral projects someone to take what we talked about last session and make it into a matrix. So this matrix on one axis your project Good Too Bad and the other matrix you on the other side of the matrix you have how much cash is returned relative to free cash flow equity. So let's take the top right hand box. These are companies that are accumulating cash and have good projects. So if you take a Google in there say that's where I'd put it even though Google had a bad couple of days as you as you saw. So even these things can shift. So if you have a company which has good projects and it's accumulating cash it gets the maximum flexibility in terms of accumulating cash. There's no stress put on it. No pressure.

Basically you're allowed to accumulate cash if you're a company that is accumulating cash and you've a history of bad projects. You're exactly the kind of company that's going to get targeted to return cash. The activist investors focus on it. If you're a company which is returning too much in cash and its good projects you're hurting yourself in two ways. One is you returning too much and second you're turning away projects you should have taken. So there you're going to encourage the company to return cash and finally if the worst case scenario companies with bad projects that are paying out too much and you're not sure where to start. And then I said you've got to go back to the source of the problem which is if you have an investment problem you can fix it by just fixing dividends. So let's take a few examples. I want to start with an unrelated example that I want to take my five companies through and we're going to play a little game. But before I do that we take Microsoft I showed you Microsoft in 96 right. Two point two billion dollars in free cash for equity return nothing. Cash balance went up 97 another three billion 98 5 billion and each year it kept accumulating cash. In fact by the end of 2002 it had 43 billion in cash with at that time was a huge cash balance I think was the largest cash balance accumulated by a company at that point in time. And I checked all the news stories equity research reports at the end of 2002. There was absolutely no pressure and Microsoft return any cash. Nobody is complaining about the cash balance. And the reason is simple Microsoft went public in 1986. By 2002 it was already the largest market cap company in the world. As a stockholder What do you complain about. The returns were immense.

On Windows and Office they were making 50 percent return on invested capital that a great track record and people seemed to be OK with the cash balance Twelve months later Microsoft paid at that point in time again the largest dividend in history. They paid a special dividend of 33 billion dollars.

And investors were asking them to return more cash in 12 months they went from a company with no pressure to return cash to aid this company that returned 33 billion cash and felt even more pressure to return cash. So what happened in a 12 month period to change.