Via CrescatCapital

At Crescat, we remain steadfast in our net short US and global equities position in our hedge funds. We are driven by our macro fundamental modeling and themes.

Three historically extreme macro imbalances in global financial markets today pose significant risks to investors at large today, including:

- Record US equity valuations;

- Historic global debt-to-GDP; and an

- Unprecedented China currency and credit bubble.

The imbalances in and of themselves do not help with the timing of the financial market downturn and economic contraction that would correspond with their unwinding. The lopsidedness has existed for several years already and only become more extreme. For the timing of the unwinding, we need to look at macro signals that have been reliable forecasting tools ahead of prior downturns. At Crescat, never have we seen the timing indicators more abundant nor more aligned than they are today:

- Bearish late-cycle Fed pause;

- Global dollar-based liquidity squeeze;

- Global M2 and central bank assets have contracted;

- Record rate-of-change in Fed interest rate hikes + quantitative tightening;

- Multiple bearish US Treasury yield curve inversions;

- Falling 2-year Treasury yield;

- US versus world yield curve inversions;

- US versus world same-term yield spread extremes and reversals;

- Consumer confidence faltering from cyclical contrarian peak;

- Declining pace of labor gains from contrarian unemployment low;

- US earnings growth massive deceleration;

- Global economic surprise downward trend;

- Global PMI declining trend;

- Record late-cycle dollar volume of IPOs and busted IPOs;

- Corporate credit spreads recently near-record tight, starting to slip;

- Utility stocks starting to diverge from US treasuries; and

- Breakout in the gold-to-S&P 500 ratio from a multi-year resistance line.

To see Crescat’s macro charts on these, please refer to our recent quarterly and monthly letters, macro decks, website, and social media all accessible through our website.

One unique aspect of this cycle with respect to the extension of the US stock market has been the US administrations’ relentless hype of a US-China trade deal that has kept the market aloft. As we have been saying, any material trade deal remains highly unlikely. We laid out all the reasons in our last quarterly letter. Last Friday, it became clear to us that there is no imminent trade deal with China. It should soon become clear to everyone. We believe the US and China are firmly embroiled in a trade war if not a new cold war. It is yet another bearish macro timing signal that draws its closest parallel to 1930 when the US Congress passed the Smoot-Hawley Tariff Act, one of the catalysts for the Great Depression.

Crescat relies first and foremost on macro fundamentals, as opposed to technical analysis, to time the business cycle and position our portfolios. Nonetheless, we can’t help but point out the bearish triple top pattern on the S&P 500 with a broken trendline. This could be the technical signature of a historic market top.

According to Stanford PhD money manager, John Hussman, who correctly timed the bear markets associated with the tech bust and global financial crisis, a “60-65% market loss would be run-of-the-mill…over the completion of this cycle” and “assumes that reliable valuation measures will simply revisit their historical norms, rather than breaking below them as they have in most bear markets.” Like Crescat, Hussman has been early in timing the coming downturn, but we believe we will both soon-enough be vindicated.

From record valuations for US stocks across at least eight fundamental measures, as we have laid out in our prior letters, a roughly 50% correction would only get us near median historical valuation measures. Another way to view this from a technical standpoint is to take the longest-running US stock market index, the Dow Jones Industrial Average, and calculate a regression line from its beginning to today as we do in the chart below. Investors can see that we are more than two standard deviations away from the Dow’s long-run trend mean, portending a 49% correction just to get to mid-levels.

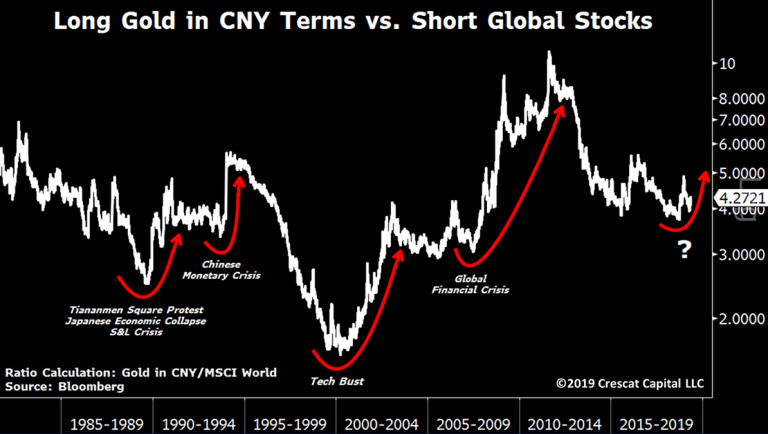

Today we continue to be the most tactically bearish that we have been in this economic cycle and are positioned accordingly. While we hold many individual securities in our portfolios to extract alpha, when it comes to our global macro fund, the following chart explains about 75% of our core underlying macro positioning in the fund.

Crescat Believes this Could be the Macro Trade of the Century

Whether one is looking to capitalize on an outright downturn or to merely hedge a traditional long portfolio, we believe Crescat’s strategies can add substantial value. We are not perma-bears, but we have indeed had an increasing number of bearish macro themes over the last half of this record-long US economic expansion now in its tenth year. The good news is that we have proven that we can profit from our bearish themes even though we have not had an official bear market and recession yet.

We show this in the chart below. The idea came from Russell Clark. He and his currently bearish Horseman Global Fund were featured in a recent Bloomberg article. Like Clark, Crescat is determined to tactically capitalize on a near-term market downturn. Bloomberg showed Horsman’s performance during the worst months of the S&P 500 Index in recent years.

We show the similar chart for Crescat’s two hedge funds below. The chart shows Crescat’s hedge fund performance in the seven worst global equity market down months of the last five years as measured by the MSCI World Index. These coincidentally were also the worst months for the S&P 500.

Crescat Global Macro Fund made substantial money during all seven of these worst global equity sell-off months. Crescat Long/Short Fund made substantial money in six of them. These market downturns were characterized as follows:

- January 2014: Emerging market equity and currency rout;

- August and September 2015: China yuan devaluation and stock market crash;

- January 2016: China stock market crash and oil bust;

- Feb 2018: “Volmageddon”, the short-vol ETF bust; and

- October and December 2018: 20% correction in US stocks.

Crescat had active themes and positions based on the macro fundamentals that unfolded in each of those market selloffs. We point these periods out because we don’t think we have seen anything yet. How well we did in these downturns should provide some inspiration and give us something to live up to when we finally get the bear market and recession that ends the current business cycle.

After a tough April and YTD, the good news for our investors is that in May the market has started to fall once again. Through yesterday’s close month to date, the MSCI World Index was down 4.1% and the S&P 500 Index was down 4.5%. At the same, Crescat Global Macro Fund was up approximately 8.4% net, and Long/Short was up approximately 5.7% net.

We invite you to watch our recent Real Vision videos if you have not had a chance to see them yet:

https://www.realvision.com/tv/videos/end-of-the-cycle

https://www.realvision.com/tv/videos/the-macro-view-on-gold

Performance through April is shown below

Sincerely,

Kevin C. Smith, CFA

Chief Investment Officer

Tavi Costa

Global Macro Analyst

For more information please contact Linda Smith at [email protected] or (303) 228-7371

© 2019 Crescat Capital LLC

Important Disclosures

Case studies are included for informational purposes only and are provided as a general overview of our general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of our strategies or of the entirety of our investments, and we reserve the right to use or modify some or all of the methodologies mentioned herein. Only accredited investors and qualified clients will be admitted as limited partners to a Crescat fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. Crescat funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to the Crescat funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any Crescat fund with the SEC. Limited partner interests in the Crescat funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in the Crescat funds are not subject to the protections of the Investment Company Act of 1940. Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and annual audit. Current performance may be lower or higher than the performance data presented. Crescat is not required by law to follow any standard methodology when calculating and representing performance data. The performance of Crescat funds may not be directly comparable to the performance of other private or registered funds. Investors may obtain the most current performance data and private offering memorandum for a Crescat fund by contacting Linda Smith at (303) 271-9997 or by sending a request via email to [email protected]. See the private offering memorandum for each Crescat fund for complete information and risk factors.