Choice Equities Capital Management letter to investors for the first quarter ended March 31, 2019.

Dear Investor:

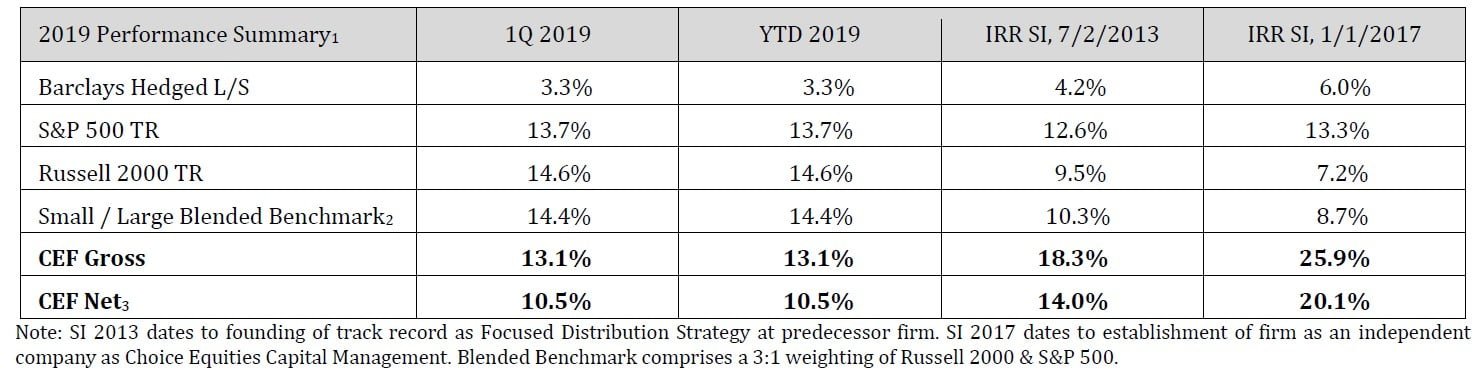

2019 is off to a solid start. The dour mood that marked markets at the end of the year has quickly faded and been replaced with more optimistic leanings as signs of looser monetary policy and progress on global trade initiatives have allayed investors’ fears. Though our portfolio lagged a touch in a largely vertical move for the markets in the quarter, Choice Equities Fund (CEF) fared well, up +13.1% and +10.5% on a gross and net basis. By comparison the Russell 2000 and S&P 500 were up +14.6% and +13.7%, respectively, putting our Small/Large blended benchmark up 14.4%. This latest update now means $1 invested in our portfolio since becoming independent in 2017 is worth $1.51 versus our Small/Large blended benchmark of $1.21.

Q1 hedge fund letters, conference, scoops etc

Executive Summary

In this letter, we will highlight the notable performance drivers in the quarter as usual. We will then discuss recent portfolio changes and provide a write-up on our most recent addition in shares of US Xpress, Inc. Finally, we will welcome Thompson Clark, CFA to our team as Senior Analyst and discuss how his hiring fits into our plans as a boutique investment management firm.

Notable Performance Drivers

Rubicon Project, Inc. (RUBI), our largest position in the quarter, performed well contributing ~7% to gross returns for the quarter. The Q4 report marked the first “clean” year over year comparison since the company became a one-sided supply-focused platform and featured strong 25% level revenue growth and impressive incremental margins in the ~90% range. The outlook, which includes continued mid-20s revenue growth and steady progress to a mid-20s EBITDA margin was equally strong. With new products soon to rollout to enable continued share gains against an industry backdrop that has advertisers focused on consolidating to fewer and more trustworthy platforms, the company appears well positioned to become the preeminent independent supply side platform in an industry featuring attractive mid-teens expected growth rates.

Chipotle was the second largest contributor to performance in the quarter, adding ~3% to gross returns. New management has the company performing well as a combination of inventive marketing and burgeoning delivery initiatives have returned the store traffic counts to growth for the first time since early 2017. Strong execution and nascent company initiatives in digital and delivery continue to position the company well for continued success as our nation’s preeminent fast casual food chain.

In the detractor column, light hedging reduced gross performance by ~1.5% while our position in Destination Maternity (DEST) also deducted ~1.5% from performance in the quarter. DEST shares have been stuck in neutral since our entry point two quarters ago. Though the new management team continues to make progress in rightsizing its cost structure, poor optics in critical top line variables continue to muddy the picture of the company’s potential earnings power. The Q4 report fell short of expectations and produced some outbursts of seriously rotten sentiment from investors as anyone who was on the call can attest. While the negativity is something that can be expected given shares’ recent performance, a dispassionate and forward-looking analysis of the earnings report suggests a few critical variables may have been overlooked that point to improvement, and potentially soon.

Gross margin, which declined meaningfully from 3Q to 4Q, was later confirmed to be running nearly flat to the prior year’s quarterly level thus far in Q1 which implies an improving trend in merchandising efforts given subsiding product discounting. Additionally, performance in the company’s eCom business, a key pillar of the investment case which has featured unimpressive flattish growth in each of the last two quarters, has generally been underwhelming for a company intent on transitioning much of its business to the online channel. However, much of the sales softness stems from the company’s third-party business as management has placed a renewed emphasis on pursuing sales at higher margins there. In contrast to this subsegment, the company’s own site eCom sales, which importantly is now 80% of the eCom business, continues to perform well with 9% growth for the quarter. With the third-party business stabilizing, growth in the total eCom channel looks set to improve to a mid-single digit or better level soon.

As before with many of our investments, we believe the current muddied optics and lack of investor attention combine to make for an interesting opportunity. As these metrics begin to show improvement and the poor optics fade, a case can be made that the current 30% levered free cash flow yield presents quite an attractive entry point.

Portfolio Activity

We added one new position in the quarter with the acquisition of shares of US Xpress, Inc. (USX). It is a deep value play featuring a deeply depressed price following a busted IPO which we will highlight further below. We exited investments in LKQ and Entercom primarily to make room for recent additions. Finally, in early April, we added a new position in a seller of home-based goods which itself looks to be on sale, trading at half its prior forward earnings multiple on depressed earnings due to one-time growth investments. The company has a differentiated model and is in its very early days of its new store expansion initiatives. Late April also saw us add two new starter positions which we are excited to talk about in future letters once we have fully established our positions.

USX – US Xpress was founded in 1986 by Max Fuller and Patrick Quinn after they received a gift of 48 trucks from industry veteran Clyde Fuller, Max Fuller’s then-retiring father. Since then, the 32-year-old trucking company has grown to become the 5th largest in the category of asset-based fleets in the US featuring a blue-chip customer base where eight of its top ten customer relationships have been in place for 15 years or more. Originally highly acquisitive when they were public the first time in the ‘90s and ‘00s, the business was bought out from public markets in a management led buyout in 2007. After an IPO last May, the company reemerged as a public company under the direction of CEO Eric Fuller, Max’s son.

Describing the IPO as a bust may perhaps be overly polite. Originally looking to price around $19-20 / share, investors anxious that a still growing truckload cycle was set to soon slow were only willing to pay $16. Other signs gave potential investors pause as well. Entering the IPO, the company was over-leveraged and seeking capital to fund operational improvements. Its fleet was old at 28 months on average and needed updating. It self-insured its accidents to limits of $10M versus more typical levels of $1-3M. And it trailed peers on many important operating metrics like utilization, driver turnover and maintenance and insurance cost ratios.

The company’s second turn as a public company has gotten off to a rocky start. The 2Q 2018 report, the company’s first since coming public, narrowly missed estimates due to a service issue with a large customer in its dedicated division. The 3Q report was little better as the company experienced its worst quarter of accidents in the last fifteen years. Even though the carrier had renegotiated its insurance limits from $10M to $3M on improved credit worthiness after using the IPO proceeds to pay down debt, they did not have the newly lowered limits in place in time to prevent a second missed quarter. As a cyclical company without a loyal shareholder base heading into a nasty market selloff, shares were punished ultimately bottoming around $5.

Despite these hiccups since coming public, the company has made quite a bit of progress. The leverage (from 4x to 2.2x) and interest rate (from 11% to 5%) are meaningfully improved. They have the aforementioned new insurance agreement in place. They have also shown some improvement at the Operating Ratio (OR) line and made progress on lowering driver turnover and improving utilization. But there is still much further to go. The fleet age remains on the high side relative to public company peers. Accordingly, 2019 will be a big capex year as they purchase trucks with expiring leases which the company anticipates will lower the fleet age to a very respectable 18 months at year end. The fleet upgrade will further pave the way for the company to drive insurance and maintenance expenses lower while also becoming more attractive to drivers thus limiting turnover and in turn improving utilization metrics. Across these three buckets, we see opportunities to lower expenses by as much as 300 bps and drive the OR into the low 90s in the near term, to a level much closer to its peers.

Importantly, management appears aligned with shareholders and incentivized to achieve these improvements. Eric and Max Fuller together own 11.3M shares of the company and notably added to their position at the IPO, purchasing another $20M worth of stock at $16 from some exiting shareholders. Also of note is that the company appears to be singularly focused on closing the OR gap to its peers as this metric is the primary driver of bonuses in the company’s short term incentive plan. Though the freight market has indeed softened relative to the decade highs seen last summer, it remains generally tight as contract rates continue to grow and offers a potential tailwind should the market tighten up again later this year as many of the tariff related inventories that were pulled forward last fall and winter are cycled through. With the wettest winter in the contiguous US on record now behind us, it seems estimate revisions for both the company and the group may be nearing a turning point in coming quarters.

Should the company execute steadily on these initiatives, we see the company potentially earning near $2 of EPS in 2020. At that point, this trucker would look more like an average trucker in terms of OR with leverage closing in on 1x which would suggest a peer average multiple of 12 – 16x would be likely. A potential acquisition in a consolidating industry also seems to offer downside support, as even Swift Transportation, universally reviled by most trucking investors, was purchased for 8x EBITDA just two years ago. As the chart below highlights, shares look cheap on EBITDA, really cheap on earnings, and really really cheap on forward earnings power.

We were pleased to again collaborate with our old friends at Value Investor Insight and were delighted to have this pick highlighted in their February 2019 issue. For those interested, that feature was just posted to our website. We look forward to updating you on their progress in quarters to come.

Business Update (Or: An Ode To Boutique Investment Management And A Diatribe On The Shortcomings Of Groupthink)

On April 2nd I officially welcomed Thompson Clark, CFA to the firm as Senior Analyst. Thompson comes to us from about eight feet down the hall of our building here at Oberlin Rd. where his office has been next to mine since last April. He brings seven years of investment experience and was most recently the author of the Focus newsletter for Bonner & Partners.

While impressed with his experience and obvious passion for stocks, one of the things I found most notable about Thompson was his seemingly unquenchable thirst to figure things out. Whatever the event, an unexpected company filing or even a random tweet, Thompson always seemed most concerned with answering the question of the moment or finding that little nugget of truth that really solved the riddle. In a business where I find a common trait amongst analysts is loudly and breathlessly proclaiming the full extent of one’s supreme knowledge at any given chance, I found this combination of humility and intellectual curiosity highly valuable and consistent with attributes I had been intent on finding in someone to add to our team. After observing these traits on full display over the last year while informally collaborating on research and stock ideas, I am delighted to officially welcome him to the team.

To many reading the announcement of this hiring, this might look like the first in a long line of subsequent hires in an effort to build out an investment staff with an army of analysts and researchers. In actuality - as far as the investment staff is concerned and if things go as envisioned - this hire will likely be much closer to the last than the first. This has little to do with any effort of mine to minimize human interaction or even shy away from an expanded office space bill, but everything to do with my own personal views of how to execute on our vision to build a best in class boutique investment firm.

You see, as a boutique we have a number of advantages other larger firms simply don’t have. We are unencumbered by bureaucratic distractions. We don’t have endless committee meetings or TPS reports. We have no growth or value style boxes limiting our stock selection. We are entrepreneurs focused on one thing. We manage a small pool of capital. With this setup, we can be quick. We can be nimble. But above all else, our lean operation positions us for continued independent thinking.

As I was rereading the Buffett Partnership letters this past fall in conjunction with Jeremy Miller’s excellent and highly recommended companion guide Ground Rules, I was struck by the importance of this last point. After some reflection, I determined this independent thinking was likely our most valuable asset as a young and growing investment firm and endeavored to preserve it at all costs as we move forward in our journey. To understand why, let us check in with Warren Buffett, here from 1965 when addressing the general unsatisfactory performance of the active management of trust companies of the time (yes, a topic of discussion even back then). Buffett writes:

“In the great majority of cases the lack of performance exceeding or even matching an unmanaged index in no way reflects lack of either intellectual capacity or integrity. I think it is much more the product of group decisions - my perhaps jaundiced view is that it is close to impossible for outstanding investment management to come from

- a group of any size with all parties really participating in decisions;

- a desire to conform to the policies and (to an extent) the portfolios of other large well-regarded organizations;

- an institutional framework whereby average is “safe” and the personal rewards for independent action are in no way commensurate with the general risk attached to such action;

- an adherence to certain diversification practices which are irrational;

- and finally, and importantly inertia.”

From Buffett’s critique on the shortcomings of groupthink above, we can surmise that it is his view that the independence of thought is among the most critical attributes available to enable superior investment performance. This makes sense in theory. After all, if consensus views are captured by market prices, then establishing a position built around a non-consensus view – a CORRECT but non-consensus view – on some stock or security assuredly offers one the best prospects for generating superior investment results. But those non-consensus views only become harder to come by as more people are invited into the decision-making process.

So that’s the theory. But does it really apply in practice? Let’s take our investment in Chipotle as an example. As I mentioned in the 1Q 2018 quarterly letter, I presented this idea at the annual investment roundtable I attend in St. Louis each May. The thesis was quite simple: if incoming CEO Brian Niccol can fix Taco Bell, imagine what he could do for Chipotle? Yes, there was clearly more nuance to it than that. I discussed the company’s category-killing emergence onto the scene, the food safety issues that put them on their back, the nascent and untapped growth opportunities on the horizon with delivery and menu expansion and how they could leverage that with their recently installed second make lines which would position them incredibly well if customer foot traffic actually did ever return. I also highlighted the fact that the company had basically been playing rope-a-dope with its marketing strategy while they got all these things figured out. But the real gist of it was: if the new CEO could duplicate the success he’d achieved at Taco Bell, a much tougher task in my view, a strong case could be made that Chipotle, while expensive on 2018’s depressed earnings, looked like a pretty attractive investment if one was willing to consider what a brighter future might look like. Confident in my well-researched thesis, I launched into my presentation and made my case.

To say the group was eagerly nodding along in enthusiastic approval as the presentation concluded would be... generous. While it wasn’t complete crickets and I didn’t have to duck any tomatoes (it is a crowd equal parts polite and qualified), it seemed clear to me that if it came down to a vote, this would have been a big giant PASS. There was a healthy discussion and there were puts and takes aplenty. But in general, the potential investment generated far more concerns than compliments. Many questioned the reliability of the supply chain. Others questioned company culture. One investor didn’t like restaurants. And one by one it seemed the stock didn’t fit the criteria for this guy who looks for that. Or it didn’t fit the eye of that guy who looks for this. All in all, the consensus seemed to agree that it looked expensive for a brighter future that was far from certain. As skepticism mounted, the presentation ended quietly with little fanfare.

And such was the treatment for the stock that commands a wide lead in price performance heading into this year’s upcoming meeting. I feel compelled to note this episode in no way reflects any shortcomings of this investor group. It is simply a window into the thinking and decision-making process of all investor groups. Because each investor there has a framework that works quite well – for that investor. But when you put them all together, you tend to end up with a filtering process that filters out everything. And then only the safest and most obvious candidates make the cut. But of course, because the investments are safe and obvious to all, they are priced accordingly – all but ensuring mediocre investment results will follow.

Mercifully concluding this overextended diatribe, why is it again that I am adding a person to the investment staff? Because I like to do research. Real, fundamental, primary research. This means calls with management and company site visits. Talking to industry insiders and former employees. Tracking down people on LinkedIn. We do these things because I believe real research adds real value. And much of this stuff is simply effort and man hours. So, by adding a person, we double our man hours. But as far as portfolio decisions are concerned, nothing will change. I remain convinced, again back to Buffett, that the “investment committee should be an odd number and three is too many”. So, if anything goes wrong going forward, as before there remains only one throat to choke. But if something goes right, well, perhaps Thompson had something to do with it.

2019 Outlook

With the market and earnings levels both back to right about where they were last summer, it seems our characterization of the market as generally fair to fully priced is again apt. In this environment, it seems likely that future returns will bounce along forward at a rate that generally approximates earnings growth.

In contrast, I feel our eclectic portfolio, composed of ~15 businesses with their own idiosyncratic risks and company-specific stories, looks to offer much greater value and appears set to perform well in this environment. Though our holdings will assuredly be influenced by the market direction in the short term, in the medium to longer term, our performance will be driven by the business results of these specific companies and the unfolding of the catalysts that lay in front of them.

Conclusion

In closing, I would like to thank all of you as investors for your support. It has been a truly gratifying experience to welcome new partners along to our journey to grow our capital together through your recommendations and referrals. While I know our approach will not produce outperformance each and every quarter, I continue to believe it will be well worth our while over the long haul. Perhaps more importantly, given the overwhelming majority of our investable assets are invested alongside yours, I hope you take comfort in knowing we will never ask you to assume risks we ourselves will not.

As always, we are happy to discuss our investment outlook with you at your convenience. Please reach out any time.

Best regards,

Mitchell Scott, CFA

Portfolio Manager

Appendix - CEF Goals, Philosophy, Approach And Alignment

GOALS – We seek to generate market-beating returns over any rolling multiyear investment horizon while minimizing the risk of permanent impairment of capital. Additionally, we seek to communicate with our investors in a transparent and straightforward manner and ask only that they accept investment risks that we ourselves are willing to take. Given the majority of our investable capital is invested alongside theirs, we invest our limited partners’ capital as if it were our own, because it is.

PHILOSOPHY - We approach investing in public equities as an opportunistic businessman would. We spend most of our time studying businesses and building circles of competence in areas likely to offer attractive investment prospects and invest in only our most compelling opportunities. We view risk primarily as the likelihood of a permanent impairment of capital and pursue a carefully balanced willingness to trade some short-term portfolio fluctuations for the opportunity to earn higher returns over the long-term. We focus on growing, understandable businesses and seek to buy them at a substantial discount to our estimate of their intrinsic value. When we find them trading at attractive prices, we often act in size and weight our best ideas accordingly. And all things being equal, we prefer to devote more of our efforts to small stocks where we believe greater price/informational inefficiencies can often be found.

APPROACH – We invest via a long-bias hedge fund structure and concentrate our long investments in our best 10 to 15 ideas. Our work begins with a two or three-year outlook, and we only pursue investments we believe are likely to offer us a reasonable chance to generate an annualized return of 20% or better. While we pursue long-term oriented investments and seek to compound capital in a tax efficient manner, we readily acknowledge the often-turbulent markets do not always fit neatly into this framework and know some trading activity is sure to follow as a result. In the short book, we seek to generate absolute profits in a few stocks where we have uncovered a company entering financial duress or an excessively optimistic valuation where we feel their earnings outlook is likely to worsen materially. We will also use industry or market specific ETFs to mitigate market risk and will look to employ options and other opportunistic hedges when conditions appear favorable.

ALIGNMENT – We believe appropriate alignment of interests is the bedrock upon which all successful partnerships are built. Our primary means of ensuring proper incentive alignment is through significant co-investment of our personal wealth alongside our limited partners. Secondarily, we offer an investor friendly fee structure. We charge a modest management fee to support investment operations and charge an annual incentive fee on new profits only. Finally, commensurate with our fee structure which is intentionally structured such that the majority of fund earnings will be earned only if we generate compelling investment results, we commit to operating the fund as a boutique shop with a limited asset size. As many of our best investments often come from small stocks, we believe it is important to preserve our ability to take concentrated positions in our best ideas. Our size and structure ensure we are incentivized to generate compelling returns, not gather assets.

Think of it this way. On the one hand, we are incentivized to generate the best investment results possible. On the other hand, we are unwilling to invest in a way we feel is likely to result in a meaningful loss of our own investment capital. What more could one want from an investment manager?