Cashless cities topping the charts for contactless payments revealed: London doesn’t top the list

New data from Paymentsense reveals the UK cities leading accelerated growth in contactless payments with the top 10 expected to go cashless first.

Paymentsense have created an interactive map exploring the UK’s cashless capitals, detailing the cities with the highest proportion of debit, credit, contactless and all transactions. On average contactless transactions have increased by 10% YOY Nationwide.

[REITs]Q1 hedge fund letters, conference, scoops etc

Over 20 million contactless transactions took place everyday in the UK in 2018. Having processed over 300m transactions in 2019, it’s been revealed that Bristol is the capital of contactless card payments with over 73% of the city’s card transactions made via contactless payment.

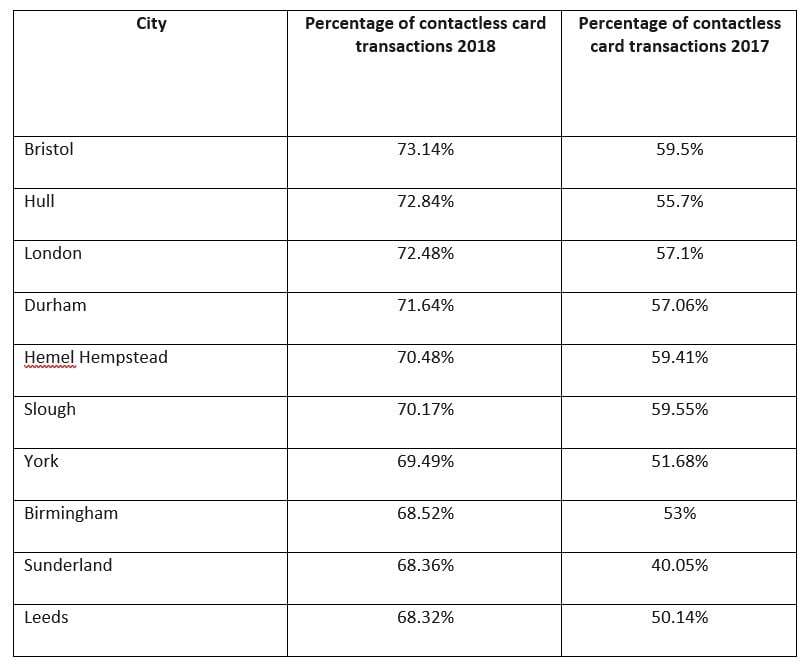

Bristol is championing the UK’s cashless movement and leading the way in terms of contactless transactions for a second year. Almost three-quarters (73%) of the city’s card transactions were made on contactless in 2018, a 14% increase from 2017 highlighting the move away from cash is only increasing.

Hull came in a close second with over 72% of transactions being contactless.

Surprisingly, London doesn’t make the list until third place, despite contactless cards being used everyone on public transport.

Top ten cities for contactless card transactions

Guy Moreve, Chief Marketing Officer at Paymentsense, says:

“As a society, we’re close to becoming cashless, with contactless transactions reaching over £5.6 billion in 2018 and set increase even further in 2019. There are areas of the country such as Bristol that are adapting to the shift in payments, while other large towns like Manchester and Newcastle are struggling to keep up according to our data. These cities must move with the times to stay competitive in our current digital era.

For the many businesses that have embraced the cashless society, the prospect of the increase in contactless payments is a positive move and likely to lead to business success ”.

Freelance copywriter Ellen Holcombe said: “I have seen a lot of cash machines and branches of banks close in my area however this hasn’t really impacted me. Most of the stores and services I use accept card and contactless. I think we’re living in a world that’s going to be cashless very soon and I’m okay with that.

With demand for cash machines falling and pressure on companies such as Link to keep specific ATMs running, it will be interesting to see how this plays out in the near future. If there’s one thing we can be sure of, however, it’s that contactless payments are here to stay and will most likely increase in popularity”.

You can see the full https://www.paymentsense.com/uk/capital-of-card-payments/

Further Information

- Card transaction data compiled by Paymentsense. Each section of the asset reveals the top performing city based on total transactions. This is then broken down to Contactless, Credit and Debit cards.

About Paymentsense

- As Europe’s largest merchant service provider, Paymentsense enables over 70,000 SMEs to process over £10 billion worth of card payments per year. From card machines to semi-integrated and online payment services, Paymentsense supplies small businesses with card processing solutions that allow them to take payments in store, online, over the phone and on the move.