Barac Capital Management commentary for the first quarter ended March 31, 2019.

Dear All,

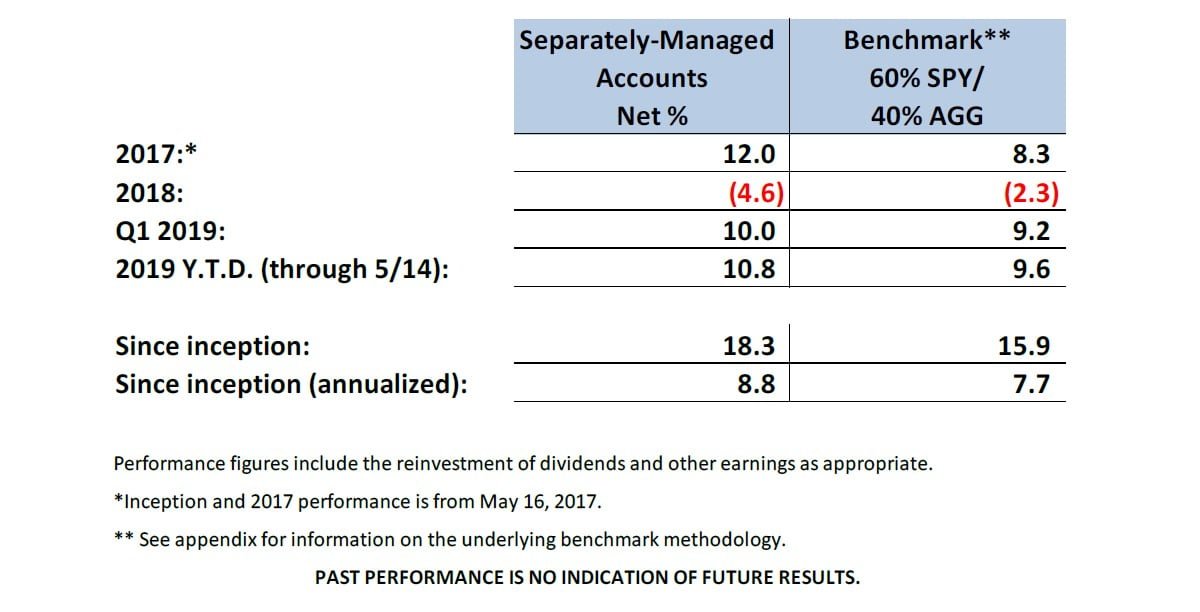

The aggregate performance of Barac Capital Management’s (“BCM”) separately-managed-accounts (“SMAs”)1 year-to-date (through yesterday’s market close; May 14, 2019) was 10.8% relative to a 9.6% return for BCM’s benchmark, resulting in 120 basis points of outperformance.

Q1 hedge fund letters, conference, scoops etc

Individual account performance may vary, depending on the timing factors and customized asset allocations. Please check your brokerage statements for the actual returns of your individual accounts.

Q4 and Partial Q1 ’19 Performance

From the beginning of Q1 through the most recent market close (on 5/14), returns amounted to 10.8% on a net basis (after fees), compared to 9.6% for the benchmark. Cumulative returns since inception amount to 18.3% (8.8% annualized) versus 15.9% (7.7% annualized) for the benchmark.

As always, it is important to re-state that returns were generated without leverage (either direct or effective leverage through options), without taking highly concentrated positions, and while conservatively holding substantial cash and/or Treasury bond positions.

Performance Commentary

Outperformance for the quarter was driven by individual security selection and I am pleased with this quarter’s performance, in light of BCM’s conservative asset class allocation (during a very bullish period for the equity markets). More specifically, BCM remained more defensively positioned than its benchmark (i.e. underweight equities and overweight defensive assets) which, itself, reflects a conservative asset allocation.

In the last quarterly report, I spent quite a bit of time talking about Roku, as it was the worst performer (down about 39% for the period). At the time, I said:

“Roku has been (and is expected to continue to be) a very volatile stock and it AGAIN went from being the best to the worst performer (down 39% for the period). If I weren’t a huge skeptic of technical analysis, I might say that I’ve identified a predictable trading pattern for this stock (up 100%-ish, then back down 50%-ish, then back up, etc., etc.).”

For this quarterly report, instead of focusing on the worst performer, I will spend some time talking about the best performer, which was…also Roku (up about 170% for the period).

So, perhaps I should revisit the technical analysis trends that I so quickly dismissed in the last quarterly report? Nah…I still don’t believe that this price movement was anything that could have been predicted with technical analysis.

In fact, I don’t think these short-term price movements could have been predicted with fundamental analysis, either. I was no more optimistic going into the company’s recent Q1 2019 results (when they exceeded expectations and their shares soared) than I was going into their Q3 2018 results (when they disappointed the market and their shares fell substantially). I’ve been invested in Roku since late 2017, based on a long-term belief in the company’s prospects and not any short-term view as to whether or not they will exceed expectations for the next reporting quarter.

Following the recent run-up in Roku’s price, I’ve taken some profits -- as more positive expectations are priced into the stock and risk/reward dynamics are less favorable (though still favorable, in my view). A typical way for an investment advisor to characterize taking profits is to essentially imply that “the easy money is gone now that everyone else realizes what I knew all along”. The truth, however, is that there really wasn’t any “easy money”.

In the investment management world, it seems that projecting complete conviction sells more than talking about the nuance of risks and rewards (i.e. reality). Nonetheless, there are risks and uncertainties with any stock, such that position sizing and diversification are essential portfolio management tools.

While the overall long-term investment thesis for Roku has played out extremely well, there were always considerable risks and uncertainties (and there still are). As a result of these risks, position sizing was always very important for risk management (particularly during the more euphoric stages of Roku’s volatile ride). Roku now accounts for less than 3% of Barac Capital’s assets-under-management (“AUM”), after growing to over 7% at one point in 2019 (during its rapid rise from the December lows).

The two holdings that had a material negative impact on performance were Walgreens Boots (-26% from position entry) and CVS Health (-21%). Both of these stocks have been severely impacted by market concerns surrounding pharmaceutical and health care regulations, as well as the seemingly ubiquitous competitive threat of Amazon.

I have shifted most of BCM’s retail pharmacy industry exposure from CVS to Walgreens, as it has less regulatory risk (with no health insurance business) and also has an attractive (depressed) valuation. Furthermore, in making this shift between the two stocks I was able to harvest CVS tax losses (for the taxable accounts that I manage), while maintaining the industry exposure (for a sector which I believe to be attractively valued). Walgreens’ stock has fallen almost 39% from its 52-week-highs and is now valued at less than 9x forward earnings (with a 3.3% forward dividend yield)2. To put that in perspective, the S&P 500 index trades at a multiple almost double that of Walgreens (with the S&P 500 at about 17x forward earnings and a 1.9% forward dividend yield)3.

To be clear, I do believe that there is some validity to the regulatory and competitive concerns surrounding Walgreens and I also believe that their stock should trade at a discount to the broader market. While the full investment thesis for Walgreens is beyond the scope of this letter, I simply believe that these risks are now much more than adequately priced into the company’s valuation. Walgreens and CVS (combined) now account for about 3.9% of Barac Capital’s AUM (with most of that exposure being in Walgreens).

Outlook and Positioning

Since the time of the last quarterly report, domestic stocks4 are up about 7% and not much has changed with regard to my conservative outlook and positioning. As I said in the last quarterly letter and will repeat, again:

“What continues to concern me is the earnings part of the price/earnings equation and the increasing risk that some of the contributors to current (high) profit margins could come under pressure. Earnings’ levels continue to reflect low interest rates (and low credit spreads), low wage growth, and the positive wealth effect of 8 years of rising stock prices and home values.

As we approach full employment and some of the government’s pro-growth policies come into effect, there is a heightened risk of wage pressure and increased interest rates with increased inflation. Furthermore, current valuations appear to incorporate little with respect to geo-political risks at a time when there is much political change and uncertainty. It also warrants keeping in mind that if/when the business cycle does turn (and assets prices fall), a resulting “reverse wealth effect” could exacerbate the impact of a cyclical downturn.”

For all of these reasons, SMA accounts remain more defensively positioned than the benchmark (which, itself, reflects a conservative asset allocation). This is reflected in the fact that 46% of the SMA assets are either in cash or U.S. Treasuries with maturities less than 5 years. Accounts also remain well diversified, with no single-stock position accounting for more than 4.0% of Barac Capital’s AUM. As always, risk management and capital preservation remain paramount to the investment strategy.

Thank you to everyone for your interest and support and please let me know if there are any questions you may have that I haven’t answered.

Sincerely,

Ted Barac

Managing Member of Barac Capital Management, LLC

This article first appeared on ValueWalk Premium