Analysis of AT&T Inc. (NYSE:T) financials comes as company lays off hundreds in California

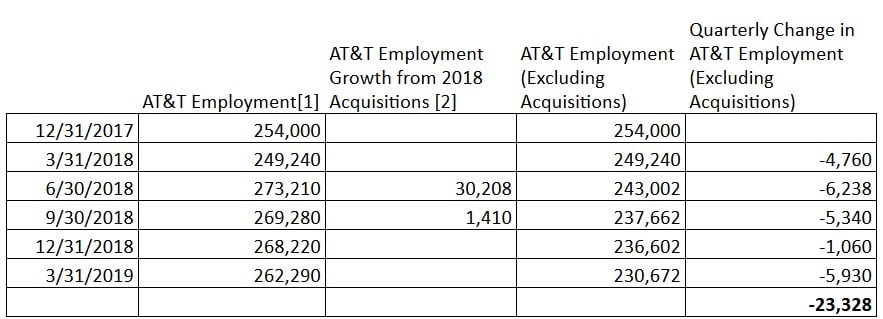

WASHINGTON – A new analysis of AT&T’s March proxy statement and annual report by the Communications Workers of America (CWA) shows the telecom company eliminated 23,328 jobs since the Tax Cut and Jobs Act passed in late 2017, including nearly 6,000 in the first quarter of 2019. These cuts come even as the company received a $21 billion windfall from the tax bill and is projecting $3 billion in annual tax savings going forward. AT&T’s annual report also shows the company boosted executive pay and suggests that after refunds, it paid no cash income taxes in 2018 and slashed capital investments by $1.4 billion.

Q1 hedge fund letters, conference, scoops etc

AT&T lobbied for the tax bill and said it would use its resulting increased profits to create more good middle-class jobs and raise wages, but the company continues to eliminate jobs, devastating workers throughout the country. Last week, AT&T announced it is laying off an additional 368 technicians represented by CWA in California. A report in Motherboard earlier this year noted that California is one of the states AT&T has targeted for “geographic rationalization.” While the cuts impact locations across the state, they are concentrated in the San Diego and Los Angeles areas.

CWA has been calling for a Congressional investigation into how AT&T has been using its tax cut since it has not fulfilled its promise to create jobs and invest in the United States. The union has been tracking employment numbers at AT&T. While AT&T responds to criticism of its massive job cuts with boasts about hiring, hiring to address turnover is not the same as job creation.

“What AT&T is doing to hardworking people across America is disgraceful,” said CWA President Chris Shelton. “Taxpayers aren’t going to let AT&T get away with receiving over $21 billion in tax cuts and then destroying the livelihoods of tens of thousands of people. Congress needs to investigate AT&T to find out how it is using its tax windfall since the company’s own publicly available data already raise serious alarm bells. AT&T got its tax cut. Where are the jobs?”

[1] AT&T quarterly reports [2] AT&T Proxy Statement (March 11, 2019)Read the new analysis here: AT&T Jobs Report Update

BACKGROUND

CWA has been leading the charge to hold AT&T accountable to the jobs promises the company made as part of its effort to pass the Tax Cut and Jobs Act. In March, CWA President Chris Shelton testified in front of the House Ways and Means Committee about the impact of the Tax Cut and Jobs Act on American workers, and called on Congress to probe AT&T on how it is spending its tax cut money, saying: “You may ask ‘what is AT&T doing with this money if it’s not being used to create jobs and invest in the U.S.?’ We’d like to know as well.”

A recent report from CWA found that AT&T has closed 44 call centers and eliminated 16,000 call center jobs in the last seven years. The report reveals the devastating impact of recent call center closures, including in areas of the country that have been hard hit by closures and layoffs.

CWA’s contracts with AT&T’s Midwest and national Legacy T units expired over a year ago, the contract at AT&T Mobility in Puerto Rico has also expired, and negotiations will begin soon in the Southeast, where the contract expires in August. AT&T has a history of constructive labor relations, but its insistence on eliminating long-term employees to reduce costs has undermined the trust of its workforce.