The Legg Mason board was overhauled last week when it added Trian Partners co-founders Nelson Peltz and Ed Garden as directors. Trian will also have the right to nominate a third independent director to be included on the management slate at the 2019 annual meeting. The new directors will replace three incumbent board members, two of whom have reached Legg Mason’s retirement age guidelines. Days after the dissidents were placed on the board, the company announced plans to reduce staffing by 12%, while also streamlining its executive committee.

Another firm more begrudging of change is Bank of East Asia (BEA). Nonetheless, CEO David Li stepped down from the top role after serving 38 years as the head of the Hong Kong bank, following pressure from Elliott Management to sell the institution. The 8% shareholder has been running the campaign for years but has so far been unsuccessful in forcing a sale. Meanwhile, there is an ongoing court case against BEA, which Elliott initiated in July 2016 when the activist asked a Hong Kong judge to declare that the company acted improperly in relation to a private placement of shares in March 2015.

Q1 hedge fund letters, conference, scoops etc

What We'll Be Watching For This Week

- How will PDC Energy shareholders vote in relation to Kimmeridge Energy Management’s three-member slate at the annual meeting on Wednesday?

- Will Ares Management launch public demands at new investment Infrastructure and Energy Alternatives?

- How will PrimeStone Capital fare with its two-member slate up for election to Mears Group’s board at the shareholder meeting on Friday?

Activist Shorts Update

Rallye, the parent company of short target Groupe Casino, entered into a French court-led protection process to freeze its debts and avoid bankruptcy for up to 18 months, days after trading in shares of both companies were suspended. Neither company explained the reasons behind the suspension but Rallye has been using Casino as collateral to secure credit lines at banks while its stock has spiraled down 41% since the start of March.

Casino has previously been the target of activist short seller Muddy Waters Research and a group of shareholders represented by lawyer Sophie Vermeille, who has also zeroed in on Rallye. Muddy Waters revealed its short position in December 2015, accusing Casino of being dangerously leveraged. The short seller renewed its assault in 2017, claiming the firm’s subsidiaries were late to file accounts.

The firm’s founder Jean-Charles Naouri criticized the short sellers in October and told the Financial Times that "they do it at their risk and peril."

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

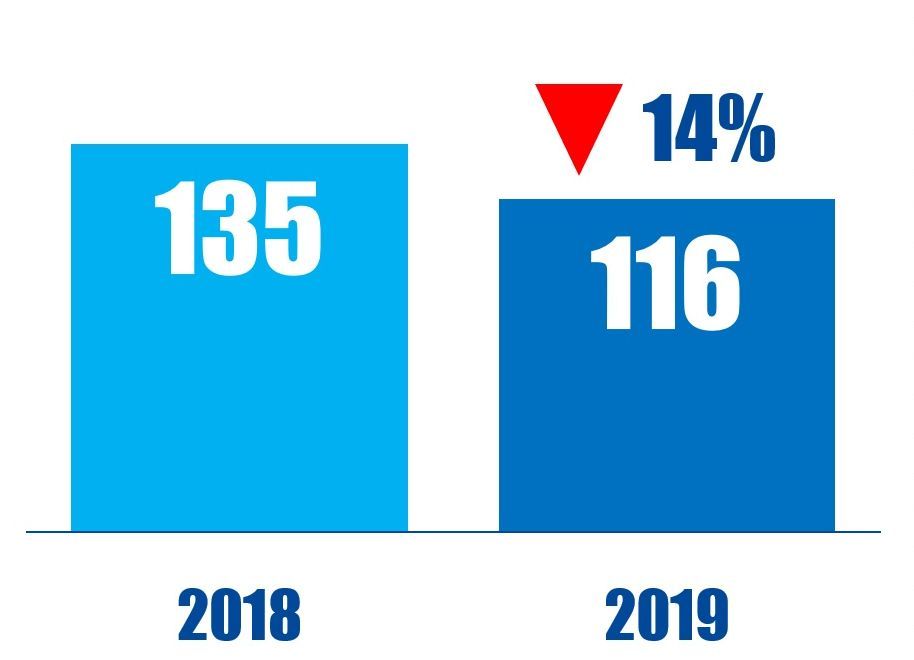

Chart Of The Week

The number of companies in the technology sector to have been publicly subjected to activist demands in the 12 months ending May 24 in respective years.