Whitney Tilson’s email to investors discussing Tesla Inc. (NASDAQ:TSLA)’s earnings ‘debacle’; Subscriber comment on Lumber Liquidators; Facebook’s blowout quarter; The dark side of America’s largest jewelry retailer; Man insists boss’s flatulence ‘was a form of bullying.’

1) Tesla (TSLA) reported a hideous $702 million loss in the first quarter – more than double consensus expectations – and guided for another loss in the second quarter.

Q1 hedge fund letters, conference, scoops etc

The cash flow statement was equally bad, as the company had negative $640 million in cash flow from operations, plus it spent $280 million in capital expenditures – for a $920 million total cash burn.

Quite a contrast from the previous quarter – when Tesla reported $210 million in profit and generated positive $1.235 billion in operating cash flow – which led CEO Elon Musk to say on the call: "I am optimistic about being profitable in Q1 and all quarters going forward."

Oops...

So why is the stock only down slightly today?

Partly because cash (at $2.2 billion) was better than some bears predicted (myself included)... But mostly because Musk promised huge growth and a return to profitability in the second half of the year.

Yet, when asked on the call for evidence of the demand that will be needed to drive this growth, he could cite none. Instead, he just offered a vague assurance that he thinks "we are seeing an uptick in demand and we expect to see that to be quite significant."

Why anyone believes his rosy forecast is beyond me, especially in light of his terrible forecasting track record and the many data points to the contrary.

I think Wedbush analyst Daniel Ives nails it in his note to investors:

In our 20 years of covering tech stocks on the Street we view this quarter as one of top debacles we have ever seen while Musk & Co. in an episode out of the Twilight Zone act as if demand and profitability will magically return to the Tesla story.

It's quite possible that Tesla will never report another profitable quarter – ever!

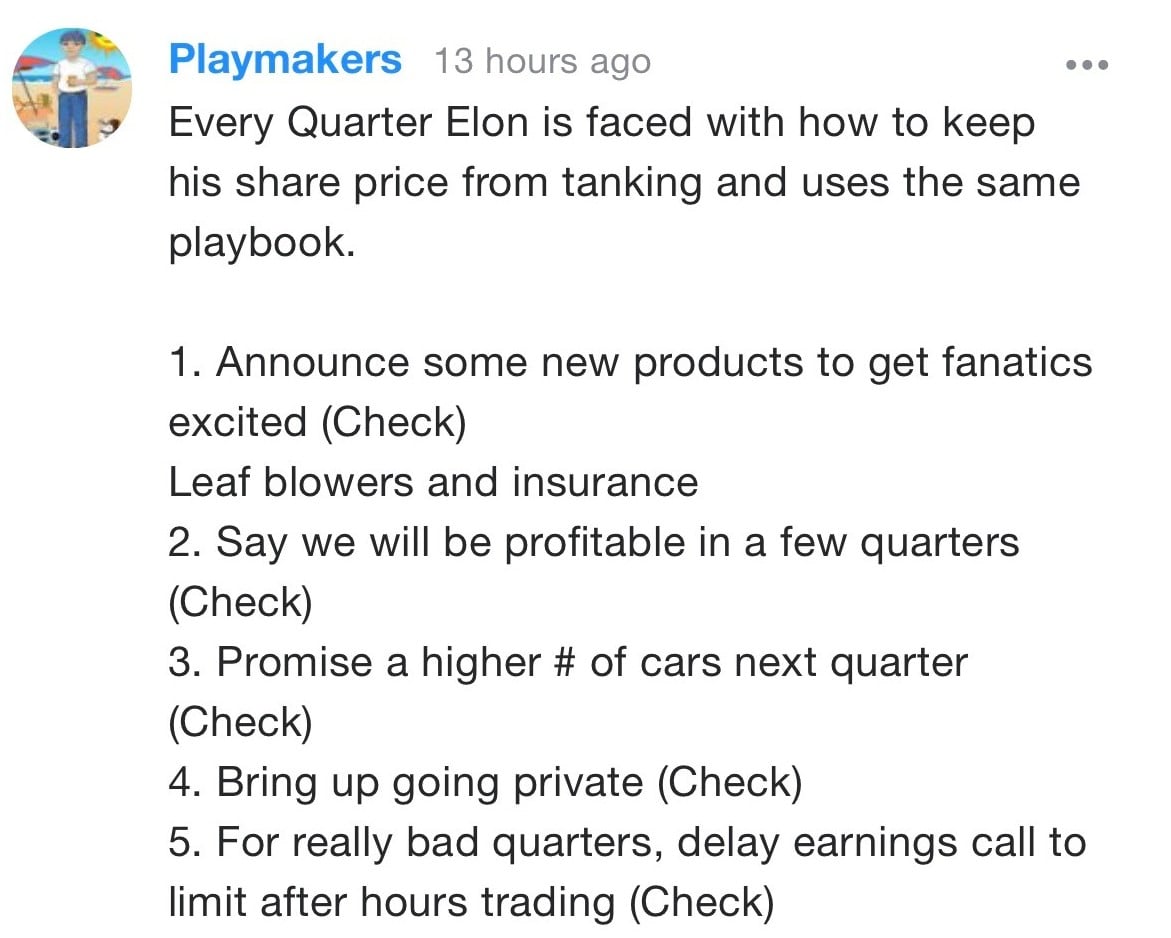

P.S. This post on the Yahoo Finance message board is spot on:

P.P.S. I'll be sending out a much more in-depth analysis of Tesla's earnings to my Empire Investment Report subscribers later today or tomorrow.

2) Short-term stock moves usually don't mean much, but nevertheless, it's great to see that Lumber Liquidators (LL) – my first stock recommendation in my new newsletter – is up 6% already. Here's a thoughtful note from my friend Chip Tucker about it:

Whitney, thanks to your analysis, I've already more than covered the cost of my lifetime subscription, and we're only three days in. Annualize THAT! Thank you!

If you want to watch a replay of the webinar that launched my newsletter, you can do so here. We're still offering a great deal for a few more days, so act soon if you'd like to subscribe.

3) Another one of my initial five recommendations, Facebook (FB), reported strong earnings after the close yesterday and the stock is up big today. User engagement and metrics were solid, with both daily and monthly average users growing 8% year over year – a bit above consensus. Top-line growth of 30% was exceptional, average revenue per user surged in every region of the world (up 16% overall, showing improving monetization), and free cash flow was a healthy $5.5 billion.

As with Tesla, I'll be sending out a much more in-depth analysis of Facebook's earnings to my Empire Investment Report subscribers soon.

4) This is an extremely disturbing in-depth article in this week's New York Times Magazine about America's largest jeweler, Signet Jewelers (SIG): The dark side of America's largest jewelry retailer: For thousands of women, their jobs brought unequal pay, harassment, or worse. Excerpt:

If Sterling Jewelers Inc. isn't a familiar name to you, it's probably not because the company isn't a part of your life. Sterling and its parent company, Signet, own the jewelry stores that dominate the malls and strip malls, with brands like Kay, Jared the Galleria of Jewelry, Osterman, J.B. Robinson, Zales and a dozen others. Often a set of two or three jewelry stores that appear to be competing in a mall are all owned by Signet, its own hall of mirrors.

It's good to see that Signet is finally paying a huge price for its misdeeds, as its stock is down 85% from its peak in November 2015, wiping out nearly $7 billion of market cap.

A hat tip to Matt Kliber of Gracian Capital, who didn't fall into the "I missed it" trap. Even though SIG had already fallen by 65% to $52.70, he pitched it at my shorting conference last December 3 – and nailed it. It closed yesterday at $23.19, down 56% less than five months later.

5) At the almost opposite extreme of workplace harassment is this case from Australia: Man insists boss's flatulence 'was a form of bullying' – and is suing for $1.2 million. Excerpt:

Hingst sued the firm for bullying in 2017, accusing supervisor Greg Short (whom Hingst referred to as "Mr. Stinky") of being a serial farter who regularly "thrusted his bum" at him, News.com.au reported, quoting the Australian Associated Press. Hingst is seeking damages of 1.8 million Australian dollars ($1.28 million).

"I would be sitting with my face to the wall and he would come into the room, which was small and had no windows," Hingst told AAP, according to News.com.au. "He would fart behind me and walk away. He would do this five or six times a day," which led the engineer to spray deodorant at his boss, the news site reported.

The recurrent gas-passing, Hingst claimed, was part of a conspiracy to end his employment and caused him "severe stress."

Once I stopped laughing and pondered the suit, it's actually an interesting question whether this constitutes workplace harassment.

Imagine that the supervisor tossed a novelty stink bomb (which are widely available for less than $1) into his employee's office multiple times a day. That would be an open-and-shut case of harassment, right?

So how is the supervisor's use of his "natural gifts" any better? In fact, I'd argue it's much worse!

Best regards,

Whitney