After a monthslong battle with Elliott Management for control of Telecom Italia’s board, French media group Vivendi withdrew its proposals to replace five directors. News of the decision came on Friday, the day of the annual meeting, surprising many onlookers. Elliott wrested control from Vivendi in a proxy contest last year, causing the latter to go on the offensive in the following months. “We have decided to not pursue today with our proposal to revoke and replace five board members provided that this has the support of this shareholder meeting,” Vivendi representative Caroline Le Masne de Chermont said at the Friday meeting. “Vivendi wishes that TIM’s board be more reflective of the company shareholder base and to be led in an independent, transparent, and inclusive manner.”

Shares in Telecom Italia have lost nearly 39% of their value since Elliott won the proxy contest. However, Elliott indicated that, in part, this was due to the fact that Amos Genish, the CEO named by Vivendi, remained in the role until mid-November, when he was abruptly fired and replaced with Luigi Gubitosi, a board member and former CEO of Alitalia. Elliott and Vivendi have endlessly debated over the best strategy for TIM, with the latter signaling it may support a spinoff of the firm’s network assets, previously a point of contention.

Q4 hedge fund letters, conference, scoops etc

What We'll Be Watching For This Week

- Will Greenway Technologies shareholders support a dissident slate of six candidates at the firm’s special meeting on Thursday?

- Will First United agree to explore a sale after receiving pressure from Driver Management to do so?

- Will Sports Direct withdraw its shareholder meeting requisition at Debenhams per lenders’ demands?

Activist Shorts Update

Germany's Wirecard announced last week that a review by law firm Rajah & Tann Singapore has found potentially criminal behavior at the firm. The probe came after the Financial Times reported in January that an executive in the Singapore branch was suspected of using forged and backdated contracts in a string of deals. Wirecard said Rajah & Tann found no instances of “tripping or corruption” and noted that the only restatement resulting from the investigation affected 2.5 million euros of revenue in 2017, which was compensated by “other positive restatements” for the same reporting period resulting from separate audit reports.

Nonetheless, Rajah & Tann said it could not correlate payments made between business partners and Wirecard entities with agreements between them, or identify why revenue from third parties that have existing relationships with Wirecard entities was booked into a different entity’s accounts. Although there was no criminal liability under Singapore law found in regards to the Munich headquarters, a few Singaporean employees could be held accountable for internal agreements and transactions made between Wirecard entities "by or on the instructions of a person without apparent authority to do so.”

In February, Germany’s market regulator banned short sales in Wirecard due to the market’s reaction after news of the potential fraud. Fahmi Quadir, whose fund Safkhet Capital is short Wirecard, said the decision removed a “critical incentive” to investigate the true state of the company. Odey Asset Management threatened to sue the regulator.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

Chart Of The Week

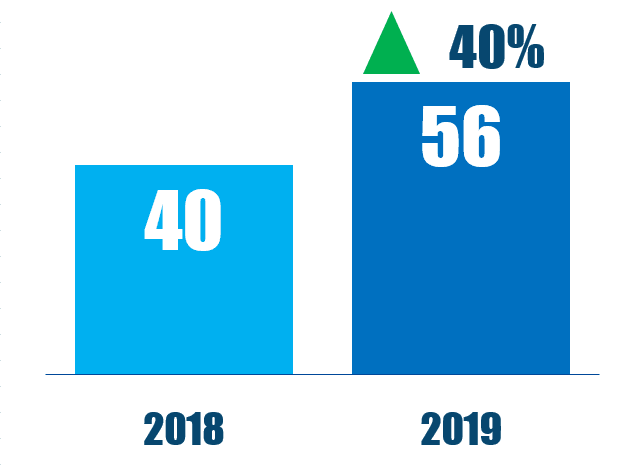

In the 12 months ending March 29, 2019, 56 U.S.-based basic material companies publicly faced activist demands, up from 40 in the 12 months ending March 29, 2018.