Iolite Partners commentary for the first quarter ended March 31, 2019. Discussing their thoughts on Jumbo Interactive, fossil fuels and global warming.

Highlights

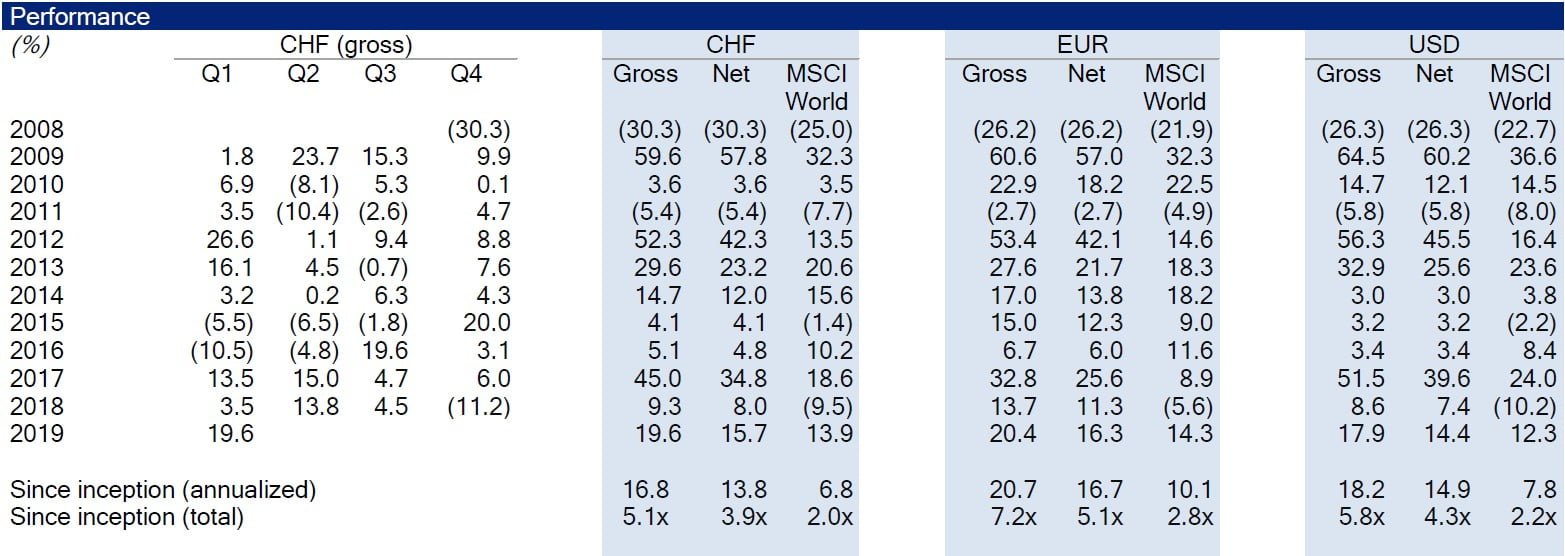

- In Q1 2019, the unleveraged core portfolio returned +15.7% in CHF (+16.3% in EUR, +14.4% in USD) net of all fees

- Thoughts on Jumbo Interactive (ASX:JIN)

- Thoughts on fossil fuels and global warming

- Celebrating iolite’s 10th anniversary – a few thank yous

Q4 hedge fund letters, conference, scoops etc

Iolite Partners Q1 2019 Commentary

"If everything you do needs to work on a three-year time horizon, then you're competing against a lot of people. But if you're willing to invest on a seven-year time horizon, you're now competing against a fraction of those people, because very few companies are willing to do that. Just by lengthening the time horizon, you can engage in endeavors that you could never otherwise pursue." (Jeff Bezos)

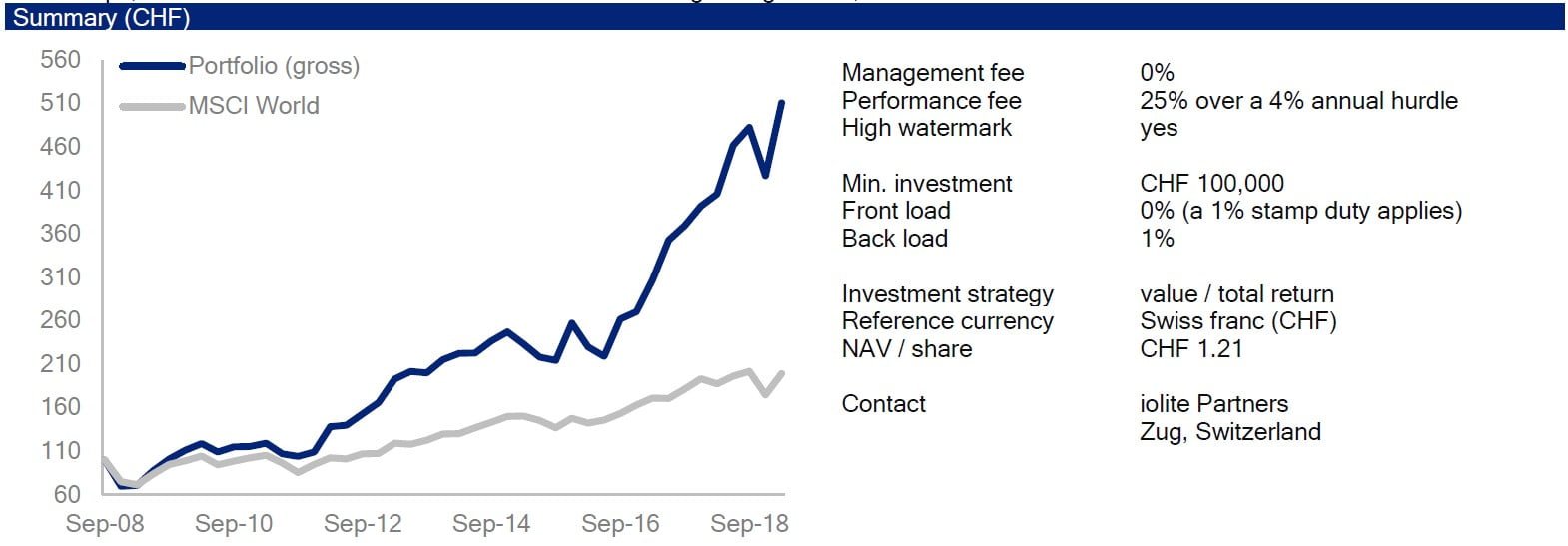

For the first quarter ended March 31, 2019, the unleveraged portfolio returned +15.7% in CHF (+16.3% in EUR, +14.4% in USD) net of all fees. Since inception on October 1, 2008, the portfolio has generated net annual returns of 13.8% in CHF (+16.7% in EUR, +14.9% in USD). In other words, a Swiss franc invested at inception has turned into CHF 3.89 (a euro invested has turned into €5.07 and a dollar invested into $4.30) for investors. On a gross basis, the portfolio has been compounding at +16.8% in CHF (+20.7% in EUR, +18.2% in USD).

Global markets took a dive in the last quarter of 2018, just to recover almost fully in the first weeks of January. Such sudden swings are fascinating and proof that markets are not efficient. Overall, there was no event that should have caused two major swings in market sentiment within a few weeks. If anything, the new year started where the old one had left off, with a government shutdown in the USA, geopolitical tensions, worries about a no-deal BREXIT, trade tensions, etc.

In periods of higher volatility, it’s easy to be swayed by the market’s sentiment and react in a pro-cyclical manner. In a benign environment, we feel safe, generous and willing to take on risks. In a volatile environment, we become fearful and cautious. Therefore, it’s also in human nature to crave investment products designed to reduce volatility. Unfortunately, most of these products are likely to underperform the market over time, as they either cost valuable upside or are pro-cyclical in nature.

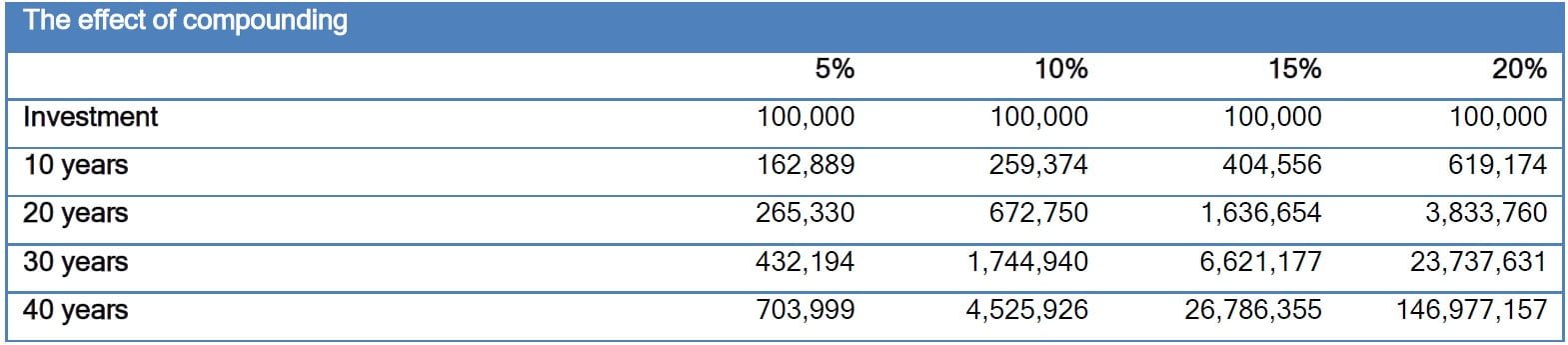

In his career, Warren Buffett suffered four major dips where the market price of his investment vehicle, Berkshire Hathaway, dropped by more than 35%. Yet, Berkshire’s market price has increased a staggering 2,472,627% since he took control in 1965. In other words: 1 dollar turned into 25,000 dollars! Obviously, it would have been great for investors to time the dips. However, buy-and-hold was more than good enough.

Investing is a humbling activity, especially when one pursues a contrarian approach. There are times where the general market is down, times of underperformance or mistakes, and periods where one may look stupid and exposed. To beat the market, an investor needs to behave differently from the mainstream.

What helps overcome our natural tendency to strive for popularity and to overemphasize volatility, what helps us stomach periods of weak performance?

1. Focus on value, not price. I view the marketable common stocks that iolite owns as interests in businesses, not as ticker symbols to be bought or sold based on their “chart” patterns, the “target” prices of analysts or the opinions of media pundits. If the markets were to drop 20-30%, our positions would go down as well. Just because something is cheap does not mean it is not going to go down. However, most of our positions should recover quickly as I consider the underlying companies in a position to use their undervaluation, their strong balance sheets, or their positioning to proactively exploit any period of market distress. If I correctly assume a position is undervalued, any market correction will only have a temporary impact on the portfolio. If I make mistakes or I am too slow to respond to changing facts, the portfolio may suffer permanent capital loss.

2. Thinking probabilistically. I deal with uncertainty by pricing it in. Humans naturally crave for leadership and firm answers. However, the future is uncertain and it is my task not to get carried away by a good story. Instead, I think about what could go wrong: the known knowns, the known unknowns, and the unknown unknowns. The lower the price I pay, the higher the margin of safety and the less vulnerable the portfolio is to undesired events. It is difficult at the time of purchase to know any specific reason why iolite’s investments should appreciate in price. However, because of this lack of glamour or lack of dependence on catalyst-driven market movement, I was able to invest at cheap prices. Sometimes, our positions will appreciate fast, many times it will take years. Sometimes, the payoffs to us will be modest; occasionally, the cash register will ring loudly. And sometimes, I will make expensive mistakes. Overall – and over time – we should get decent results.

3. Focus on process, not output. We judge decisions based on the facts known at the time, not based on outcome and with hindsight. Some of the most successful investors I have encountered in my life come from families with a long tradition of intelligent risk-taking (or better: risk-pricing). There are a few benefits in a family setup: intimate trust, a multi-generational bond, permanent capital, and a common culture of thinking. Whereas most corporations are driven by short-term goals and politics, the most successful trading families are driven by a strong emphasis on process over outcome. They don’t discuss results, they discuss investment theses, they are open to challenge each other, they are dedicated to lifelong learning, and there is an openness to change opinions when necessary. Experienced merchants know that luck is required to become successful, but that the frequency and magnitude of lucky events depends on the work one puts in. As the old saying goes: “every man forges his own destiny”.

I am proud to consider iolite a family of likeminded investors that are in it for the long-term, that endure volatility, and that are striving for intellectually honesty. Any investor’s strength is ultimately determined by the capital available to him. Thankfully, iolite has an outstanding capital base.

Thoughts on Jumbo Interactive

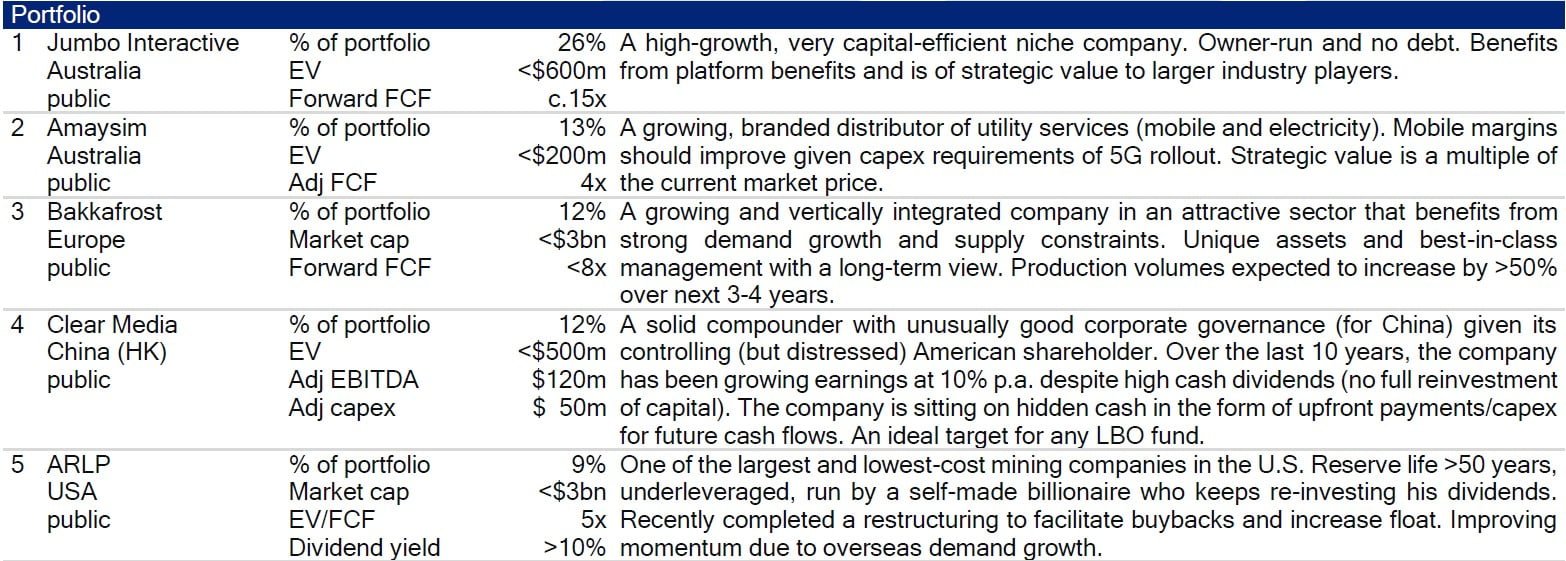

Aside from the general market’s rebound, recent performance was driven by a sensational run-up in the stock price of Australian company Jumbo Interactive. Jumbo is the leading digital retailer of lottery tickets in Australia. The company is licensed to sell lottery tickets online and through mobile apps. It’s a digital version of the traditional kiosk.

When I started buying shares of the company a few years back, the case was as follows: a young and highly scalable and cash flow-positive niche business was overshadowed by ambitious and failing international expansion plans. I took the view that the founder and CEO, Mike Veverka (who owned a 20% stake) would eventually correct course. He had done it before in a similar situation and I thought he would act rationally again, despite strong entrepreneurial ambitions.

Indeed, Mike delivered, and how! He not only shut down all money-sucking projects shortly after we bought into the company, he did a terrific job growing the Australian core business. The scalability of the domestic operations is now becoming obvious and every additional customer is strengthening Jumbo’s competitive position as well as adding to its strategic value.

There still is much room for growth. Market share keeps growing thanks to digital lottery sales vs brick and mortar, and the lottery industry is benefitting from population growth and inflation. More importantly, however, Mike has built a technology platform and a sophisticated marketing machine that will allow him to conquer new revenue streams without taking on much risk.

Once a highly cash generative and agile business starts building momentum, truly great things may follow.

Thank you, Mike, for your vision and flawless execution!

Thoughts on fossil fuels and global warming

“If a problem has no solution, it may not be a problem, but a fact – not to be solved, but to be coped with over time.” (Shimon Peres)

Earlier this year, Germany announced it would exit coal power generation by the year 2038. Prior to this, Norway (a country whose wealth is almost entirely based on fossil fuels) and the Rockefeller family charity started to divest their stakes in businesses related to fossil fuels. Accomplished investor Jeremy Grantham has publicly stated “thermal coal is dead meat”.

These attention-grabbing headlines make you believe humanity has made great strides and is winning the fight against global warming. In my opinion, a quick look at the facts reveals the material disconnect between this feeling and reality. It seems the (Western) mainstream is driven by wishful thinking and emotion, not rational thought.

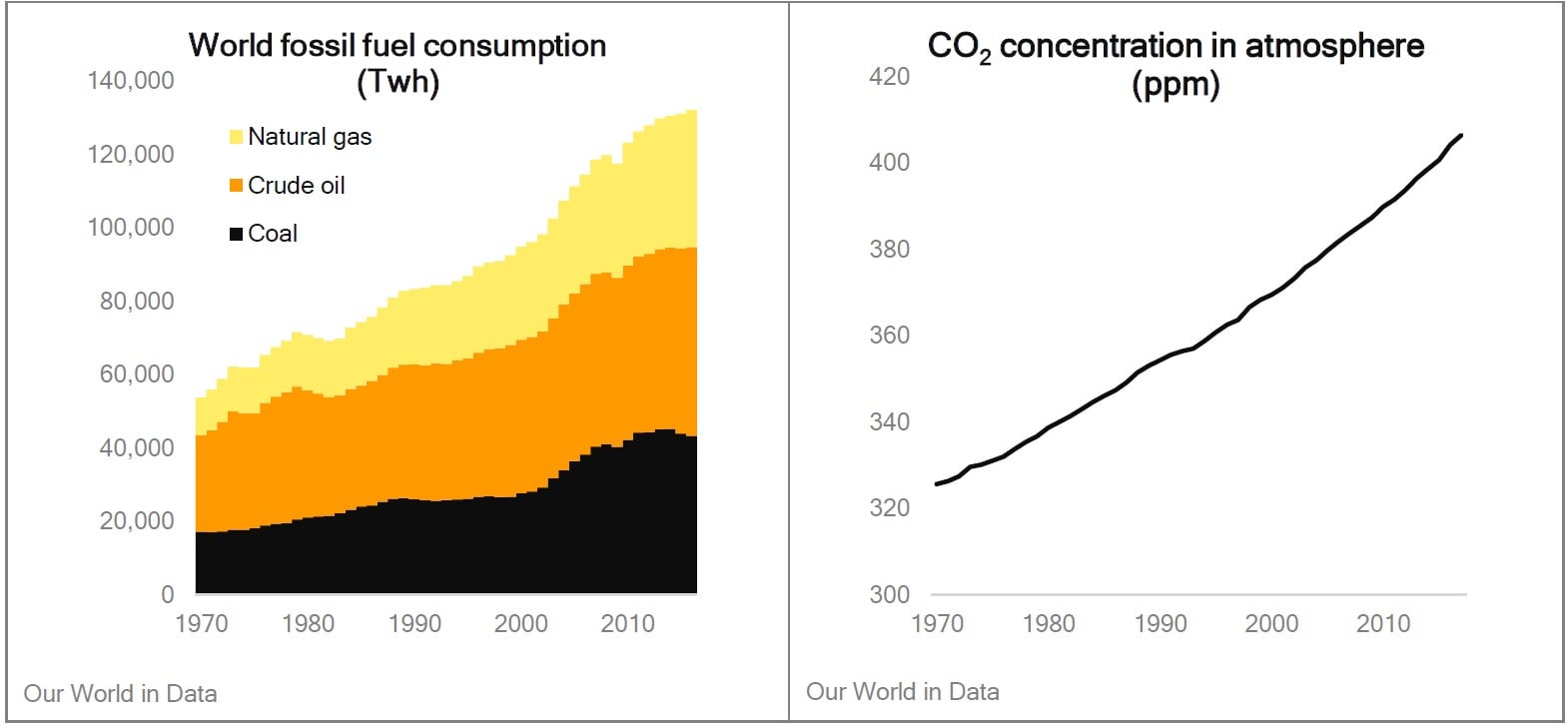

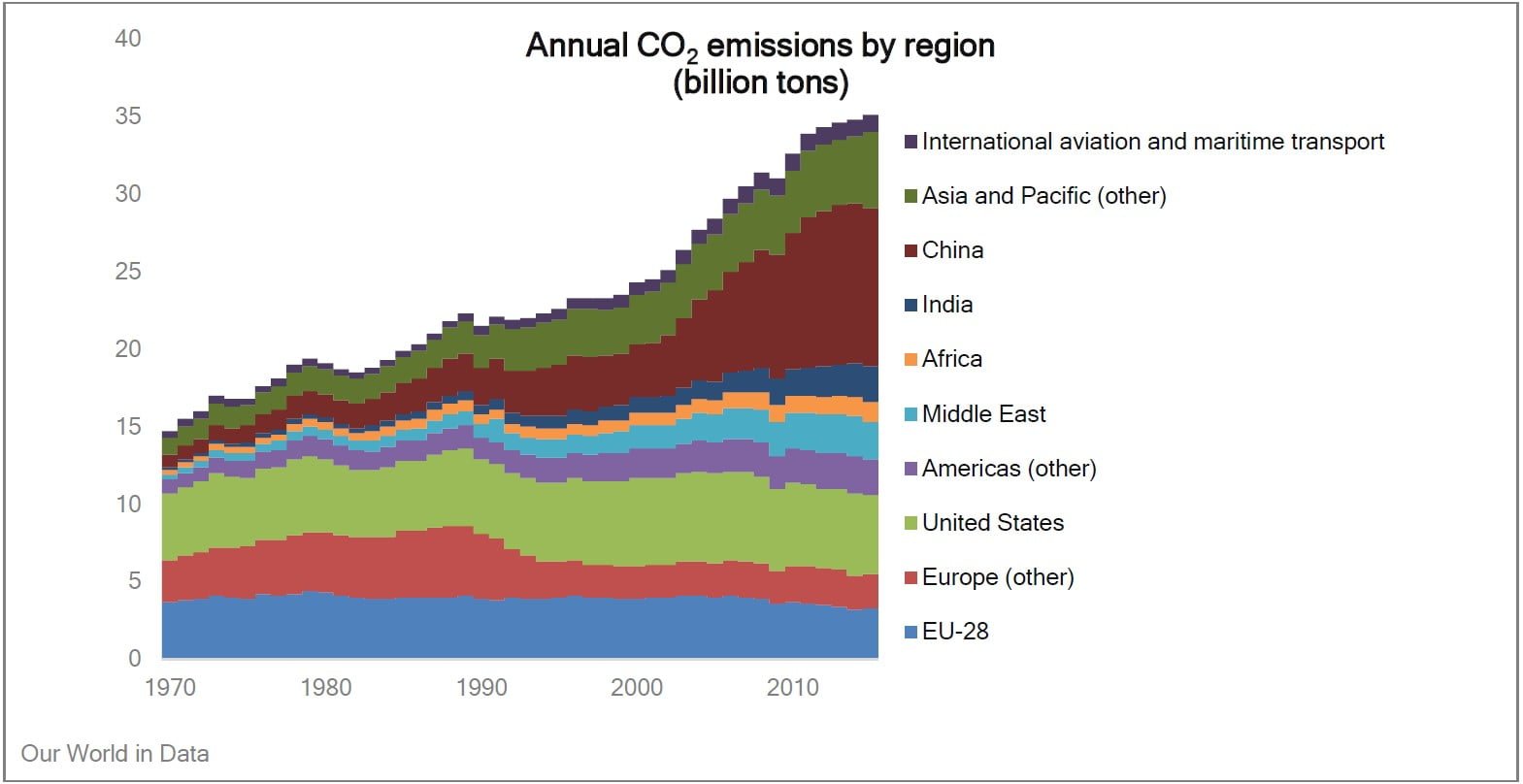

Economic prosperity is closely linked with the availability and consumption of electricity. From 2000-2017, global energy consumption increased by about 44%, at an annual growth rate of about 2.2%, while the world’s population increased by 23%. Fossil fuels account for about 85% of the global energy mix, and that share hasn’t changed much since the 1970s. This means the world keeps consuming more coal, gas, and oil.

Over the next two decades, in the absence of a major catastrophic event, the world’s population is likely to grow by more than one billion people and some two billion people are expected to join the “developed” world. Consequentially, the world’s hunger for energy will increase.

The U.N. Intergovernmental Panel on Climate Change found that global emissions would have to be cut nearly in half by 2030 to preserve a chance of capping the planet's warming to 1.5 degrees Celsius (or 2.7 degrees Fahrenheit).

This goal seems utterly unachievable, given the growing demand for energy and how the world is generating its electricity. As of today, no impactful progress has made to reduce the world’s dependency on fossil fuels and thereby lower CO2 emissions. Any industrialized nation requires reliable baseload (the permanent minimum load that a power supply system is required to deliver). Unfortunately, wind and solar are unreliable sources of energy and we currently also lack the ability to store electricity on a large scale. Hence, nuclear power and fossil fuels are essential pillars of any energy mix.

Let’s spotlight a few issues.

Coal

Coal is one of the worst climate offenders. However, coal is also a cheap, reliable and simple way to generate electricity, and therefore the preferred energy source in many developing countries. It makes up about 40% of global electricity generation. Global demand and supply are growing as lower consumption in “Western” nations is offset with growth in “developing” regions such as China, India, Pakistan, and Southeast Asia. In 2018, coal emissions were at the highest level, ever. Developing nations will look to roll out cheap energy first and we can’t deny people the right to live a modern life.

Renewables

Germany is widely considered a role model in the fight against climate change. It is estimated that the country has invested something like US$ 500+ billion into wind and solar over the last two decades. All coal power supply is to go offline by 2038, and all nuclear power reactors are supposed to go offline by 2022.

Despite the green headlines, Germany is one of Europe’s worst CO2 offenders with an average output of 450g/kWh. Fifty percent of Germany’s energy supply still comes from coal and nuclear (and up to 70% at night and when the wind is not blowing).

Germany’s recent announcement to shut down 50% of its power supply was made without a viable domestic alternative to rely on. In the absence of a major technological breakthrough regarding battery technology, Germany will have to import more energy from its neighbors in times of peak demand (i.e. nuclear from France or coal from Eastern Europe) and increasingly rely on gas sourced from Russia and the Middle East. Does this sound like a good plan?

Nuclear

A look at the electricity map also reveals that Europe’s cleanest energy producers are France (c. 75g/kWh, nuclear), Sweden (c. 50g/KWh, nuclear), and Norway (c. 50g/kWh, hydro). Hydro is restricted to geography (in Europe mainly to Norway, Switzerland, and Austria). Regarding nuclear: it took France and Sweden about 15 years each to roll out their nuclear programs and almost go emission-free. China is in process to materially increase its nuclear electricity generation, and this development could have a very positive impact on the country’s carbon footprint.

People with a rational mindset and not driven by fear and popular opinion are aware of the positive impact modern nuclear power can have on a country’s ability to produce clean energy. One of them is Bill Gates, who is supporting various projects in the field, for example Terrapower, a company working on a next generation reactor that uses nuclear waste to generate safe energy. Unfortunately, attempts to build a prototype reactor in China were halted given the current trade tensions between the U.S. and China.

Concluding thoughts

Despite many conferences on climate change, billions of dollars spent on research, glossy corporate brochures and enough public awareness, we haven’t made notable progress reducing CO2 emissions from fossil fuels on a global basis. Given the circumstances, a meaningful reduction of fossil fuels (in the absence of a huge nuclear rollout, material investment into carbon capture technologies, or a breakthrough in battery technology) in the next two decades is unlikely.

Unfortunately, we can’t substitute fossil fuels with wind and solar unless we have the capability to store renewable energy on a large scale. Aside from physical restrictions of current storage technologies (battery weight, limited recharge cycles, etc.), any rollout of scalable grid storage solutions would require massive investment and overcoming certain key raw materials bottlenecks (e.g. lithium, cobalt, nickel). Even if we were to possess the means, any rollout of such infrastructure on a global scale would take decades. It would be an investment program unlike anything the world has ever seen before.

Lastly, carbon emissions from electricity generation are only one driver of global warming. Other drivers are deforestation, cement manufacture, as well as methane releases from animal farming and gas fields. Unfortunately, these emissions are likely to increase as well given global population growth, global development, and urbanization.

Celebrating iolite’s 10th anniversary - a few thank yous

iolite recently celebrated its tenth anniversary. I would like to use this opportunity to thank a few people that have helped me tremendously along the way.

- Eli Noam, Professor of Economics and Finance at the Columbia Business School, was kind enough to offer me a desk in his institute when I asked to write my master thesis in New York. From him, I learned what it means if a sharp mind uses common sense applied to real world topics (a stark contrast to the abstract and hierarchical teaching methods in the German-speaking world).

- Tammo Andersch was the first person to offer me a full-time job as a restructuring consultant at KPMG. I had little to show except for passion and curiosity but this didn’t put Tammo off. With him, I travelled Europe, restructuring distressed companies and learning a lot about what makes some businesses and industries great – and others fail.

- Warren Buffett, Charlie Munger, and Joel Greenblatt taught me an investment approach that immediately and intuitively made sense. Through them, I found my calling.

- Erk Schuchhardt was and continues to be a mentor and a friend with an infectious entrepreneurial spirit, empathy and a curious mind. He is proof that you can become successful without being cynical and political.

- Guy Spier, a friend and mentor in the investment world, taught me all those things that don’t make the textbooks, but that are so crucial to master life and build a business ultimately based on trust.

Last but not least, I wouldn’t be where I am without the support of my family.

*****

I remain excited about the investment returns I think I can deliver over the next decades. Almost all my personal net worth remains invested in the portfolio, as I aim to compound my wealth alongside that of my co-investors.

As always, I am happy to receive feedback and answer your questions.

Sincerely,

Robert Leitz

This article first appeared on ValueWalk Premium